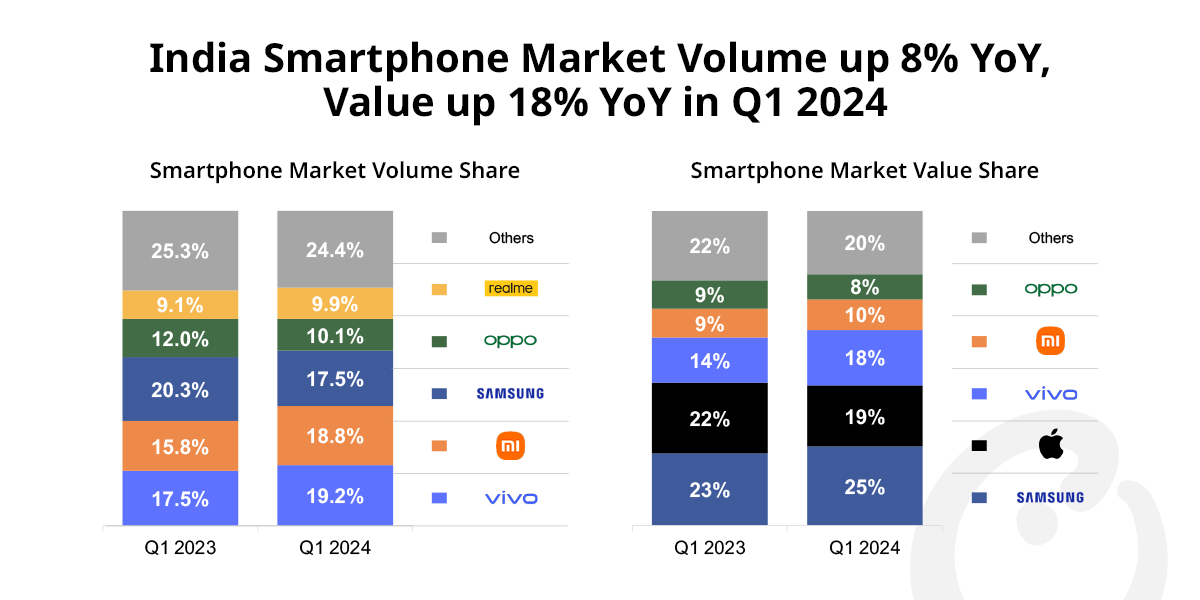

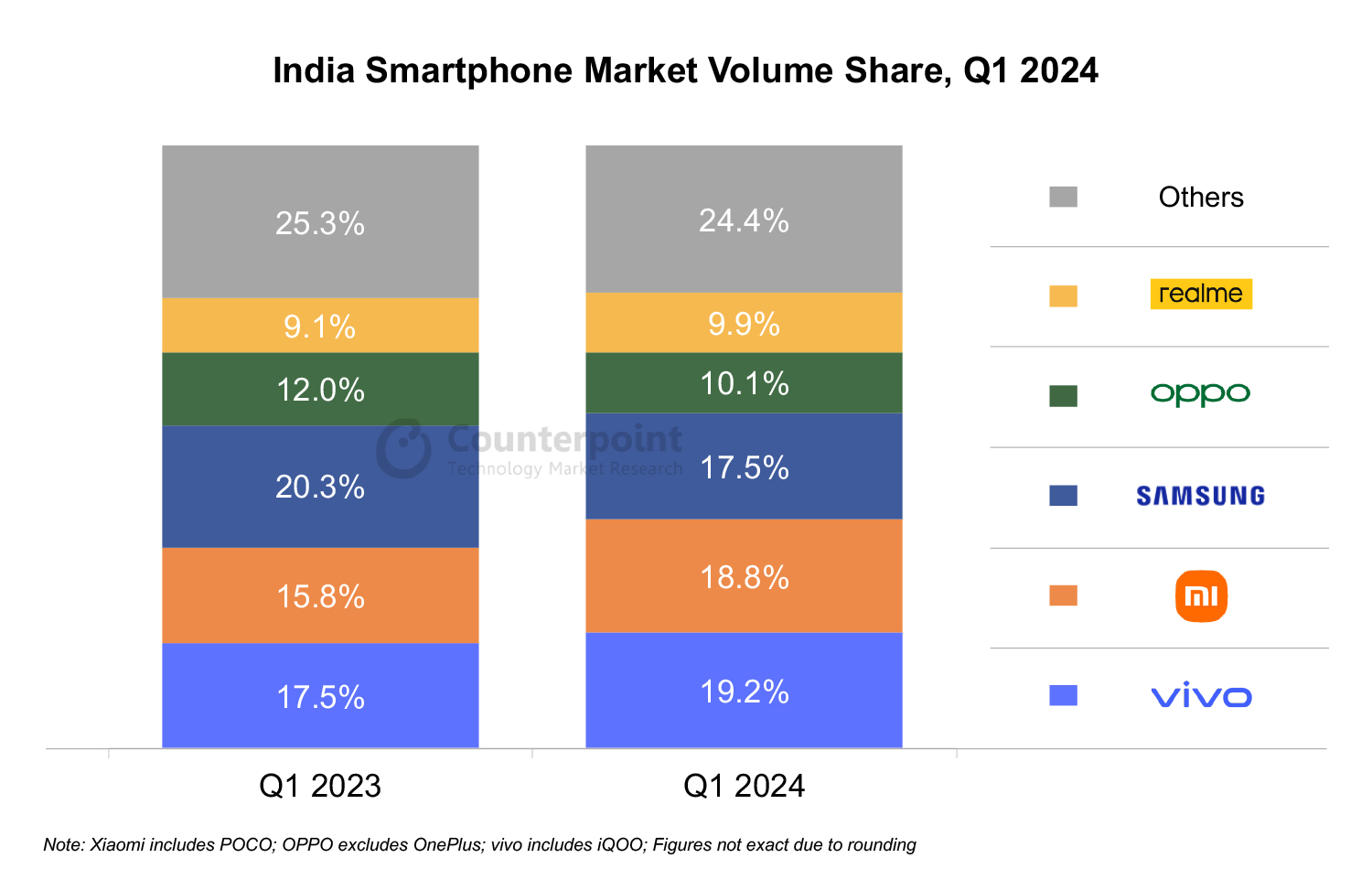

- For the first time ever, vivo led the market by volume in a single quarter.

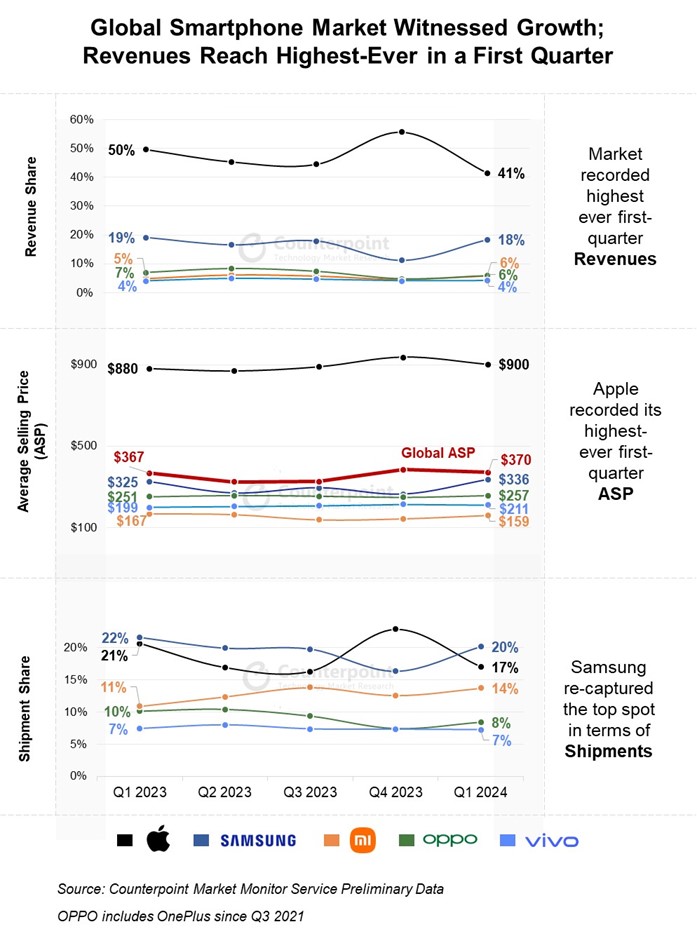

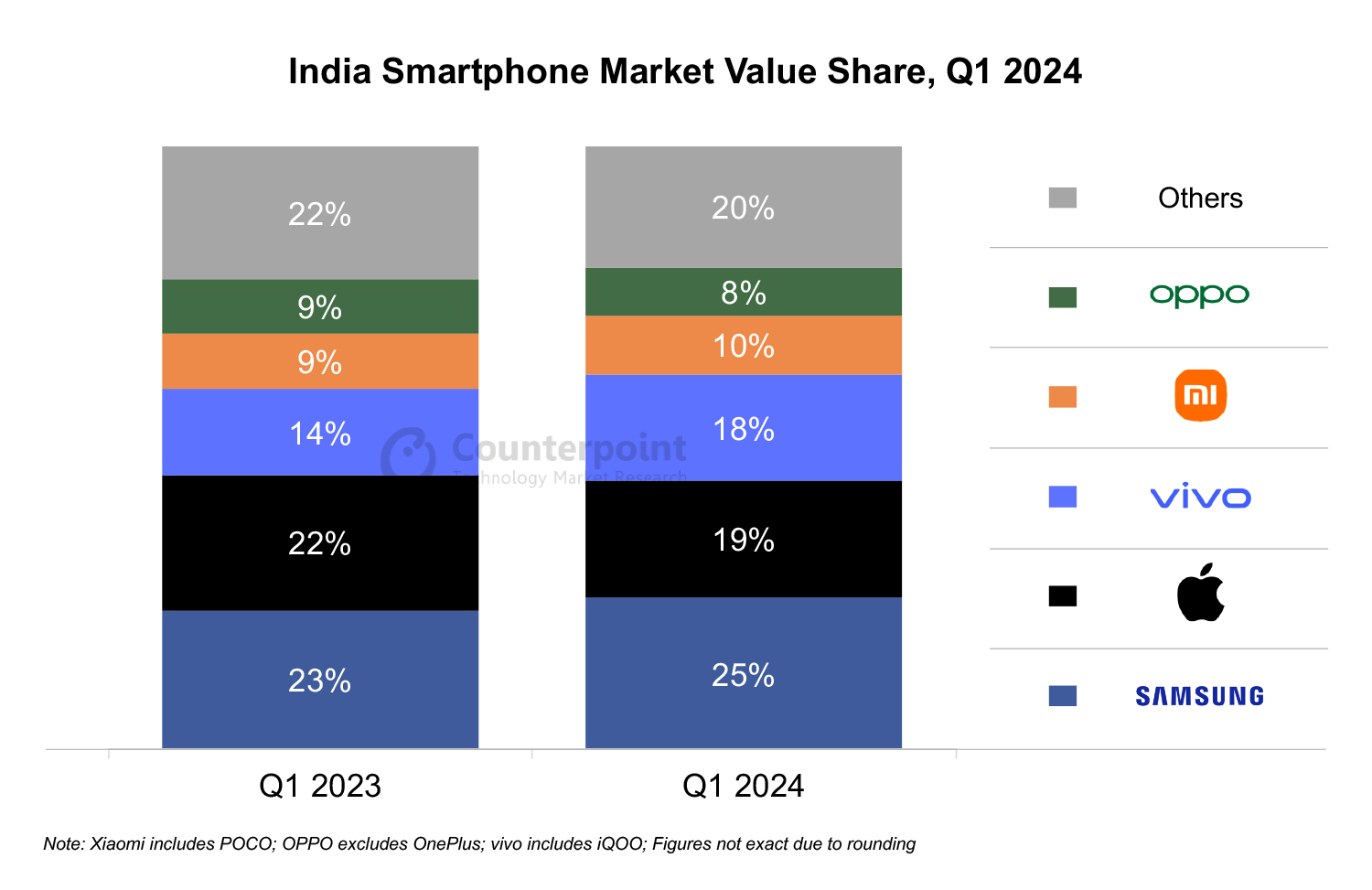

- Samsung led the market by value after capturing over one-fourth of the total market value. Samsung’s average selling price (ASP) also reached its highest ever in India.

- The premium segment (>INR 30,000) reached 20% volume share, its highest ever, and 51% value share of the overall Indian smartphone market.

- 5G smartphone shipments captured their highest-ever share of 71% in volume terms.

New Delhi, Beijing, Boston, Buenos Aires, Fort Collins, Hong Kong, London, San Diego, Seoul – May 9, 2024

