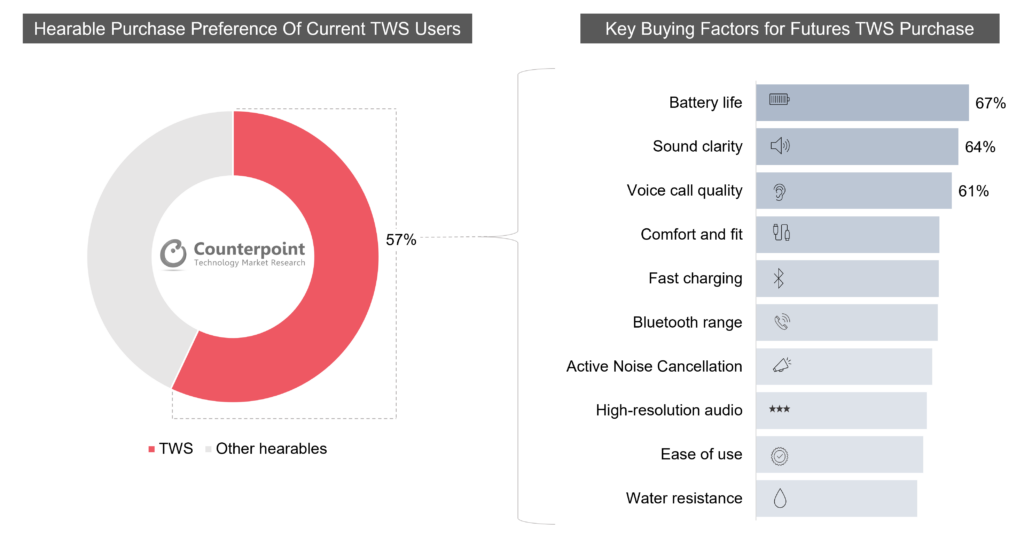

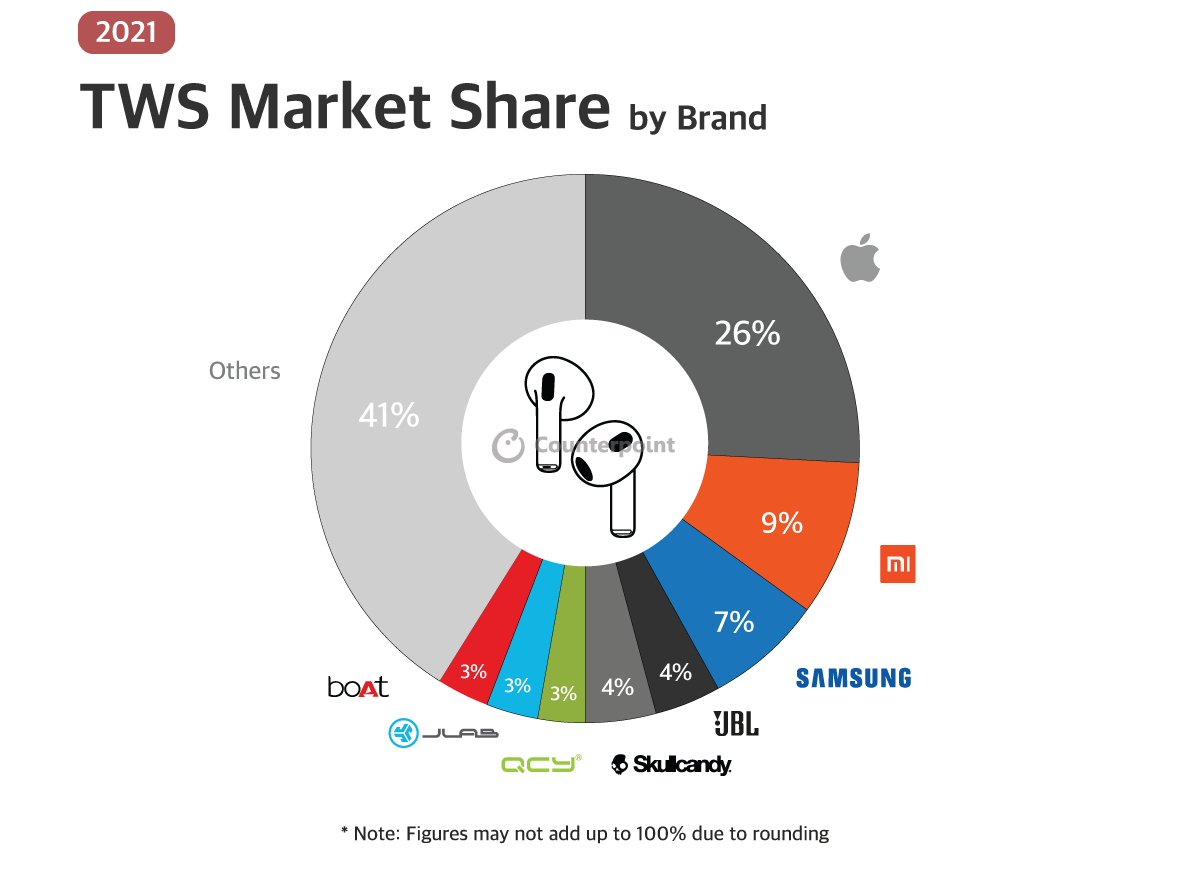

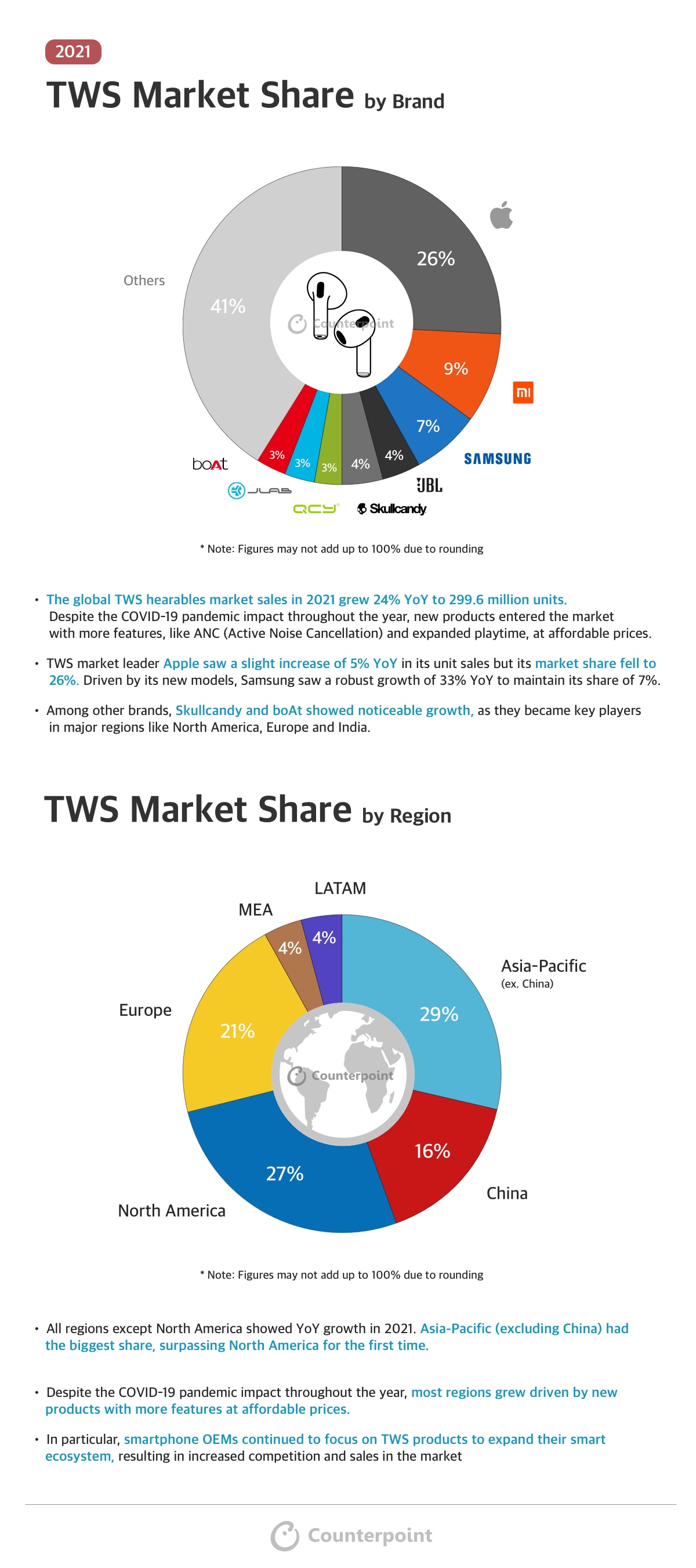

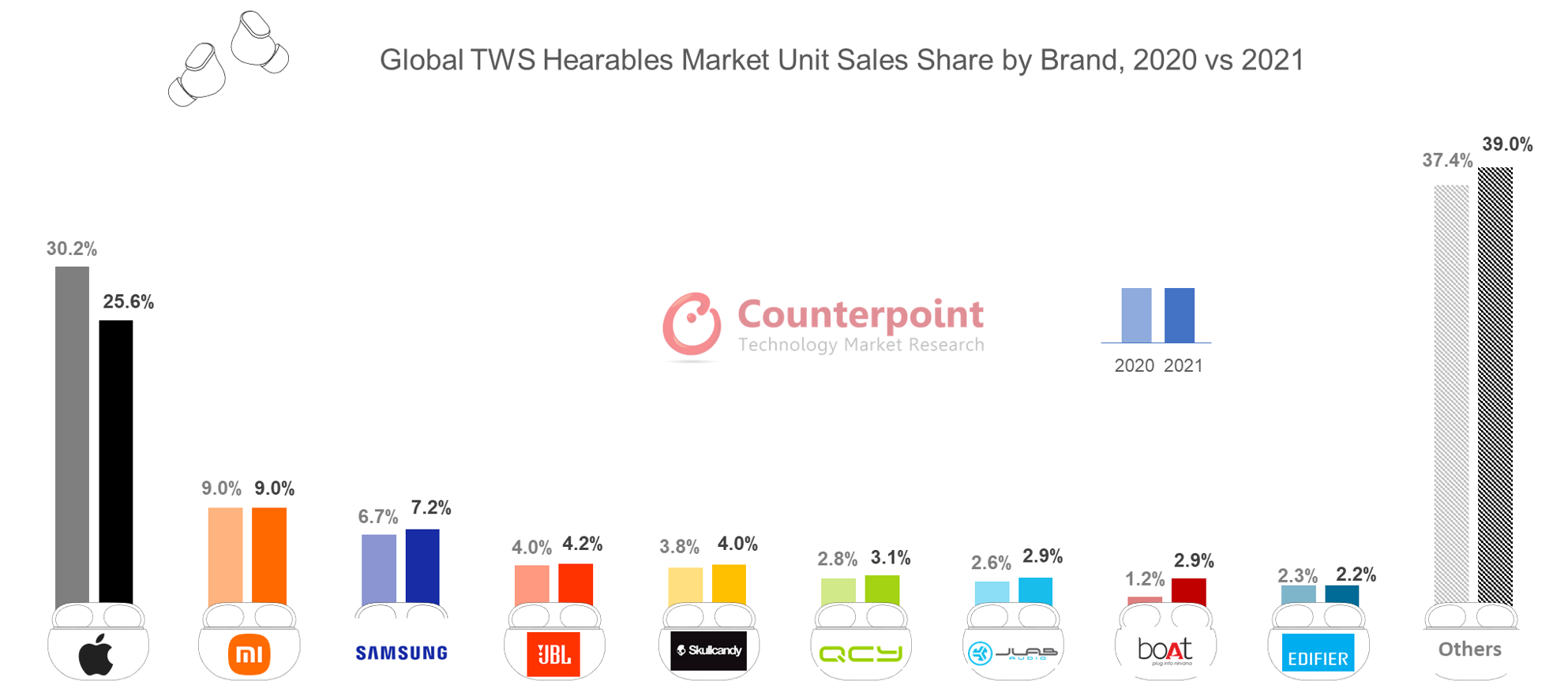

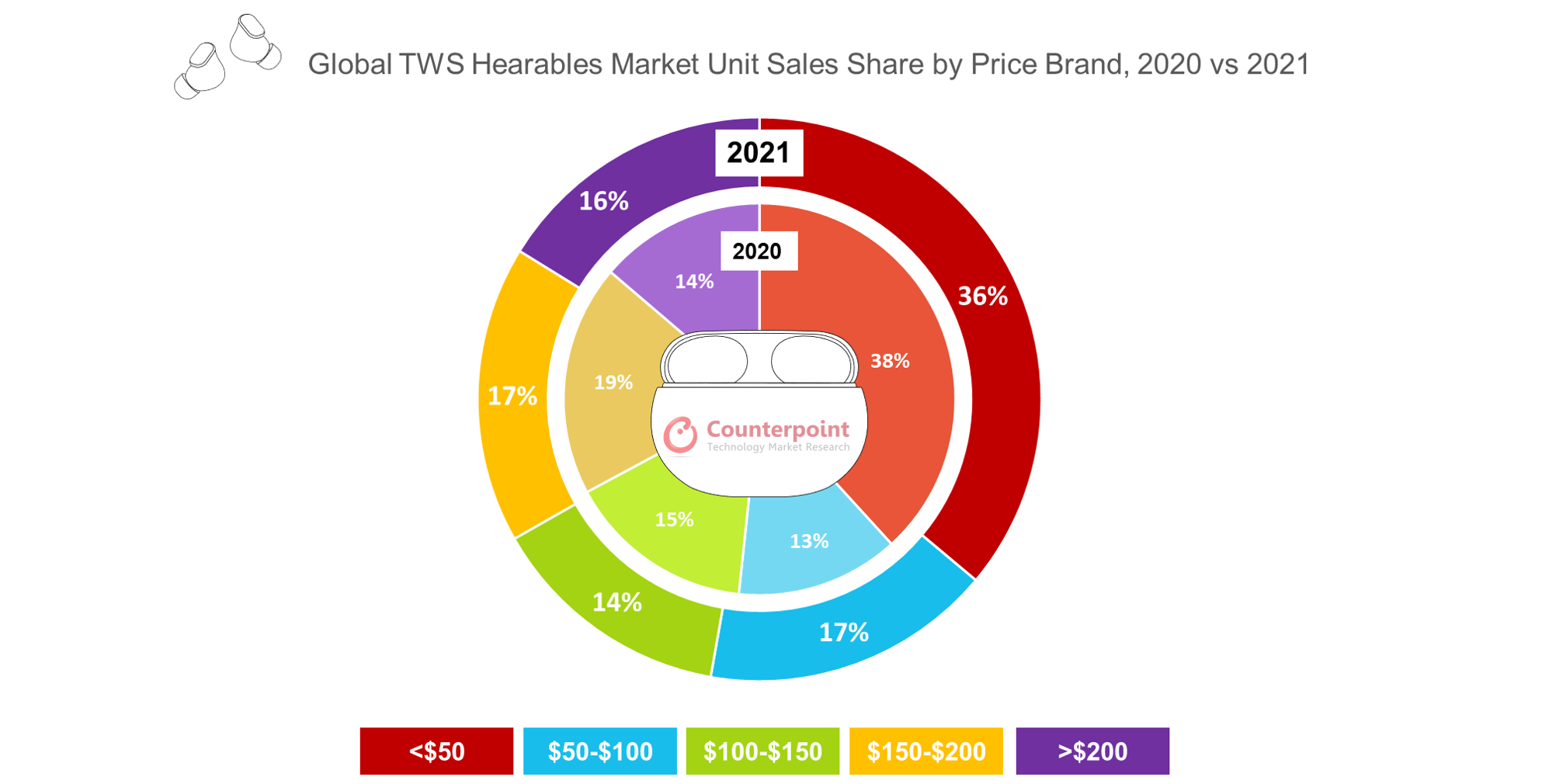

The TWS hearables are one of the fast-growing segments in consumer electronics seeing a 24% YoY growth in 2021. OEMs removing wired headphones from smartphone packaging, and the work-and-learn from home scenario post-pandemic are some of the factors contributing to this growth. The wireless earbuds also have a higher attach rate than other accessories such as smartwatches. In 2022, we expect the trend to continue and the TWS earbuds market is expected to grow by another 24% YoY.

