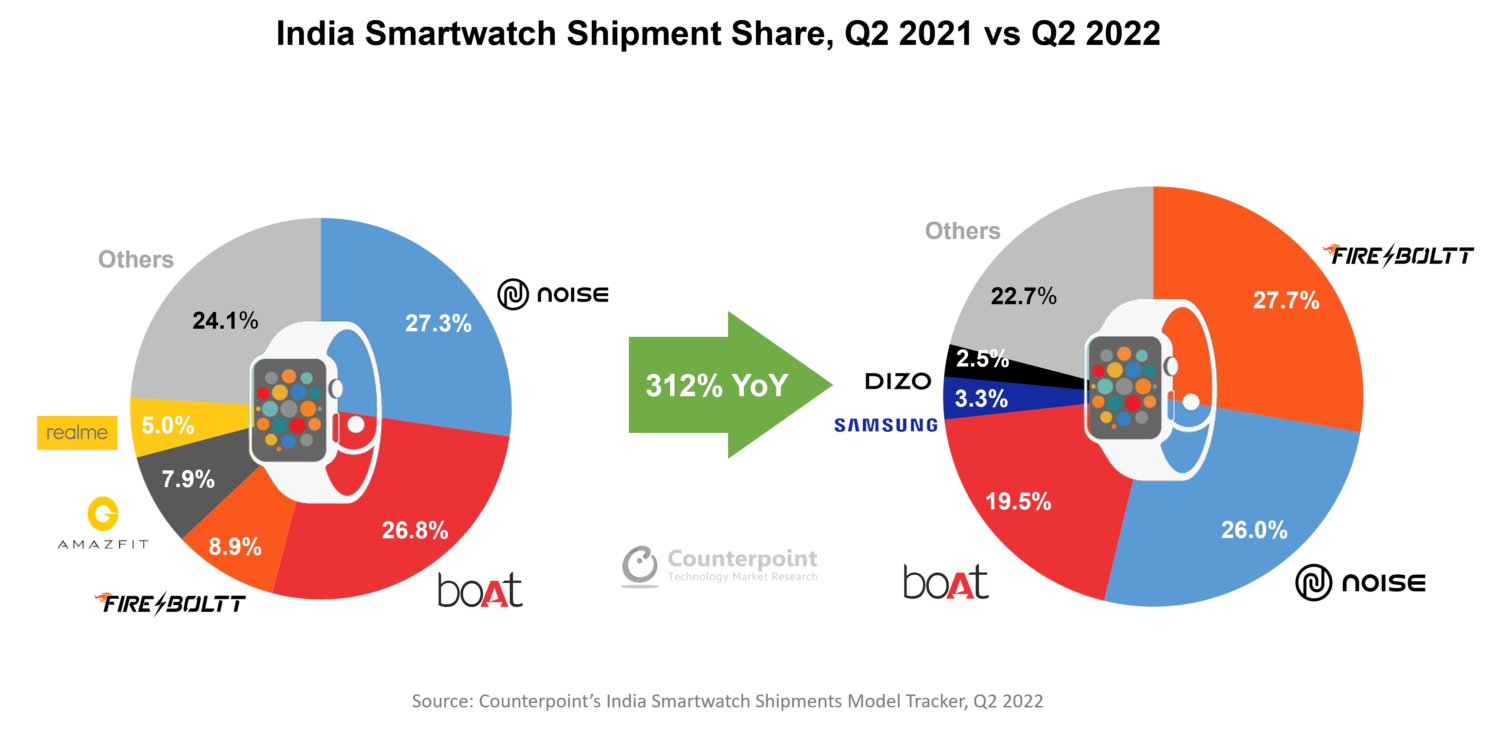

- Fire-Boltt led the market for the first time in Q2 2022 with 28% share.

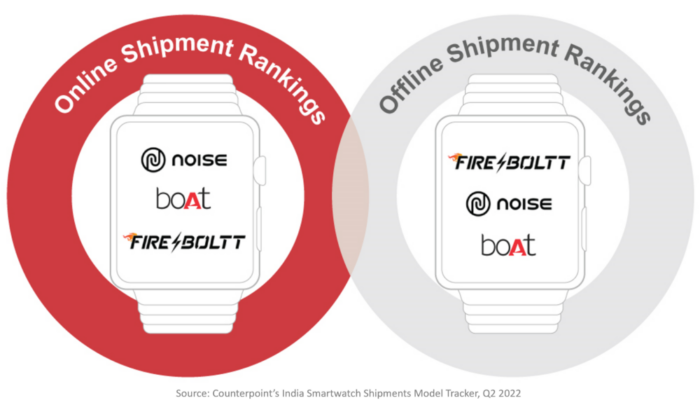

- Noise second with 26% share overall, but it was the best-selling brand in online channels.

- boAt, together with its sub-brands, maintained the third place with 19% share.

- Online channels contribute 67% to the total shipment volume with Amazon leading.

New Delhi, Boston, Toronto, London, Hong Kong, Beijing, Taipei, Seoul – Aug 19, 2022

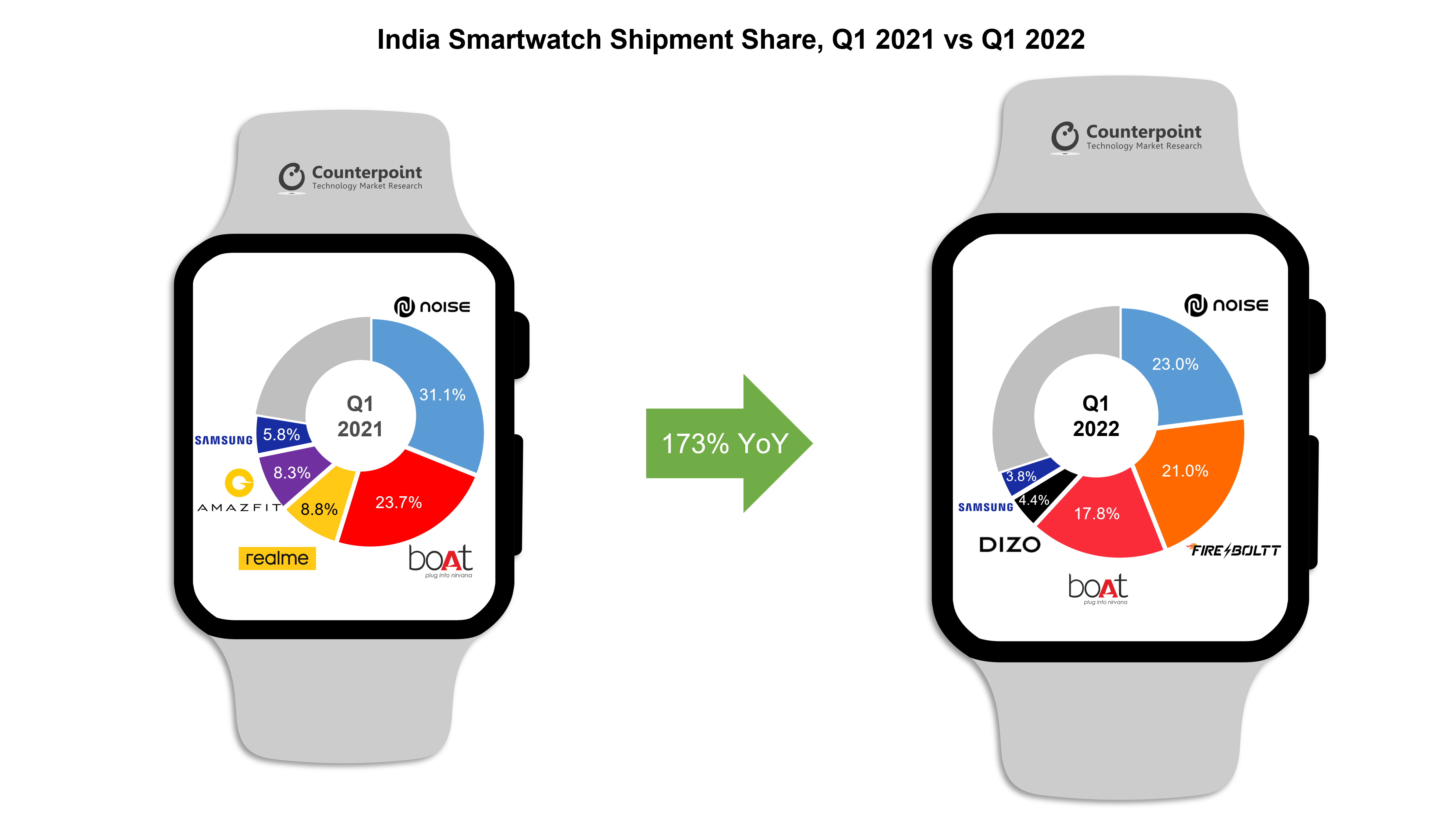

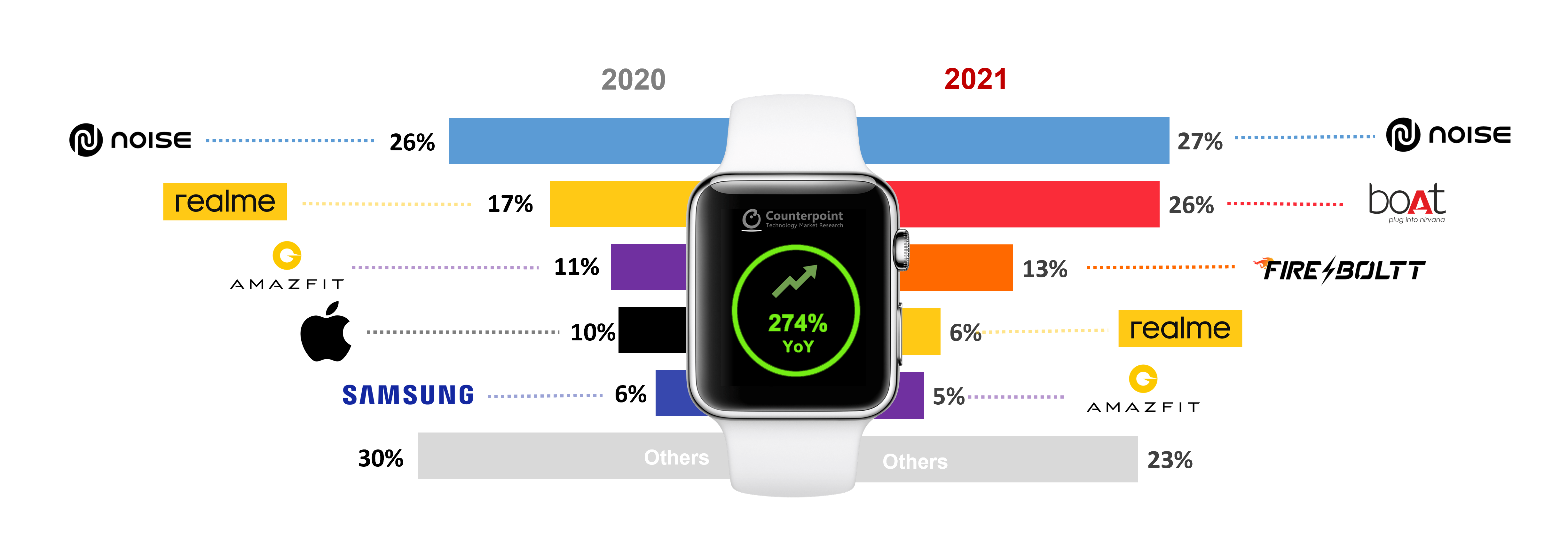

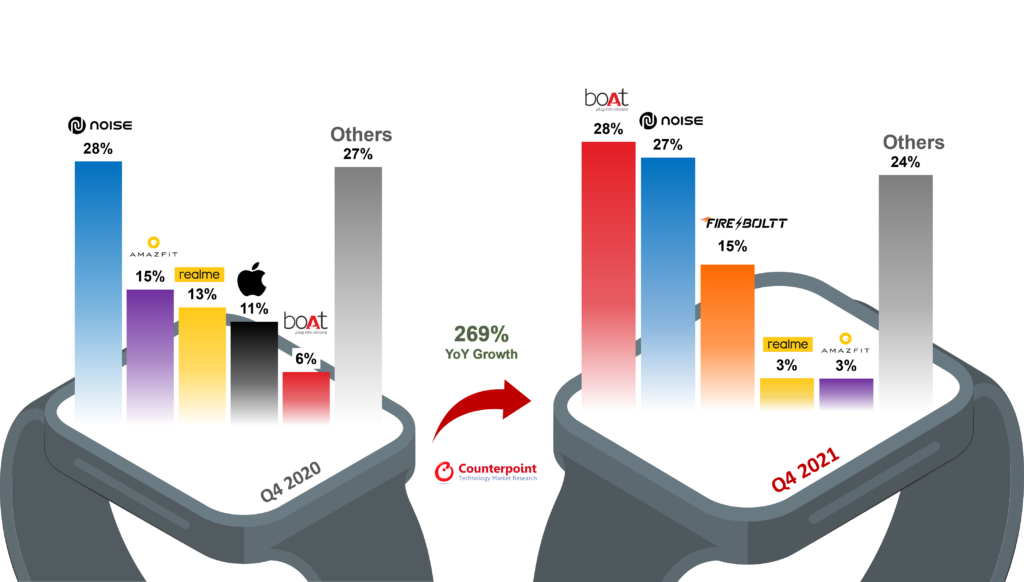

India’s smartwatch market grew 312% YoY in Q2 2022, according to the latest research from Counterpoint’s IoT Service. This growth can be attributed to growing consumer interest in smartwatches as an accessory and as a fitness tracker. There were numerous product launches throughout the quarter as brands sought to grow their offline presence across the country.

Commenting on the market dynamics, Senior Research Analyst Anshika Jain commented, “India’s Smartwatch shipments grew by 4x annually in Q2 2022, with Fire-Boltt leading. Fire Boltt and Noise captured more than half of the total smartwatch market. The market is very dynamic and the top three positions will be fluid in the coming quarters. In terms of channels, we are seeing a steady increase in sales through offline channels with brands launching offline exclusive models and extending their partnerships with distributors across the country. One-third of the smartwatches are sold offline, the highest ever share. In the online domain, Amazon led the market followed by Flipkart, and with Noise, boAt and Fire-Boltt being the best-selling brands.”

Commenting on smartwatch models, Research Analyst Harshit Rastogi said, “We saw over 300 smartwatch models selling this quarter, the highest ever number. The top three brands combined offered 75 different models. The quarter saw over 50 new launches from major brands. Low-end smartwatches continue to attract more competition as half of the total models are in the sub-INR 3500 ($44) retail price band. Brands are pushing various models as consumers look for different options to choose from including dial size, display form etc. The colours and materials used continue to play a huge role in the purchase decision.”

Market Summary

- Fire-Boltt led the market and had the most product launches in Q2 2022. Its increasing offline presence and good product features at affordable prices helped the brand to take the lead.

- Noise captured the second spot with 26% share and registered 293% YoY growth. The brand has ramped-up its domestic production this quarter and contributed 3/4th of the locally manufactured smartwatches. It introduced more models with Bluetooth calling features and this feature was present in 40% of its shipments for the quarter.

