- With tablets gaining a wider consumer base, tablet specifications are undergoing changes to meet the demands of a diverse range of applications.

- Display sizes are increasing every year to cater to the growing range and consumption of multimedia and applications.

- Battery capacity has seen continued advancements following the adoption of bigger displays.

- Previously seen as only optional, devices such as the stylus and external keyboard have been accepted as necessary tools to realize the tablet’s fullest capabilities.

From a device used by a niche consumer base to a device widely used for work, study and entertainment at home during the COVID-19 pandemic, the tablet has covered a big distance in a short span of time. This surge in its popularity can be attributed to its ability to combine the portable appeal of smartphones and the productivity offered by notebooks. The popularity, in turn, has triggered changes and improvements in the tablet’s features to meet the demands of a diverse range of applications.

These changes range from enhancements in technical specifications to refinements in the tablet’s light and slim structure. However, with tablets steadily approaching maturity in the market, certain ubiquitous preferences have emerged that are shifting the device away from its core design philosophy of portability. The focus is now more on increasing its productivity by improving certain technical parameters and features.

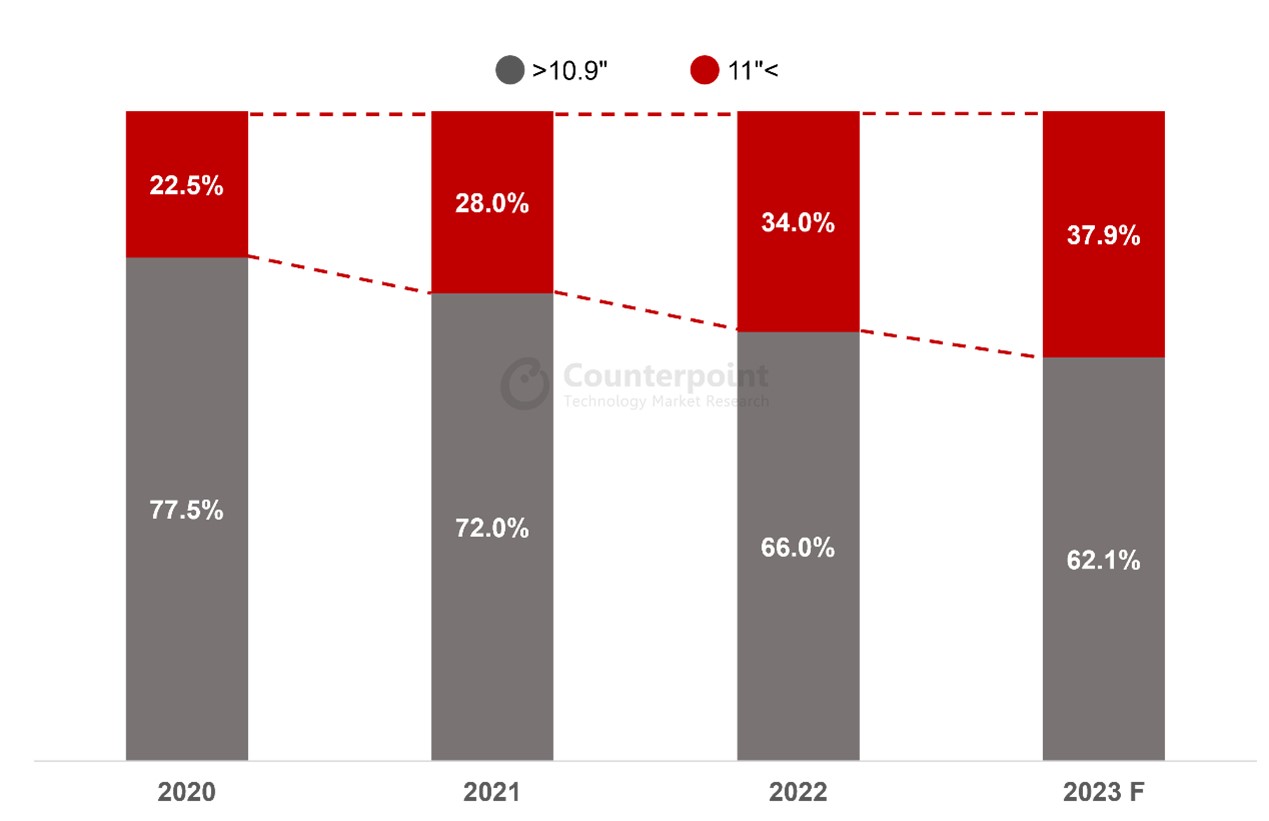

Tablet display size

One such improvement is the steady increase in display sizes. Being the sole medium through which users interact with tablets, displays have increased in size with every subsequent year, despite an increase in the weight of the device, to cater to the growing range and consumption of multimedia and applications.

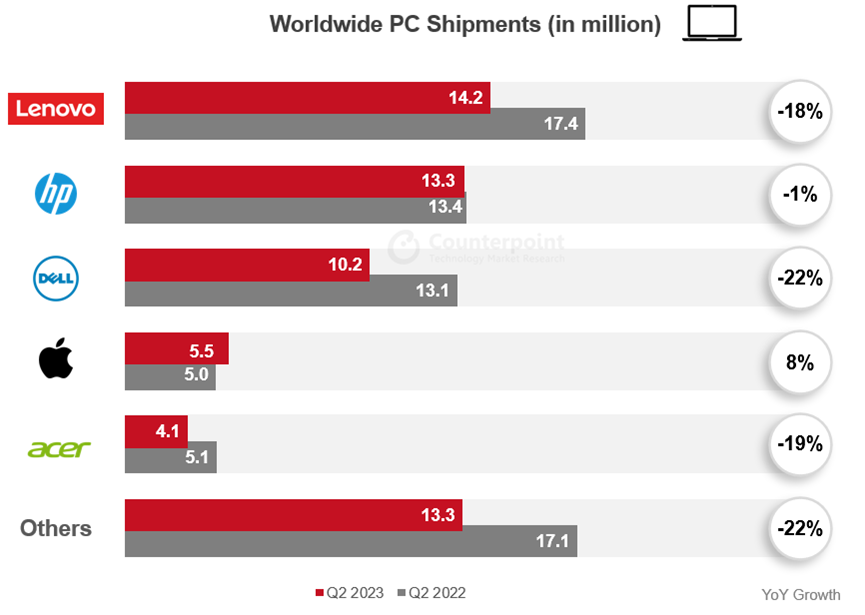

Global Tablet Market Shipment Share by Display Size

Source: Counterpoint Research

Over the three years from 2020 to 2022, tablets continued to adopt increasingly larger display sizes with the 11” and above screens gaining share in total volumes. This trend is expected to continue in 2023. With the display sizes of 11” and above taking 34% of the tablet market in 2022 and forecasted to grow an additional around 4% points in 2023, tablets have started to take on roles traditionally filled by laptops for tasks in professional and educational settings, according to Counterpoint’s Tablet Research.