The personalized content consumption from music listening to podcasts, video streaming, and gaming has increased during the pandemic. Even video conferencing needs to connect & communicate with clients, colleagues’ school, and family has grown significantly. And these trends have catalyzed the need for reliable earbuds with features that include Active Noise Cancellation (ANC), great audio, mic quality, and chords free being increasingly preferred. While these features have been available in premium earbuds but with growing demand, scale and innovation are quickly trickling down to relatively lower price points. There are only a handful of OEMs those package all of the above features really well, and Sony is one of them carving out mindshare alongside Apple and Samsung.

Sony’s TWS earbuds in the 1000XM-series are very popular and have set a benchmark for features like ANC, superior audio quality, and design. Focusing on the premium market and limited distribution reach compared to Apple or Samsung, the Japanese manufacturer was still able to capture a 3% volume share globally in 2021. However, Sony is also expanding its TWS line-up and premium features for models in the mainstream $100-$200 segment which should help it gain more share in 2022.

Talking about TWS growth in the high-end segment, Counterpoint Research Senior Analyst Liz Lee said, “The premium TWS earbuds segment saw robust growth in the second half of 2021 and we believe despite the recent macro-uncertainty due to the Ukraine crisis, lockdowns in China and inflationary climate, the demand for premium and mainstream TWS earbuds will continue to rise. Sony is expected to do well being the vanguard of driving key features such as ANC and audio experience in the TWS earbuds market.”

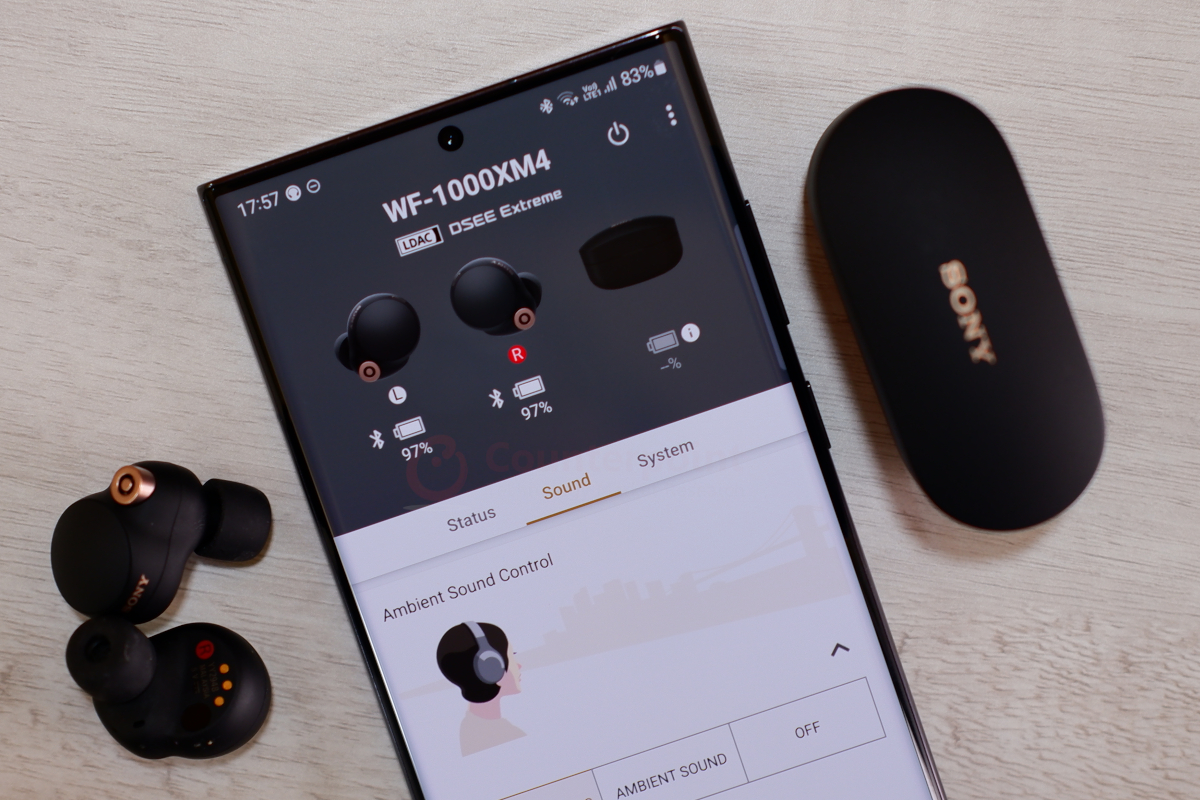

We have been using the premium Sony WF-1000XM4 true wireless earbuds for a few months now. The new XM4 version sports advanced features such as LDAC codec for higher bit-rate audio transmission, Speak-to-Chat using bone conduction sensors, ambient sound mode, and 360 Reality Audio support, vs the previous generation XM3 model. So, while the WF-1000XM3 was arguably one of the best all-round TWS, what has Sony done differently this time with the new 1000XM4 to take it to the next level?

Following is our detailed analysis of the new XM4 model right from packaging to performance after making it our daily driver for the last three months:

♻️ Plastic-free Unboxing Experience: A Move Towards Sustainable Future

- Sustainability and efforts toward reducing the carbon footprint are becoming a key strategy for several tech companies and it’s good to see Sony going above and beyond.

- The WF-1000XM4’s packaging does not use any plastic, and the box is made from recycled paper.

- Sony also used embossed logos instead of printing the box with ink, a small effort without compromising the user experience.

WATCH: Sony WF – 1000XM4 – Unboxing & First Look

Compact Design, Comfortable Fit

- Compared to the 1000XM3, the new 1000XM4 comes with a more compact design where the charging case is now 40% smaller, and the earbuds are 10% smaller.

- The compact case makes it even easier to carry in the pocket, whereas the earbuds also now fit well, without popping out of the ear, like on the predecessor.

- The earbuds snugly fit in the ear and are comfortable to wear for hours, provided, you don’t push them too hard in your ears to get a tight fit.

- Even when working out – like doing a few jumping jacks or high stepping, the earbuds were firmly secure in the ears.

- Sony has done away with silicone ear tips, and bundled foam ear tips instead.

- Foam ear tips are a good addition as they offer great passive noise isolation while fitting comfortably in your ears.

Sony WF-1000XM4 Specifications and Features

Hi-Res Audio Streaming, Quick Pairing

- The earbuds come with 6mm dynamic drivers that support a frequency range of 20-40,000Hz.

- With Bluetooth 5.2 connectivity, the earbuds support AAC, SBC, and LDAC (bit rate up to 990kbps) codecs.

- The pairing process is straightforward, and if you have an Android smartphone, the Sony WF-1000XM4 also supports the Google Fast Pair feature.

- Though, the multi-point connectivity feature as seen on Jabra, Apple AirPods, and Samsung Galaxy Buds series, could have been a good addition.

- The earbuds are sweat-resistant and come with an IPx4 rating, so you can wear them during workouts, or even in light rains when you go on a walk or run.

