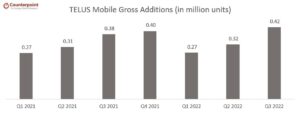

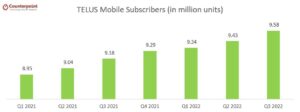

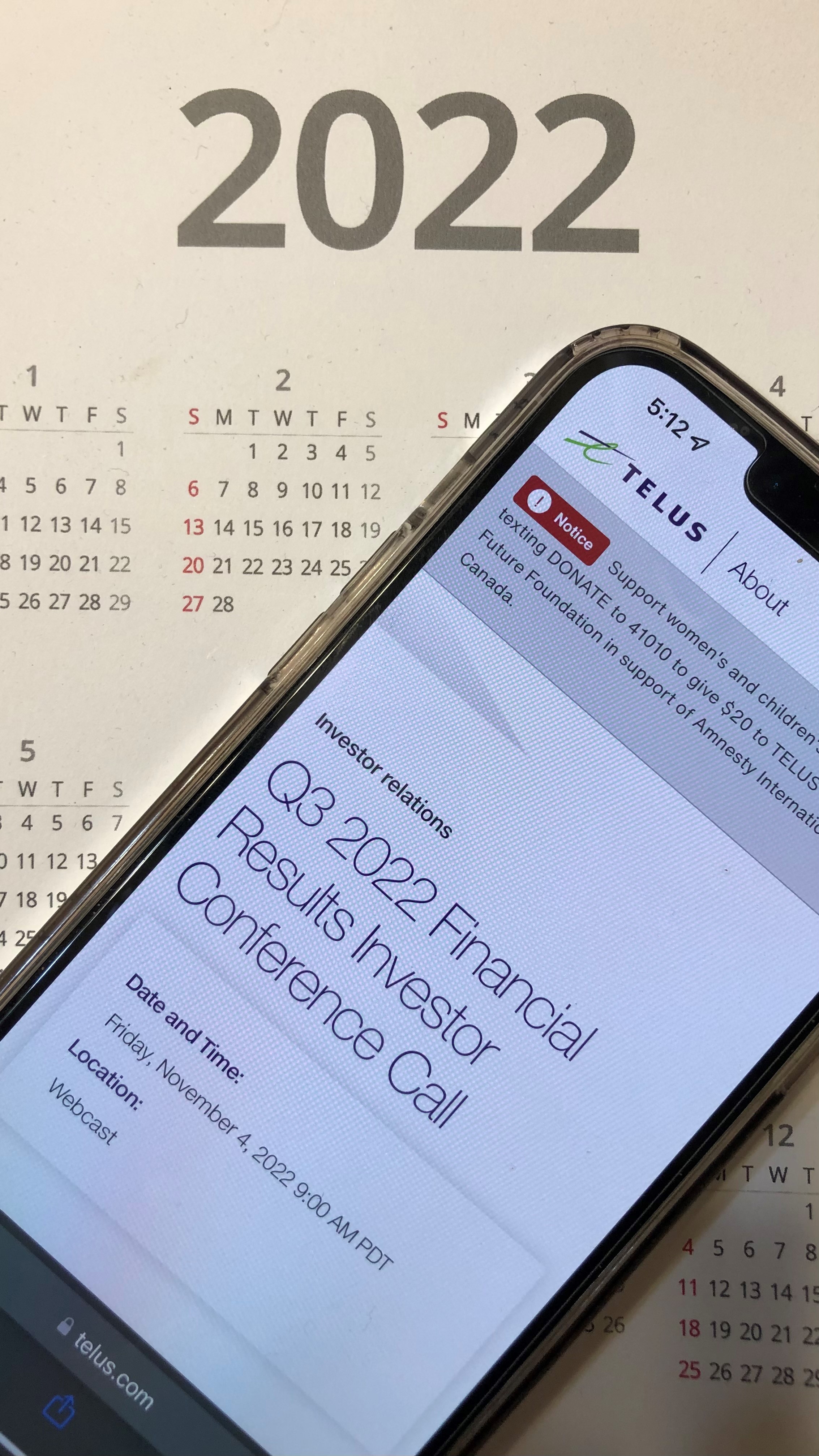

TELUS had an excellent third quarter with YoY growth across all segments. The earnings call focused on the lack of churn in this quarter and the dependability of TELUS’ network, with no direct reference to the Rogers nationwide outage that caused a standstill in the country at the beginning of July. But the mobile gross additions during Q3 2022 were at their highest for TELUS since before the pandemic. Even as TELUS saw great success in its mobile segment, its other segments like IoT, TV and wireline also saw significant growth this quarter.

Information Source: TELUS

TELUS continues to keep churn low; Expands 5G Coverage by 23%

- While emphasizing on customer loyalty and lower churn, TELUS highlighted that this was the eighth quarter out of the last 11 where the postpaid churn was below 0.80%. The quarter saw 0.73% churn for the postpaid segment and 0.95% when combined with the prepaid segment.

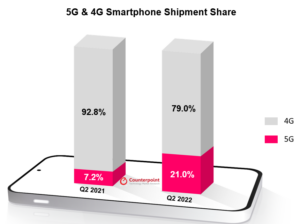

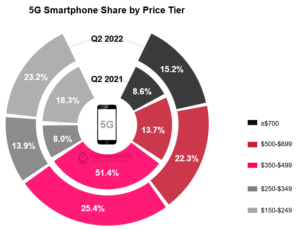

- Mobile phone ARPU increased 2.3% YoY. This was attributed to the adoption of 5G+ plans that customers are upgrading to. The early launch of the iPhone 14 series would also help boost ARPU as carriers are a dominant sales channel for these devices.

- Service revenue was up 4.2% YoY. Mobile network revenue was also up 6.8%. Roaming revenues continued to increase to approach pre-pandemic levels as people continued to travel and absorb roaming fees. The upgrade to 5G+ plans also contributed to the increase in mobile network revenue.

- 5G expansion has been progressing fast for TELUS, with the total 5G population coverage increasing 22.8% to 29.6 million as against LTE’s 37 million.

Information Source: TELUS

Growth in connected devices category slowed down

- Connected devices have been a large growing segment for TELUS in the past year, with the sales of smartwatches, tablets and other IoT devices increasing at the carrier. Connected device sales saw an increase of 15.1% from Q3 2021.

- Wireline saw 36,000 internet net additions, not as strong as the 46,000 net additions last year. Total internet subscribers saw a YoY increase of 6.3% in Q3 2022.

- TV net additions saw large growth at 18,000, up 8,000 from last year to result in a 4.9% increase YoY.

TELUS continues to strengthen its position in Healthcare and Security

- Healthcare has been a growing focus for TELUS outside the wireless industry as COVID-19 proved the need for better connectivity within the healthcare system. TELUS has been able to add 1.7 million virtual healthcare members to its Lifeworks network in the past year. It can accommodate up to 60.4 million people.

- Security devices and memberships have also seen a spike this year for TELUS, with total subscribers to the service now reaching 950,000, a 22.9% increase YoY. Ecosystem OEMs like Google have developed smart doorbells and house cameras with connectivity to smartphones, which has boosted this segment significantly.

- New global metrics show a 19.3% revenue increase for the technology and games segments of TELUS. With cloud and mobile gaming gaining popularity, these metrics will invite an increased focus from carriers.

Overall, TELUS has had great success this year, not only boosting its wireless market but also quickly expanding its other businesses in sectors like healthcare and security. Apple iPhone 14 series significantly contributing the the late Q3 success of device sales, as per Counterpoints North America Channel Share Tracker. TELUS is on track to meet the 2022 guidance it had set at the end of last year. TELUS has already reached the goal of 10% growth in adjusted EBITDA and 9.9% growth in operating revenues YoY. The consolidated targets are attainable in Q4 as strong sales of flagship devices continue to drive the market and roaming fees continue to climb with travel becoming easier the world over with the gradual lifting of COVID-19 curbs.

Source: Counterpoint Monthly Indonesia Channel Share Tracker

Source: Counterpoint Monthly Indonesia Channel Share Tracker

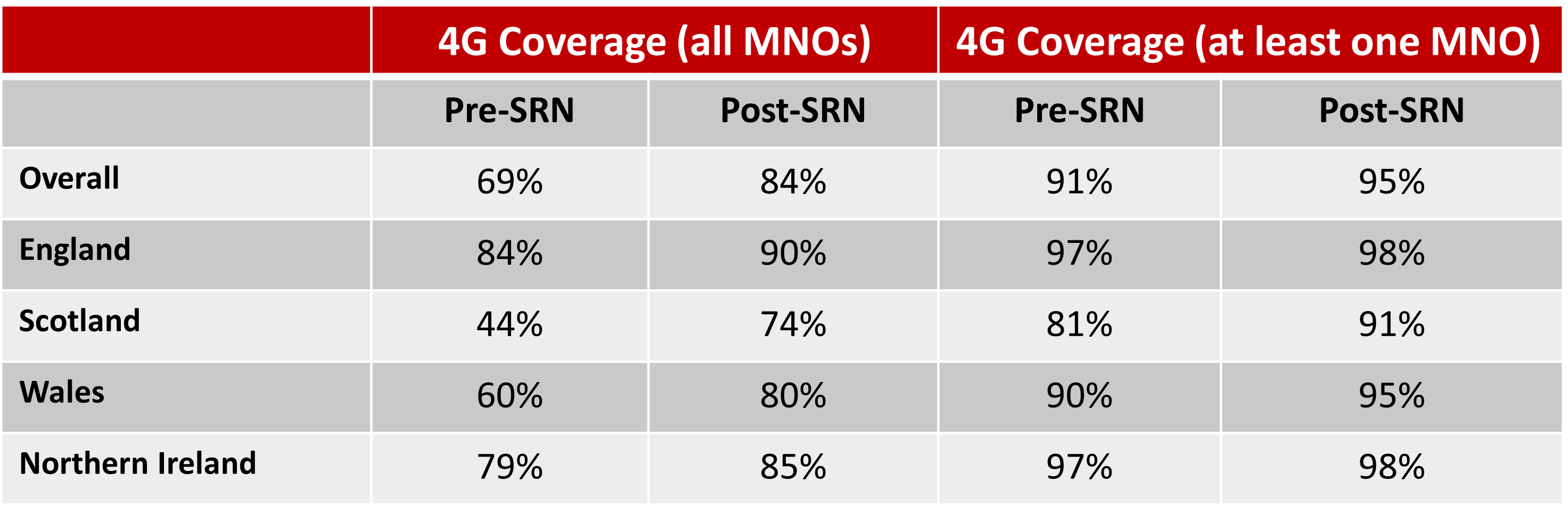

©Counterpoint Research; Source: Digital Mobile Spectrum Ltd.

©Counterpoint Research; Source: Digital Mobile Spectrum Ltd.