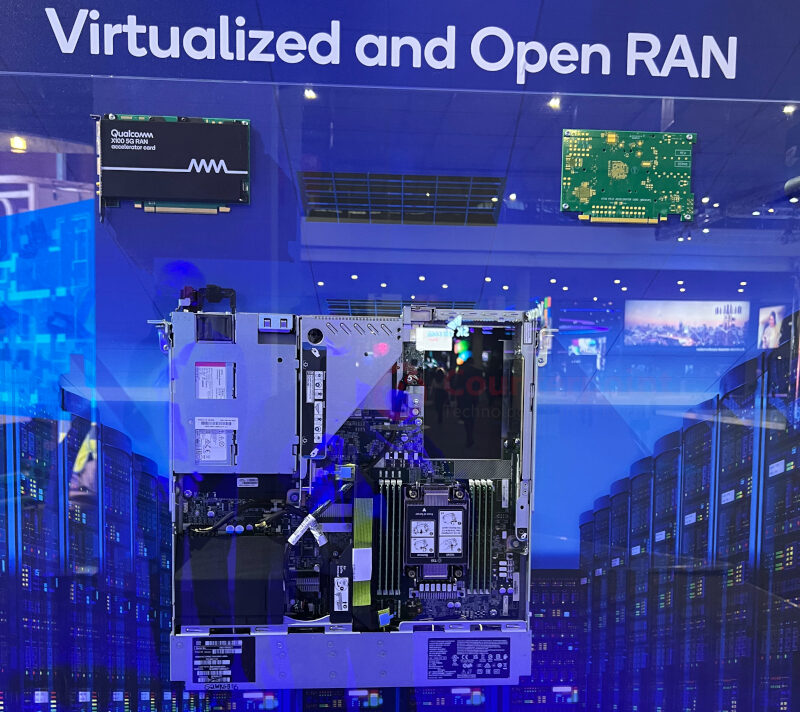

The private network market is evolving with operators, equipment vendors, system integrators, and specialized solution providers working together to meet enterprises’ needs. In some cases, operators lead the deployment, but in others, an ecosystem partner with an established customer relationship leads the deployment. Collaboration between all players in the ecosystem is essential to satisfy the precise requirements of enterprises.

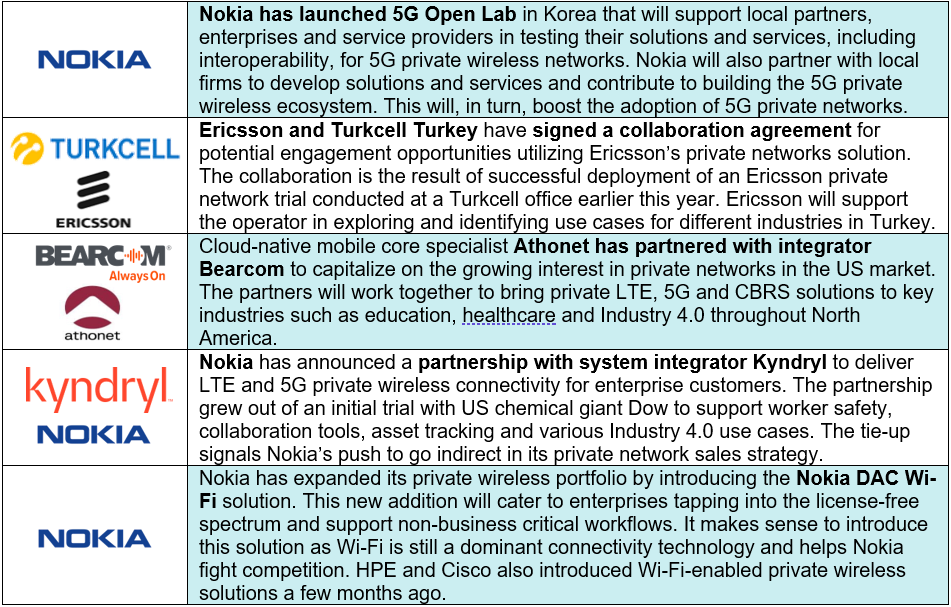

Let us look at the key announcements in 2022 highlighting growing collaboration with a broadening vendor ecosystem:

These announcements are in addition to some heavyweight announcements from AT&T, Microsoft, HPE and others around MWC 2022. We covered those announcements and key takeaways in our blog ‘MWC 2022 Highlights Growing Interest in Private 5G Networks’.