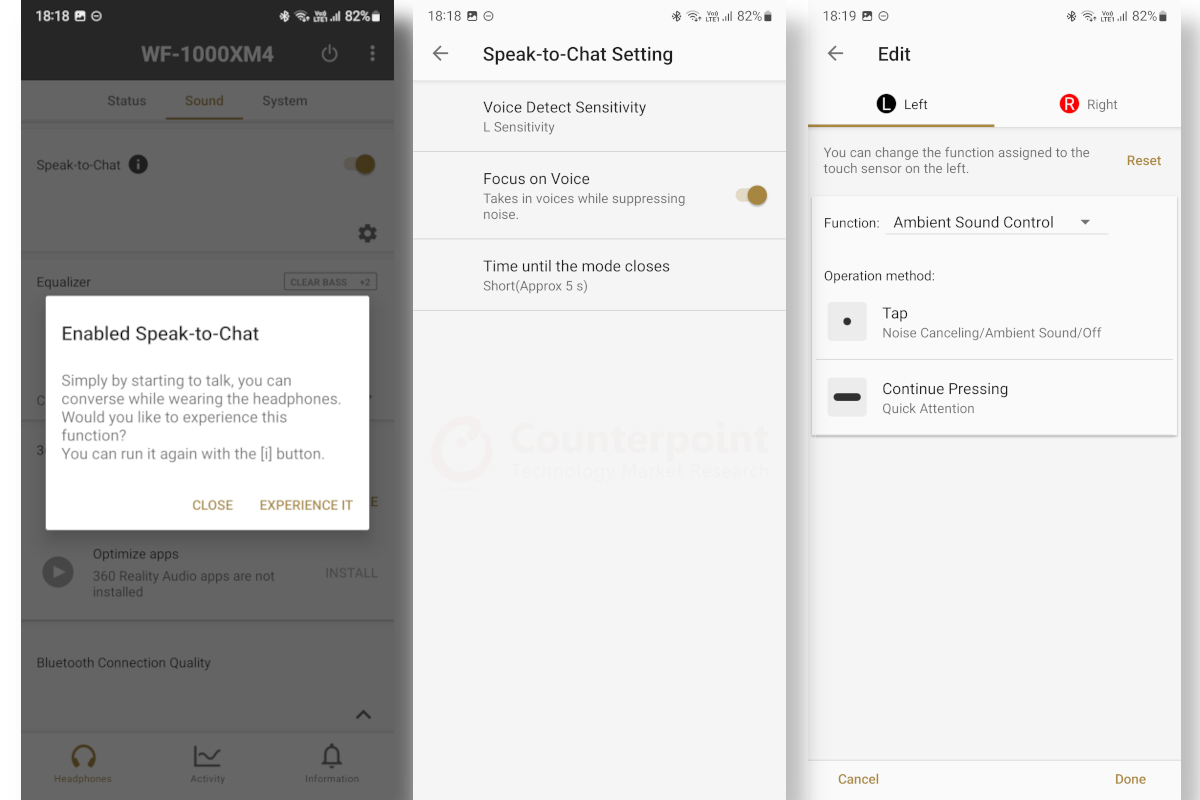

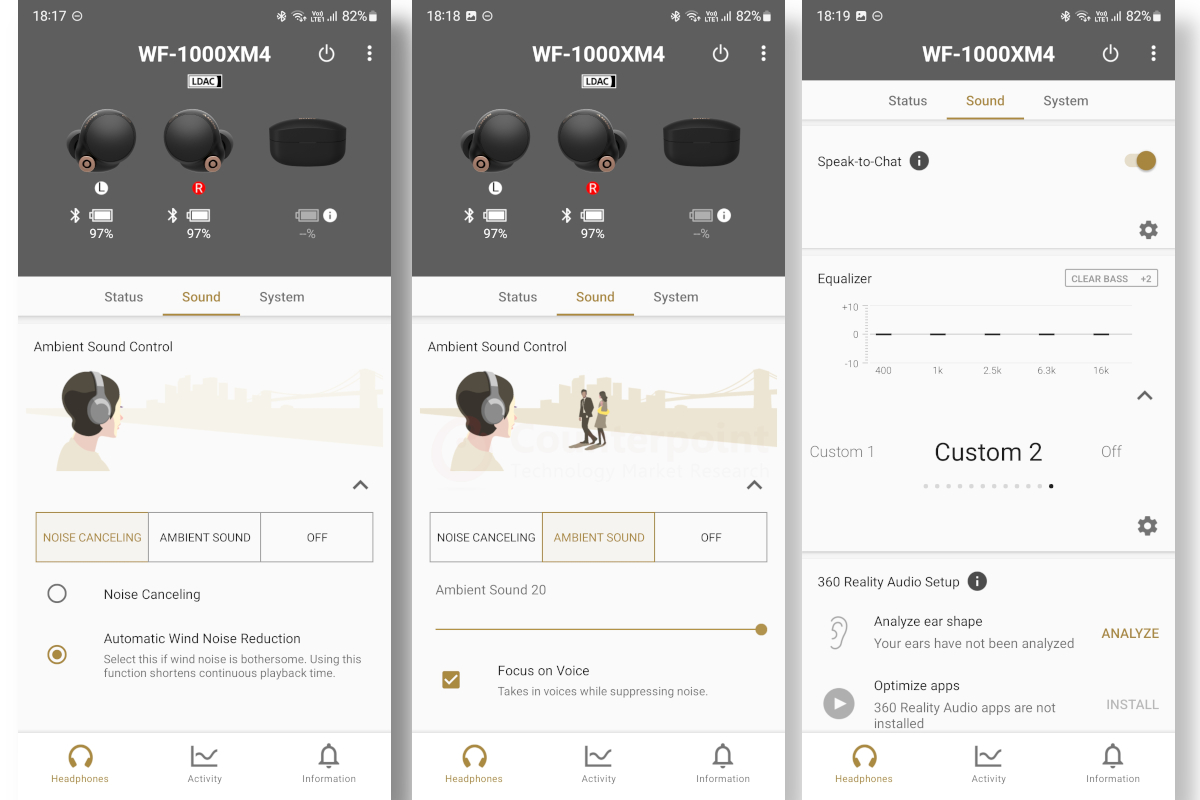

Companion App and Features

- Both on Android and iOS, Sony has a companion app called “Headphones” which gives you can access to some core features.