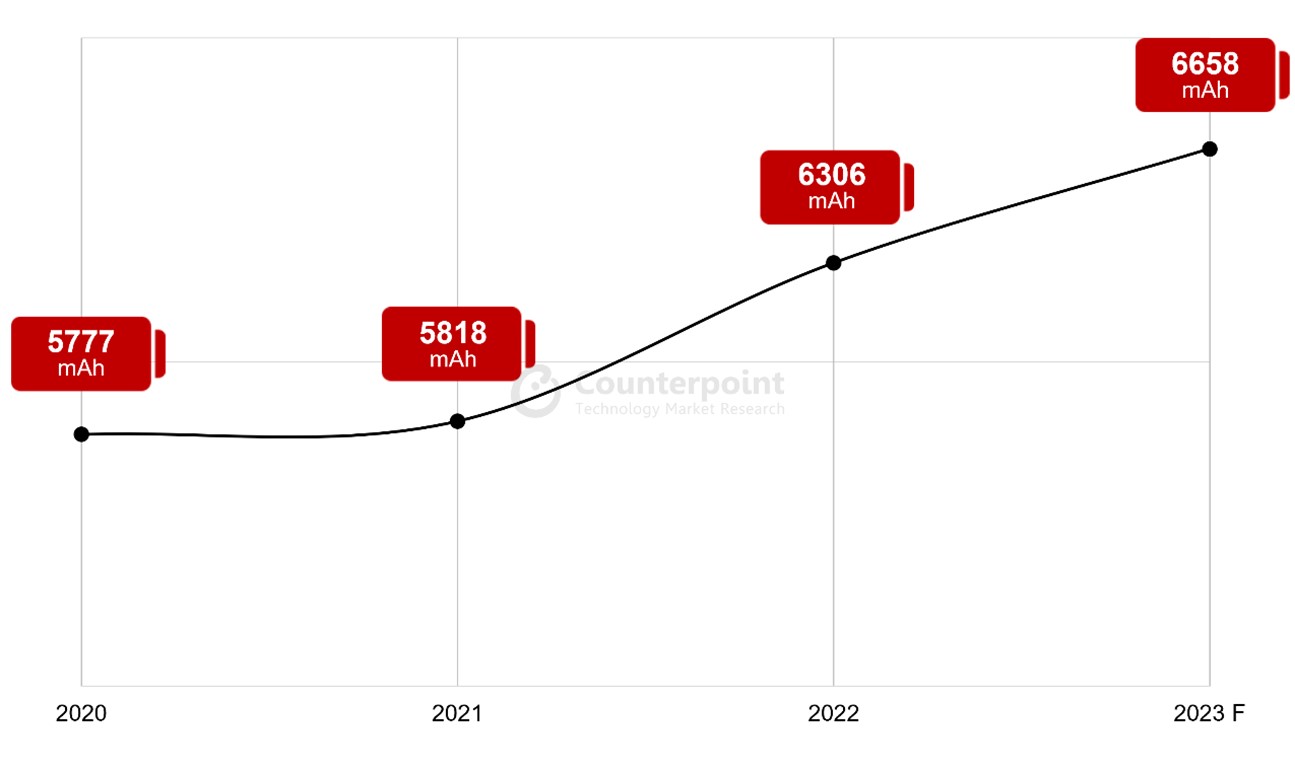

Battery capacity

An increased battery capacity is another technical aspect that has seen continued advancements following the adoption of bigger displays. Occupying the maximum weight in a tablet, larger battery capacities have been crucial in supporting the ever-increasing demand for more power, stemming from larger and brighter displays and other performance enhancements.

Average Battery Capacity

Source: Counterpoint Research

After remaining relatively stagnant until 2021, the average battery capacity of tablets increased by 8% in 2022 due to the pandemic-triggered increase in usage. With the emphasis now being placed on longer usage than portability, tablet OEMs have started introducing devices with larger battery capacities to reduce the frequency of charging between uses. The average battery capacity is expected to continue growing, reaching 6658 mAh in 2023.

External hardware

Lastly, the most noticeable shift in preference from mobility to productivity is the acceptance of external hardware as the new normal in the use of tablets. Previously seen as only optional, devices such as the stylus and external keyboard have been accepted not as remedial devices but as necessary tools to realize the tablet’s fullest capabilities. While these devices still come separate from tablets, they are offered by most tablet OEMs, with the majority of popular tablets optimized for their combined usage.

While tablets are still valued for their lightweight nature compared to their heavier and bulkier notebook counterparts, they are expected to continue favoring productivity over portability as larger tablets continue to maintain their popularity among consumers and grow further upon the increasing frequency of adoption of these preferences.