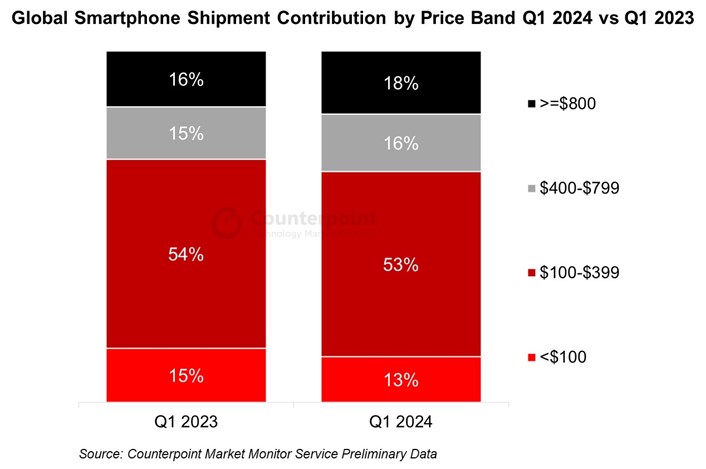

India’s smartphone shipments in Q1 2024 (January-March) grew 8% YoY in terms of volume and 18% in terms of value, according to the latest research from Counterpoint’s Monthly India Smartphone Tracker. Volume growth was primarily driven by healthy inventory levels and the low base of Q1 2023. Value growth was driven by the ongoing premiumization trend and new launches during the quarter, such as the Samsung Galaxy S24 and OnePlus 12 series. The premium segment (>INR 30,000) reached 20% volume share, its highest ever, and 51% value share of the overall Indian smartphone market in Q1 2024.

Commenting on the market value dynamics, Senior Research Analyst Shilpi Jain said, “During the quarter, India’s smartphone market reached its highest ever Q1 value. The growth was driven by the strengthening trend of premiumization, with consumers upgrading to higher-value smartphones across price tiers. According to Counterpoint’s Consumer Lens survey, more than one-third of mid-tier consumers are willing to upgrade to the premium segment. Factors driving this trend include affordable financing schemes, better value for trade-ins, and bundled schemes, along with the demand for top-tier features such as AI, gaming, and imaging enhancements.

With a one-fourth share, Samsung led the market in terms of value. Also, at ~$425, Samsung’s ASP was its highest ever, driven by its leading position in the >INR 20,000 segment. This can be attributed to a stronger mix of its newly launched Galaxy S24 series due to its features such as GenAI, and the newly revamped A series, along with the increasing popularity of Samsung’s financing schemes. Apple also had a record quarter in India in terms of value, leading the premium segment both in value and volume terms, driven by the latest iPhone 15 series, especially in offline channels.”

Commenting on the market dynamics, Research Analyst Shubham Singh said, “The onset of 2024 brought a promising start for OEMs, with better inventory levels allowing them to fill channels with multiple new launches. However, sales were less than expected due to a drop in retail footfalls and a section of consumers cutting down on discretionary spending.

During the quarter, vivo captured the top spot by volume for the first time ever, with a 19% share driven by its 5G leadership and CMF (Color, Material, Finish) positioning, along with strong imaging capabilities. Key OEMs focused on diversifying their channel strategies during the quarter, which led to growth in shipments in offline channels, with inventory building up by the end of the quarter.”

Nothing, Motorola, Xiaomi fastest-growing brands

- Nothing grew the fastest at 144% YoY due to its new mid-segment model Nothing (2a), which gained significant mind share.

- Motorola’s shipments grew 58% YoY in Q1 2024 driven by demand for better CMF in smartphones and its smoother stock Android experience.

- Xiaomi’s shipments grew 28% YoY to secure the second spot driven by a leaner and streamlined portfolio and a proactive offline channel strategy.

- Transsion brands grew 20% YoY after increasing offline focus and offering premium specs in the affordable segment.

- realme witnessed an 18% YoY growth in Q1 2024 driven by its latest number series, which targets young age groups through its superior camera capabilities and premium-like design.

Other key trends

- We expect India’s smartphone market to grow in single digits in 2024, driven by strong premiumization, 5G adoption and post-COVID upgrades.

- In Q1 2024, India’s 5G smartphone shipments captured their highest ever share of 71%.

- MediaTek led India’s smartphone chipset market with 53% share, Qualcomm leads the premium segment with 35% share.

- During Q1 2024, the offline share reached 64%, marking the highest quarterly post-COVID figure.

Notes:

- India smartphone OEM shipment revenue mentioned in this release do not reflect the realized revenue for some of the OEMs.

- ASP has been calculated on the basis of retail market price.

- Revenue (Value) is based on retail market price.

The comprehensive and in-depth ‘Q1 2024 India Smartphone Tracker’ is available for subscribing clients.

Feel free to contact us at press@counterpointresearch.com for questions regarding our latest research and insights.

The Market Monitor research relies on sell-in (shipments) estimates based on vendors’ IR results and vendor polling, triangulated with sell-through (sales), supply chain checks and secondary research.

You can also visit our Data Section (updated quarterly) to view the smartphone market shares for World, US, China and India.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research

press(at)counterpointresearch.com