Meta doesn’t expect anyone to pay for Instagram.

Meta’s proposal to charge $10.5 per month for Instagram looks deliberately priced to fail, creating a strong incentive for users in the EU to explicitly allow targeted advertising which will also test just how valuable the service is to its users.

Meta Platforms is currently embroiled in negotiations with the EU with regard to its business model where the regulators’ view is that just because users clicked “Agree” to an agreement, this does not give Meta the right to target them with advertisements. This is an ongoing issue as Meta was fined €390 million by Ireland’s Data Privacy Commissioner for precisely this activity and was told it had to think of something else.

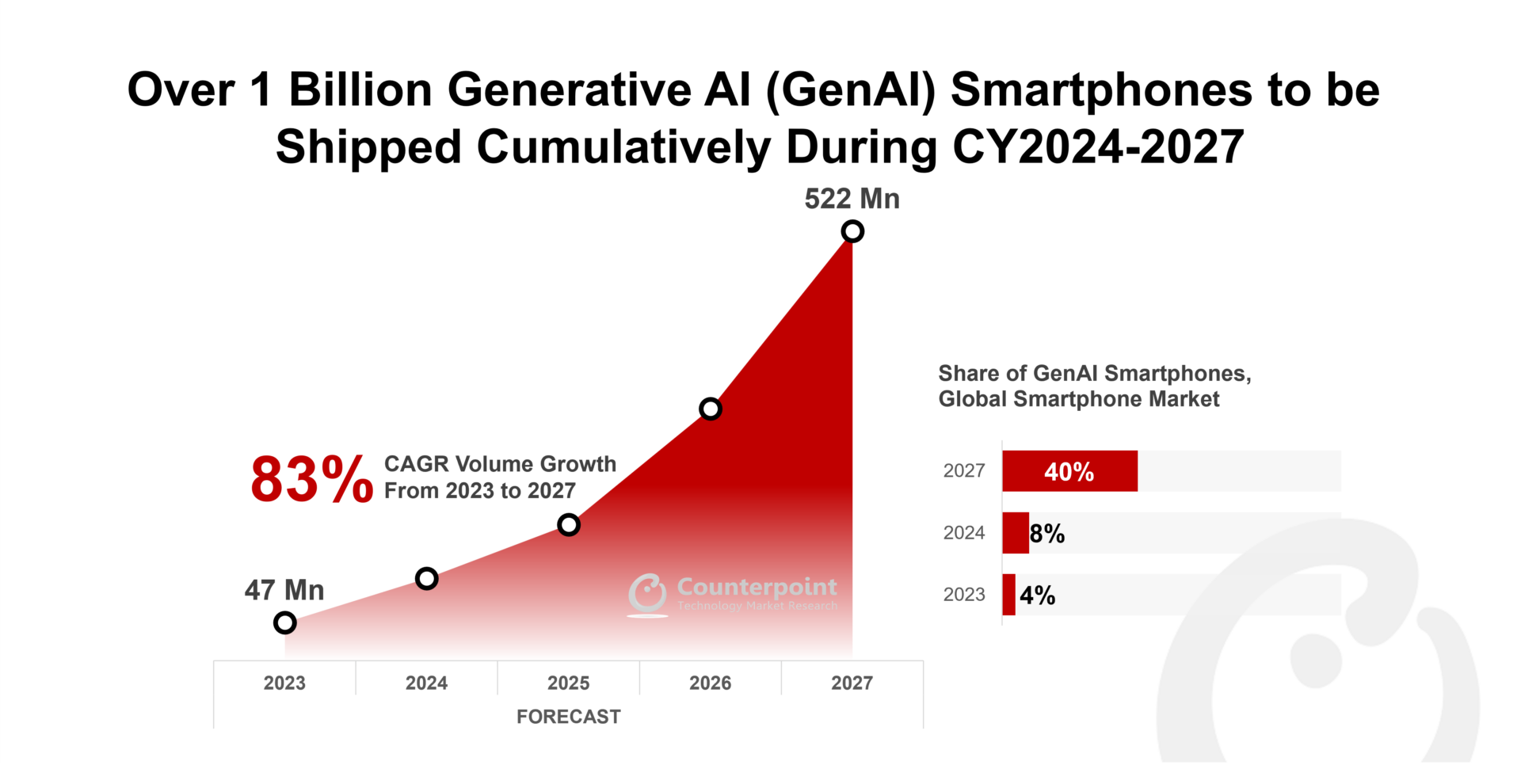

The monetization model for digital ecosystems can have three methods – hardware, advertising and subscription. Advertising and subscription are mutually exclusive and the option for users to choose one or the other is now commonplace across many types of digital services.

RFM Research conducted a study in 2018 that examined the viability of digital ecosystems switching from advertising to subscription as their source of revenue. The results of the study indicated that while X and Snap could probably make the switch without risking damage to their revenue base, the same was not true for the larger players such as Google and Meta Platforms. This is because although they generate an average revenue per user (ARPU) of around $3.00-$3.60 per month, the distribution of ARPU within the user base is very large.

For example, even though the US makes up a small portion of the user base, it often accounts for as much as 50% of revenues, indicating that US users generate far more advertising revenues per user than non-US users. This creates a pricing problem for subscription because in order to ensure that revenue is not lost, the price would have to be so high that no one would ever pay it.

The $3.00-$3.60 ARPU includes all of Meta’s properties and so it is easy to deduce that ARPUs for Instagram in the EU are likely to fall well short of $1 per user per month. Hence, a price of $10.5 per user per month represents a price increase of more than 950% and it’s pretty clear that no user in the EU will be willing to pay it.

It seems that this is precisely what Meta Platforms is aiming at. In order to keep the regulator happy, it provides an option that no one will want, and assuming that the users still want to use Instagram, they will sign up for targeted advertising in a way that satisfies the EU.

The risk of this strategy is that users decide that Instagram is actually not that important and stop using it entirely, although its engagement and user metrics indicate that this is a very small risk. Instead, what can be expected is that Meta makes this offer and almost all of its users sign up for targeted advertising and life returns to normal.

Hence, there doesn’t seem to be any meaningful implications from this issue, although there may be another fine in the works for infractions that Meta may have committed in the past.

(This guest post was written by Richard Windsor, our Research Director at Large. This first appeared on Radio Free Mobile. All views expressed are Richard’s own.)

Related Posts