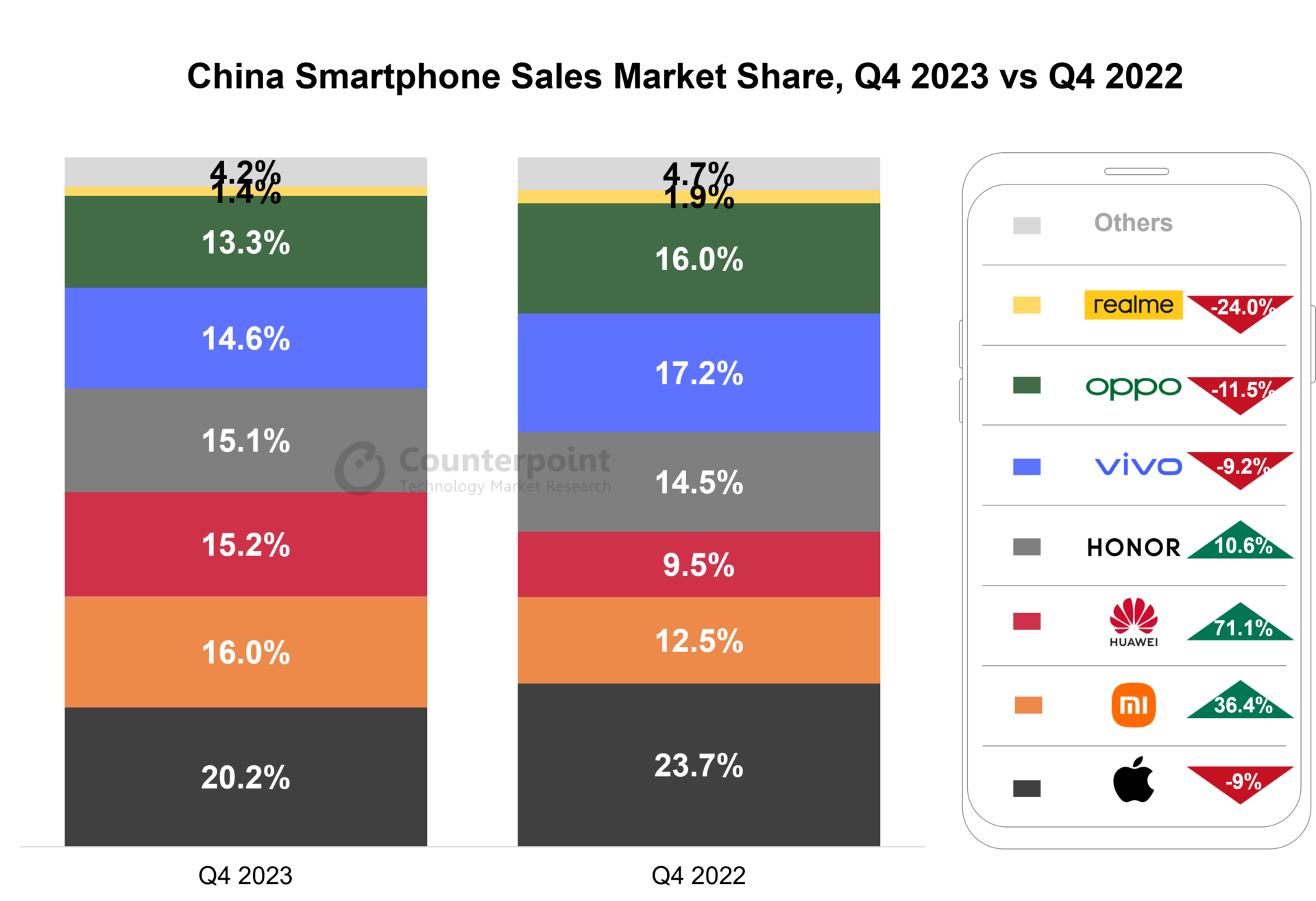

- Q4 2023 saw 6.6% YoY growth, marking the first quarterly increase in more than two years.