LISTEN: Private Networks – What are the Key Trends, Market Drivers, & Challenges

Key trends shaping the market

We have seen a fundamental change in the private network market in the last 2-3 years. Major vendors such as Nokia and Ericsson now increasingly sell their network equipment to enterprises or intermediaries, bypassing the operators. Some of the other key trends that are shaping the market are:

- New players including hyperscalers are entering the market with easy and simplified solutions, thereby increasing awareness and reducing entry barriers around private networks.

- Large enterprises (in countries that offer licensed spectrum to enterprises) are most likely to acquire their own spectrum and deploy private networks. It enables them to control security and architecture.

- LTE private networks are having a good run compared to 5G private network deployments as there is a global ecosystem and established scale.

Factors affecting the growth of 5G private networks

There are several factors affecting the private network market’s growth and some of these are specific to 5G private networks. For instance, the delayed release of 3GPP Standards can be blamed for holding up the progress of 5G networks for several years. Many enterprise-oriented features were not finalized until the latest Release-17, and it is still a work-in-progress until Release-18 or even Release-19 is brought to fruition. Another major factor is the unavailability of chips to support applications demanding higher levels of durability. Our latest podcast also covers the most pressing problems in the growth of private networks and how this market is shaping up.

Growing market size

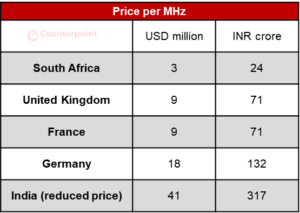

The potential market size of private networks is expanding as more and more countries (such as Germany, UK, Brazil and Japan) are unlocking licensed/unlicensed spectrum for enterprises. Countries that started this trend have continued to expand and develop initiatives based on growing demand. For instance, we saw Priority Access Licenses (PAL) distributed in the US market in 2020 progressing with deployments in 2021. Germany is continuing with granting licenses to enterprises. Furthermore, MulteFire Alliance (MFA) is developing and promoting MulteFire and Uni5G standards based on unlicensed spectrum usage. Counterpoint Research has recently published a report that provides an overview of the global private network market today, including spectrum availability across multiple geographies, device/network equipment availability, detailed information on several use cases from different industry verticals, and more.

Beyond the first movers, we see momentum across the verticals. More and more enterprises are converting their network trials into commercial deployments as private networks are able to deliver the desired results. We expect mining, manufacturing, ports, utilities and energy verticals to increasingly expand private networks at multiple sites and, in some cases, in multiple countries in 2022 and beyond.

