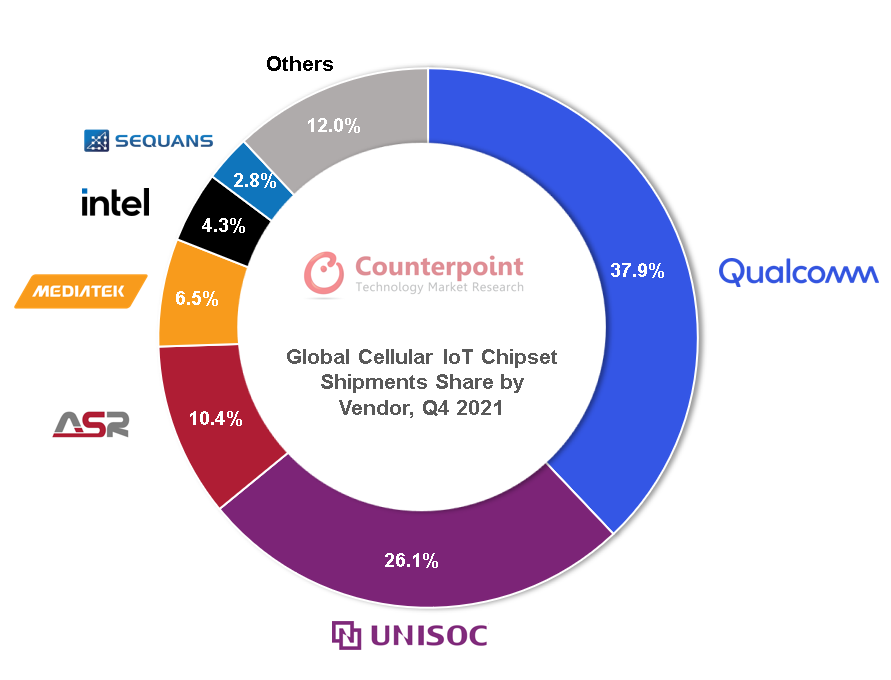

- Qualcomm, UNISOC and ASR were the top three cellular IoT chipset vendors in Q4 2021.

- NB-IoT contributed to almost a third of the cellular IoT chipset shipments during the quarter.