- boAt registered 199% YoY growth and captured the third position. The Storm and Xtend models remained the most popular. It launched “boAt Primia”, its first smartwatch with Bluetooth calling this quarter. Its sub-brands TAGG and Defy continue to grow as well.

- Samsung grew 295% YoY in Q2 2022. The Galaxy Watch 4 continued to be its top-selling model thanks to frequent promotional offers.

- Dizo remained flat QoQ taking the fifth spot. Dizo Watch 2 Sports was the top model for the brand for the quarter. The brand also launched the offline-only Watch 2 Sports-i during the quarter.

- Titan along with its sub-brand Fastrack was 6th with 2% market share. It leveraged its existing brand value and wide distribution network across the nation.

- realme grew 76% YoY this quarter and took the 7th It also launched its first smartwatch with Bluetooth calling, the Watch R100. The brand maintained its presence almost equally across channels.

- Apple registered 197% growth in Q2 2022. The Watch Series 7 continued to be its best seller and has reached to almost 250k shipments till the end of the quarter in India. With upcoming launches in Q3 2022, Apple is expected to gain further market share.

- Pebble grew 267% in Q2 2022. It was acquired by Mensa Brands during the quarter with the aim to expand its distribution and further accelerate its growth.

- OnePlus maintained its first position in the INR 10,000-INR 15,000 ($125-$190) retail price band due to the popularity of the OnePlus Watch.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts:

Anshika Jain

Harshit Rastogi

Counterpoint Research

press(at)counterpointresearch.com

Use the button below to download the high resolution PDF of the infographic:

Use the button below to download the high resolution PDF of the infographic:

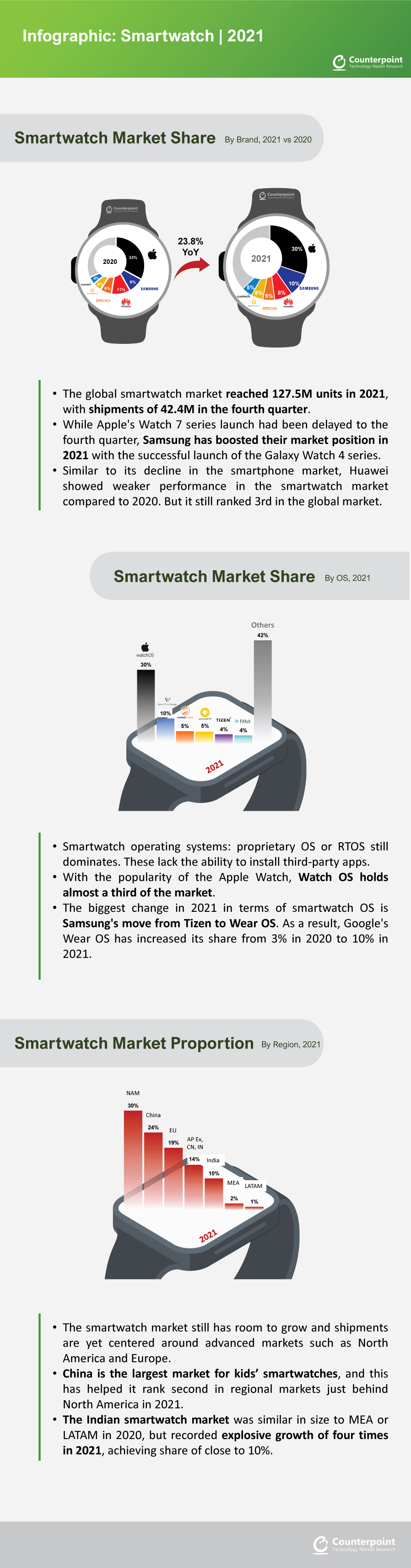

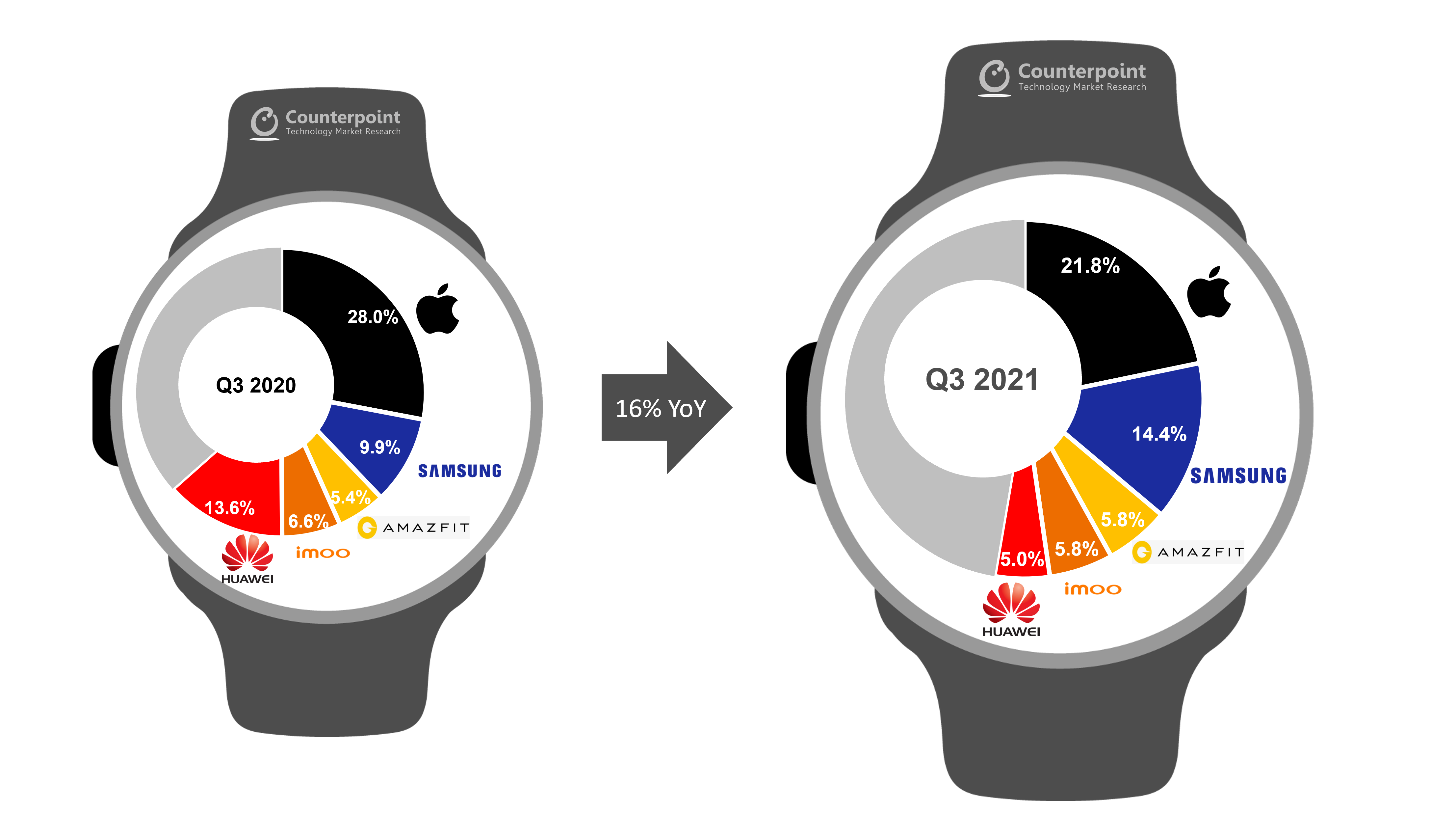

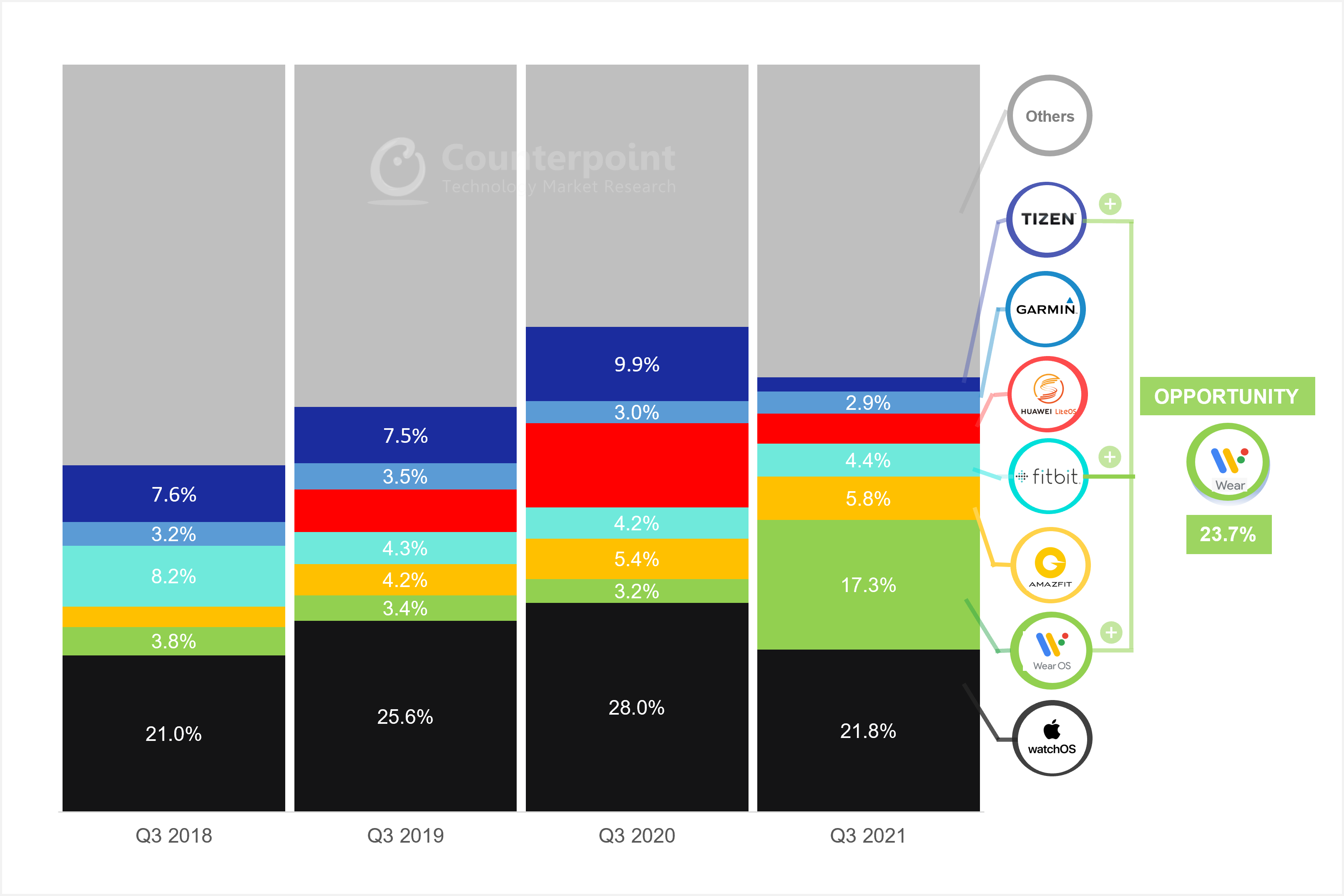

Source: Global Smartwatch Model Tracker, Q3 2021

Source: Global Smartwatch Model Tracker, Q3 2021