London, San Diego, New Delhi, Beijing, Buenos Aires, Seoul, Hong Kong – March 10, 2021

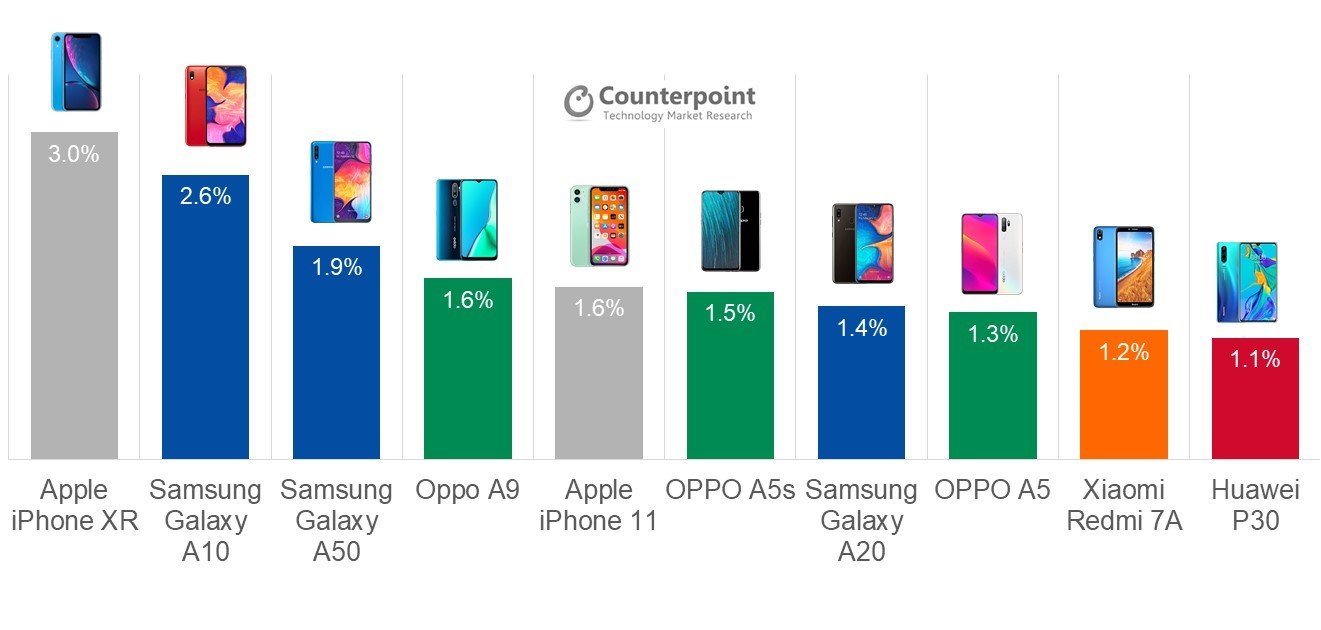

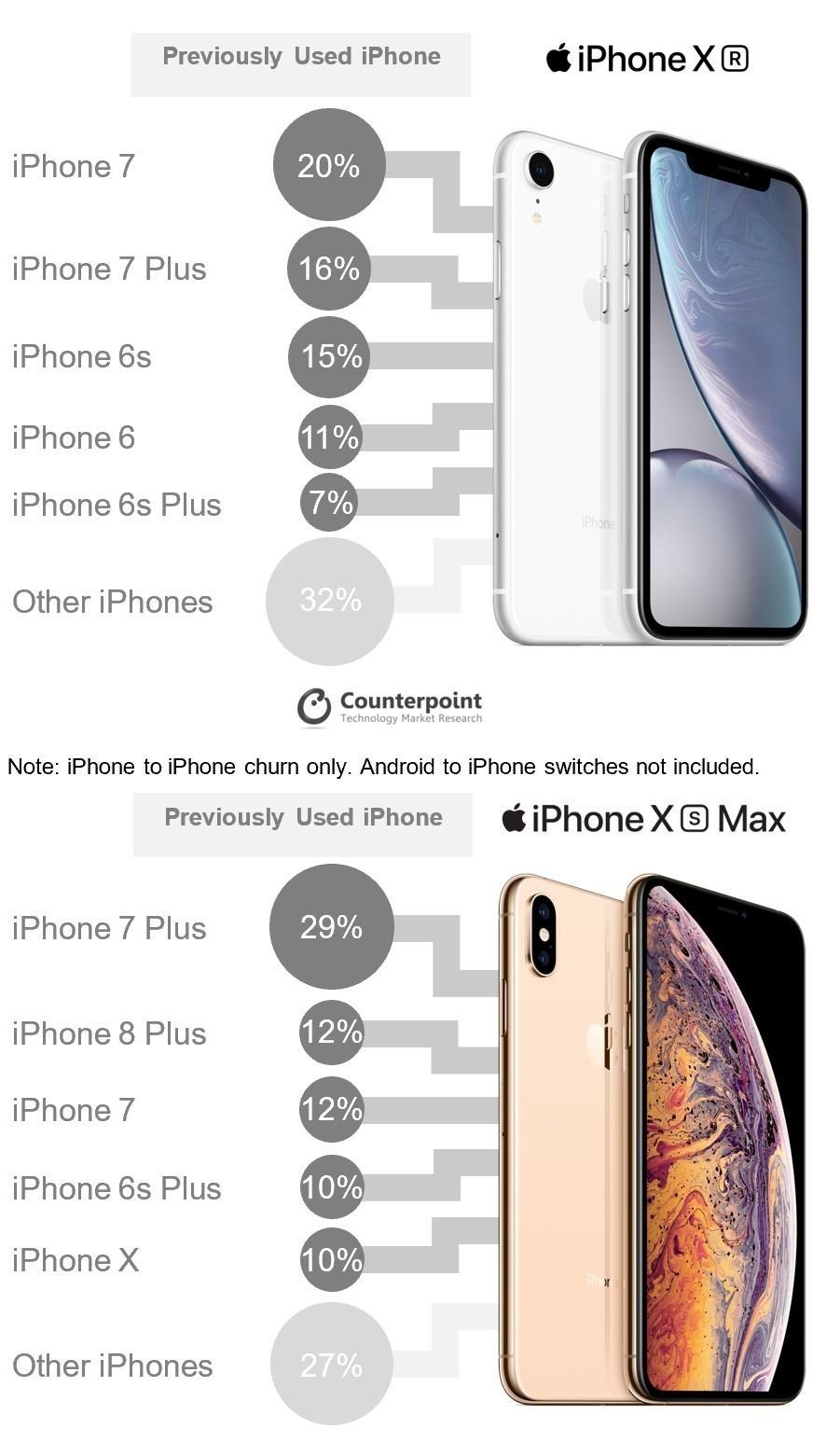

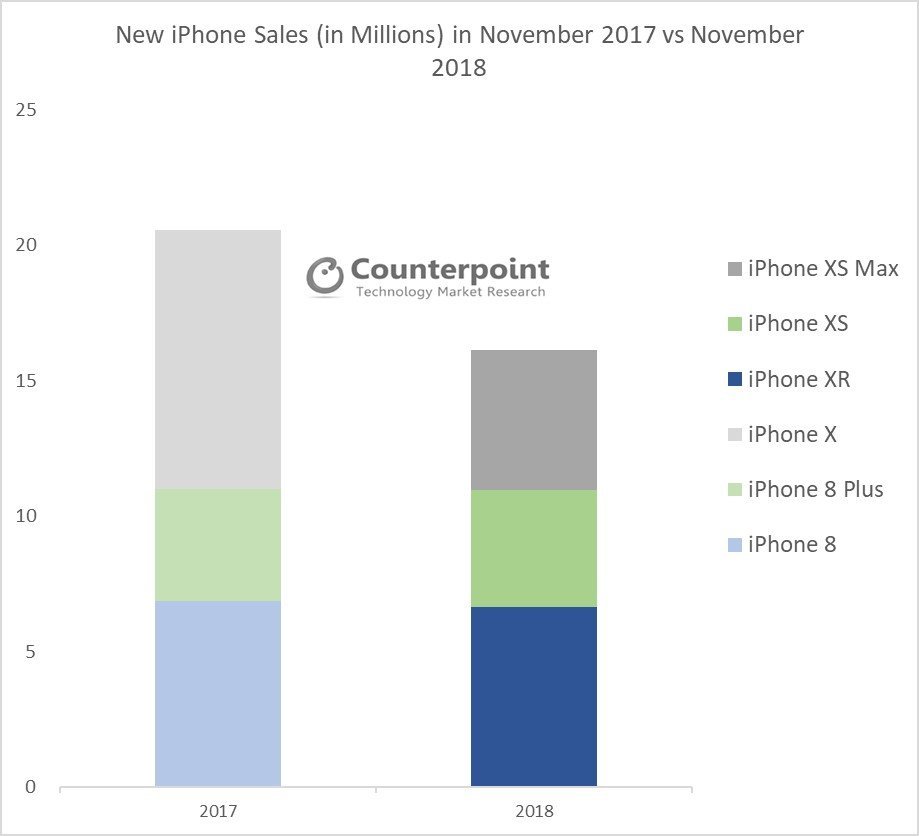