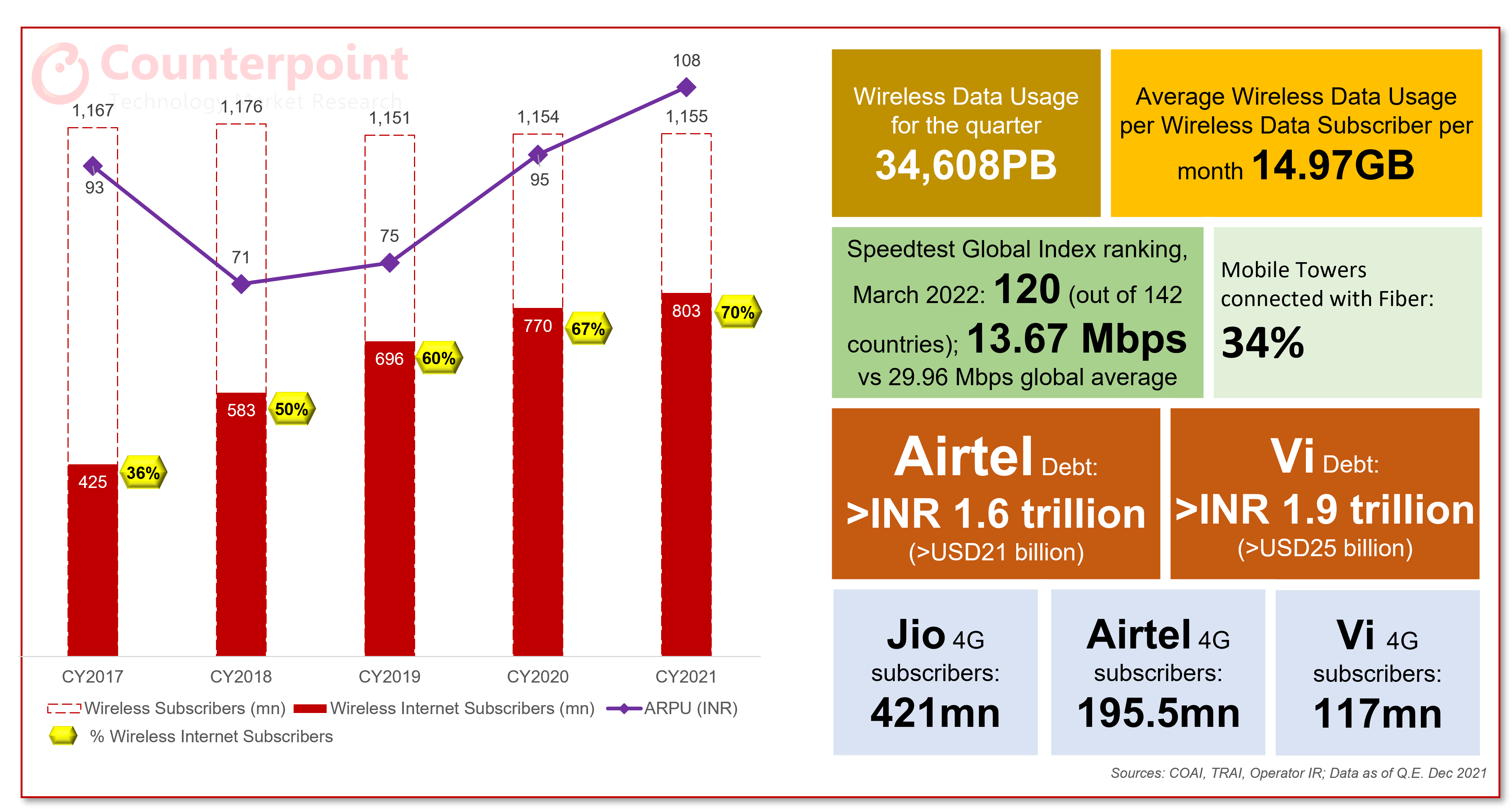

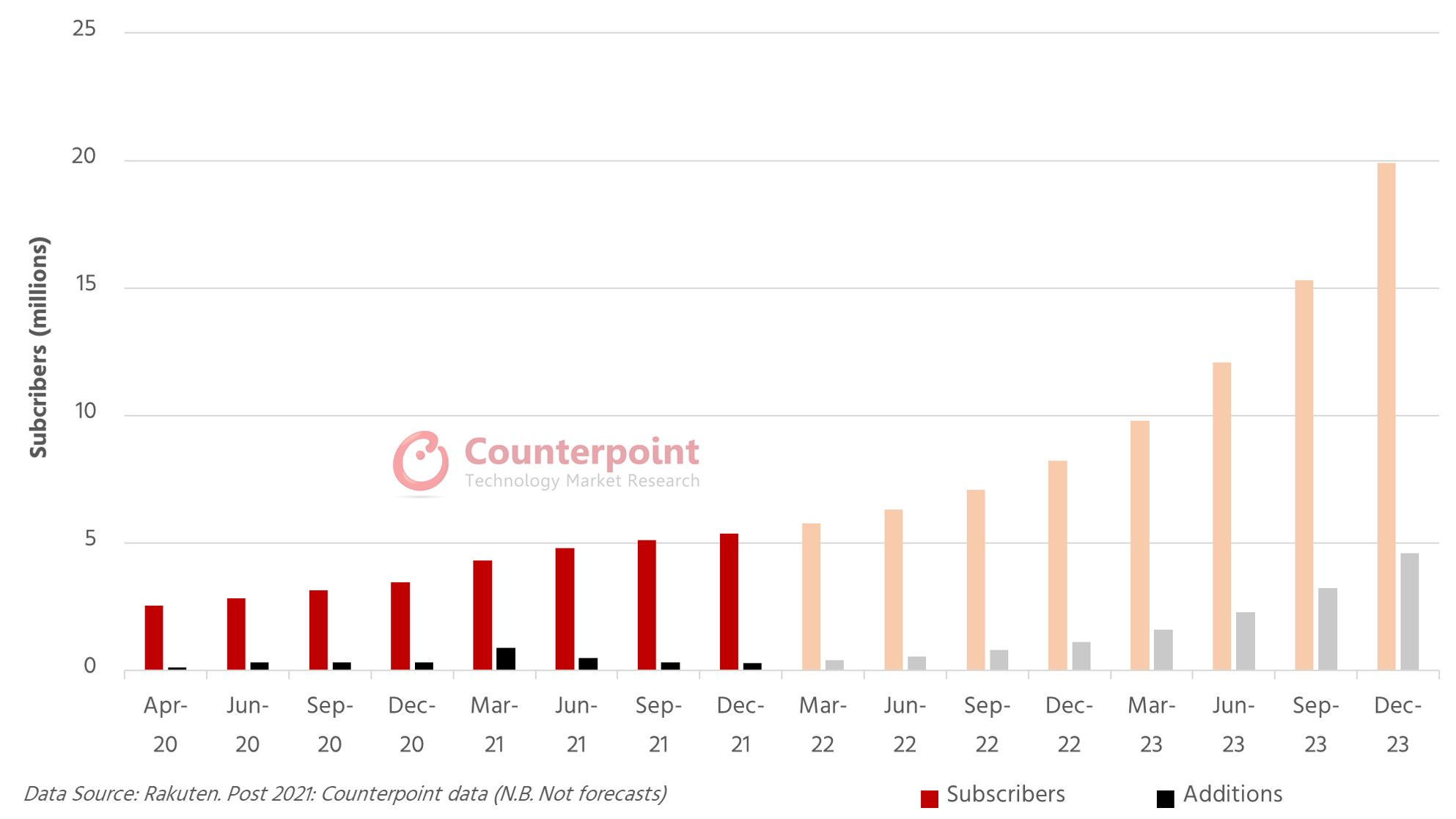

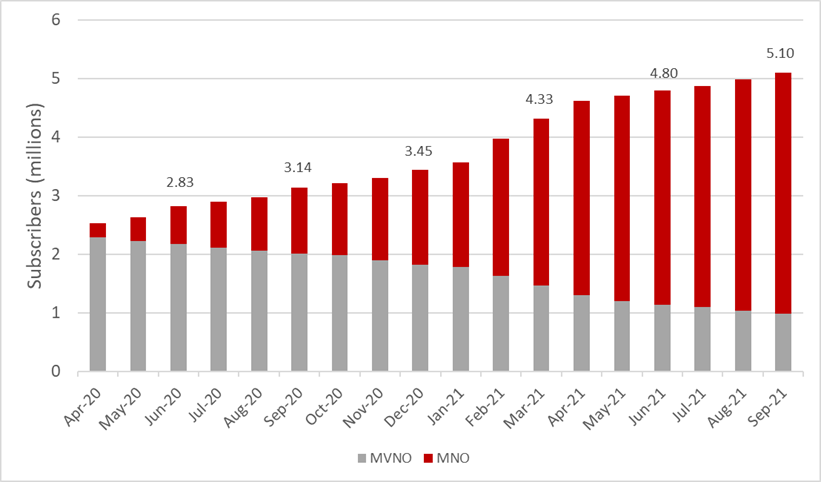

As a result, Rakuten may be biding its time. Nevertheless, at some point it will need to commit to marketing if it is going to have any hope of achieving success in the retail market. Although it offers the lowest-priced data packages, particularly for high data users, lower pricing alone does not seem to be sufficient to attract customers in their droves. This may be due to the lack of marketing but also because the number of customers interested in high-data packages at present is limited. However, this will inevitably change with the transition to 5G. And Rakuten is confident that it will benefit, as it believes that it will be able to offer much more competitive pricing than rivals due to its network cost advantages.

As a result, Rakuten may be biding its time. Nevertheless, at some point it will need to commit to marketing if it is going to have any hope of achieving success in the retail market. Although it offers the lowest-priced data packages, particularly for high data users, lower pricing alone does not seem to be sufficient to attract customers in their droves. This may be due to the lack of marketing but also because the number of customers interested in high-data packages at present is limited. However, this will inevitably change with the transition to 5G. And Rakuten is confident that it will benefit, as it believes that it will be able to offer much more competitive pricing than rivals due to its network cost advantages.

© Counterpoint Research, Data Source: Rakuten Group

© Counterpoint Research, Data Source: Rakuten Group