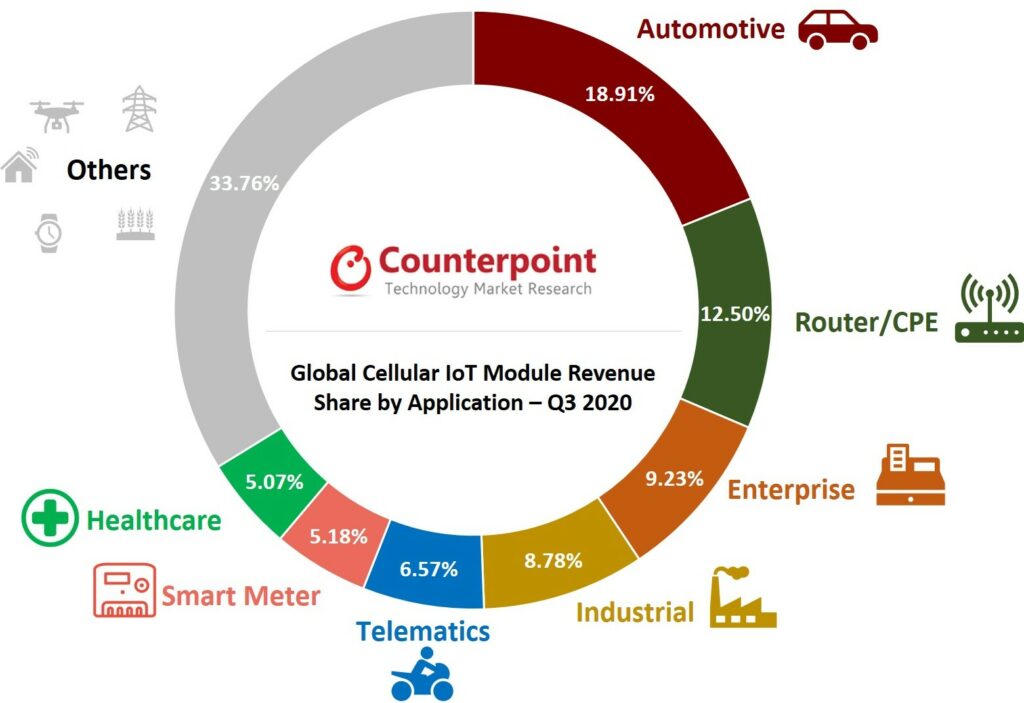

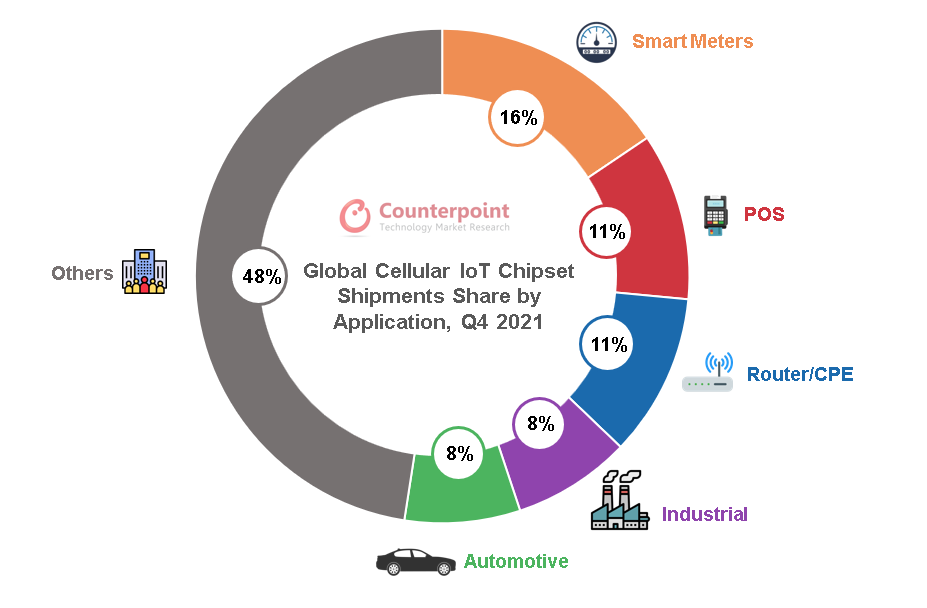

- Smart meter, POS, router/CPE, industrial and automotive were the top five applications in Q4 2021.

New Delhi, San Diego, Buenos Aires, London, Hong Kong, Beijing, Seoul – April 12, 2022

Global cellular IoT chipset shipments grew 57% YoY in Q4 2021, according to the latest research from Counterpoint’s Global Cellular IoT Module and Chipset Tracker by Application. China continued to dominate the cellular IoT chipset market by accounting for nearly 60% of the shipments. 5G grew 392% YoY followed by 4G Cat 1 with 154% YoY growth. Router/CPE, PC and industrial were the top three applications for 5G.

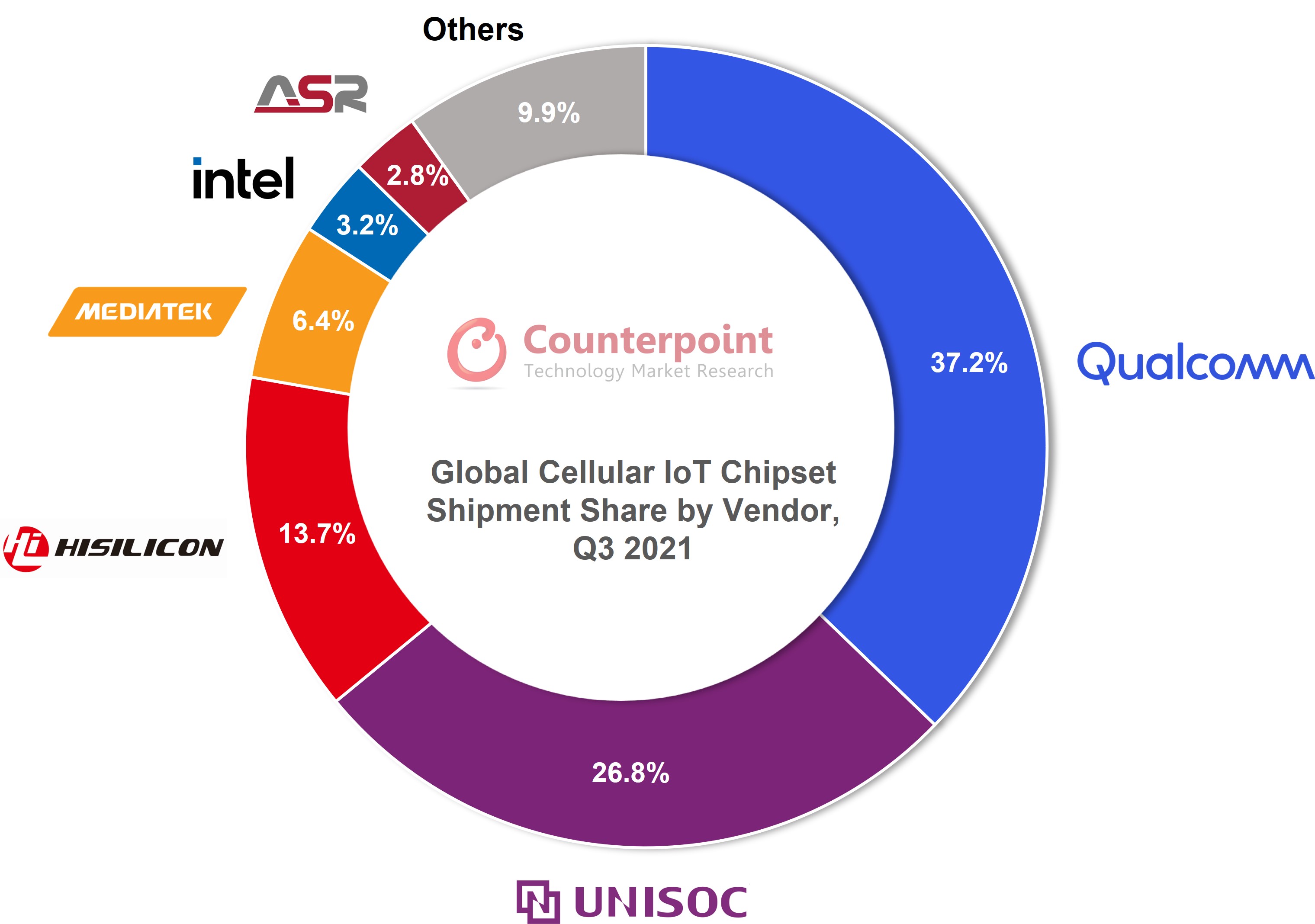

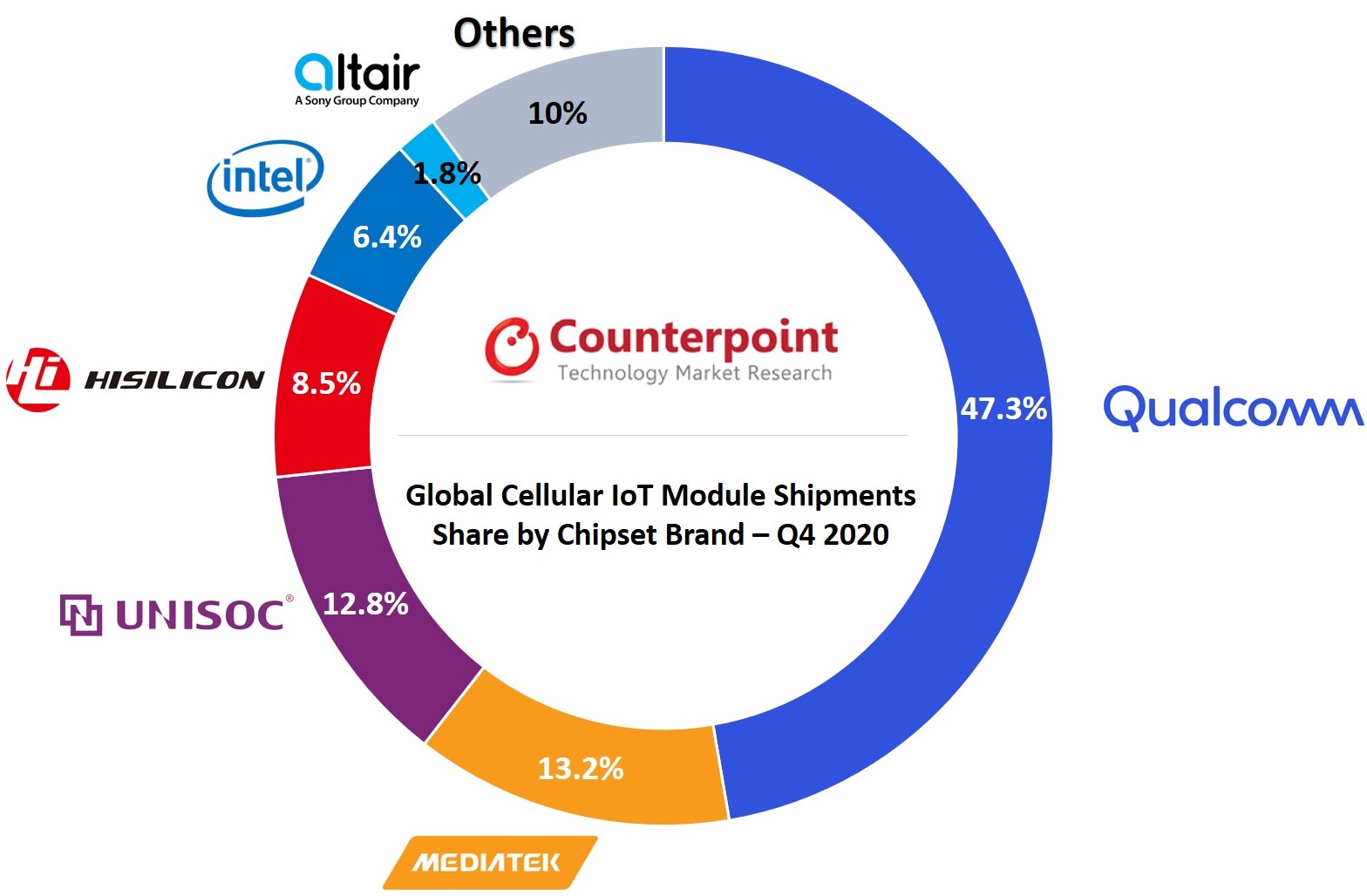

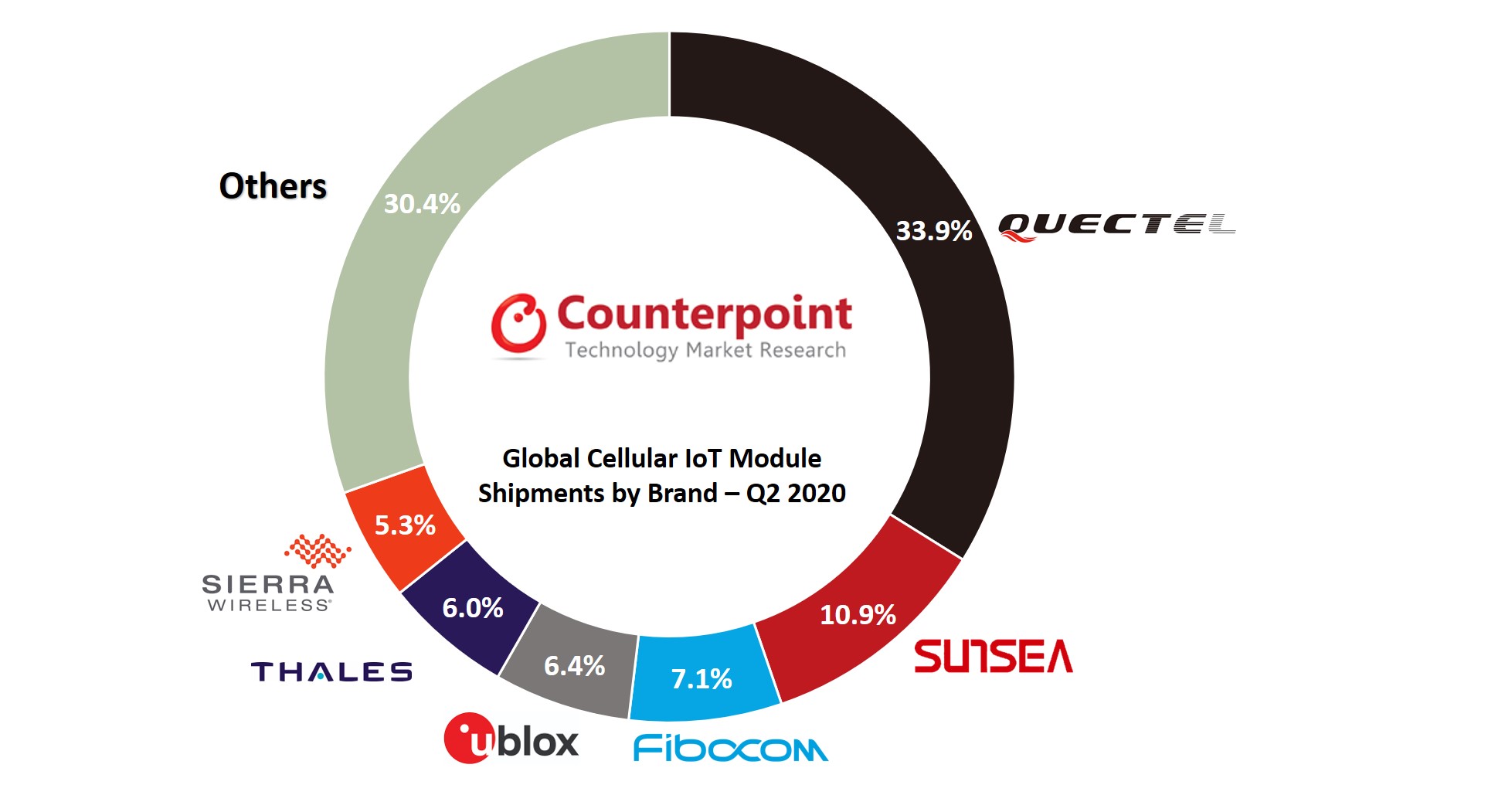

Commenting on the market dynamics, Research Analyst Anish Khajuria said, “Qualcomm, UNISOC and ASR held the top three positions in the global cellular IoT chipset market in Q4 2021, accounting for nearly 75% of the total shipments. UNISOC, Qualcomm and ASR were the top three players in China. For the rest of the world, Qualcomm led the market, followed by UNISOC and Intel.”

Qualcomm led the global cellular IoT chipset market with a 38% share in terms of shipments. Qualcomm grew its share both annually and sequentially with traction across key segments such as automotive, router/CPE, retail, asset tracking and industrial IoT. However, competition from local players in China, such as UNISOC and ASR, in key fast-growing segments like LTE Cat-1/Cat-1 bis and NB-IoT limited Qualcomm’s growth opportunities in the world’s largest IoT market. However, Qualcomm has broadened its portfolio of IoT solutions, targeting specific verticals like retail, automotive, industrial IoT and smart cities. It has also launched an IoT services suite covering more than 30 verticals to enhance platform support for IoT-as-a-service (IoTaaS) applications and accelerator programs (like smart cities) with a more ecosystem-led approach bringing in different stakeholders across the value chain.

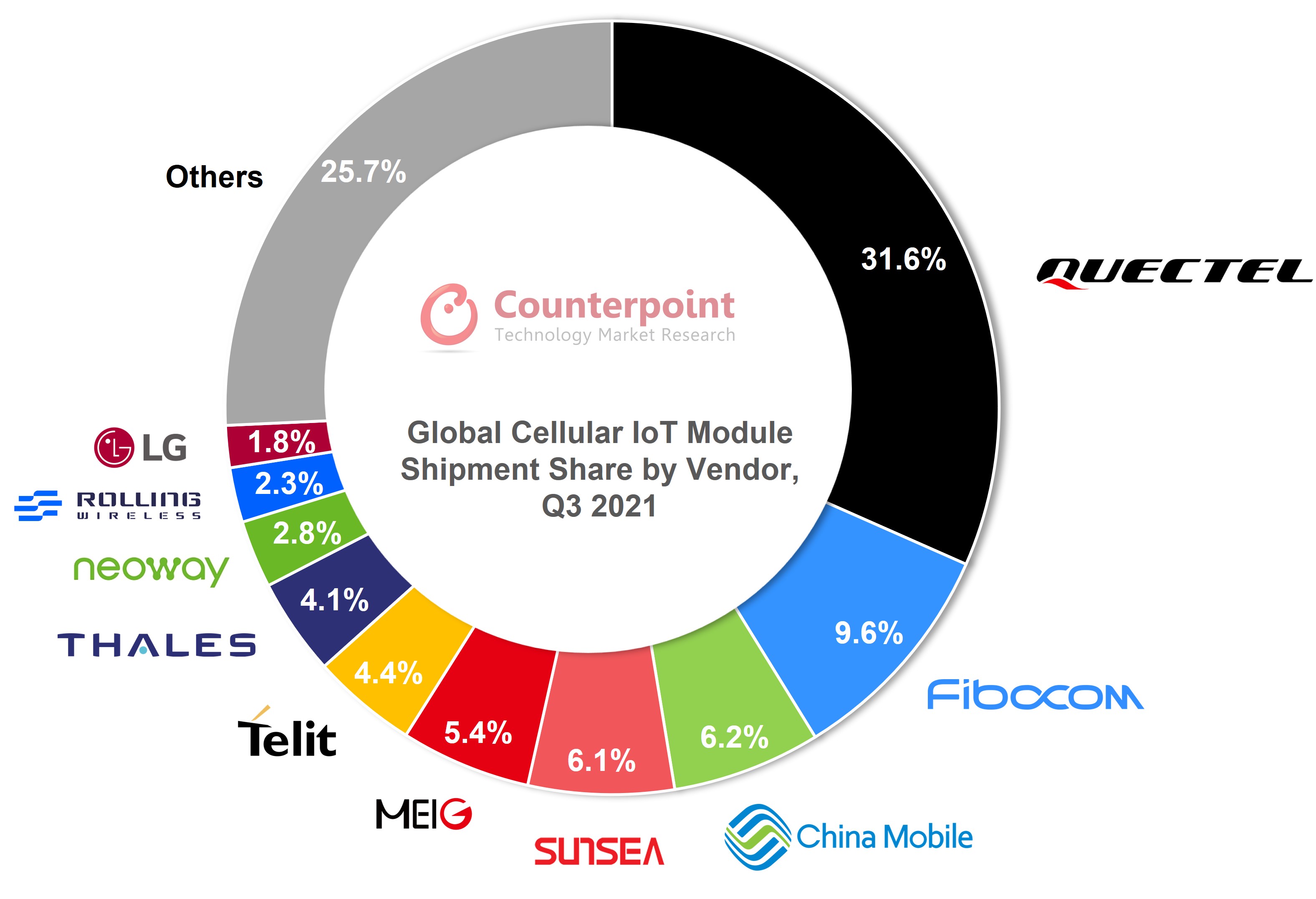

UNISOC, the second-largest cellular IoT chipset player globally, has been strong across NB-IoT and 4G Cat 1 technologies. Its cellular IoT chipset shipments growth has continued for nearly last four quarters and is able to fill the gap which HiSilicon left in the market. Moreover, it is making steady improvements in higher-end technologies such as 5G, 4G Cat 4 and above. It has also succeeded in expanding its customer base to Quectel, Fibocom, China Mobile and many more module players. This helped it to capture more than one-fourth of shipments in Q4 2021. UNISOC is focused on low-end applications like smart metering, POS and industrial. For 5G, it has launched the V510 baseband and V516 platform which are widely used in FWA routers and CPE devices.

ASR Microelectronics maintained its third ranking in the cellular IoT chipset market in Q4 2021 due to strong performance in the 4G Cat 1 and 4G Cat 4 module segments. ASR is providing strong competition to UNISOC for 4G Cat 1 and to Qualcomm for 4G Cat 4 module-based applications lately. However, ASR is yet to launch NB-IoT and 5G solutions and thus will have to work on its long-term capabilities and strategy to maintain this high growth which could remain for the next 2-3 years. The company has increased its production capacity this year to meet demand. ASR has local partnerships with many module players in 4G Cat 1 and Cat 4 technology, like Quectel, Longsung and Rinlink.

MediaTek took the fourth position in the market in Q4 2021. However, it is not much focused on the cellular IoT market compared to the smartphone chipset market. This is one of the key reasons for it to lose 4% market share sequentially in this quarter. MediaTek is also focusing on 5G enhancement and recently launched Kompanio 900T, a new 5G platform for tablets, notebooks and other IoT devices. The MediaTek T750 chipset is already quite popular for FWA and CPE devices.

Global Cellular IoT Chipset Shipments Share by Chipset Vendor, Q4 2021

Eigencomm registered a strong growth of 3743% YoY albeit on a smaller base as it struck partnerships with Quectel and Fibocom for NB-IoT module chipsets.

Sequans also registered growth with a robust 4G, LPWA and 5G chipset portfolio. The French manufacturer saw strong traction in key markets such as asset tracking, healthcare and smart meters.

Sony Semicon (Altair Semi) registered growth this quarter with a strong partnership with Sierra Wireless and Wistron NeWeb targeting smart meters, asset trackers and smart cities markets.

Samsung also launched a 5G chipset targeting automotive applications. It may provide strong competition to Qualcomm and MediaTek if it can enter a strong partnership with automakers.

Intel and HiSilicon are still supplying their leftover inventory to some of their top customers where the modules with their chipsets are designed in.

Global Cellular IoT Chipset Shipments Share by Application, Q4 2021

*Note: Figures may not add up to 100% due to rounding

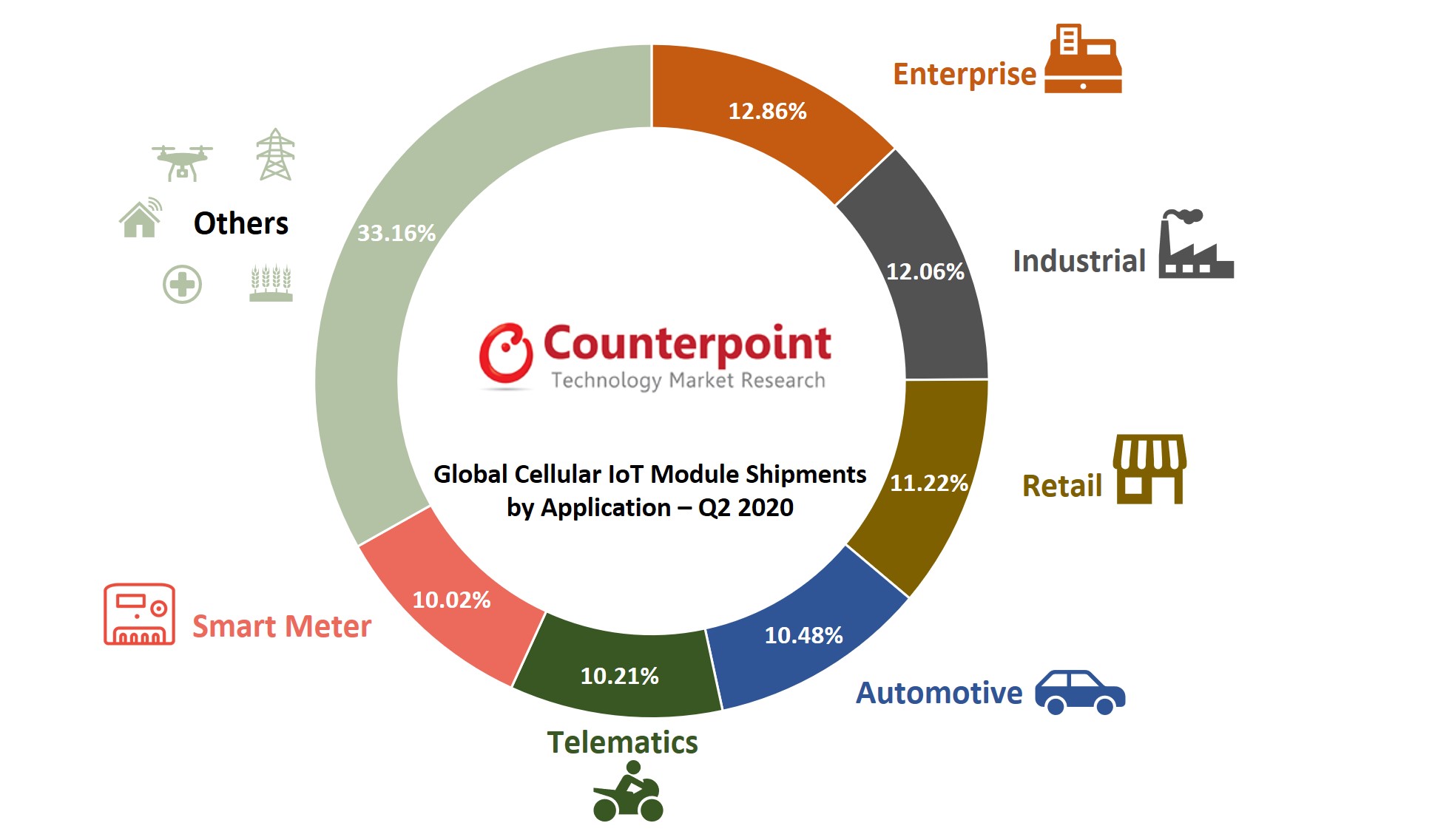

Commenting on the application side of chipsets, Vice President Research Neil Shah said, “Smart meter, POS, router/CPE, industrial and automotive were the top five applications in terms of shipments in Q4 2021. PC had the maximum growth of 245% YoY, followed by smart meter with 124% YoY and router/CPE with 112% YoY growth. Router/CPE, PC and industrial were the top three applications for 5G. For NB-IoT, smart meters, asset tracking and energy were the top three applications. 4G Cat 1 is becoming popular in the POS, industrial and smart meter segments due to its high performance and low power consumption architecture. We forecast that smart meters, industrial and router/CPE will grow the maximum in the future.”

