- Noise maintained its lead for the fifth consecutive quarter.

- boAt Storm remained the most popular model.

- Fire-Boltt registered tremendous QoQ growth of 394%.

New Delhi, Boston, Toronto, London, Hong Kong, Beijing, Taipei, Seoul – November 9, 2021

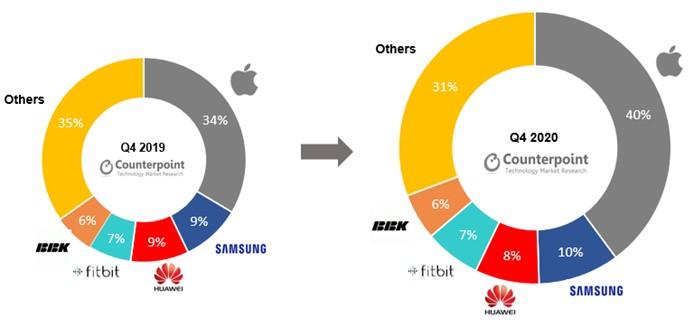

India’s smartwatch market registered its highest ever shipments in Q3 2021 to have a record QoQ growth of 159%, according to the latest research from Counterpoint’s IoT service. In YoY terms, the growth was 293%. The top three brands contributed to almost two-thirds of the total market. The growth can be attributed to promotions across various platforms along with new launches, which contributed to around 28% of the total market in terms of shipments.

Commenting on the market growth, Senior Research Analyst Anshika Jain said, “Q3 is crucial for the smartwatch players as this is the time when they witness the highest growth. To meet the anticipated surge in demand during the festive sale, the brands push increased shipments into the channel. Besides, they come up with multiple launches and big discount schemes throughout the quarter. The market remained competitive in Q3 2021 with Noise and Boat together capturing almost 50% of it. Fire-Boltt, Apple and realme emerged as the fastest growing brands during the quarter.”

On the growth of local brands, Jain said, “Domestic brands have grown rapidly. They captured around 75% of the Indian smartwatch market in Q3 2021, compared to 38% in Q3 2020. This is the highest contribution from the Indian players so far. The strategy of celebrity endorsements, introductory pricing schemes, discount offers, affordable and feature-rich devices and increasing the frequency of new launches has worked well for the Indian brands.”

Commenting on pricing, Research Associate Harshit Rastogi said, “We are seeing a steep decline in the average selling price of a smartwatch. It has almost halved from the level a year back. More than 90% of the market now falls under INR 10,000 with INR 2,500-INR 3,000 being the most competitive segment and contributing to around 40% of the overall market. With new launches coming at even lower prices, the market under INR 2,000 is expected to witness higher growth in the coming months.”

India Smartwatch Market Share of Top 5 Brands, Q3 2021 vs Q3 2020

Source: India Smartwatch Shipments Model Tracker, Q3 2021

Market Summary:

- Noise grew 231% YoY and 141% QoQ in Q3 2021, capturing 25% of the market. Noise has a well-balanced portfolio with multiple models. Its newly launched devices had a 43% share in its total shipments during the quarter.

- boAt grew 132% QoQ with 24% market share. Its boAt Storm remained the best-selling model in the market and alone had a 17% share in the overall smartwatch market. It led the market in the most competitive price band of INR 2,500-INR 3,000.

- Fire-Boltt had a tremendous quarter with 394% QoQ growth. It was the fastest growing smartwatch player in this quarter. Fire-Boltt had seven new launches in Q3 2021, which helped it gain the third spot in the market with a 17% share. It led the market in the INR 2,000 and below segment. It also roped in cricketer Virat Kohli as its brand ambassador just before the festive sales in October.

- realme made a comeback with the refreshed Watch 2 line-up. The brand registered 267% QoQ growth in Q3 2021, taking the fourth spot in the market with a 7% share. The Watch 2 series contributed to more than 70% of realme’s shipments in the quarter.

- Amazfit grew 54% QoQ and more than four times in YoY terms. It topped the market in the INR 5,000-INR 10,000 price segment. Amazfit hosted its Brand Day Sales in September and introduced the premium Zepp Z model in the Indian market. The GTS 2 Mini was its most popular model during the quarter.

- Samsung grew 153% QoQ and 40% YoY in Q3 2021. It introduced the Galaxy Watch 4 series with Wear OS during the quarter. The Galaxy Watch Active 2 remains popular and contributed to more than half of Samsung’s shipments in Q3 2021.

- Apple had a great quarter with 289% QoQ growth. Its major contribution came from the SE series launched last year. Even the Series 3 contribution remained high. It led the market in the INR 20,000 and above price band.

- OnePlus remained stable and continued to lead in the INR 10,000-INR 15,000 price band with its OnePlus Watch.

- Dizo entered the smartwatch market during the quarter with three models. The brand had a good start and is close to making a mark in the Top 10 list.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts:

Anshika Jain

Harshit Rastogi

Counterpoint Research

press(at)counterpointresearch.com

Market Summary:

Market Summary: