- In Q2 2023, global smartwatch shipments increased 11% YoY after declining for two successive quarters.

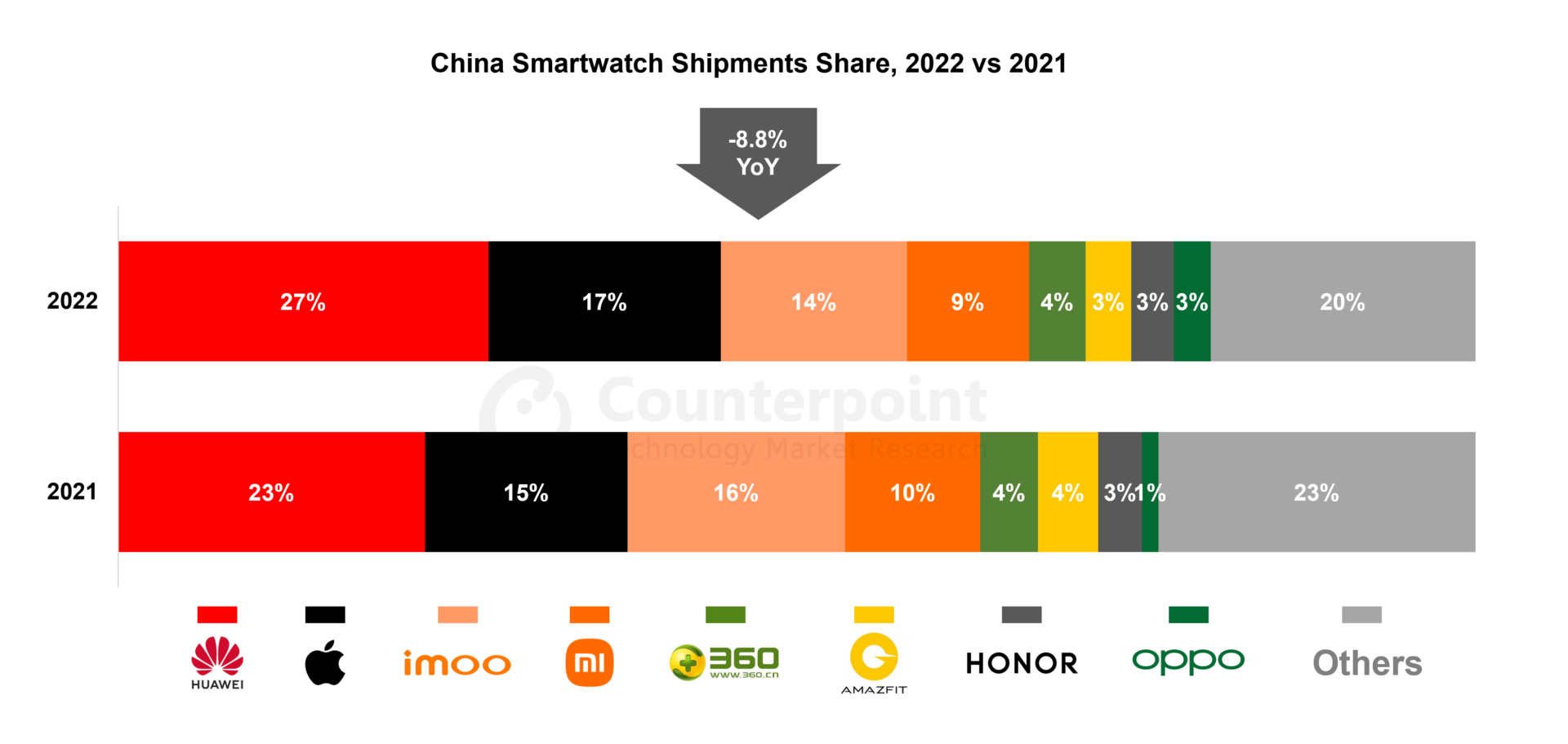

- For the first time in two years, Huawei took the second spot, fueled by a 58% YoY surge in domestic shipments.

- India’s market recorded a remarkable 70% YoY growth, whereas North America saw a 9% decline.

Seoul, New Delhi, Hong Kong, Beijing, London, Buenos Aires, San Diego – August 29, 2023

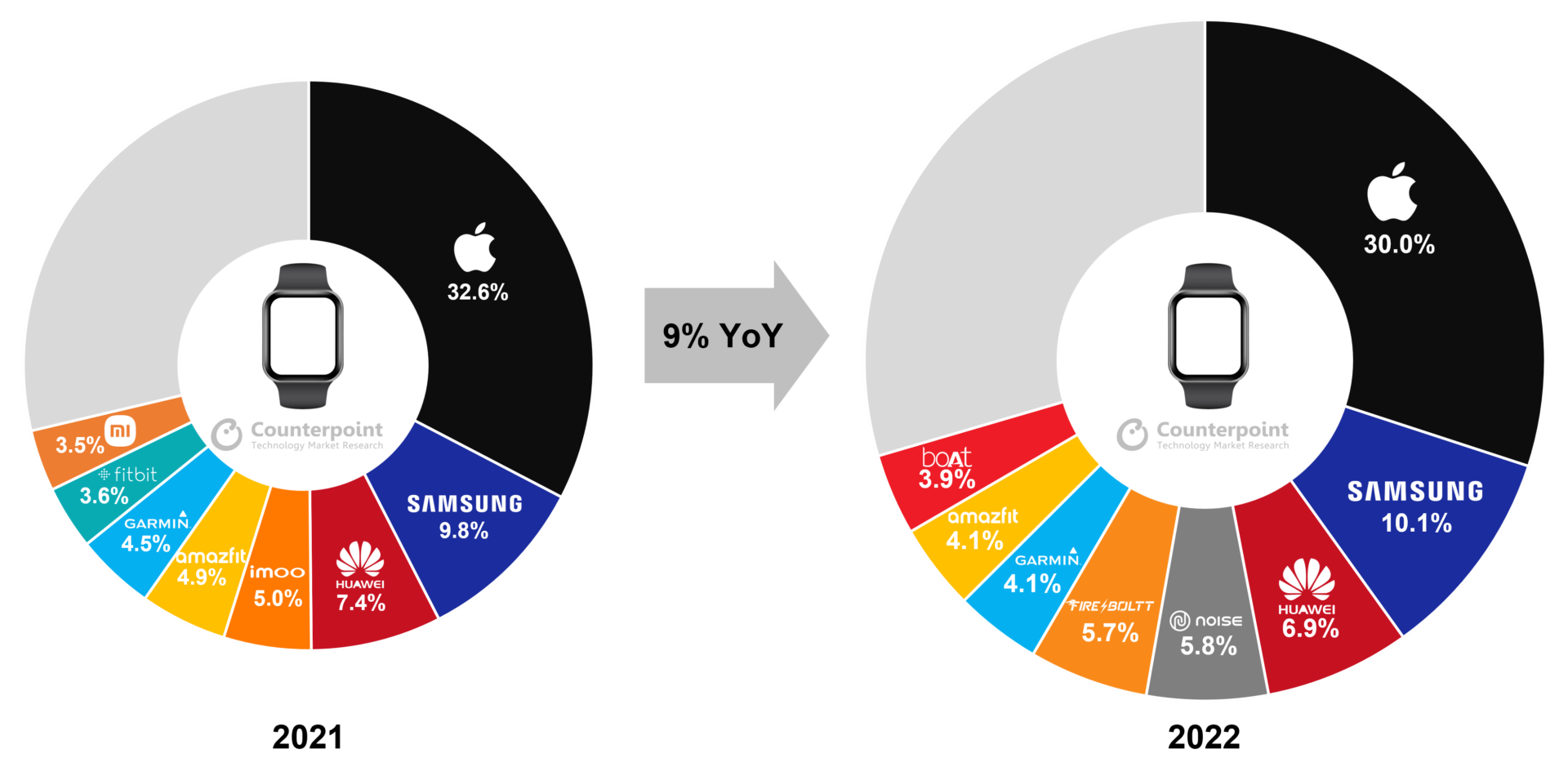

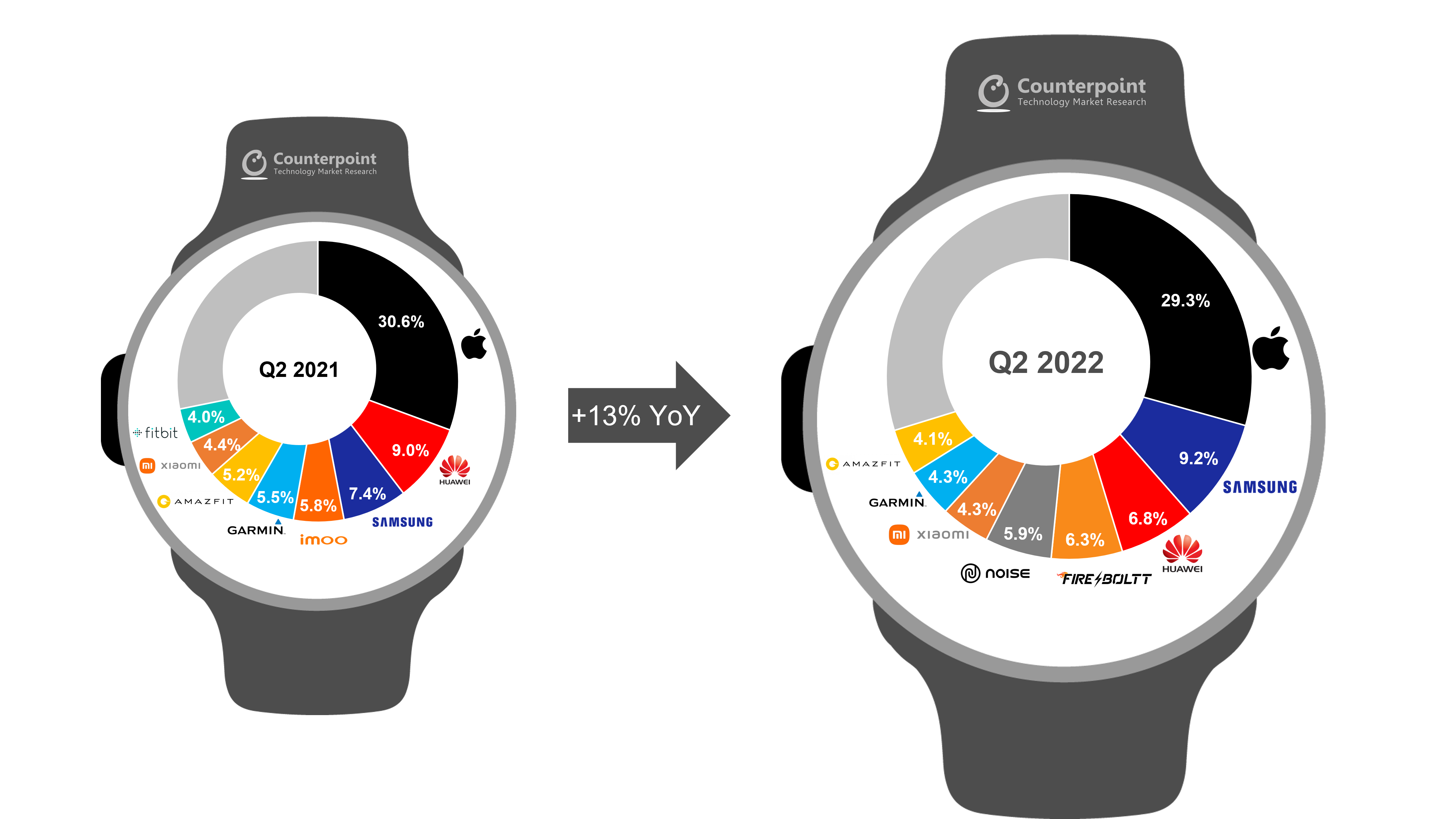

Global smartwatch shipments increased 11% YoY in Q2 2023 after declining in both Q4 2022 and Q1 2023, according to Counterpoint Research’s recently published Global Smartwatch Model Tracker. India’s shipments soared by 70% YoY, serving as the primary driver for the global market’s rebound. China’s market also recorded a modest increase. Besides, a shift in the competitive landscape was evident as Huawei ascended to the second position in terms of global market share.

Research Analyst Woojin Son said, “Huawei recorded impressive growth in Q2 2023, securing the second position in quarterly shipments for the first time in two years. The leading Chinese brand’s growth stagnated for some time due to technological sanctions and a slowdown in its domestic market. Although the Chinese market’s recovery remained lukewarm, Huawei aggressively pushed new flagship products such as the Watch 4 series into the market in Q2, achieving its highest quarterly shipments after 2020. Huawei seems to be determined to bounce back in the market. It remains to be seen whether this momentum can be effectively expanded to other sectors, such as smartphones.”

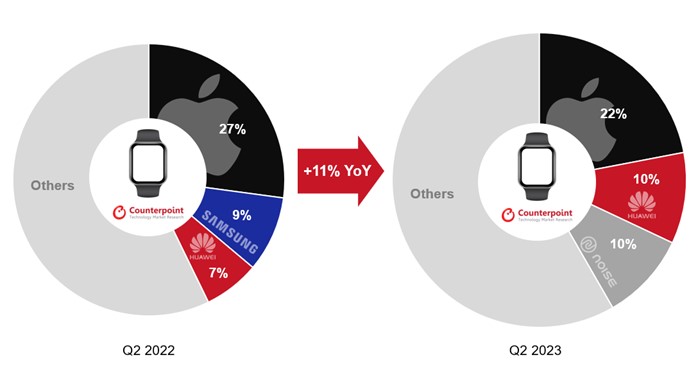

Global Top 3 Smartwatch Brands’ Shipment Share, Q2 2023 vs Q2 2022

Source: Counterpoint Global Smartwatch Model Shipment & Revenue Tracker, Q2 2023

Market summary

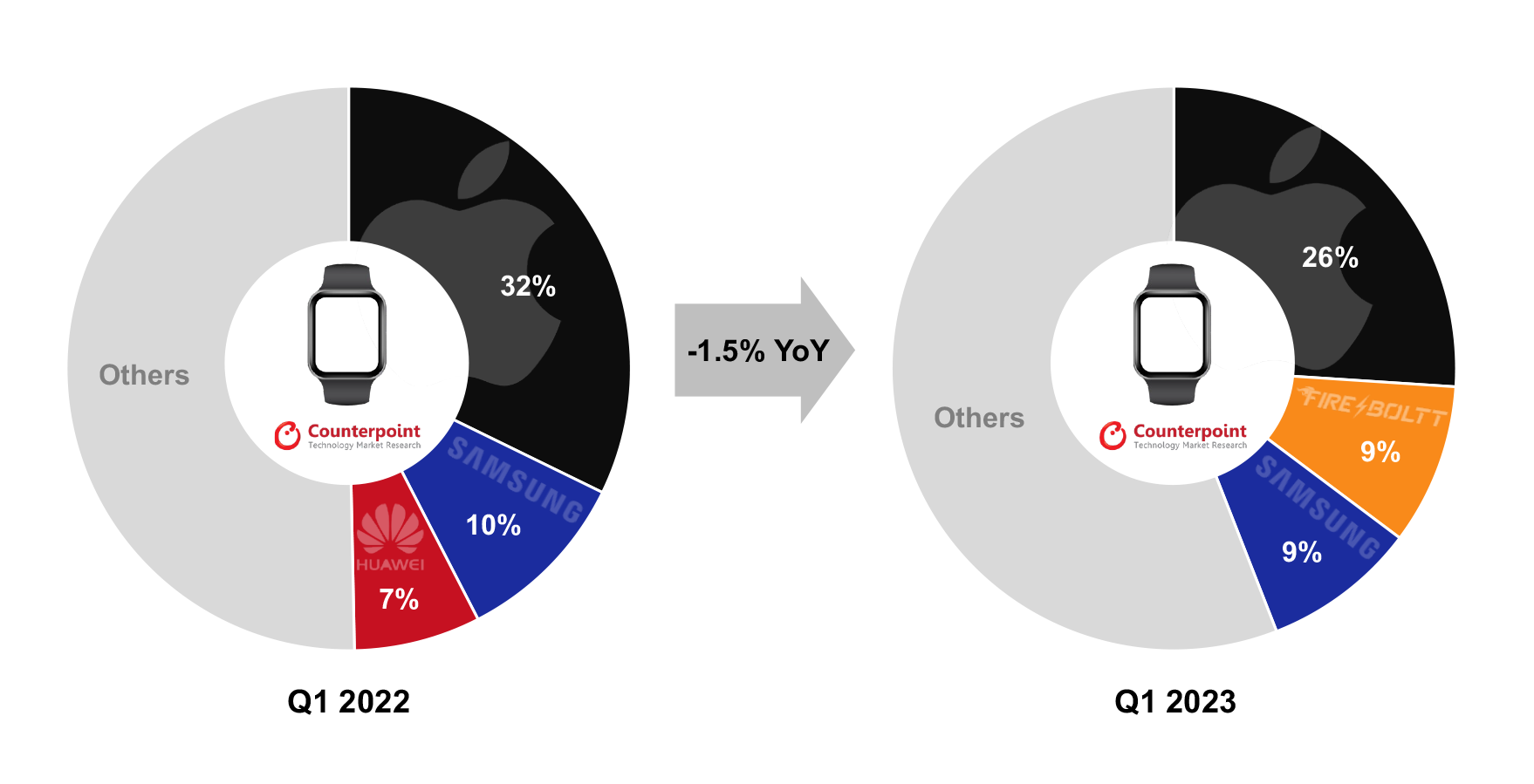

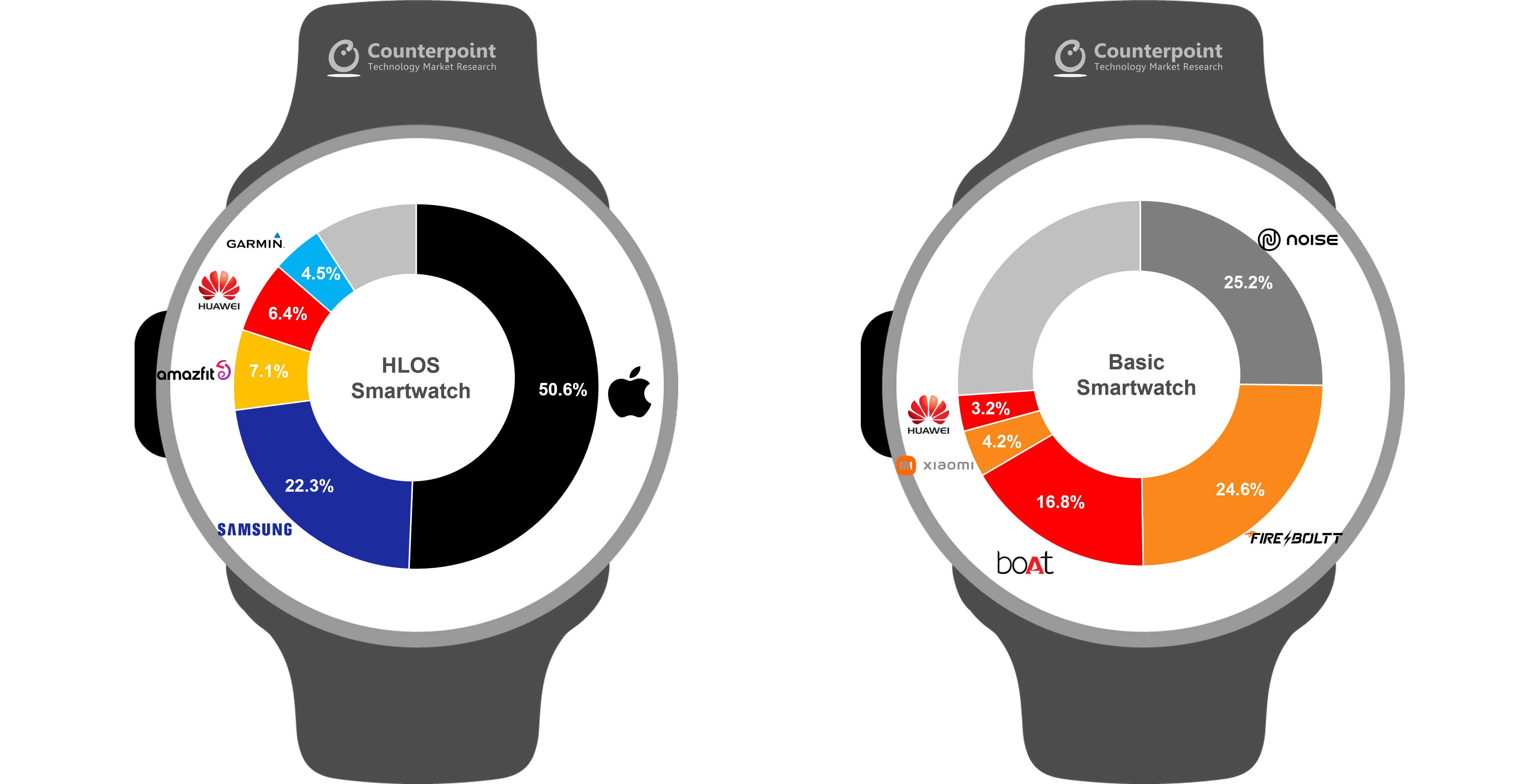

- Apple saw a 10% YoY decline in its Q2 2023 shipments. This decline pushed its Q2 shipments to below 8 million units for the first time in three years. Consequently, Apple’s market share fell to 22% from 27% in Q2 2022.

- Huawei made big strides by increasing its domestic market share to 39% following a surge of 58% in shipments. This achievement propelled the brand to the second spot in the global smartwatch market share rankings. Another significant change was observed in the premium segment, especially in the >$500 band. Huawei’s products in the >$500 band in China expanded their share in the band to 52% in Q2 2023, a remarkable leap from the brand’s near-absence from the band in the same quarter of 2022.

- Indian brands Noise and Fire-Boltt emerged as major contenders, boasting 86% and 70% YoY growth, respectively. Within Noise’s offerings, products priced under $50 constituted a significant 98% of total shipments. Noise’s Colorfit Icon series managed to carve out a substantial 28% share of the total shipments. Fire-Boltt also made strides in expanding its market share by capitalizing on cost-effective smartwatches.

- Samsung witnessed a 19% YoY decline in Q2 2023. The brand managed to boost shipments in the Chinese and Indian markets. Samsung’s performance in North America and Europe, its pivotal markets, recorded 24% and 13% YoY declines, respectively.

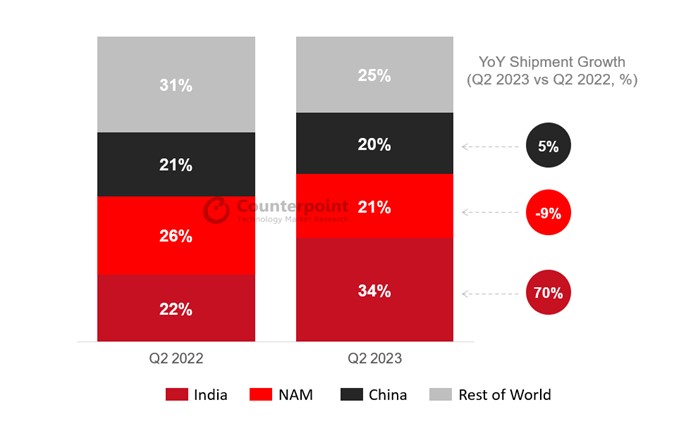

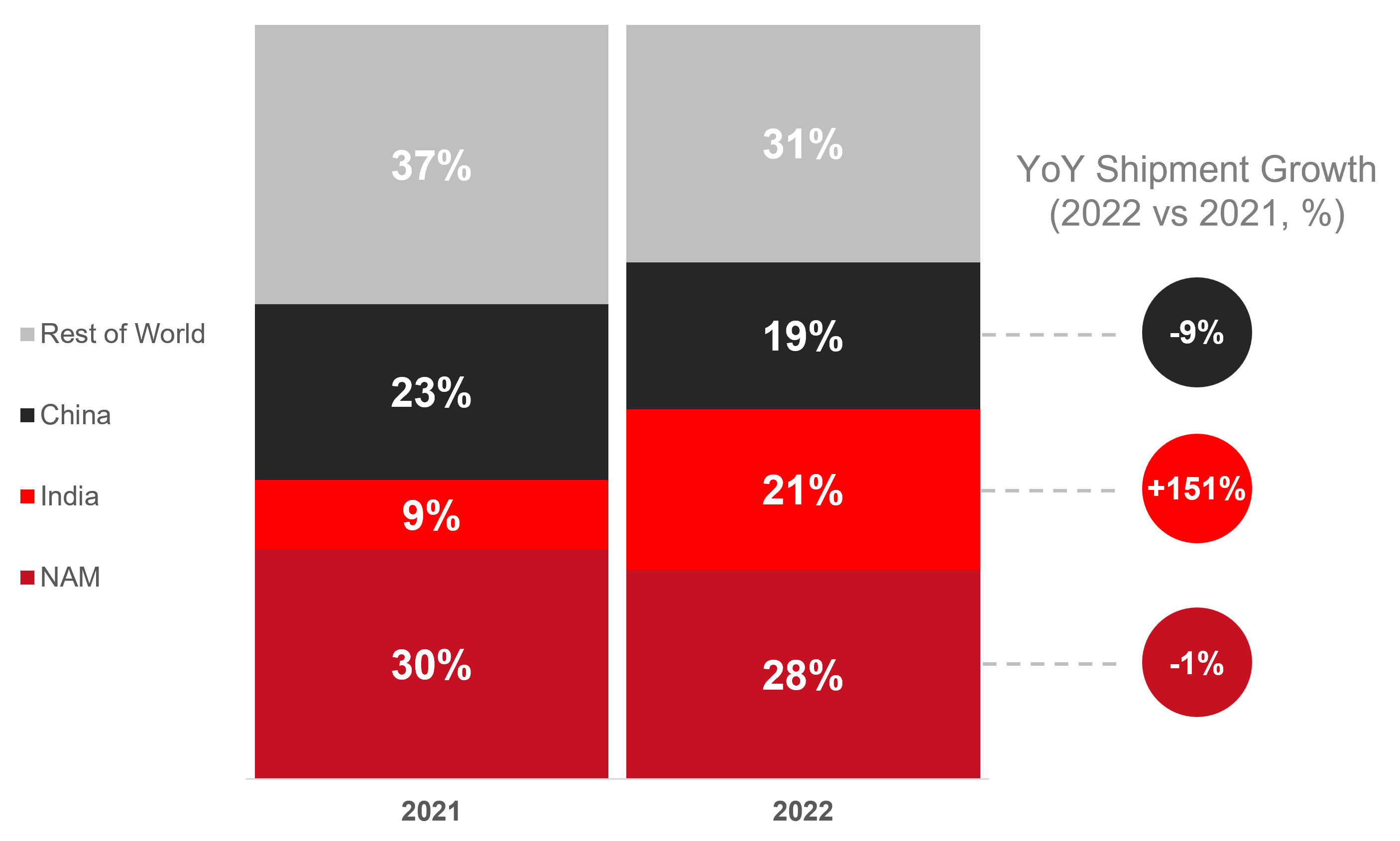

Smartwatch Shipment Share by Region, Q2 2023 vs Q2 2022

Source: Counterpoint Global Smartwatch Model Shipment & Revenue Tracker, Q2 2023

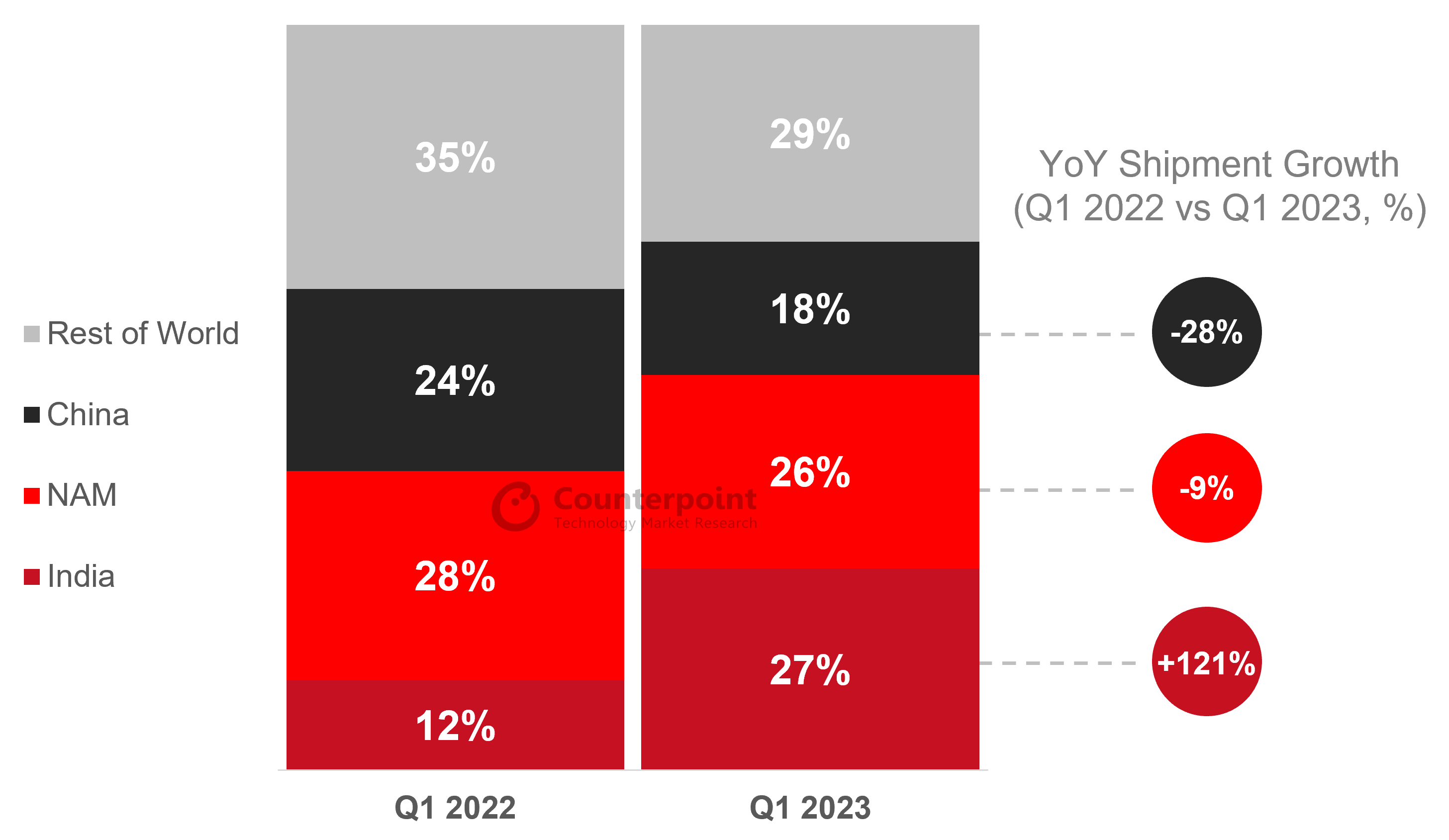

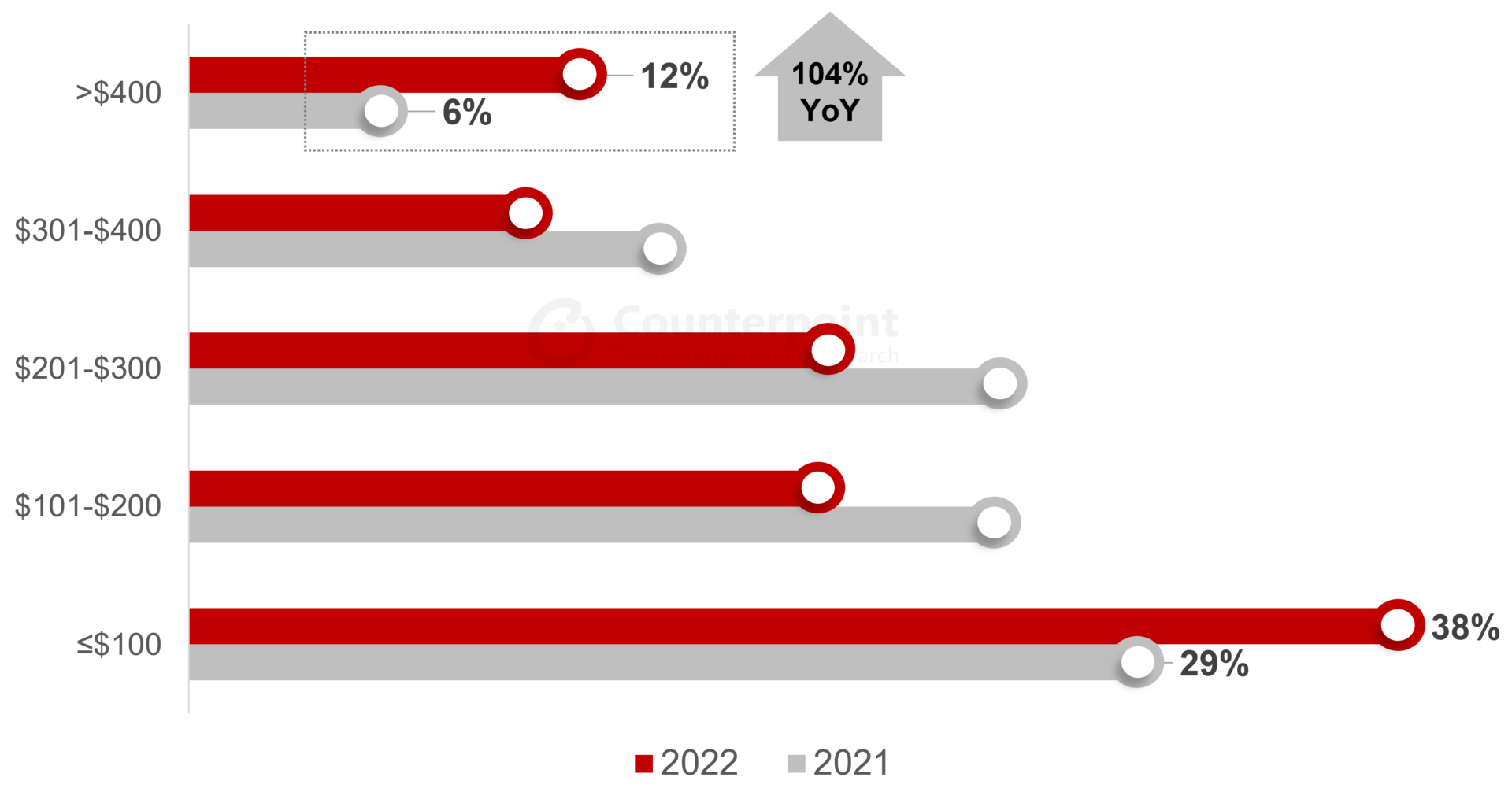

In terms of regional shipment shares, India’s market stood at 34%, a 12% points surge compared to the year-ago period. In Q2 2023, 88% of India’s smartwatch shipments were dominated by products priced <$50. Leading the charge in this segment were Noise, Fire-Boltt and boAt, collectively contributing to 72% of India’s total shipments.

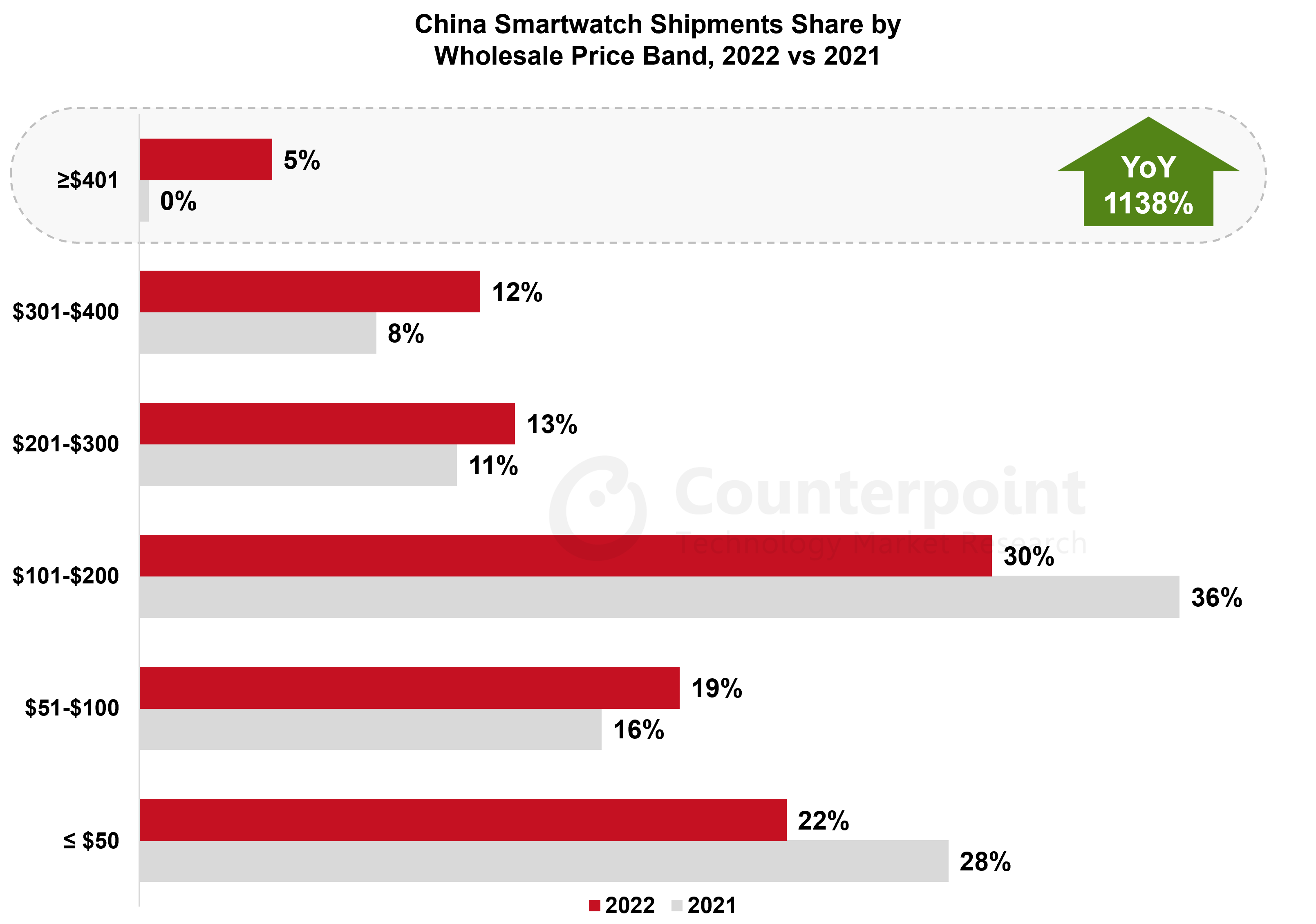

The Chinese market’s share declined due to the swift expansion of India’s market. However, China’s shipments grew 5% from Q2 2022. In terms of revenue, the share of products priced >$500 surged to around 34% in China.

In North America, there was an 9% YoY reduction in shipments in Q2 2023. However, the revenue saw a rise of around 3% due to the sustained popularity of high-end premium products. Nevertheless, North America’s share in global smartwatch revenues declined, compared to both Q2 2022 and Q2 2021.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Sujeong Lim

Neil Shah

press(at)counterpointresearch.com

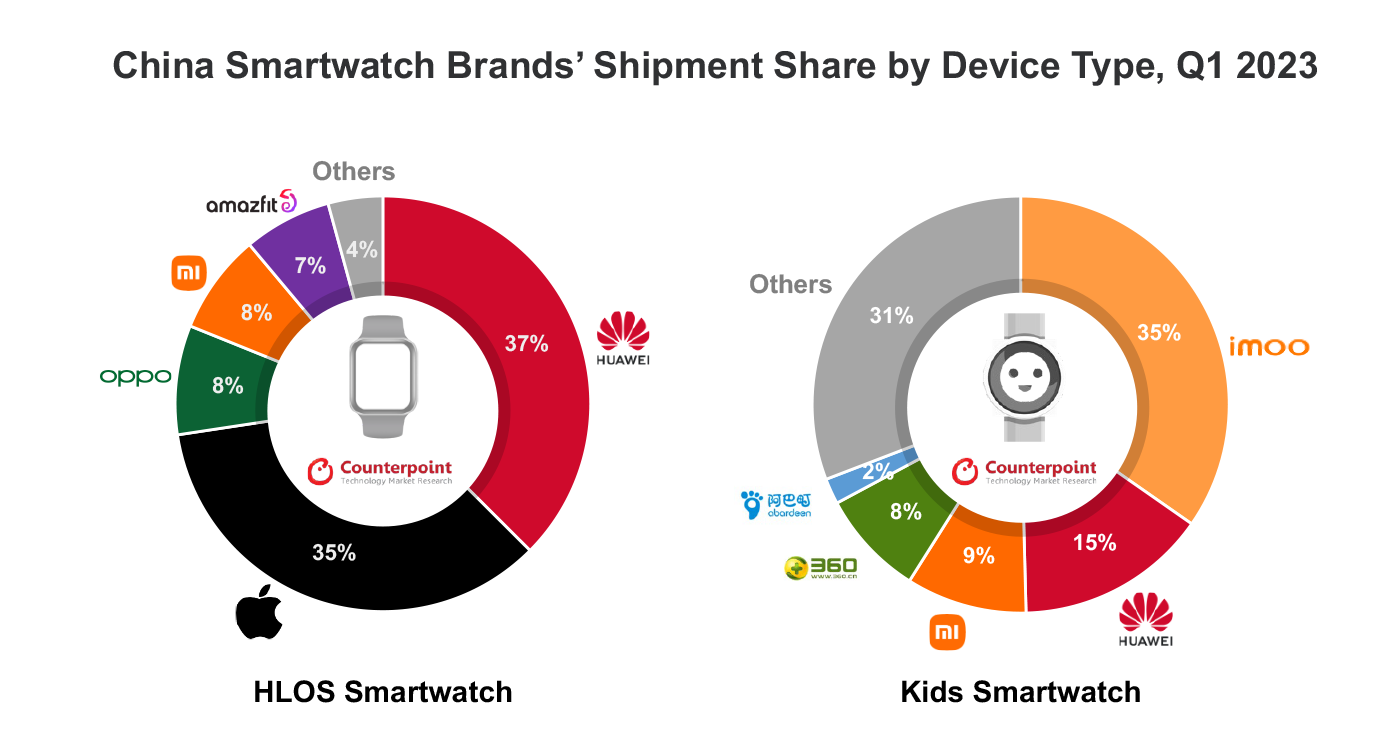

Source: Counterpoint Global Smartwatch Model Shipment & Revenue Tracker, Q1 2023

Source: Counterpoint Global Smartwatch Model Shipment & Revenue Tracker, Q1 2023

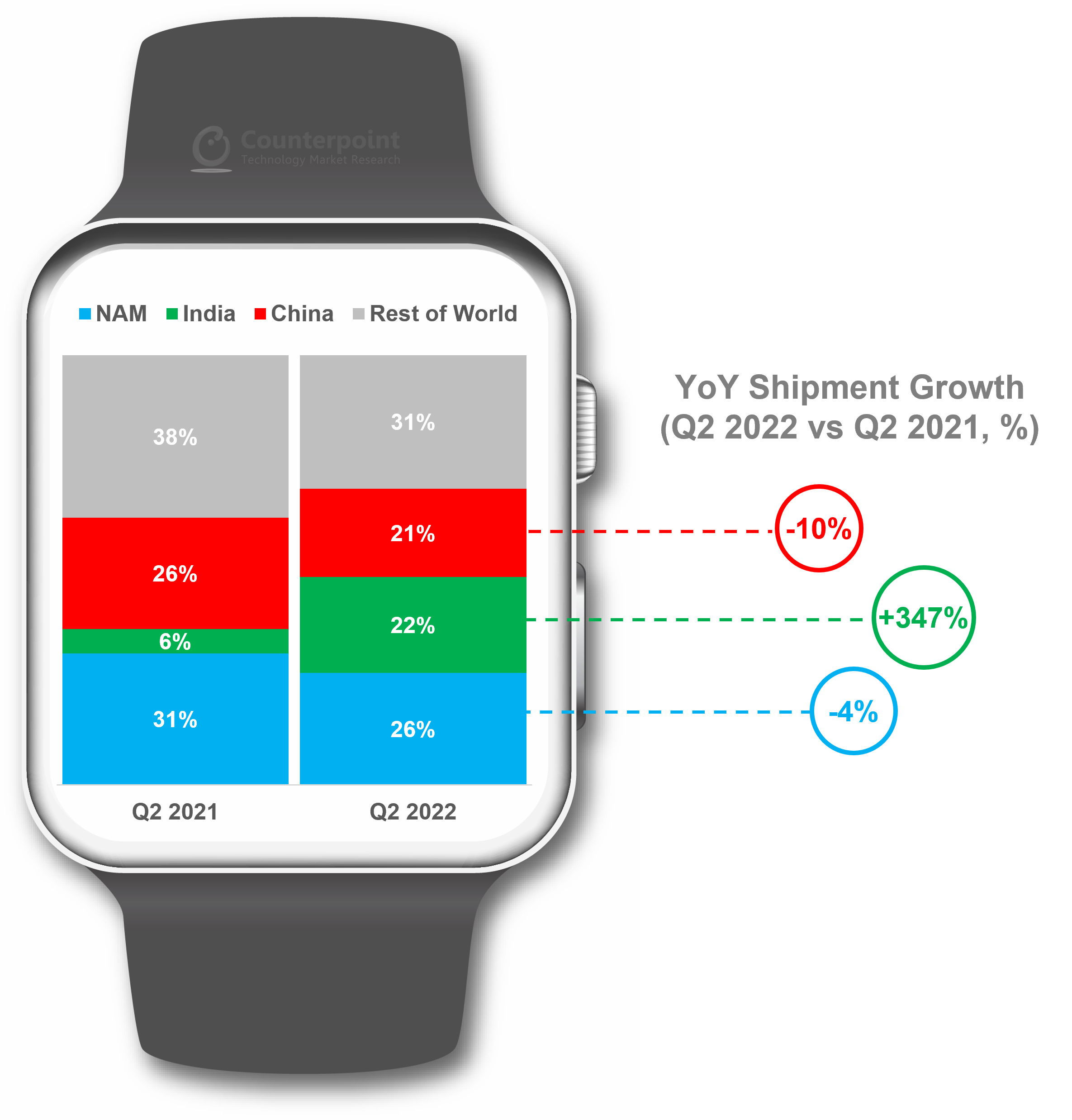

Source: Counterpoint Global Smartwatch Model Shipment & Revenue Tracker, Q2 2022

Source: Counterpoint Global Smartwatch Model Shipment & Revenue Tracker, Q2 2022