For detailed research, refer to the following reports available for subscribing clients and also for individual subscriptions:

- Global Cellular IoT Module and Chipset Tracker, Q1 2018 – Q4 2021

- Global Cellular IoT Module and Chipset Tracker by Application, Q1 2018 – Q4 2021

Counterpoint tracks and forecasts on a quarterly basis 1,450+ IoT module SKUs’ shipments, revenues and ASP performance across 85+ IoT module vendors, 12+ chipset players, 18+ IoT applications and 10 major geographies.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts:

Anish Khajuria

Neil Shah

Counterpoint Research

press(at)counterpointresearch.com

Related Reports:

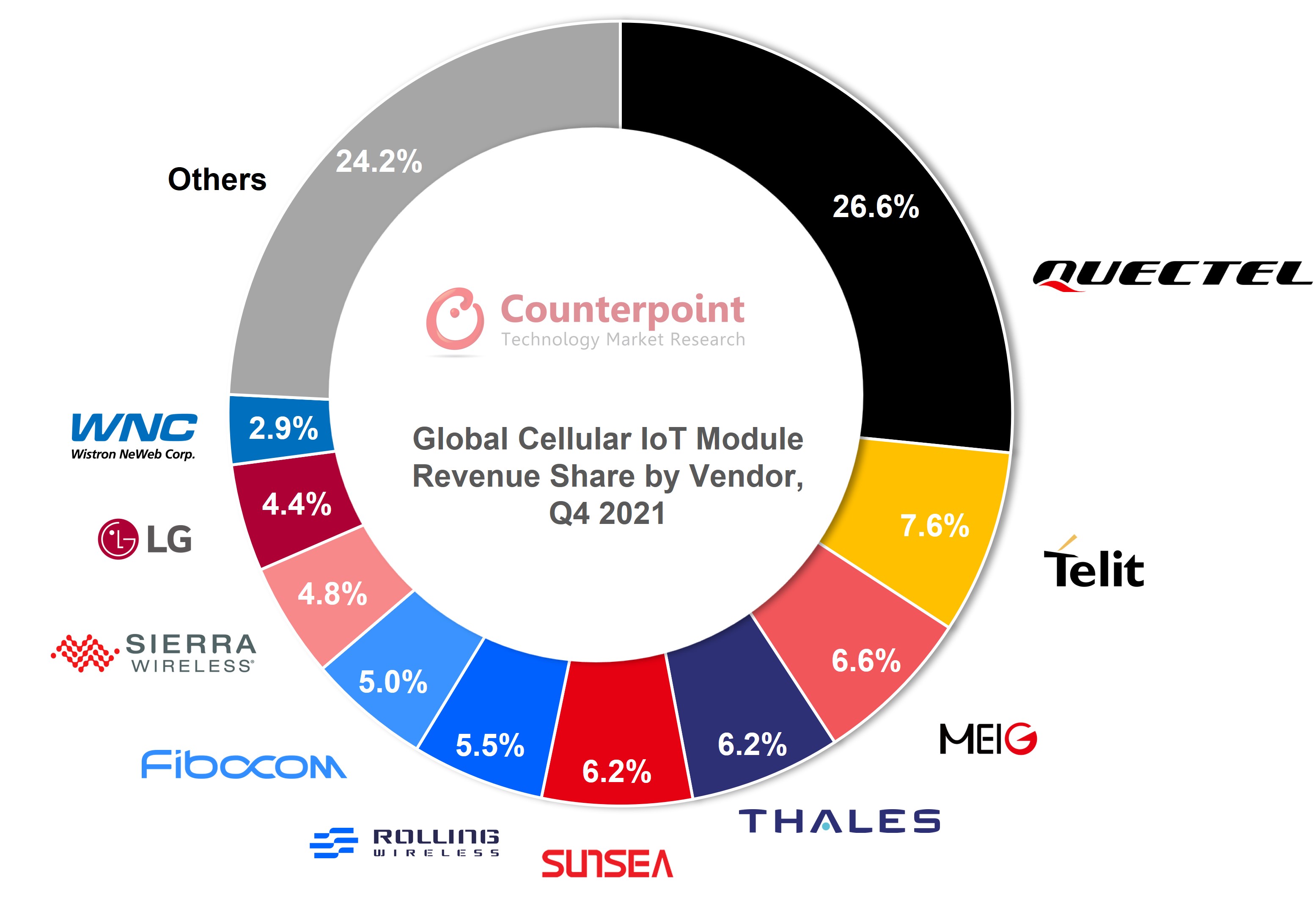

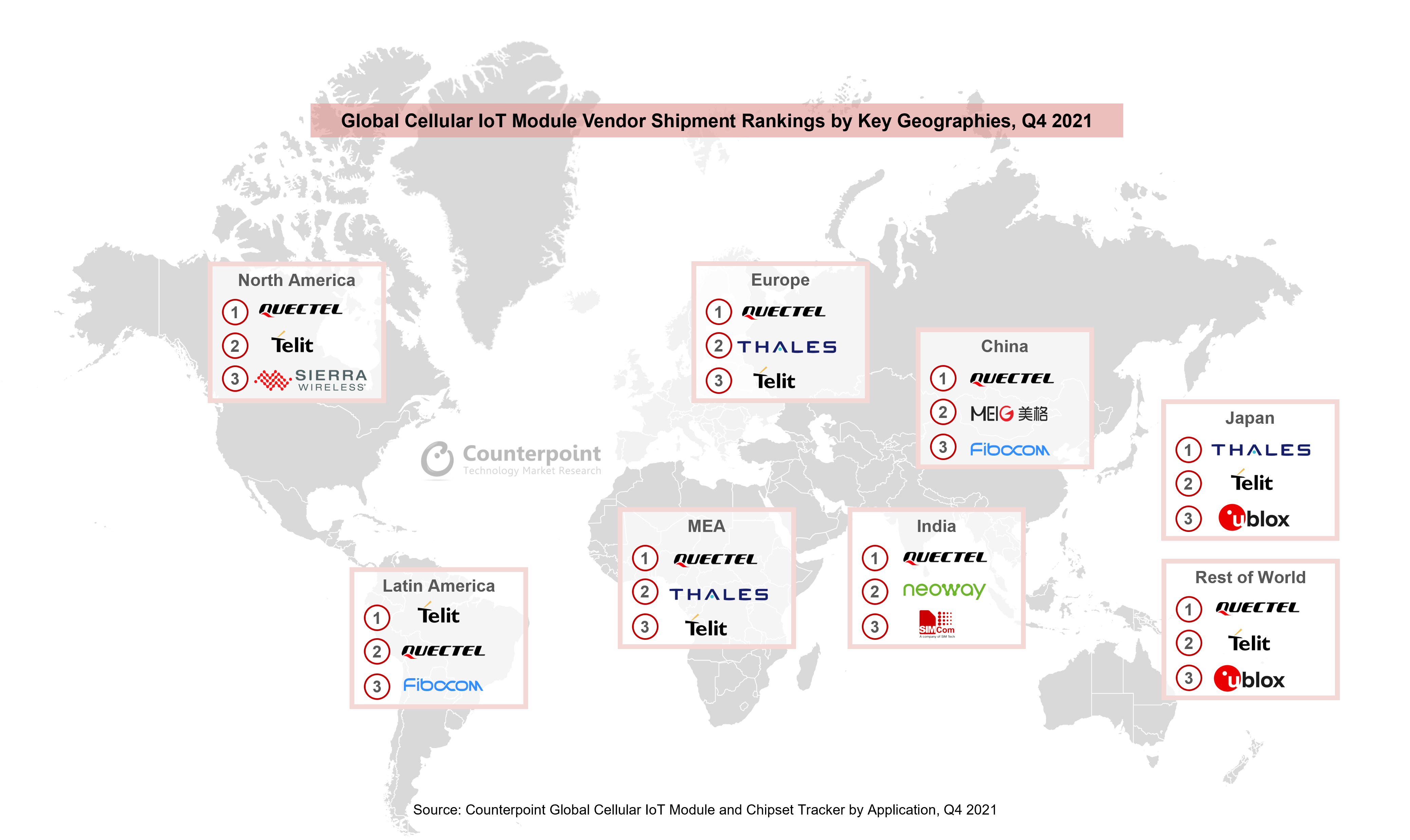

- Global Cellular IoT Module Revenue Grows 58% YoY in Q4 2021

- IoT Intelligence Tracker – February 2022 Edition

- Unpacking 5G AIoT Opportunity

- Global Cellular IoT Module Installed Base, 2021

- Global Wearables Shipment Forecast, 2020 – 2030

- Quectel: Driving Towards Becoming a True IoT Company

- Global Smartwatch Shipments by Model Quarterly Tracker, Q1 2018 – Q3 2021

- Global Point of Sale (POS) Market, 2018 – 2025

- Global Tablet Market Analysis, Q4 2021

- Global Connected Car Installed Base, 2021

- Global FWA + CPE Forecast, 2019-2030 – H1 2021

- Global XR (VR & AR) Market Forecast, 2016 – 2025

- Wi-Fi 6 Market Key Drivers, Challenges, Applications, Market Size, Outlook

- Global Automotive NAD Module and Chipset Tracker, Q1 2018 – Q4 2021

- Global Telematics Control Unit Tracker, Q1 2019 – Q4 2021

- Global Connected Car Tracker, Q1 2019 – Q4 2021