- You can adjust the equalizer, ambient sound control, ANC (Active Noise Cancellation), and more.

- Once you set the equalizer, the profile is created and saved on the earbuds, which is a good differentiator over competitors.

- So, even if you pair the earbuds with a new smartphone or a PC on which the “Headphones” app is not installed, you can still enjoy music with the equalizer profile you set using the app on another smartphone.

🎙Speak-to-Chat for Quick Communication

- Speak-to-chat is an interesting feature that uses bone conduction technology to pick vibrations from your voice to temporarily pause music and start ambient noise.

- This feature comes in handy when you are listening to music and want to talk to someone, say while commuting or walking on the road and asking for direction.

- The feature works like a charm, but if like me, you too like humming to the tunes while listening to music, better to keep the feature off as the bone conduction is very sensitive in picking voice, and it activates the ambient sound while pausing music.

- There is also a Quick Attention feature, where you can “Tap and Hold” on the left earbud to quickly pause music and activate the ambient sound mode, and it turns off as soon as you release your finger.

Sony WF-1000XM4 Performance: More Bang for your Buck

Ambient Sound: Stay Aware of Surroundings

- Activating the ambient sound mode, you can hear your surroundings more clearly, thanks to the two noise-sensing mics on each earbud.

- It lets you stay connected with the surroundings while listening to music, very useful when commuting on a metro or bus.

- The app even lets you adjust the strength depending on the amount of ambient noise you want to let in.

🔇Excellent ANC: Zone Out from the Noise

- Sony has included a new V1 integrated processor in the earbuds which powers ANC and LDAC Bluetooth codec support.

- The V1 processor takes its noise-canceling capabilities even further than the predecessor by cutting off more noise at different frequencies.

- We tested the ANC capabilities on a long-haul flight while traveling to MWC 22, and locally while traveling in metro and cabs.

- With ANC ‘On’ and listening to music even at 50% volume, the earbuds block out ambient noise effectively while letting you immerse in the music.

- There is also a wind noise reduction feature which worked very effectively in blocking out noise when sitting on a window seat on a local train.

🔊Clean, Immersive Sound Quality

- Sony has consistently delivered great personal audio devices, and the WF-1000XM4 is no different.

- The earbuds are very well tuned to instantly get yourself lost in the groove.

- It offers a versatile performance irrespective of the music genre you are listening to.

- With most TWS, I prefer customizing the equalizer to suit my listening preferences, but with the XM4, I mostly kept the EQ off.

- Though, at times when I felt like having some bass punch, I would set Clear Bass to +2, while keeping the rest of the frequencies flat.

- Most of my listening is generally on iPhone with Apple Music as a source, and despite having songs in Lossless quality, the iPhones only support AAC codec.

- Though audio on flagship Android smartphones sounds a little better due to support for LDAC codec.

- The connectivity is stable too, as long as you are within a five-meter range.

- Apple Music lossless, Tidal, or Prime Music on Android lets you take advantage of high-res audio listening, but the same is not possible with Spotify.

- Mic quality on calls was good and recipients had no issues hearing me.

🔋Reliable Battery Life

- On a full charge with mixed usage and ANC On, the WF-1000XM4 offered a good battery life of a little over six hours.

- The charging case adds two full charges for the earbuds, so you get a total of 18-19 hours of battery life before needing the charge the case again.

- The earbuds also support a quick charge feature where even five minutes of charging can offer up to 60 mins of playtime and during my testing, it worked for close to 50 mins, which is good.

- The case takes about 90 minutes to fully charge with a wired Type-C fast charger.

- There is also support for wireless charging, but it takes a little over three hours to fully charge.

Key Takeaways

- The Sony WF-1000XM4 delivers excellent sound quality catering to audiophiles and general users.

- The active noise cancellation (ANC) is among the best that we’ve tried on TWS earbuds.

- Battery life even with ANC ‘On’ is not an issue with the 1000XM4, and with ANC ‘Off’, it covers you for almost the entire workday.

- Additional features like saving the audio profile on the earbuds, IPx4 rating, and wireless charging, offer a value package.

Wishlist for WF-1000XM4 Successor

- While the attention awareness feature using bone conduction technology is a good addition, the low sensitivity needs more refinements to not trigger aggressively.

- In-ear detection could be better, currently, even if the earbuds are kept on the table, the music playback does not stop, and it continues to play.

- Multi-point Bluetooth connection to quickly and automatically switch between devices will be a good addition, especially as most of us extensively use a smartphone and a laptop in our daily life.

- Gaming latency could be better, as it will come in handy when playing games like BGMI or COD: Mobile on a connected smartphone.

ALSO READ: Other Strategic Reviews on Smartphones, Smartwatches, TWS & More

- Huawei Watch 3 Review: Gorgeous Display, Fluid UI & Reliable Fitness Tracker

- OPPO Find N Review: Small Wonder

- Nothing ear (1) Review: Unique Semi-transparent Design, Clean Sound, Good ANC

- Lenovo ThinkPad X1 Fold Review: Folding Screen PC Hits a Sweet Spot Between Laptops & Tablets

- Samsung Galaxy S21 Ultra Long-term Review: Smooth Performance, Refined Software Offer Best Android Experience

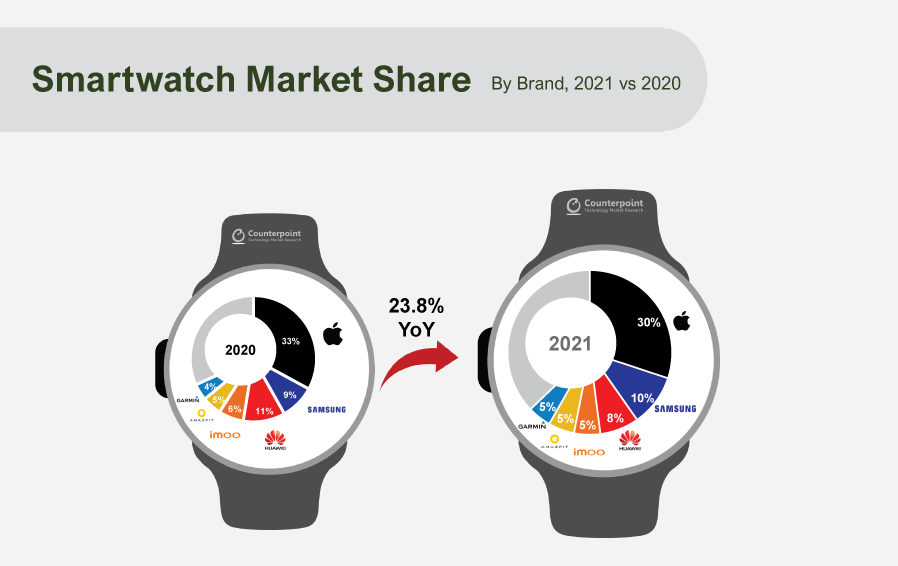

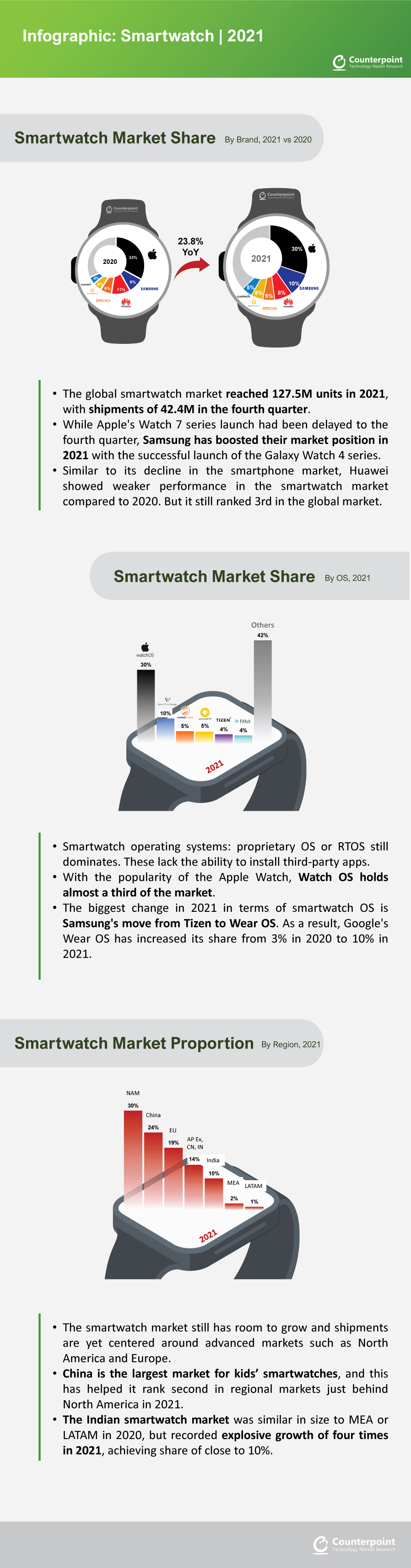

Use the button below to download the high resolution PDF of the infographic:

Use the button below to download the high resolution PDF of the infographic: