Taipei, London, Hong Kong, Boston, Toronto, New Delhi, Beijing, Seoul – July 27, 2022

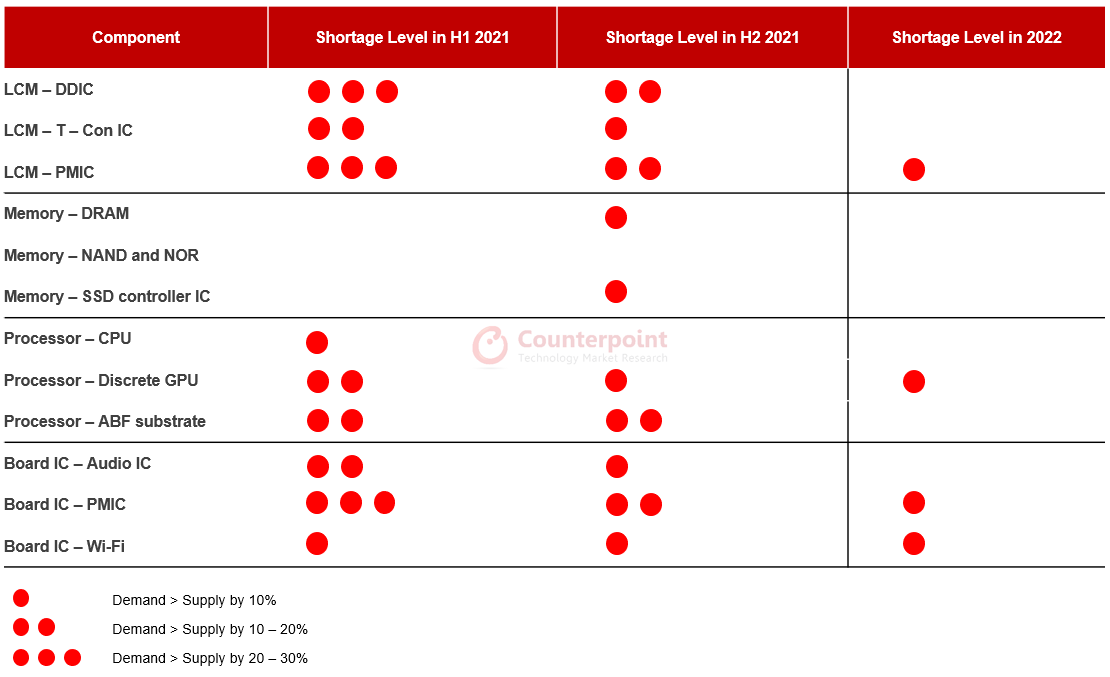

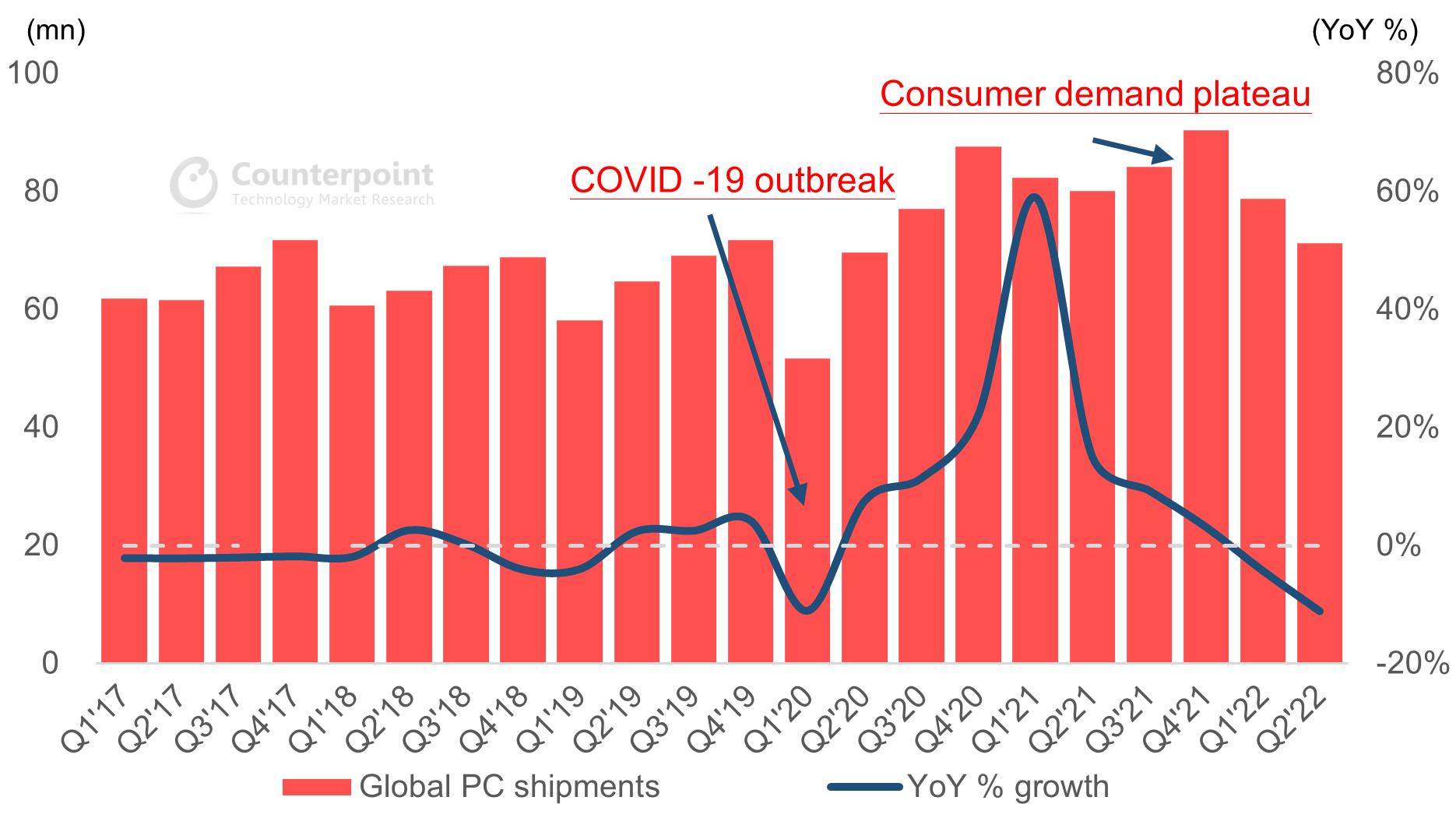

Global PC shipments fell 11.1% YoY in Q2 2022 to reach 71.2 million units and record the largest YoY decline since Q2 2013, according to Counterpoint data. The Q2 2022 decline was largely due to lockdowns in China’s Shanghai and Kunshan, which hit the PC supply chain. However, as the OEMs’ inventory continues to accumulate amid lackluster consumer demand globally, we believe supply issues will likely get resolved in the second half of this year.

Diminishing YoY PC Shipment Growth Since Q1 2021

Source: Counterpoint Research

The macroeconomic turbulence continues to impact worldwide consumption momentum. Regional conflicts as well as global inflation have resulted in a downward sloping demand and consumer spending. Enterprises too are putting off their new purchases and device upgrades, though the orders from the commercial segment have remained more solid compared to the consumer segment. By region, the US and EU experienced relatively huge double-digit YoY declines in their Q2 2022 shipments, mainly dragged by Chromebook demand correction and soft consumer demand, as these regions had started seeing shipment growth ahead of other regions last year.

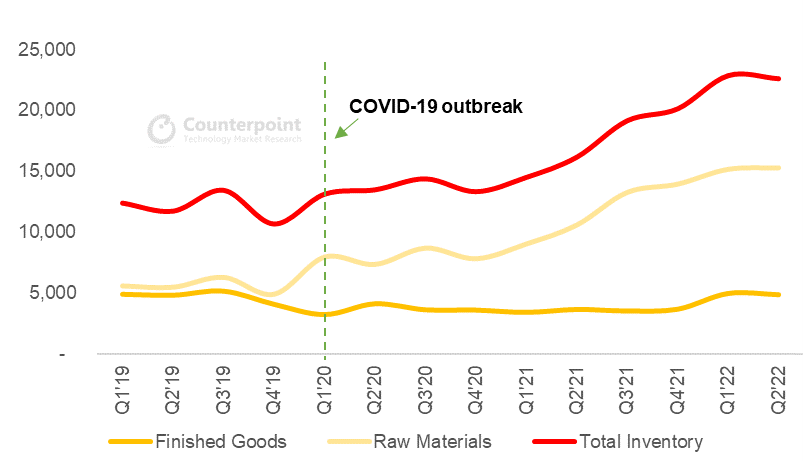

On the other hand, lockdowns in China during the quarter hit hard the laptop supply chain, as major laptop ODMs, including Quanta, Compal and Wistron, suffered manufacturing disruptions. The most harmful impacts were in April and May when we saw approximately 40% and 20% YoY declines respectively for key ODMs. Production lines resumed normal operations in the second half of May and were trying to clear order backlogs.

Major Laptop ODMs’ Inventory Levels (in $ mn)

Source: Counterpoint Research

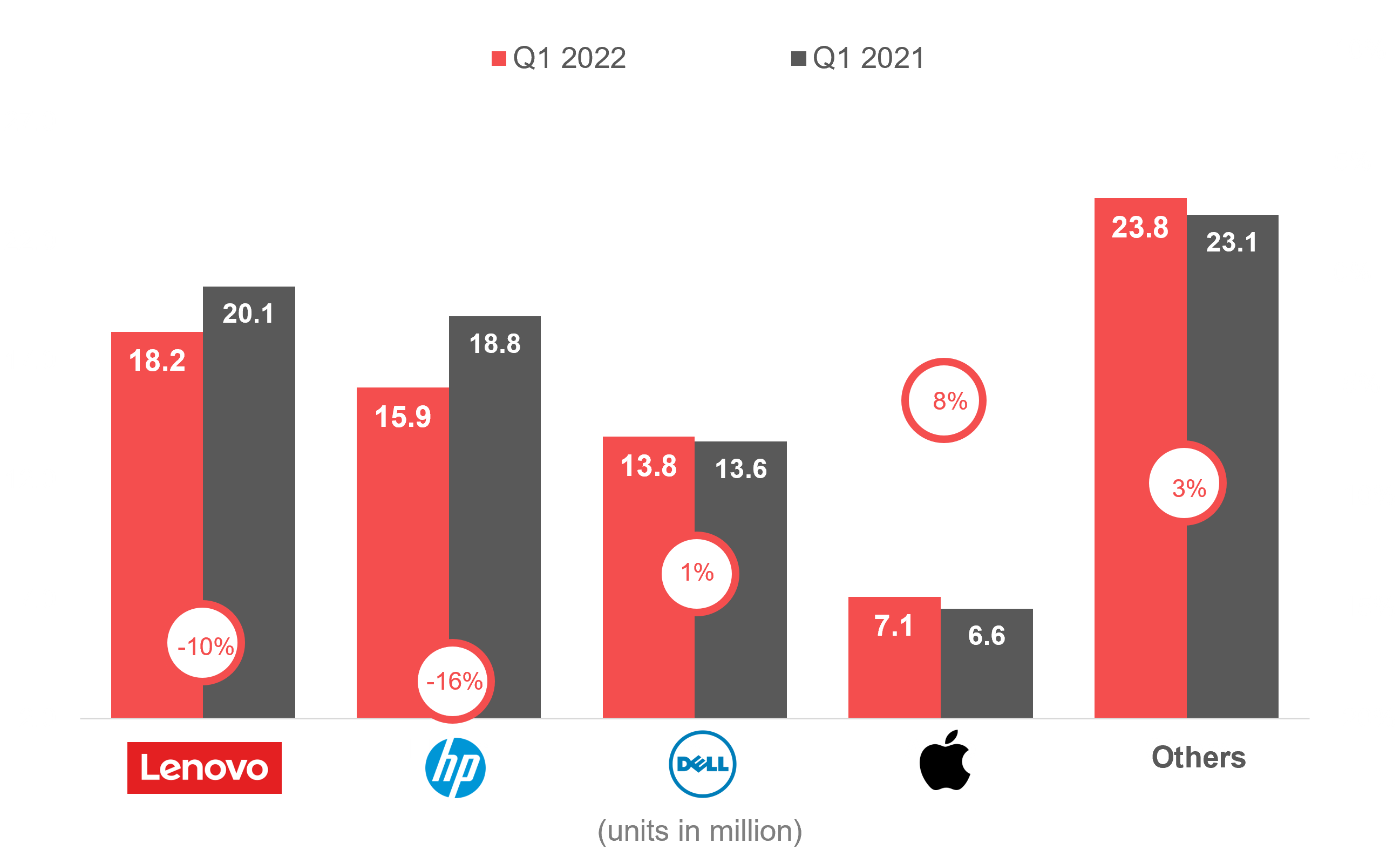

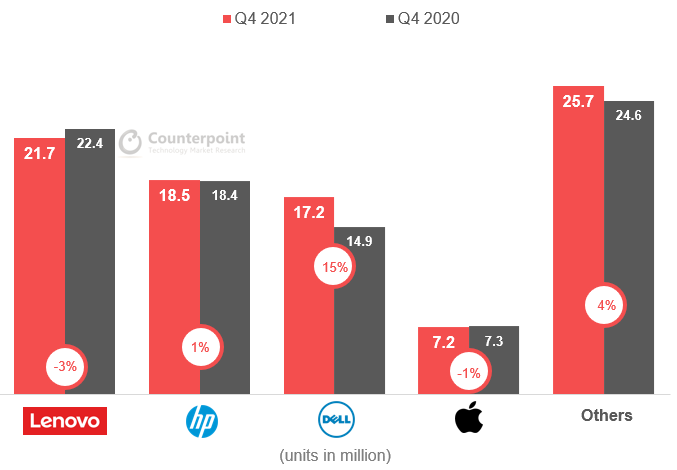

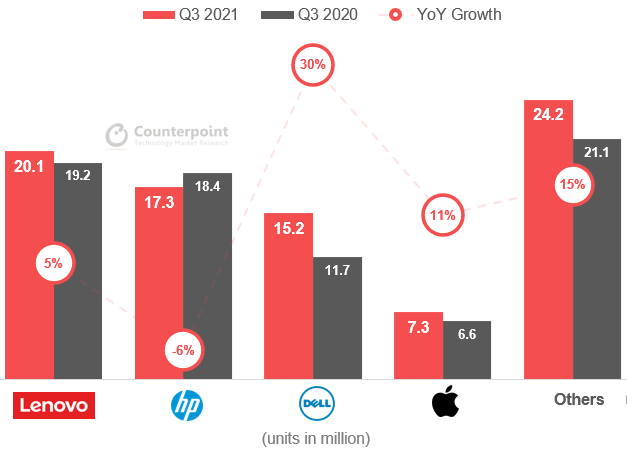

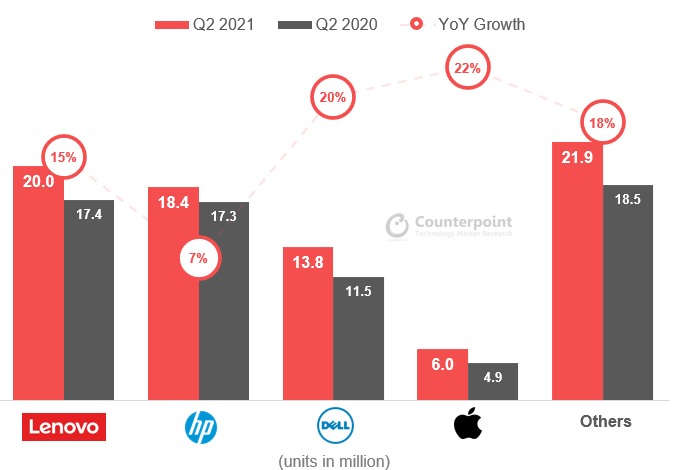

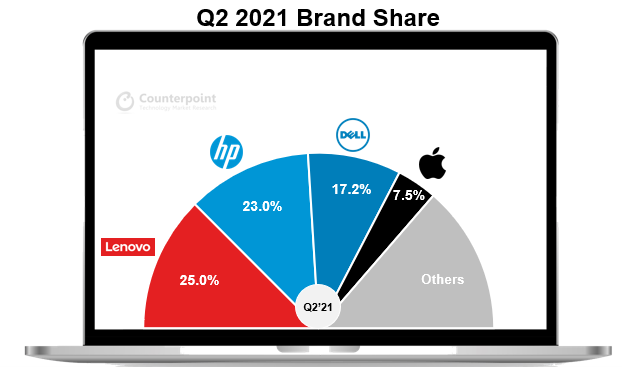

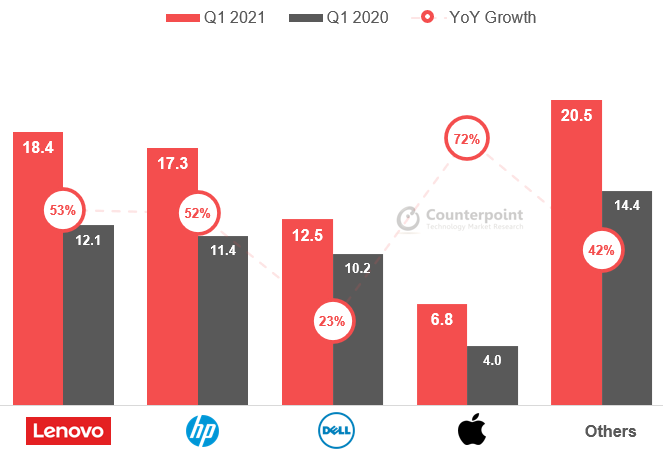

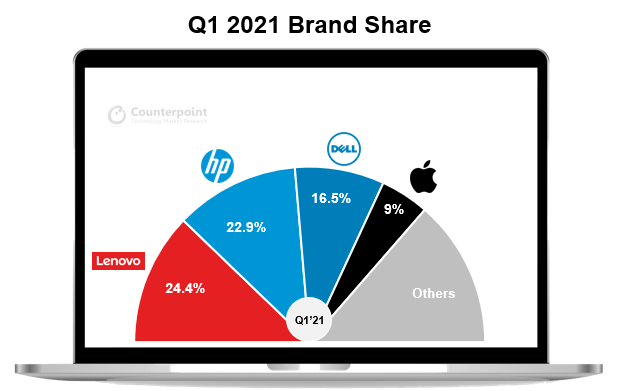

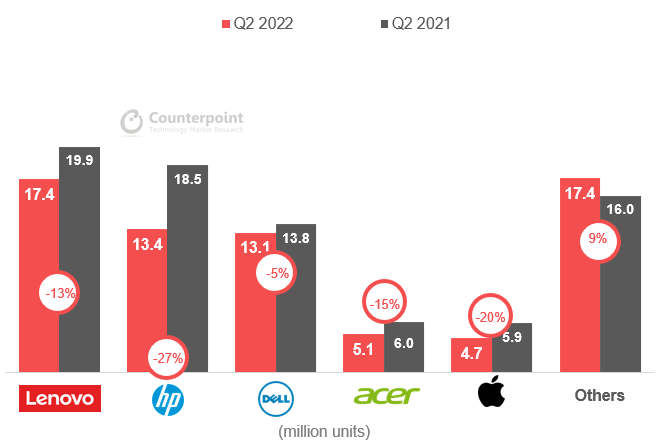

Even though the top three brands showed a YoY decline in Q2 shipments, they all managed to keep their rankings unchanged. Lenovo maintained its leadership in the global PC market with a 24.4% share in Q2 2022. The brand’s total shipments fell 12.7% YoY to 17.4 million units mainly due to weak consumer demand, partly offset by moderate commercial orders.

