- The Dimensity 9300 is integrated with the 7th-gen APU 790 processor, which supports a broad generative AI ecosystem and models including Meta Llama 2, Baidu ERNIE 3.5 SE and Baichuan 2.

- It can run with 13 billion parameters, which are scalable up to 33 billion, on-device at a processing speed of up to 20 tokens per second.

- The Dimensity 9300 will debut with the vivo X100 smartphone in mid-November

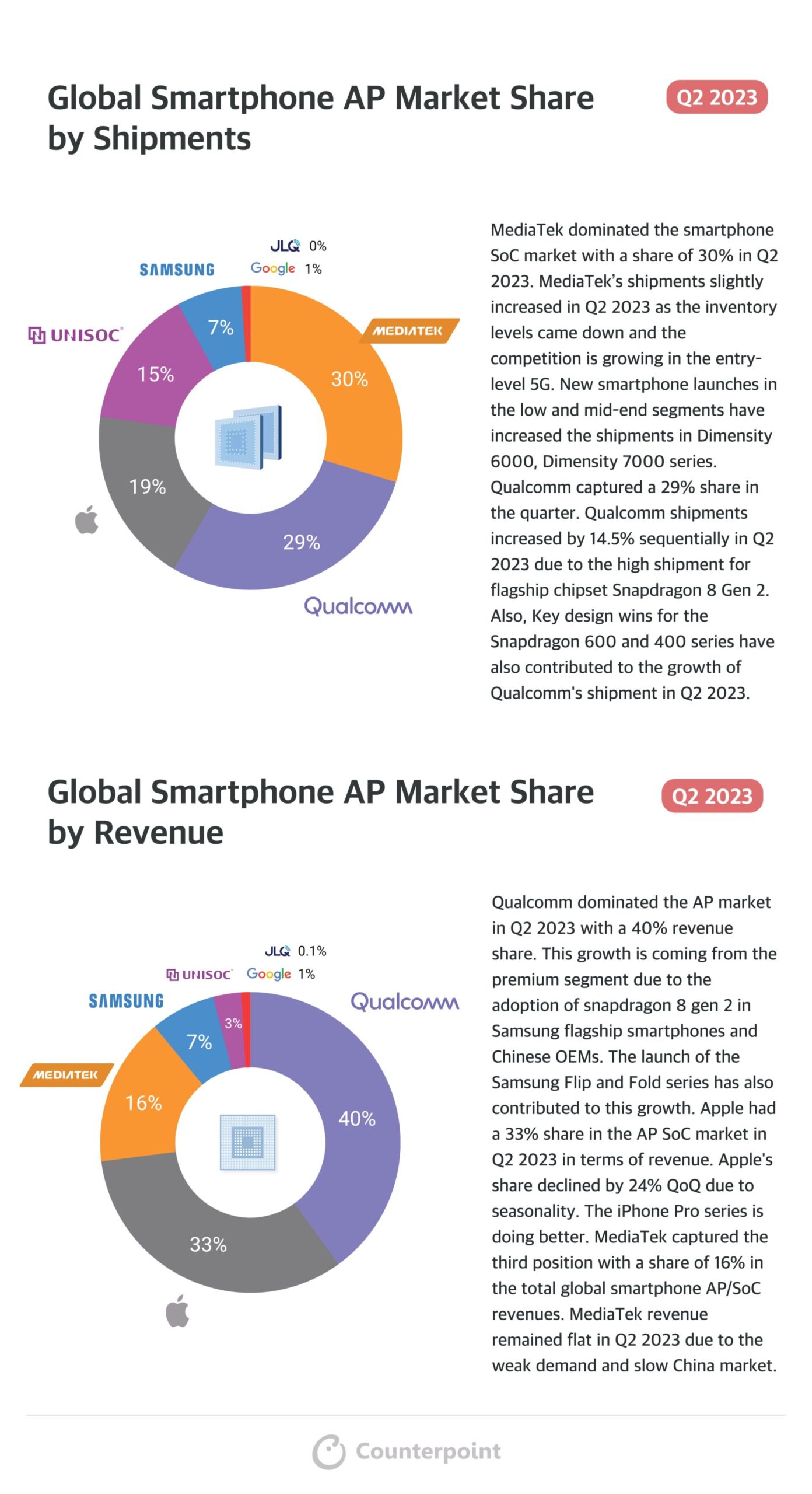

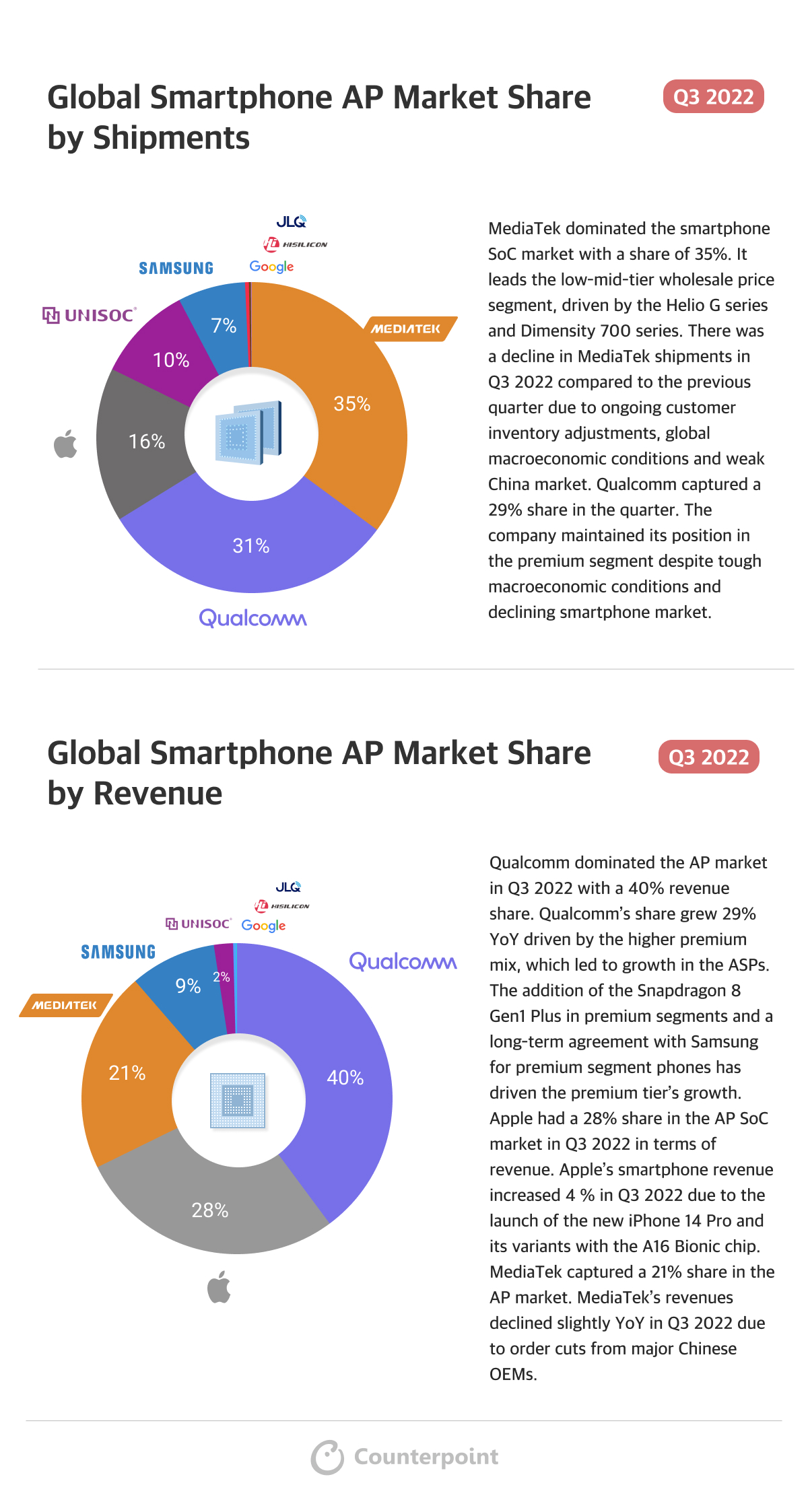

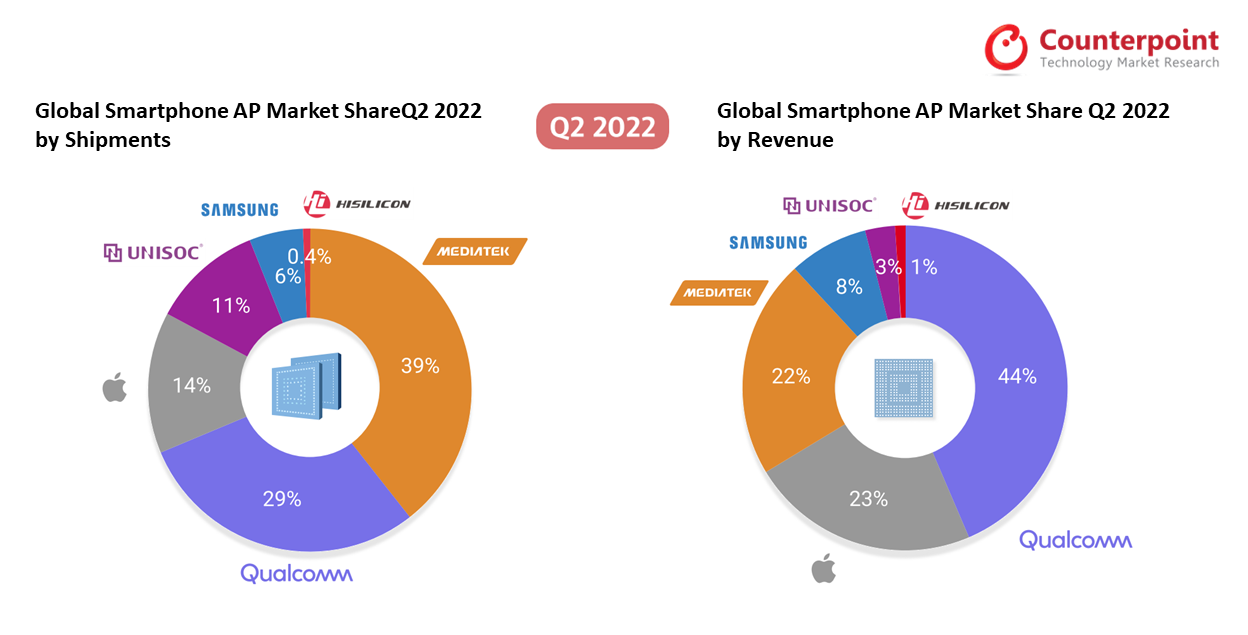

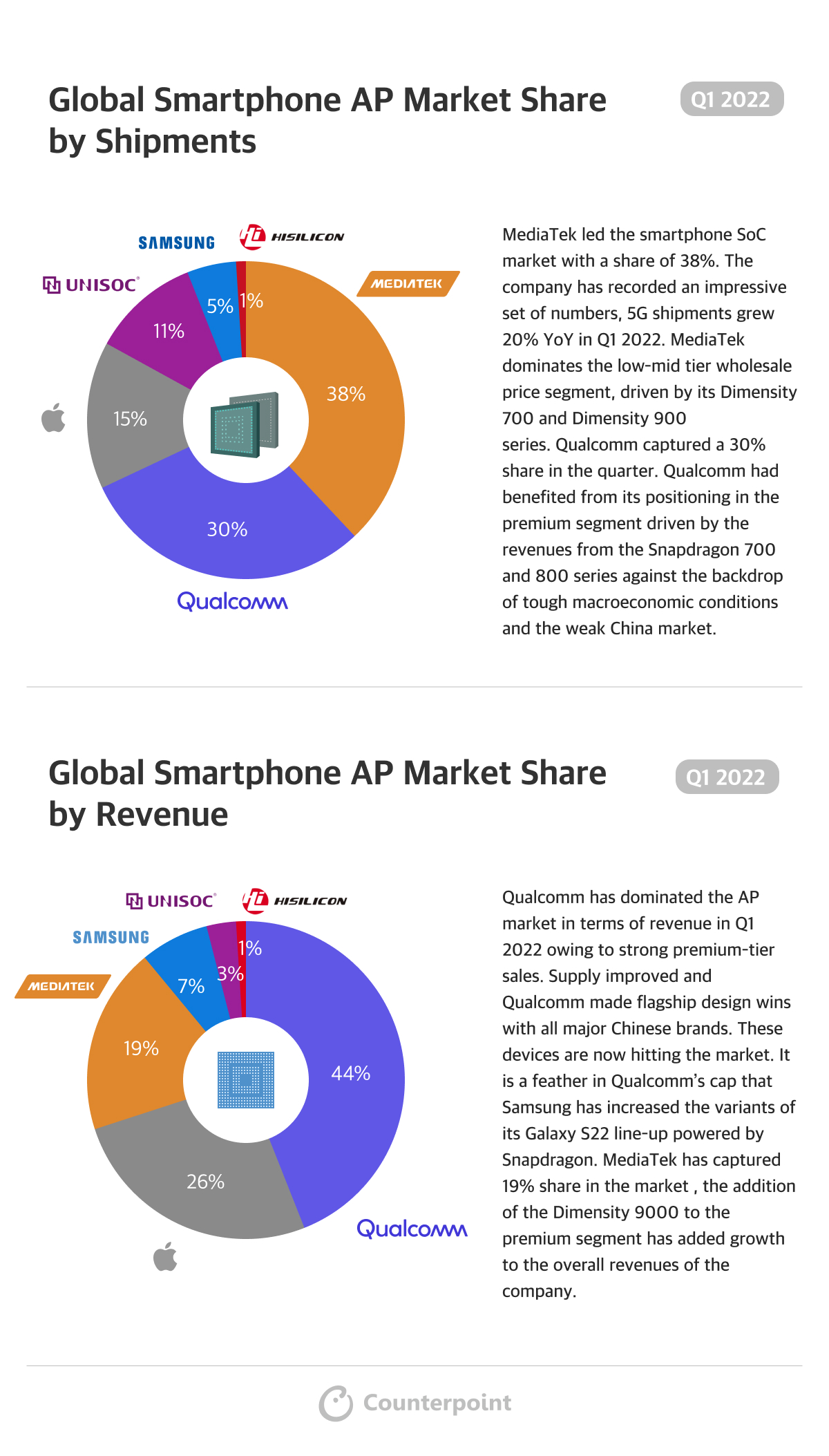

MediaTek recently launched its third-generation premium chipset Dimensity 9300. The company has emerged as a strong competitor in the premium smartphone chipset market after launching the Dimensity 9000 in Q1 2022. Currently, MediaTek leads the low-mid segment and drives significant volumes both for 4G and 5G in this tier.

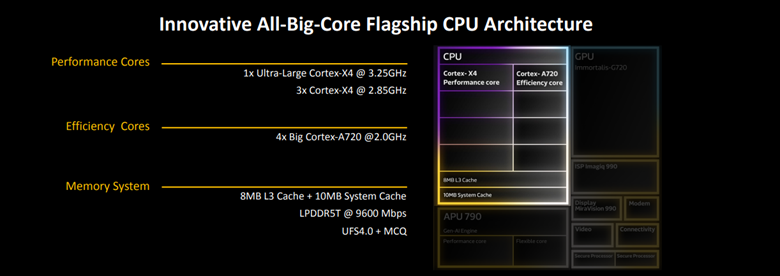

Adopting a non-traditional CPU core design, the Dimensity 9300 focuses on raw performance. It has four large cores (Cortex-X4) and four performance cores (Cortex-A720 cores), thus enabling it to excel in raw computing power and advanced AI capabilities.

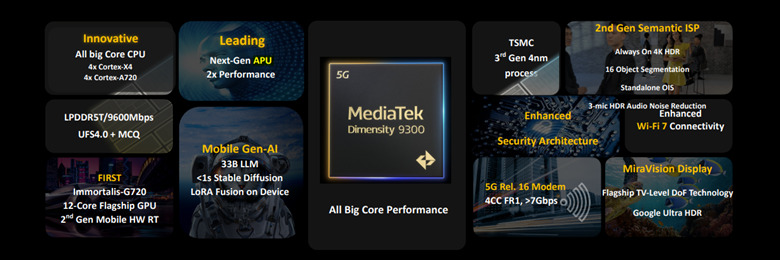

Dimensity 9300 key specifications

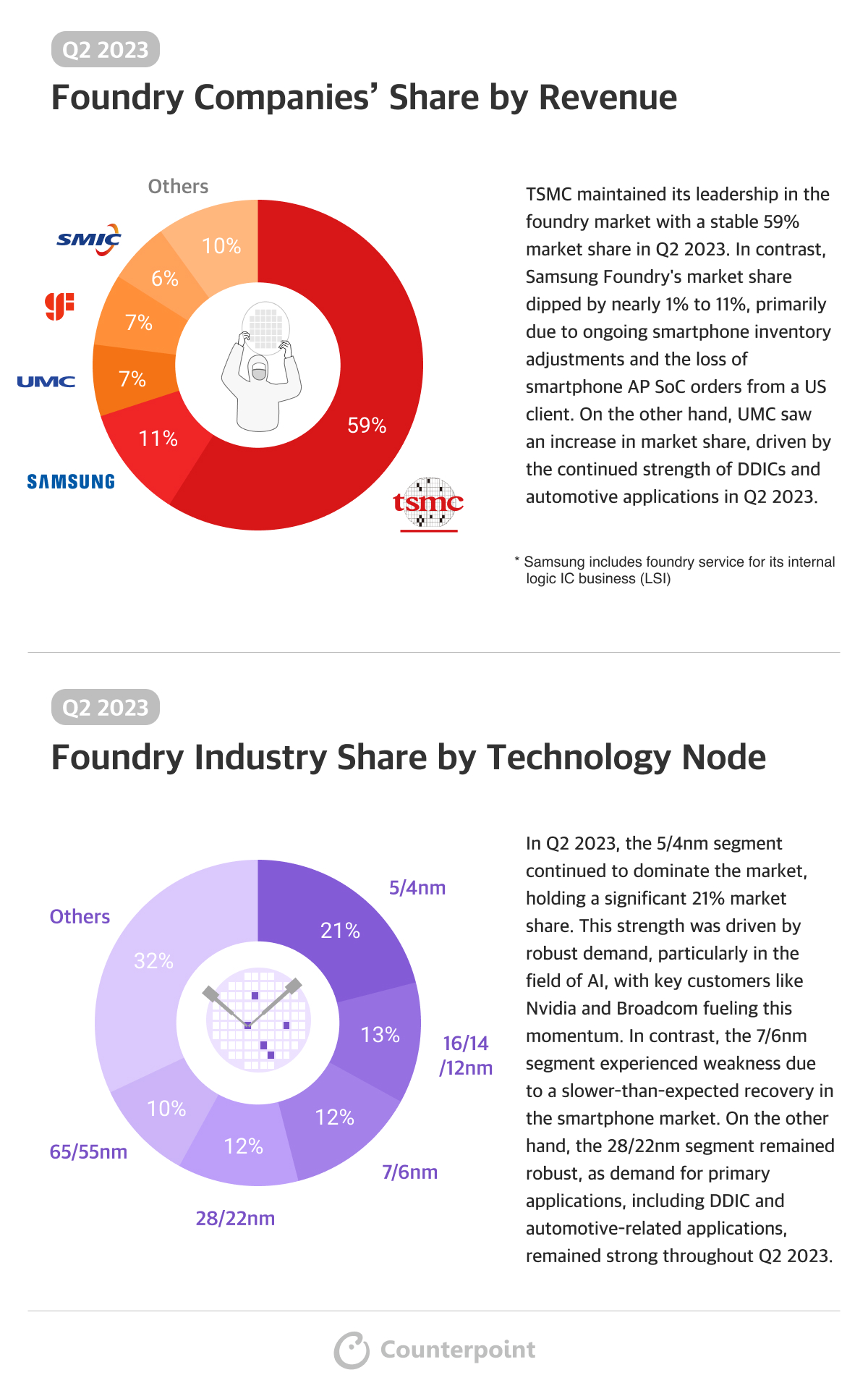

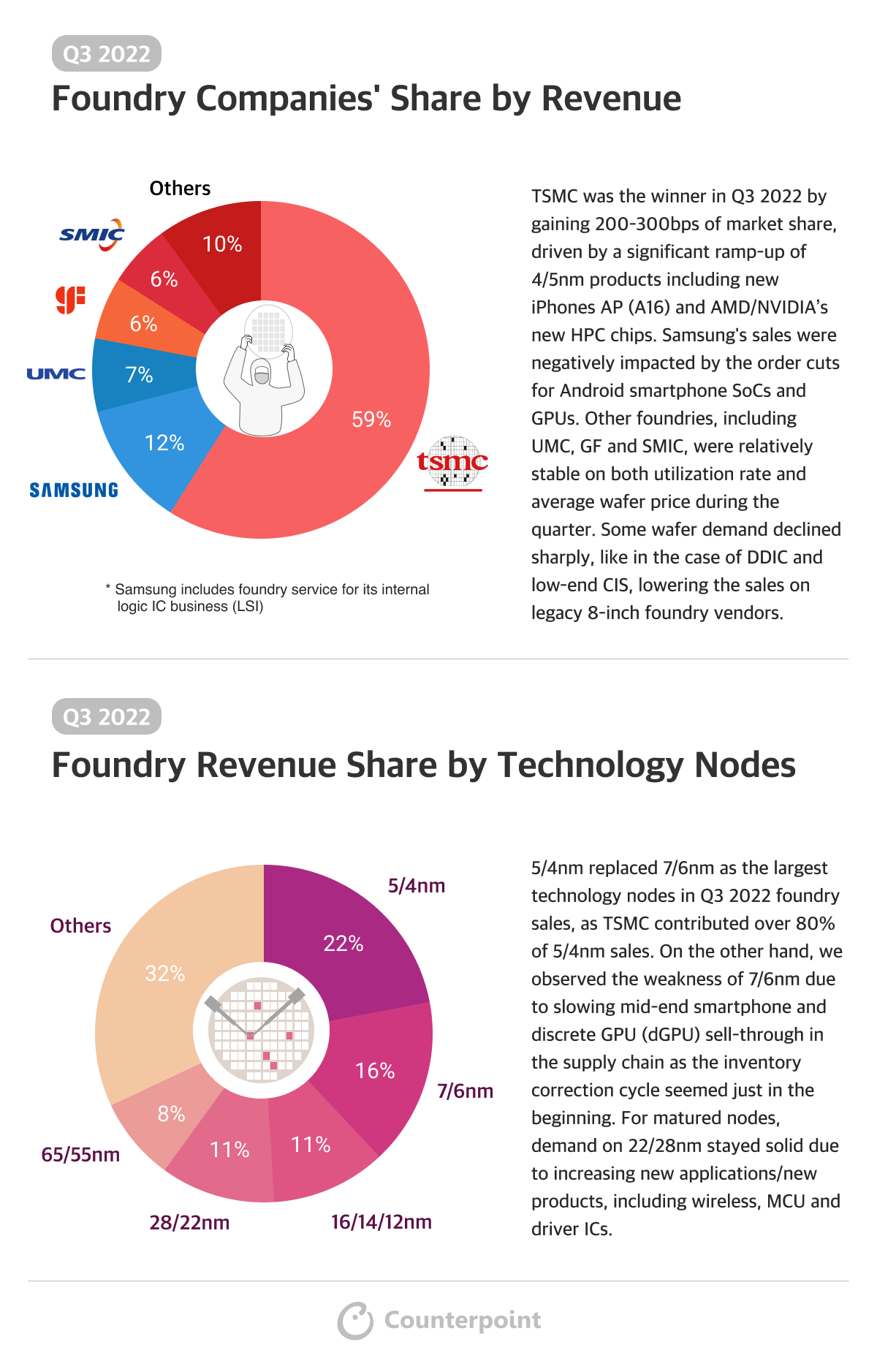

Like the last two generations, the Dimensity 9300 SoC is built on a TSMC 4nm process node. It is more efficient and performs better than the Dimensity 9200. There is a 40% improvement in the multi-core performance and a 15% improvement in the single-core performance. The Dimensity 9300 combines an octa-core CPU with the company’s second-generation hardware raytracing engine, enabling smartphones to achieve console-level global illumination effects at a smooth 60 FPS. Besides, the chipset supports seamless multitasking, allowing users to simultaneously play games and stream videos or watch a video while gaming.

- Four ARM Cortex-X4 CPU. Prime core clocked at up to 3.25GHz

- Four ARM Cortex-A720 CPU clocked at up to 2.0GHz

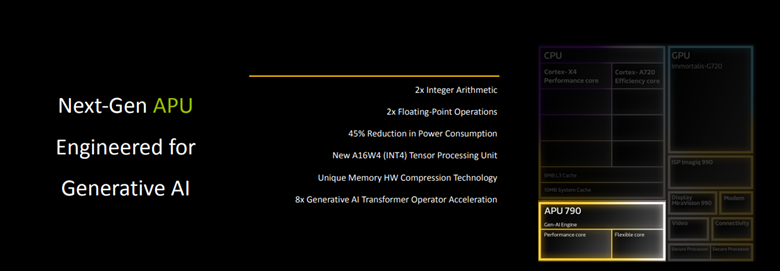

7th-gen APU 790 processor

The chip is equipped with MediaTek’s next-generation APU 790 processor, which reduces power consumption by 45% while improving performance. Its processing speed is eight times that of the APU 690. It also offers significant improvements in generative AI performance and energy efficiency for edge computing. The APU 790 is specifically designed for generative AI tasks, marking a substantial upgrade over its predecessor. It accelerates processing through the Transformer model and supports image generation within one second using Stable Diffusion. The APU 790 also supports large language models with up to 33 billion parameters. MediaTek has also implemented mixed-precision INT4 quantization technology and NeuroPilot memory hardware compression to optimize memory usage for large AI models.

The Dimensity 9300 has a strong AI generative ecosystem, which supports language models like Llama 2, Baichuan 2 and Baidu AI LLM. It helps developers to efficiently deploy multi-modal generative AI applications for users.

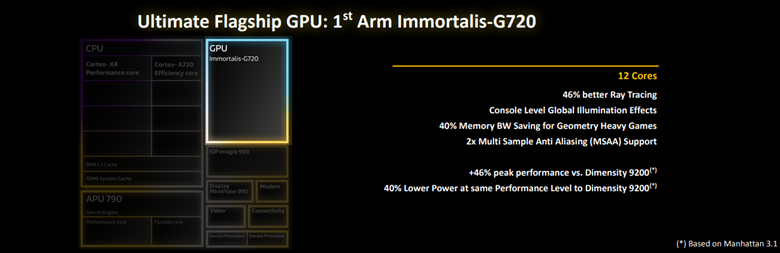

Immortalis-G720 GPU

With the integration of ARM’s latest GPU, the Immortalis-G720, the Dimensity 9300 offers almost a 46% boost in GPU performance and 40% power reduction compared to the Dimensity 9200.

The Dimensity 9300 chipset supports the new Ultra HDR format in Android 14, improving mobile photography with vibrant images and compatible JPEG files. It also offers ambient light adaptive HDR recovery technology for enhanced photography. It supports 100% pixel-level autofocus, dual lossless zoom and 3-microphone HDR audio recording.

The chipset’s display system is equipped with the MiraVision Picture Quality (PQ) engine which dynamically adjusts the contrast, sharpness and color of primary objects, resulting in lifelike video experiences similar to high-end TVs. It uses on-device AI to detect primary objects and background images in real time.

Enhanced connectivity

The Dimensity 9300 offers Wi-Fi 7 speeds up to 6.5 Gbps and improved long-range connectivity with Xtra Range 2.0 Technology. It also enhances smartphone tethering speeds by up to three times using Multi-Link Hotspot technology. The Dimensity 9300 also supports up to three Bluetooth antennas and features dual Bluetooth flash connection technology for an ultra-low latency Bluetooth audio experience.

DRAM support and security

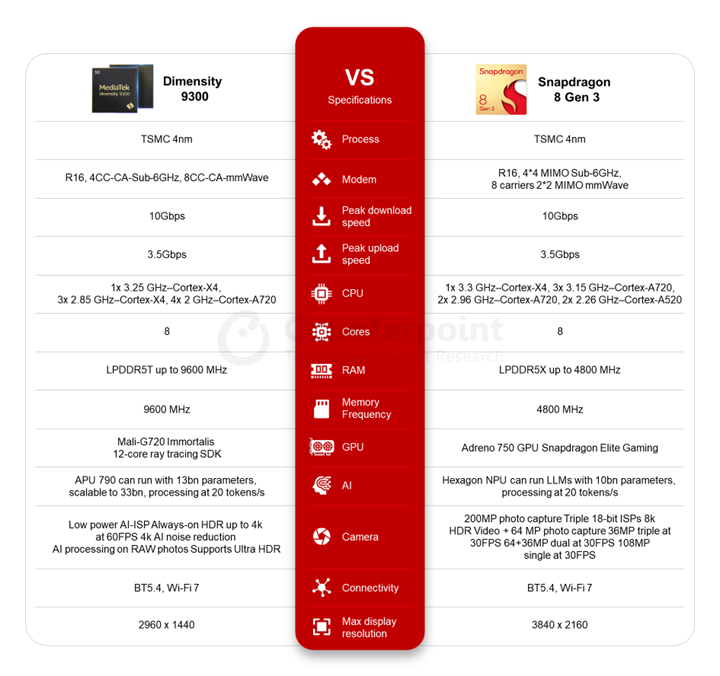

The Dimensity 9300 is the first SoC that supports the LPDDR5T up to 9600 Mbps. Also, it integrates two SUPs, one for boot security and one for computing security.

Dimensity 9300 vs Snapdragon 8 Gen 3

In terms of specifications, the Dimensity 9300 uses all big core architecture 4 prime cores (Cortex-X4) and 4 big cores (Cortex-A720), whereas the Snapdragon 8 Gen 3 uses one prime (Cortex-X4), five big (Cortex-A720) and two small cores (Cortex-A520). MediaTek with its all-big core design is addressing generative AI and gaming applications. On paper, the Dimensity 9300’s AI performance is competitive. The Dimensity 9300 supports large language models that can run with 13 billion parameters, whereas the Snapdragon 8 Gen 3 can run with 10 billion parameters on-device.

The fact that MediaTek now offers performance and efficiency gains that are comparable to Qualcomm’s latest-generation flagship offerings, shows MediaTek wants to directly compete with Qualcomm in the premium segment. Overall, this is going to be a win-win for the industry, as it will raise the bar and, in turn, benefit the end users.

Expected timeline

The vivo X100 will be the first smartphone to carry the Dimensity 9300 chipset. It will be available in the market by the end of 2023. We expect that the Dimensity 9300 will have better adoption among Chinese OEMs compared to the Dimensity 9200. China will be the first target market for smartphones with the Dimensity 9300, followed by India, SEA and Europe.