Last week, Dish Network announced a strategic partnership with Amazon Web Services (AWS) whereby AWS will become Dish’s preferred cloud provider. Dish is the fourth-largest MNO in the US cellular market and is building a greenfield open RAN-based 5G network across the country. Leveraging AWS’s cloud infrastructure and services – including AWS Outposts and AWS Local Zones – Dish claims that it can build a cloud-native 5G network for around $8bn to $10bn, a figure significantly less than its rivals.

Advantages for Dish

Teaming with AWS potentially has many advantages for Dish, particularly cost. By becoming a tenant of AWS, with its global economies of scale, Dish will be able to reduce its capital outlay dramatically. Clearly, using AWS to host virtual base stations on its network will be much cheaper than buying servers and hosting them on-site or in a private cloud. This could also allow it to reduce OPEX costs as it will be able to scale its computing needs up and down according to traffic demands. There are also other potential benefits, particularly with respect to enterprise customers, as it could leverage AWS’s expertise around analytics, AI and data management to introduce new features and functionalities for enterprises.

Implications for Dish’s Partners

Dish has already announced contracts with more than 30 vendors, including radio and chip vendors, tower operators, backhaul providers, network core software and security vendors. However, this deal with AWS has potential implications for some of of these vendors.

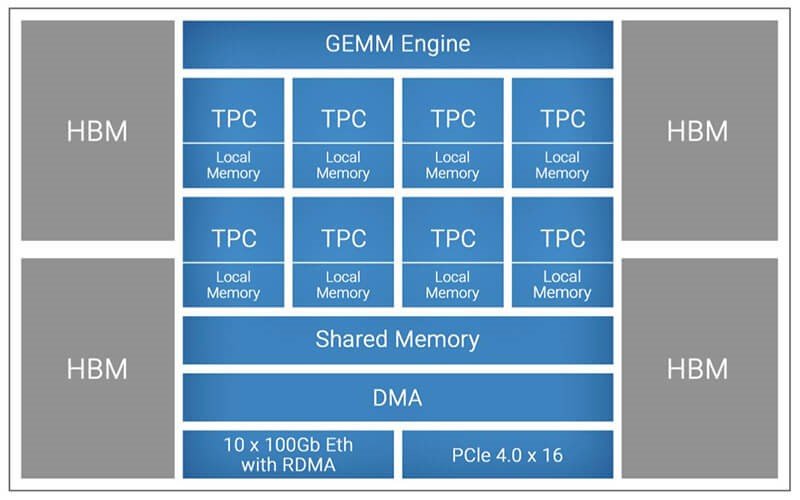

For instance, Dish has already formed partnerships with Altiostar and Mavenir as providers of Dish’s RAN software. Both companies have built their software on Intel’s x86-based FlexRAN platform. However, Dish has announced that it intends to run some of the Distributed Unit (DU) elements of its baseband computing operations on AWS’ custom designed Graviton2 processors. Amazon claims that its ARM-based Graviton processor has a 40% better price performance over comparable current x86-based chips for a wide variety of workloads. Other DU operations will run on Intel’s FlexRAN platform, depending on the configuration of Dish’s network in a select location. Clearly, the use of the AWS processor implies less business for Altiostar and Mavenir as well as a smaller role for Intel.

From One Lock-in to Another?

Vendor diversity is a hot topic among MNOs as well as many governments in the US, UK and elsewhere with claims that open RAN can be used to decrease Huawei’s 5G dominance as well as break the Nordic stranglehold in markets where Huawei and compatriot ZTE are banned.

However, the ambitions of the big public cloud providers such as Amazon, Google and Microsoft go far beyond simply managing servers in massive centralised data centres. All three are extending their cloud service offerings to the edge, a territory that telcos once hoped to dominate. Telcos nowadays seem more interested in partnering with the big three providers rather than focusing on developing an alternative telco-based solution. Verizon and Vodafone, for example, are key customers of AWS’ edge technology Wavelength. There are thus legitimate concerns about the dominance of the big three cloud providers. Barriers to entry in the sector are virtually insurmountable and customers attempting to move clouds typically face high switching costs as well as technical design challenges.

Dish looks like it will be the first network in the world to run its entire network from the public cloud and as such this is seen as a key test case. It will be closely watched by all in the telecoms industry, and if successful, others will inevitably follow. However, there is a real risk here that MNOs could fall into a lock-in that is much worse than what they complain about today!

Related Posts

5G MEC Ecosystem – Stakeholders Partner in Mad Rush to the Edge

Microsoft Gets Serious about Telco Cloud with Metaswitch Acquisition

5G MEC – Deployment Options and Challenges for Mobile Operators