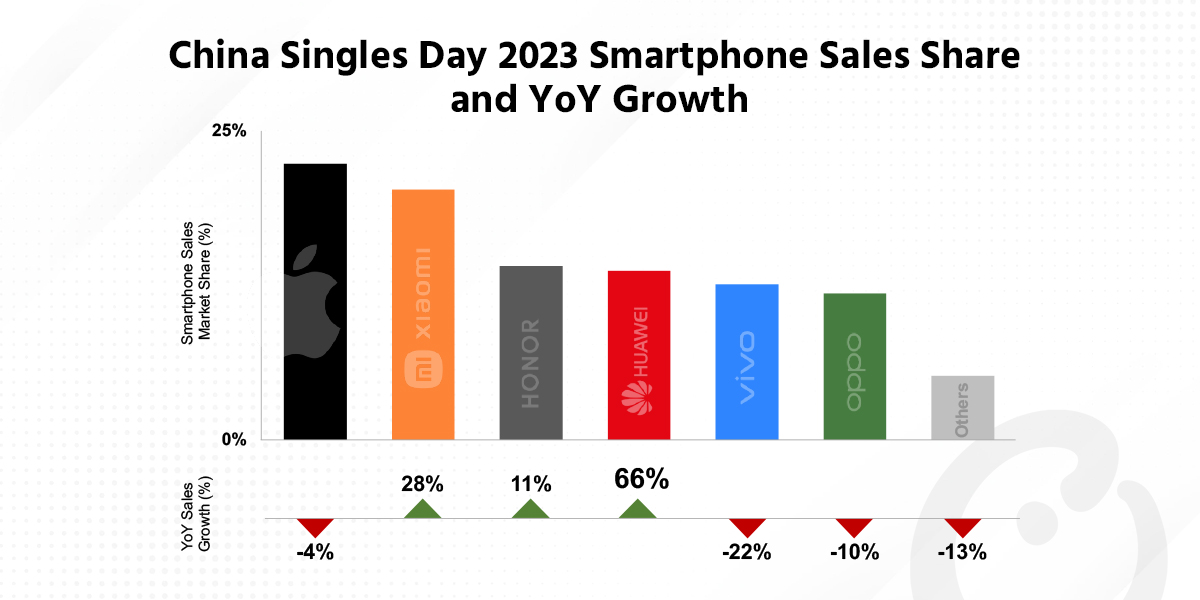

- Apple took the top spot followed by Xiaomi and Huawei.

- Apple’s sales dropped 9.0% YoY in Q4 while Huawei’s sales rose 71.1% driven by its 5G chipset.

- Xiaomi and HONOR managed to sustain growth momentum from Q3 into Q4.

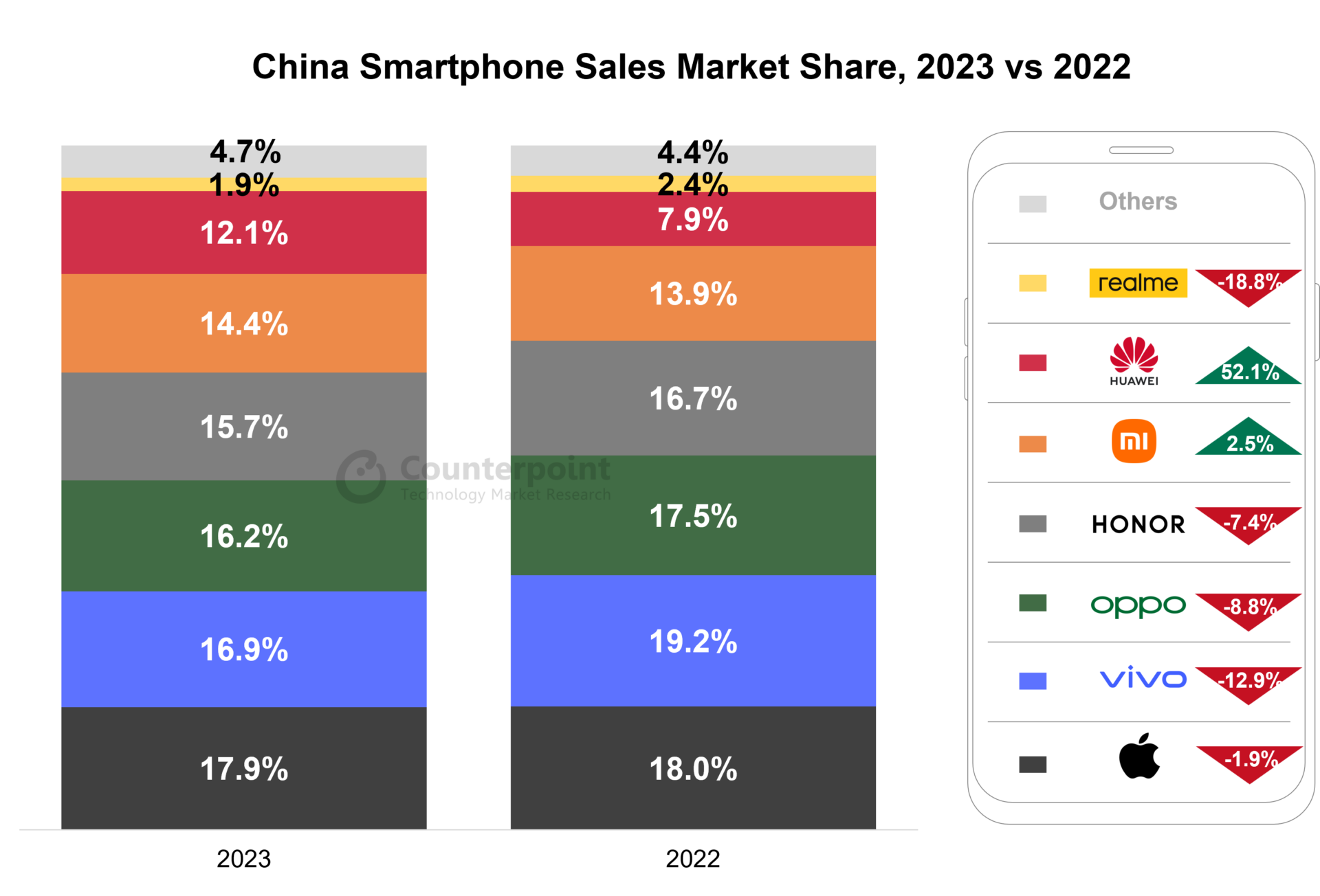

- For the full year of 2023, China smartphone sales fell 1.4% YoY, compared to a 13.9% YoY decline in 2022.

- The market is expected to record low single-digit YoY growth in 2024, the first one since 2018.

Beijing, Boston, Buenos Aires, Hong Kong, London, New Delhi, San Diego, Seoul – January 25, 2024

China’s smartphone sales bottomed out in Q4 2023, increasing 6.6% YoY to mark the first quarterly YoY growth after 10 consecutive quarters of YoY declines, according to Counterpoint’s Market Pulse Service. Huawei’s comeback with its own 5G chipsets continued to attract consumers, while Xiaomi and HONOR sustained strong performance with double-digit growth.

Despite a 9.0% YoY drop, Apple retained its first position in Q4 with 20.2% market share, followed by Xiaomi (16%) and HONOR (15.2%).