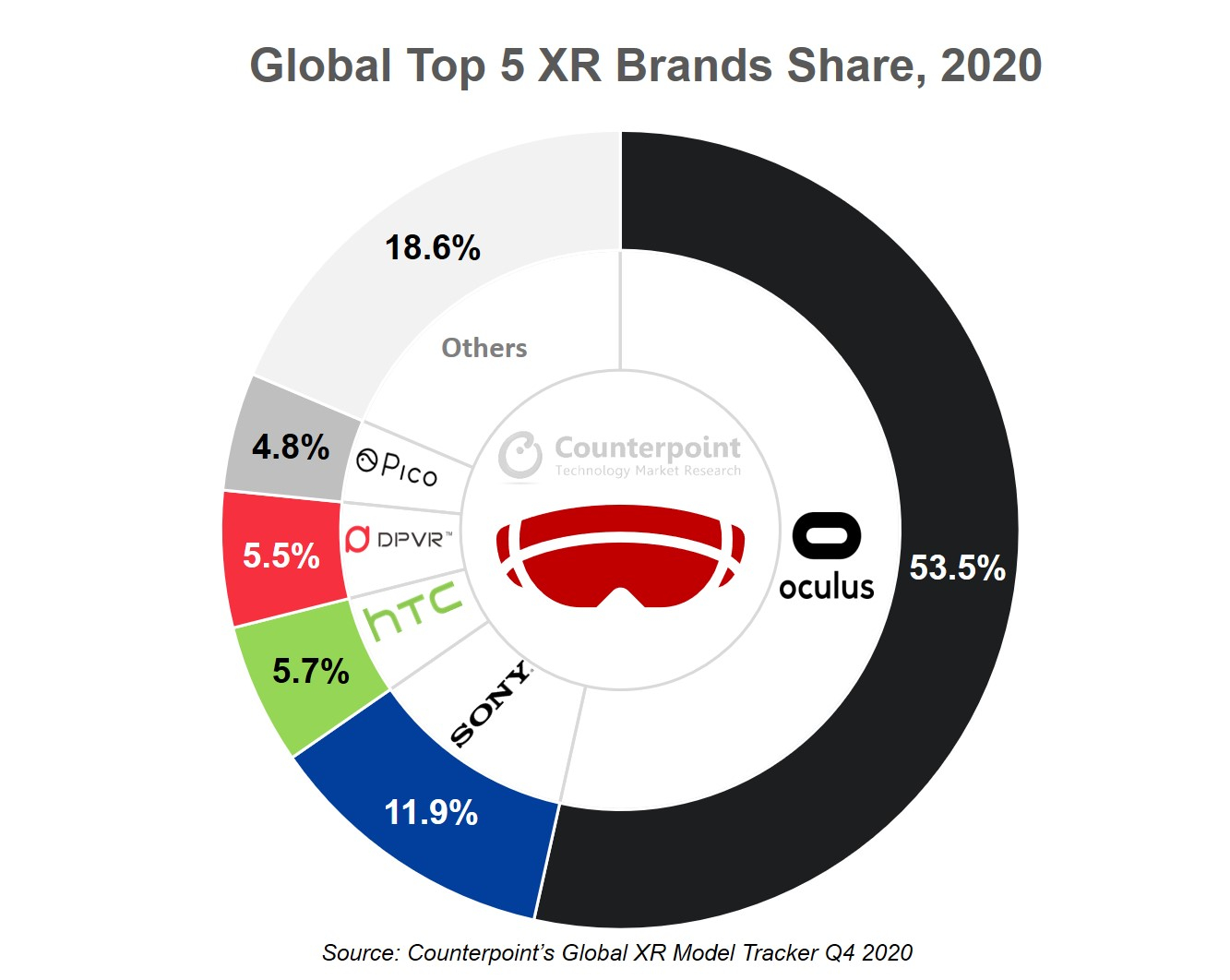

The Extended Reality (XR) headset shipments in 2020 declined 9% YoY, according to the latest research from Counterpoint’s Global XR Model Tracker. The decline was less than expected thanks to the Oculus Quest 2 performance during the holiday season. As a result, Oculus captured 53% of the XR market in 2020 as compared to 44% in 2019. The improved specs, like increased memory, larger battery life, and higher resolution and refresh rate, at an affordable price point were the clear drivers. The pandemic-triggered lockdowns also had a role here, pushing people to invest in content for entertainment and gaming, especially during the second half of 2020.

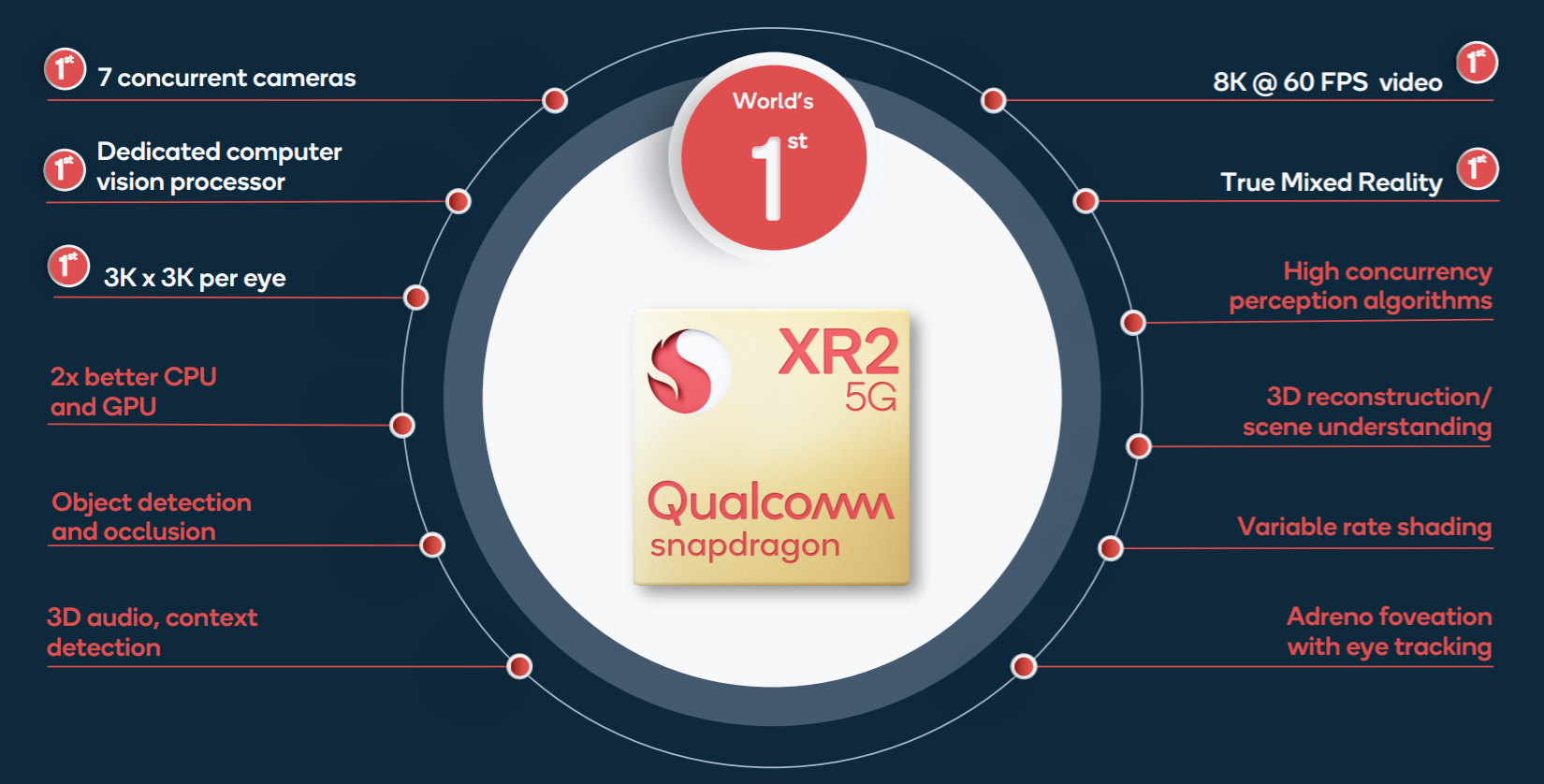

Commenting on the market dynamics, Research Director Peter Richardson said, “Virtual Reality (VR) headsets captured more than 90% of the total XR shipments. The adoption of VR, mainly for standalone form-factor, is increasing, as the industry is showing significant advancements in design, specifications and features at reasonable prices. Additionally, the availability of good quality content across platforms is growing. The users of VR are limited to the gaming community, but enterprise users from the education and training sector gained some interest during the pandemic.”

Commenting on brand performance, Senior Analyst Karn Chauhan said, “With a strong supply chain and brand value in the gaming segment, Oculus remained the biggest XR brand throughout 2020 by capturing half of the shipments. Sony grabbed the second spot riding on its strong PlayStation user base who went in for the five-year-old PlayStation VR. HTC, DPVR and Pico took the third, fourth and fifth spots, respectively. Enterprise-level sales deals, like for schools and training centres, helped Chinese players to grow in 2020.”

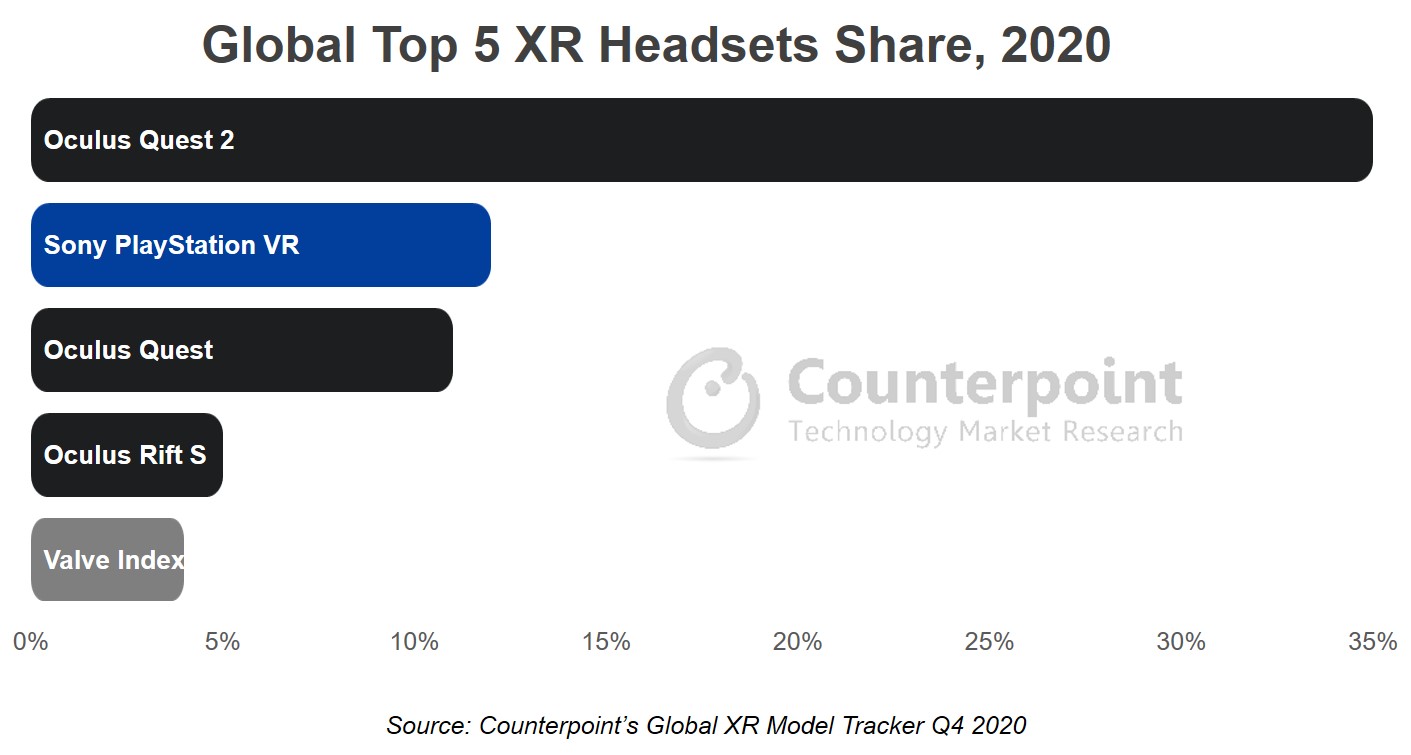

Oculus also dominated the list of top five XR devices. Three headsets in the list were from Oculus. However, the competition in this segment will increase in the coming years. One of the reasons this segment doesn’t witness new launches as frequently as some other categories is that it is more dependent on latest innovations in the overall component and supply chain, especially from the form-factor, display, power and sensor perspective. But the segment holds a big potential in the coming decade, as players like Apple and Sony (PSVR 2) will enter or scale up in this segment.

There are many current and potential enterprise and industrial use cases for XR. These include field force support, product design and development, construction and fabrication, manufacturing, logistics, education and training, media, healthcare and many more. We can, therefore, expect a steadily increasing trend towards enterprises and other organizations investing more in the development and use of XR devices and services.

Some players like Microsoft and Varjo have been taking a wider enterprise-level approach to target this segment. Microsoft now aims to enjoy wider adoption in the fast-growing consumer segment. This combined with Microsoft’s strong bases in major economies, which are the biggest enterprise-level consumers of XR devices and are likely to be the biggest consumer-segment buyers too, ensures the company’s continued growth in the XR industry.

XR’s consumer use can be subdivided into VR and AR. For VR devices, the strongest use case is gaming, although social interaction will provide an interesting niche. Consumer use of AR has thus far largely been confined to smartphone displays via applications.

We believe that XR will continue to show in double digit for the next five years.

Background:

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts:

Follow Counterpoint Research

press(at)counterpointresearch.com

![]()