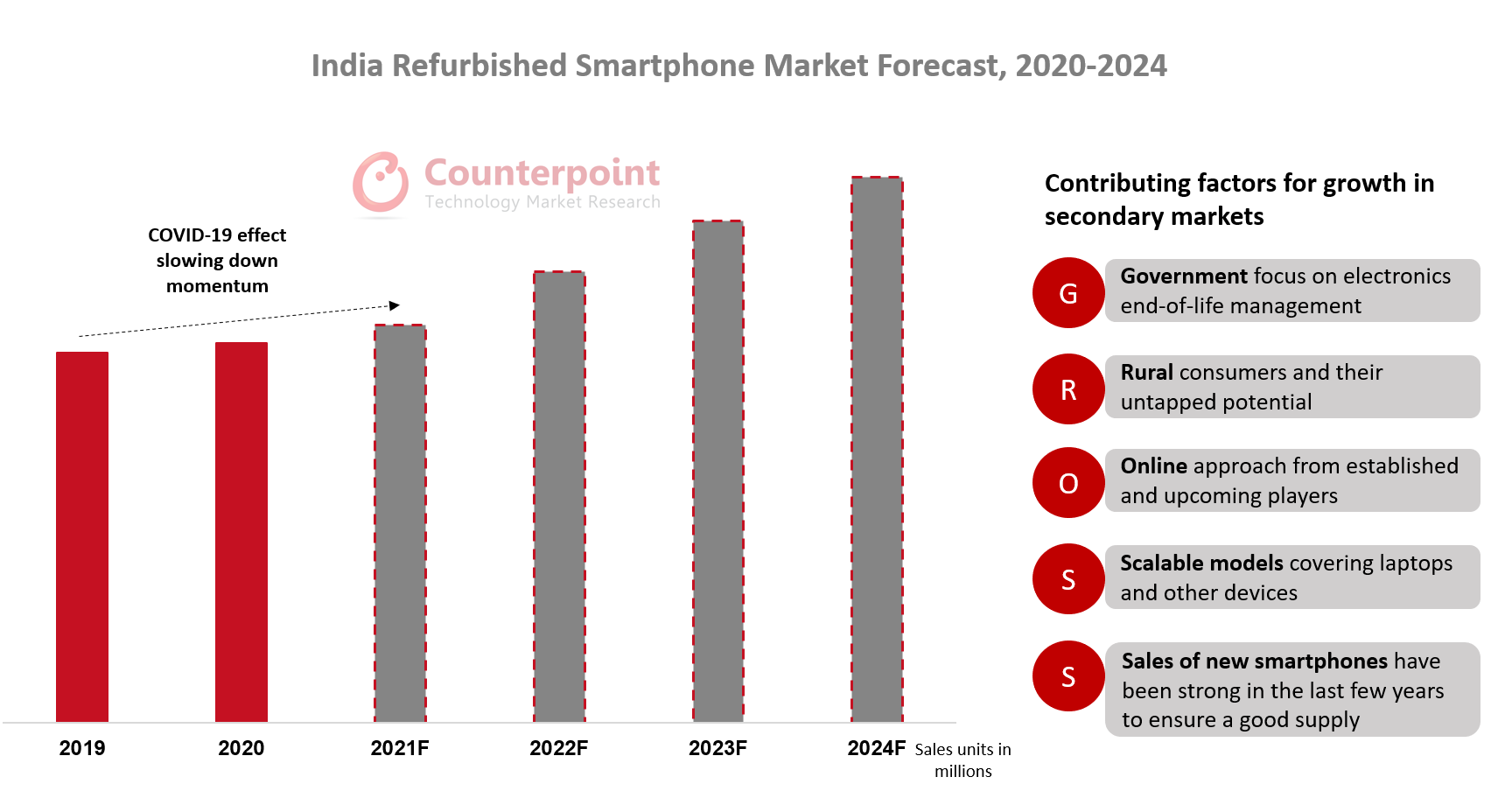

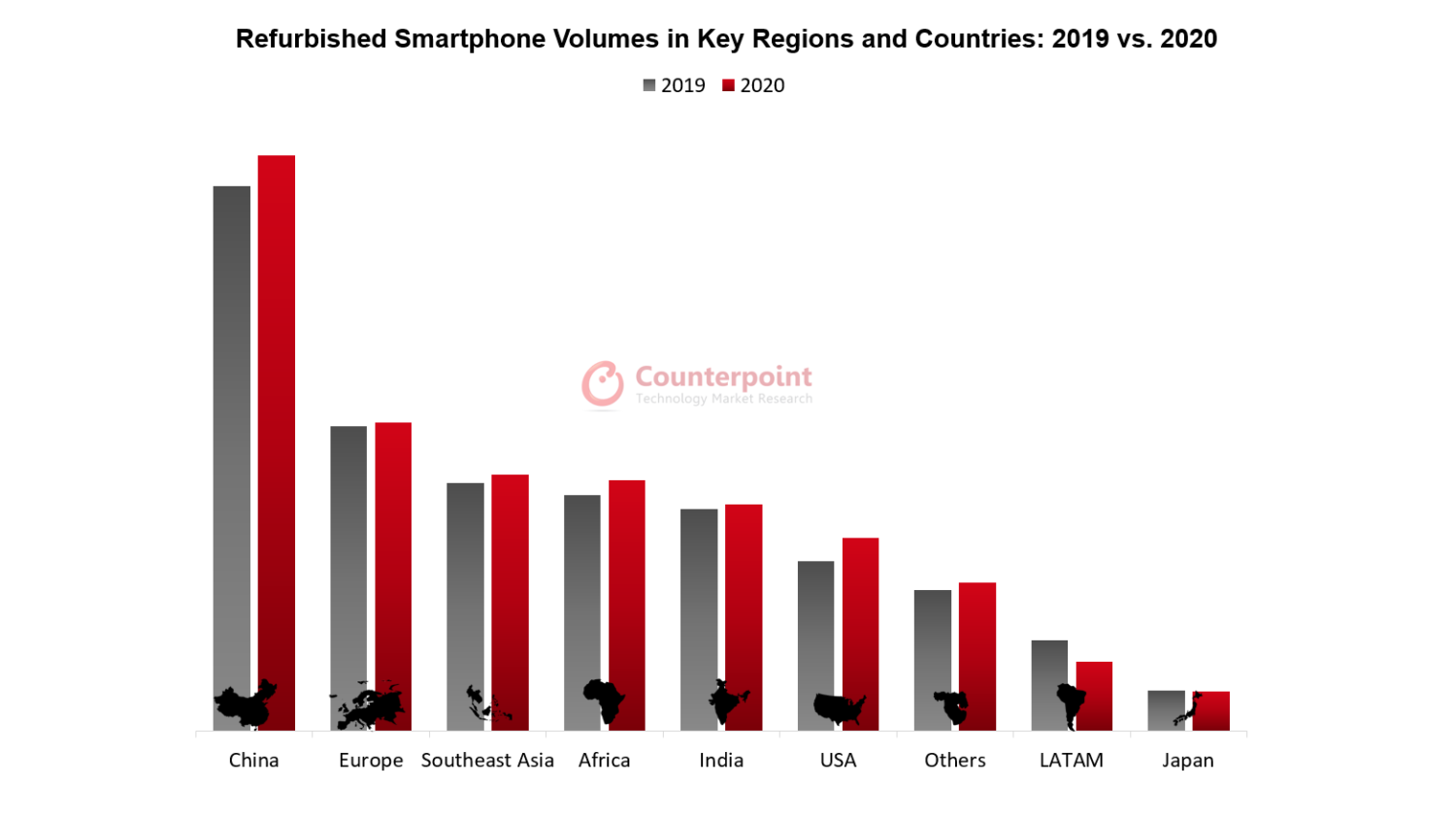

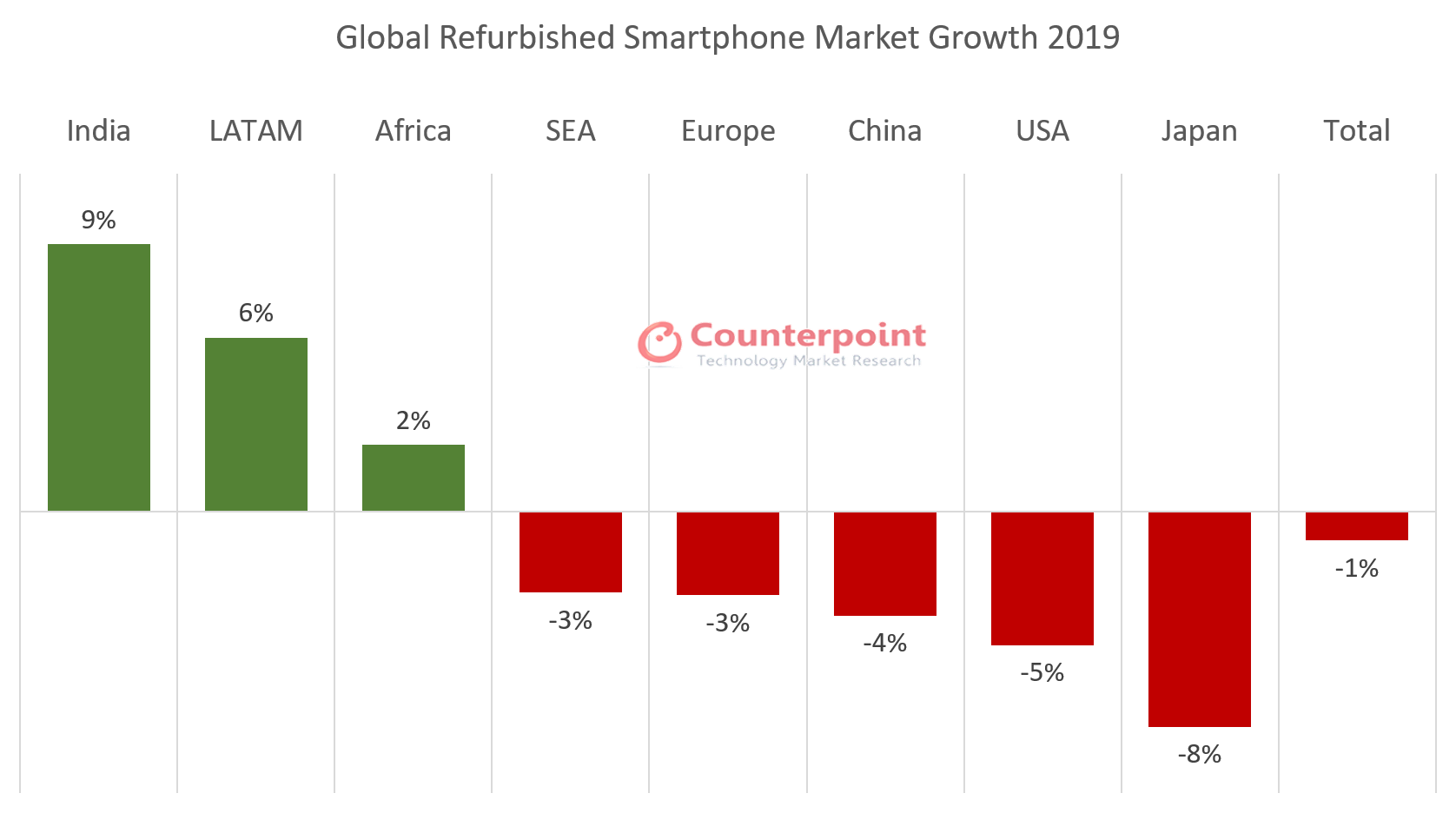

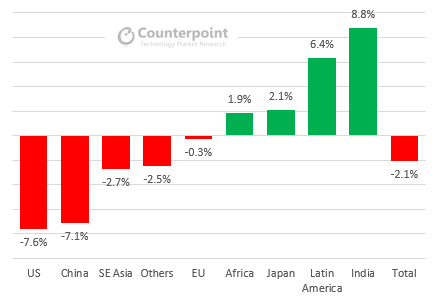

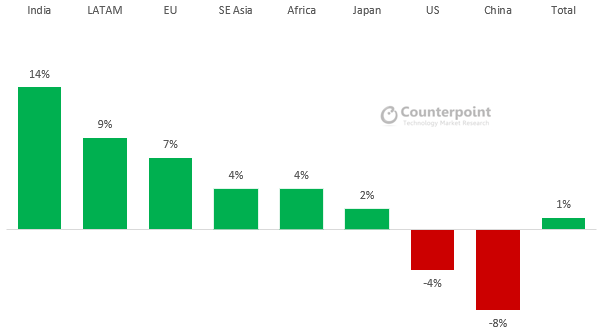

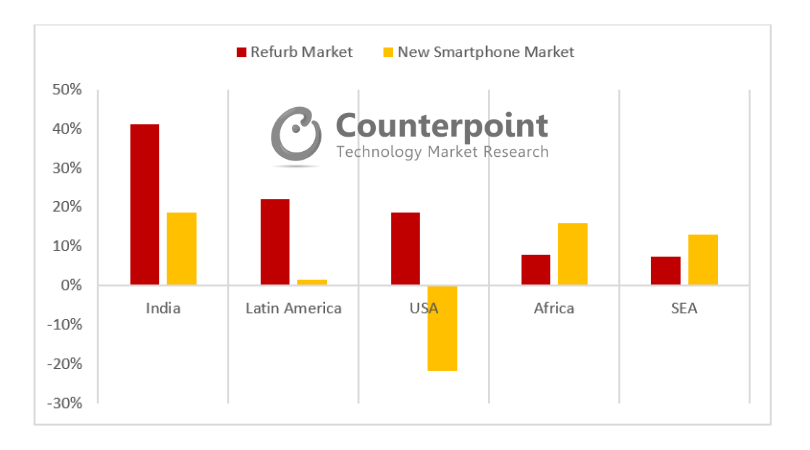

India is a booming market for pre-owned smartphones. The market showed its potential in 2019 when it grew the most globally. Even in 2020, the second half of the year more than made up for the volumes lost in the first half, according to Counterpoint’s Global Refurb Smartphone Tracker. This year too, the market is expected to report stellar numbers.

Important factors shaping the Indian market

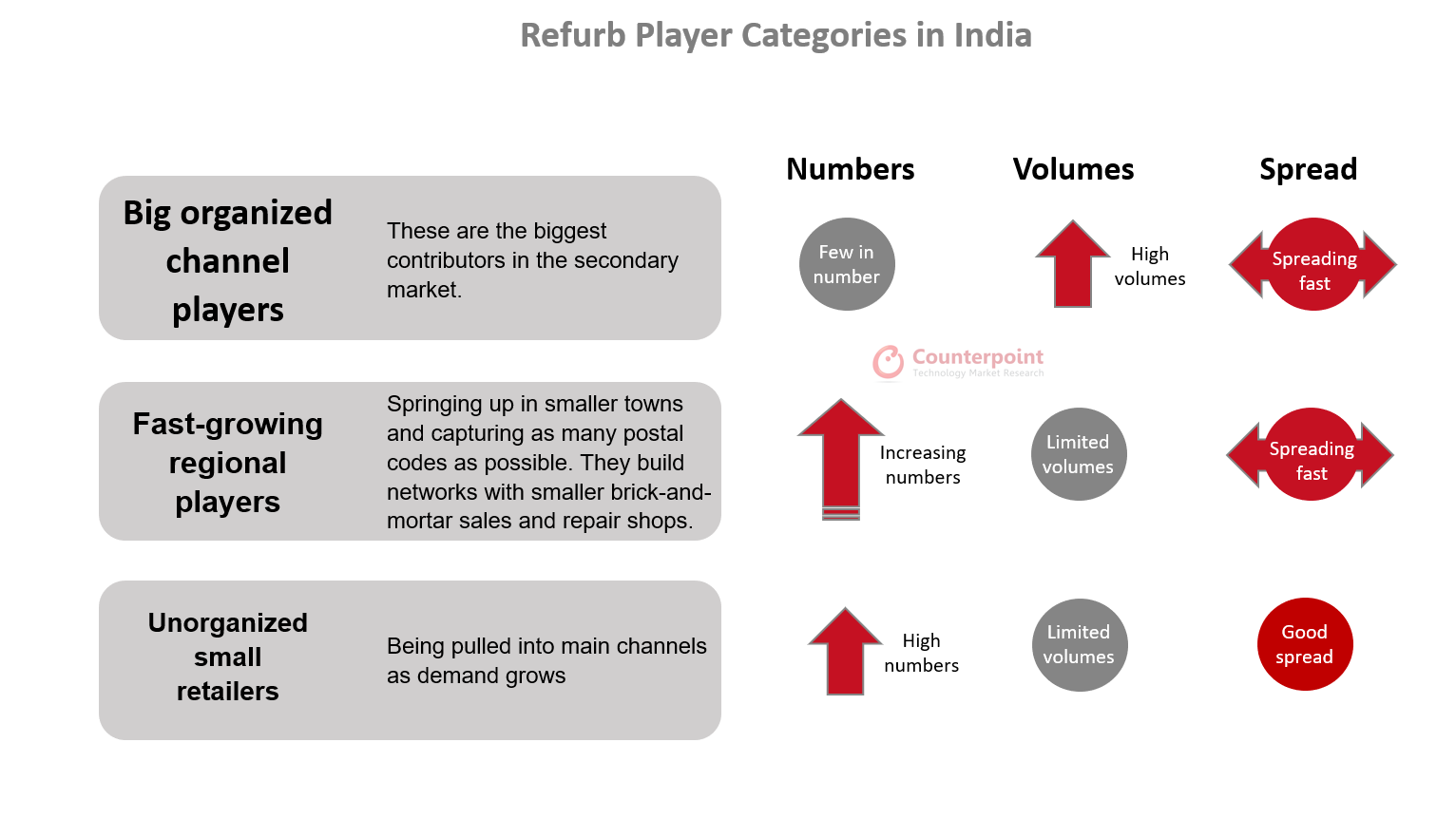

Importing pre-owned smartphones into India for usage is curtailed by the government. But that does not slow down the players dealing with volumes in the refurb market. Although India is relatively self-sufficient with supply compared to other countries, one of the main challenges is a complex and unstructured chain in the value system.

The brands and models which sold 2-3 years ago are the ones that make up the bulk of the supply in the secondary markets. Therefore, the players do not have control over what brands or models come their way. Similarly, the level of repair or refurbishment differs across volumes. Refurb players then have to take a call on which ones can be taken in and which need to be disposed of to others in the chain.

While brands like Apple have the most demand, they also command a premium price in the Indian secondary market. Unlike others, Indian consumers have also shown an affinity towards Chinese brands like OnePlus, Xiaomi, OPPO and vivo.

The online channel for buybacks and resale activities has been present in the refurbished smartphone market for a while now. Most large players already have online platforms which are promoted well to ensure convenience. This holds true for metro and Tier I cities. However, the strategy to tap rural areas needs to be different. These areas hold a high potential and that is why players are keen to gain volumes at the earliest.

2021 Outlook

- As online sales of new smartphones increase, more consumers choose to trade in their devices, which provides an added supply to the secondary markets.

- Increasing volumes are flowing in from Tier II, III and IV towns. These geographies also represent the highest potential for refurbished smartphone demand.

- Consumers who previously chose to sell to friends/acquaintances or small neighborhood stores are looking at selling to structured businesses with an online presence and doorstep options. This spells value for the consumer in the form of money and convenience.

There is a need to structure the vast unorganized secondary smartphone market in India but currently, players are looking at gaining volumes in a market where the potential is very high.

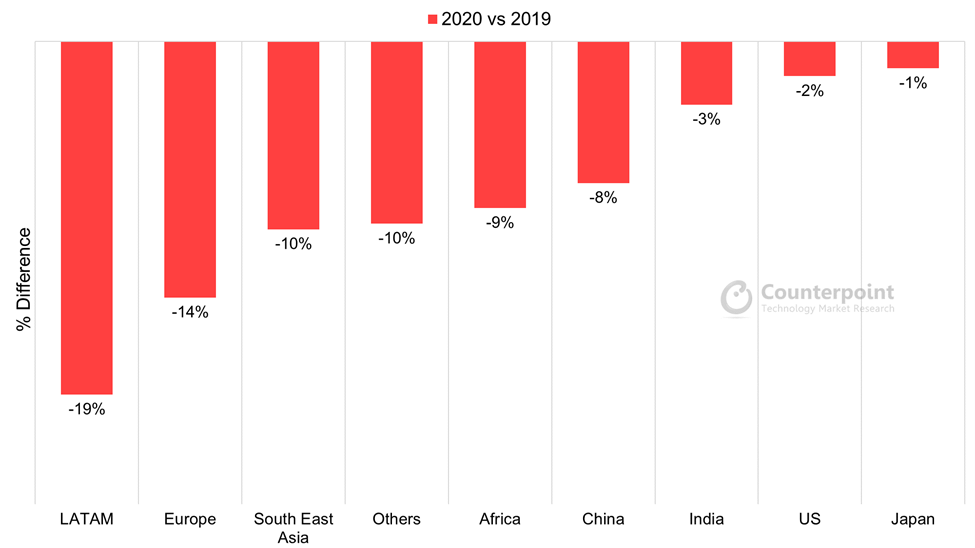

Source: Global Refurbished Handset Tracker

Source: Global Refurbished Handset Tracker