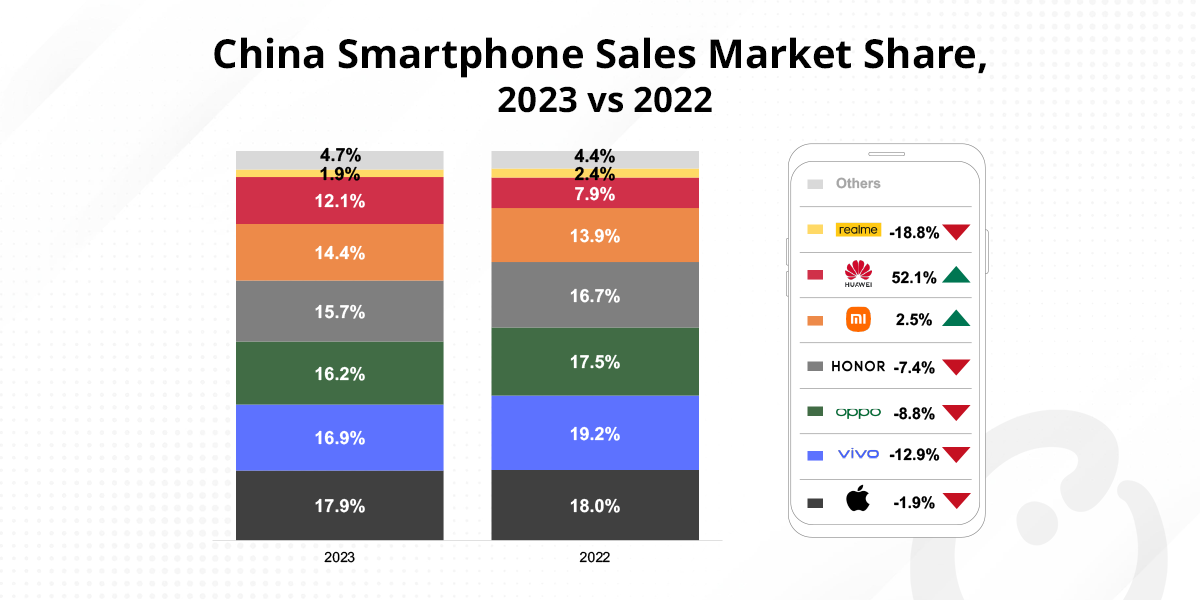

However, from an annual perspective, China’s smartphone sales still declined 1.4% YoY, compared to a 13.9% YoY decline in 2022. Apple ranked first with 17.9% share, followed by vivo (16.9%) and OPPO (16.2%).

Notes: OPPO includes OnePlus; Xiaomi includes Redmi; vivo includes iQOO; Figures may not add up to 100% due to rounding.

Commenting on the market dynamics, Associate Director Ethan Qi said, “There are several factors behind the YoY growth in Q4 2023. The market was at a low point in Q4 2022, making YoY comparisons more favorable. Besides, new Huawei phones powered by its own 5G chipsets drove the Q4 2023 recovery to some extent.”

Commenting on OEM performance, Research Analyst Archie Zhang said, “Huawei’s Kirin chipset was the primary driver of the brand’s growth. Xiaomi and HONOR also adopted aggressive strategies, including for marketing and distribution, to boost sales. Xiaomi’s Mi 14 series, HONOR’s X50 series and the HONOR 100 contributed to their strong growth.”

In Q4 2023, Apple faced stiff competition from Huawei. Besides, the iPhone 15 series’ performance was lukewarm, something which was also indicated by the strong sales of the iPhone 14 series in H1. It seems OPPO and vivo are yet to benefit from the market recovery so far.

