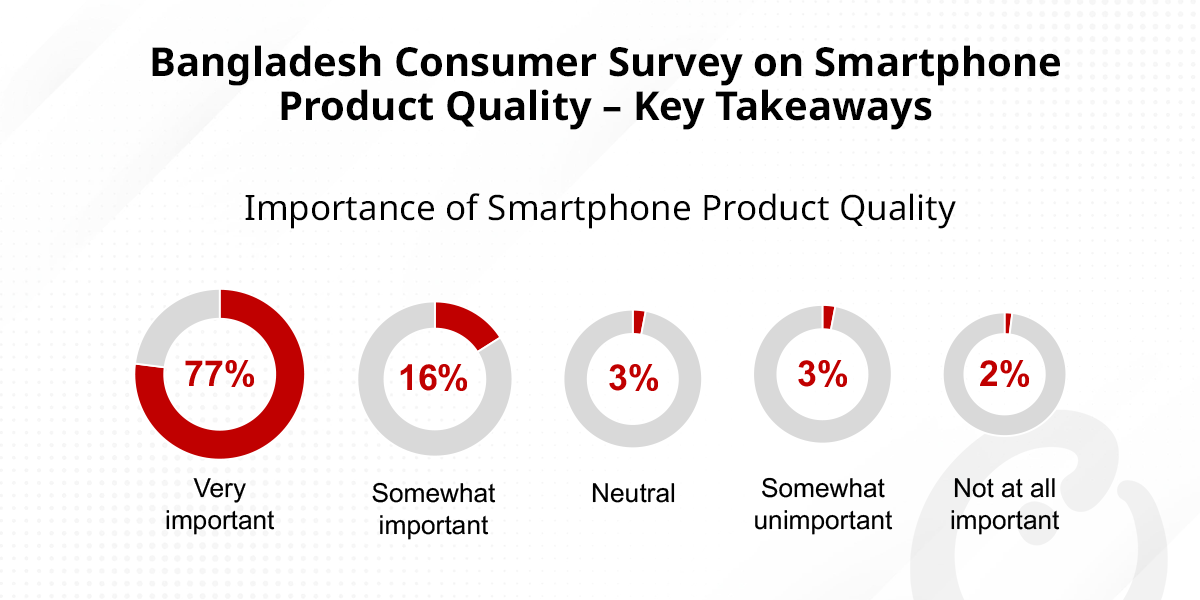

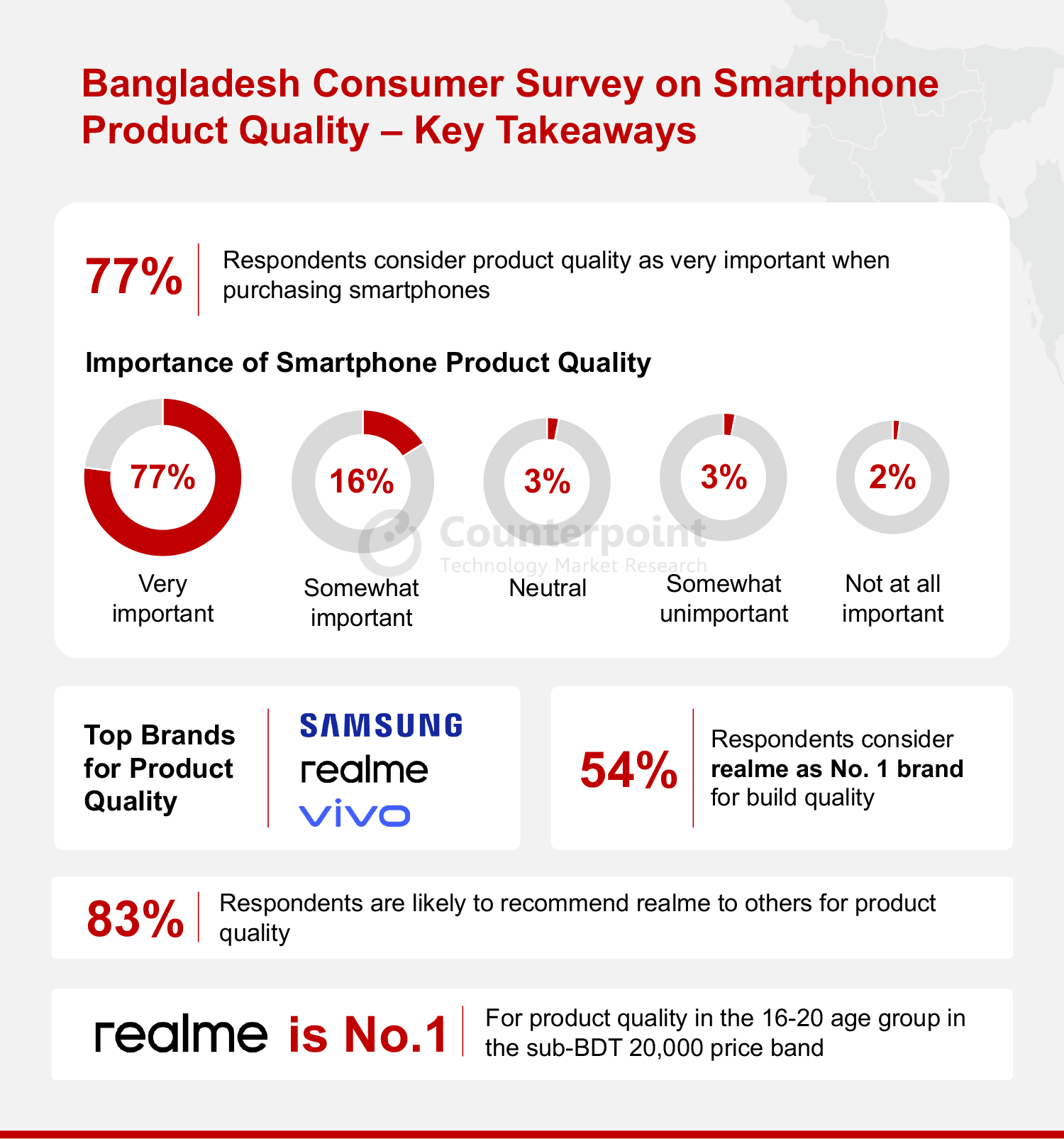

- 77% of respondents prioritize product quality when buying smartphones.

- Samsung, realme and vivo are top-rated for smartphone product quality.

- 54% of respondents rated realme as the No. 1 brand for smartphone build quality.

- realme is also the No. 1 smartphone brand in product quality in the sub-BDT 20,000 (around $180) price band among users in the 16-20 age group.

New Delhi, Beijing, Boston, Buenos Aires, Fort Collins, Hong Kong, London, Seoul, Taipei, Tokyo – April 29, 2024

As many as 77% of smartphone consumers in Bangladesh consider product quality a very important parameter when purchasing smartphones, according to Counterpoint Research’s recent consumer survey in the country. The survey further reveals that Samsung, realme and vivo are the top brands in Bangladesh when it comes to smartphone product quality.

According to Counterpoint Research’s quarterly smartphone shipment tracker for Q1 2024, 80% of Bangladesh’s smartphone market belongs to the sub-BDT 20,000 (around $180) price band and has an average selling price (ASP) of BDT 20,700. In the sub-BDT 20,000 price band, the consumer survey reveals, realme is the No. 1 brand for product quality in the 16-20 age group. Further, realme tops the overall market in terms of build quality, a sub-parameter of product quality, with 54% of the survey respondents preferring the brand. When asked what brand would they recommend to others for product quality, 83% of the respondents expressed a strong inclination for realme.

Note: Numbers may not add up to 100% due to rounding.

Commenting on realme’s positioning in Bangladesh’s smartphone market, Senior Analyst Arushi Chawla said, “As smartphones have become an integral part of daily life, their quality is increasingly gaining importance. Besides, product quality is also important for securing a favorable resale value. Factors like camera quality, battery life, processor, build quality and display are key considerations for smartphone buyers in Bangladesh when evaluating the product’s quality. Among various brands in Bangladesh, realme is particularly popular among young users in the affordable price range. This is because realme offers a well-designed and tailor-made portfolio for the Bangladeshi market. In addition, its innovative software and trusted build quality make it a top choice for smartphone buyers.”

Disclaimer

This survey, commissioned by realme Bangladesh, aimed to learn what people think about product quality when buying smartphones. Counterpoint Research conducted the survey in Bangladesh, reaching over 1,000 respondents with questions in Bengali and English. Both online and offline methods were used to gather insights from smartphone users aged 18 and above. We anticipate the results to be accurate within +/- 4%.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research

press(at)counterpointresearch.com