HP suffered the most among the top brands in Q2 2022, reporting a 27% YoY decline in shipments from a high base last year. The sharp decline was mainly due to soft momentum for consumer products and Chromebooks. On the other hand, Dell had the smallest adjustment to its YoY shipment performance, thanks to a commercial/premium-focused product strategy.

Acer saw a 14.8% YoY shipment decline off a relatively high base in Q2 2021. Despite Chromebook weakness continuing to cap Acer’s growth momentum, its market exposure in entry- to mainstream-level laptops helped the brand take fourth place in global PC shipments in Q2 2022.

Apple reported a sharp decline of 20% YoY in its Q2 shipments largely due to supply chain disruption at Quanta’s manufacturing lines in China. The consumers too were waiting for a new MacBook series equipped with M2 chips. As a result, the company lost its fourth place in the global PC rankings for Q2 2022.

Asus’ Q2 shipments were down 7.7% YoY thanks to its commercial segment focus in recent quarters combined with consumer spending weakness entering 2022. The brand’s total shipments of 4.7 million made it share the fifth position with Apple in Q2 2022.

Global PC Shipments by Vendor, Q2 2022

More shipment adjustments seen

We had cut our 2022 shipment forecast in Q1 2022 to reflect the beginning of a weakening PC demand. But with persistent inflation pressure and enterprise spending saturating, we expect order adjustments to continue even as the average selling price plateaus on easing supply constraints. Therefore, we are revising our forecast for the 2022 PC shipments to a 9% YoY decline, with potential bright spots of new M2 MacBooks and desktop demand rebounding after the post-COVID-19 reopening of offices.