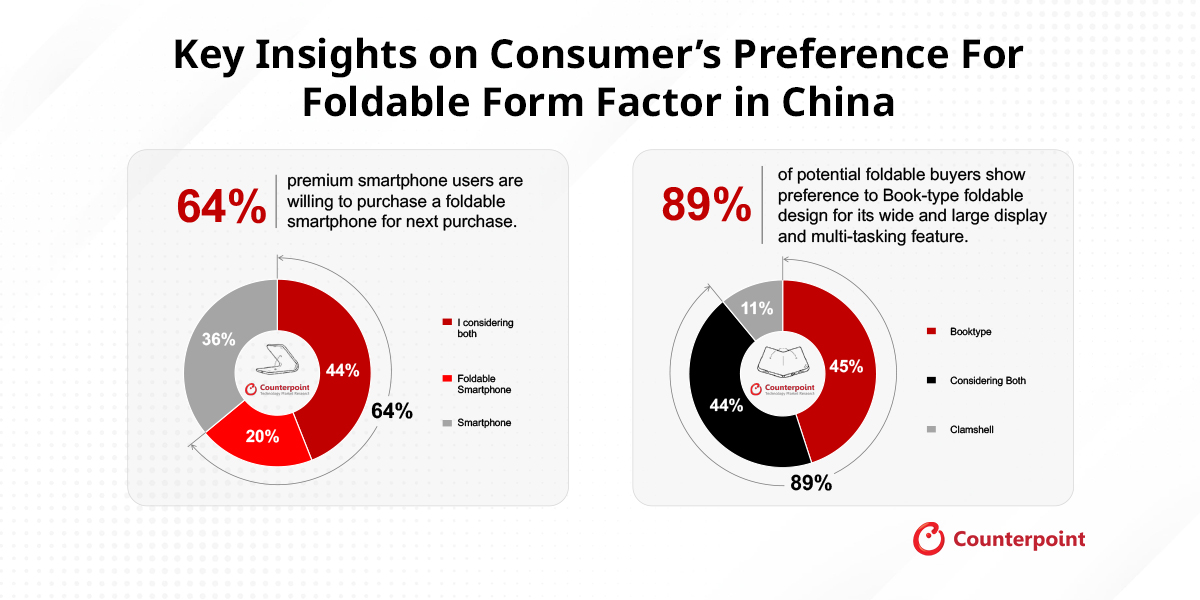

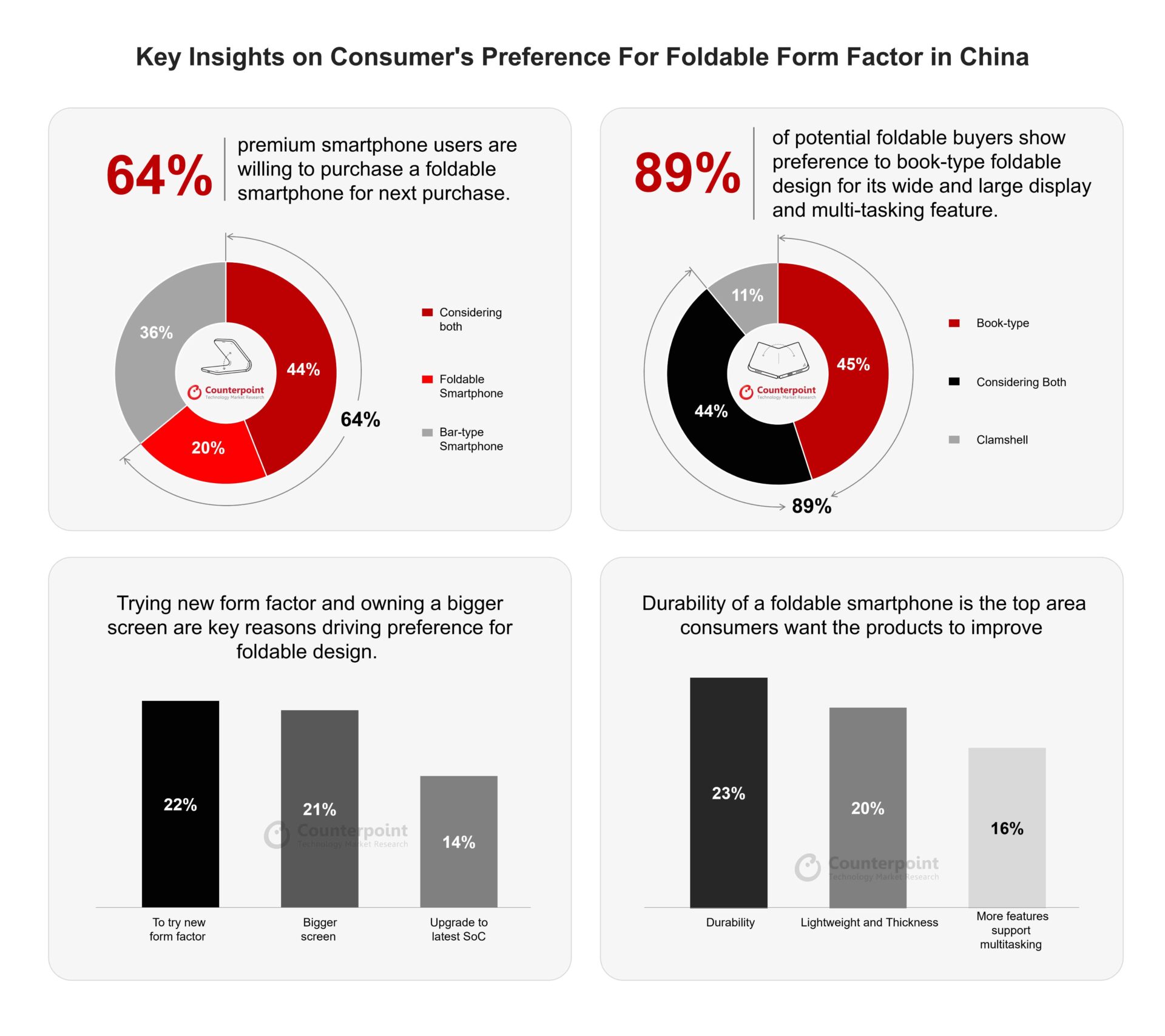

Looking ahead to 2024, Counterpoint Research expects low single-digit YoY growth for China’s smartphone market, bringing it back to growth after five years. Huawei’s mid-end Nova 12 series with 5G Kirin chipsets, launched at the end of Q4 2023, is expected to continue bringing back loyal users. Apple embraced price cuts in January to capitalize on the recovery and offset the pressure from local OEMs. Chinese OEMs are also expected to focus on generative AI, innovative form factors like foldables, and advanced imaging technologies to boost sales and expand their user bases.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

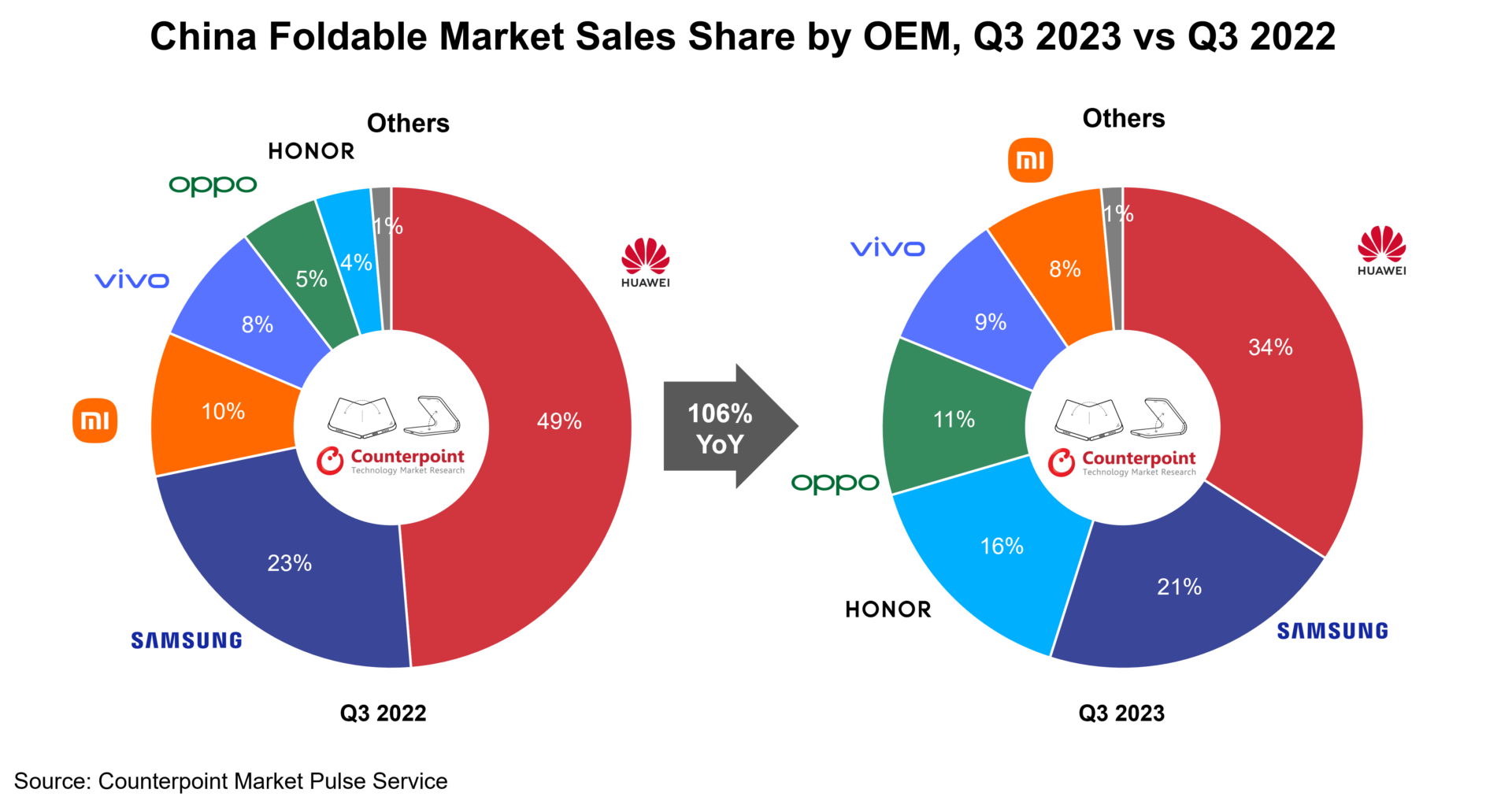

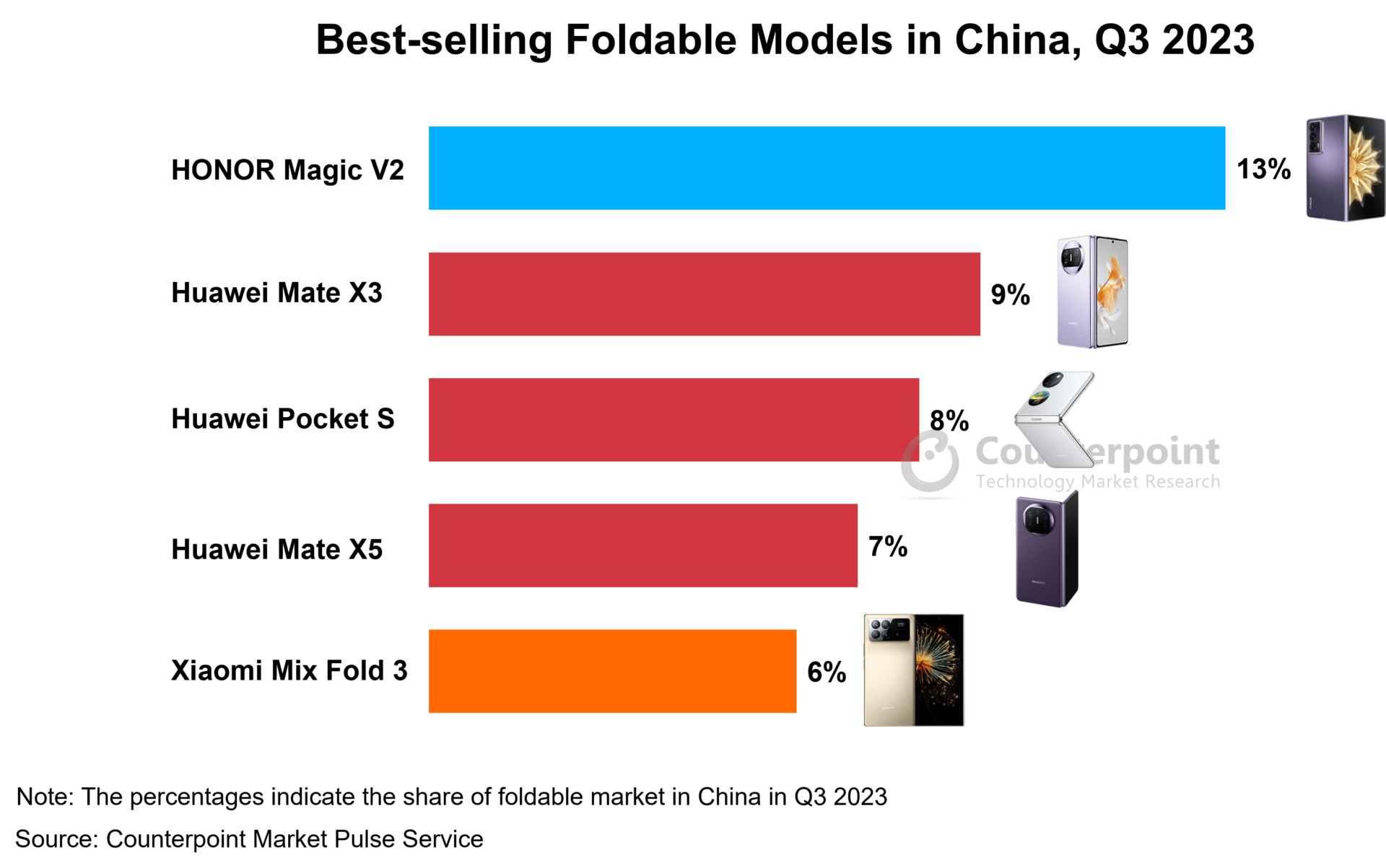

HONOR and other Chinese OEMs have stepped up foldable shipments while aiming for faster growth in the premium segment globally. This will make the

HONOR and other Chinese OEMs have stepped up foldable shipments while aiming for faster growth in the premium segment globally. This will make the