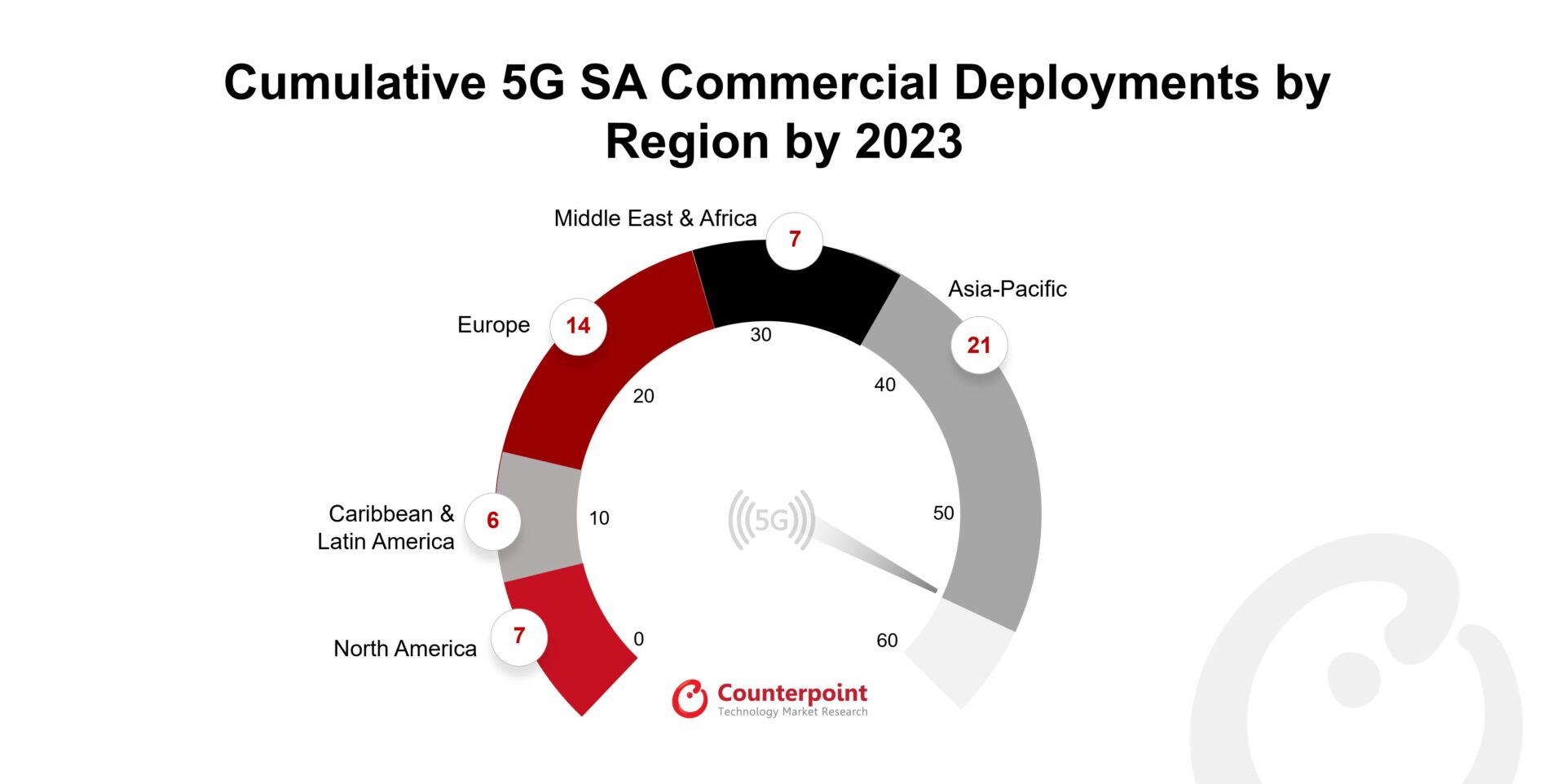

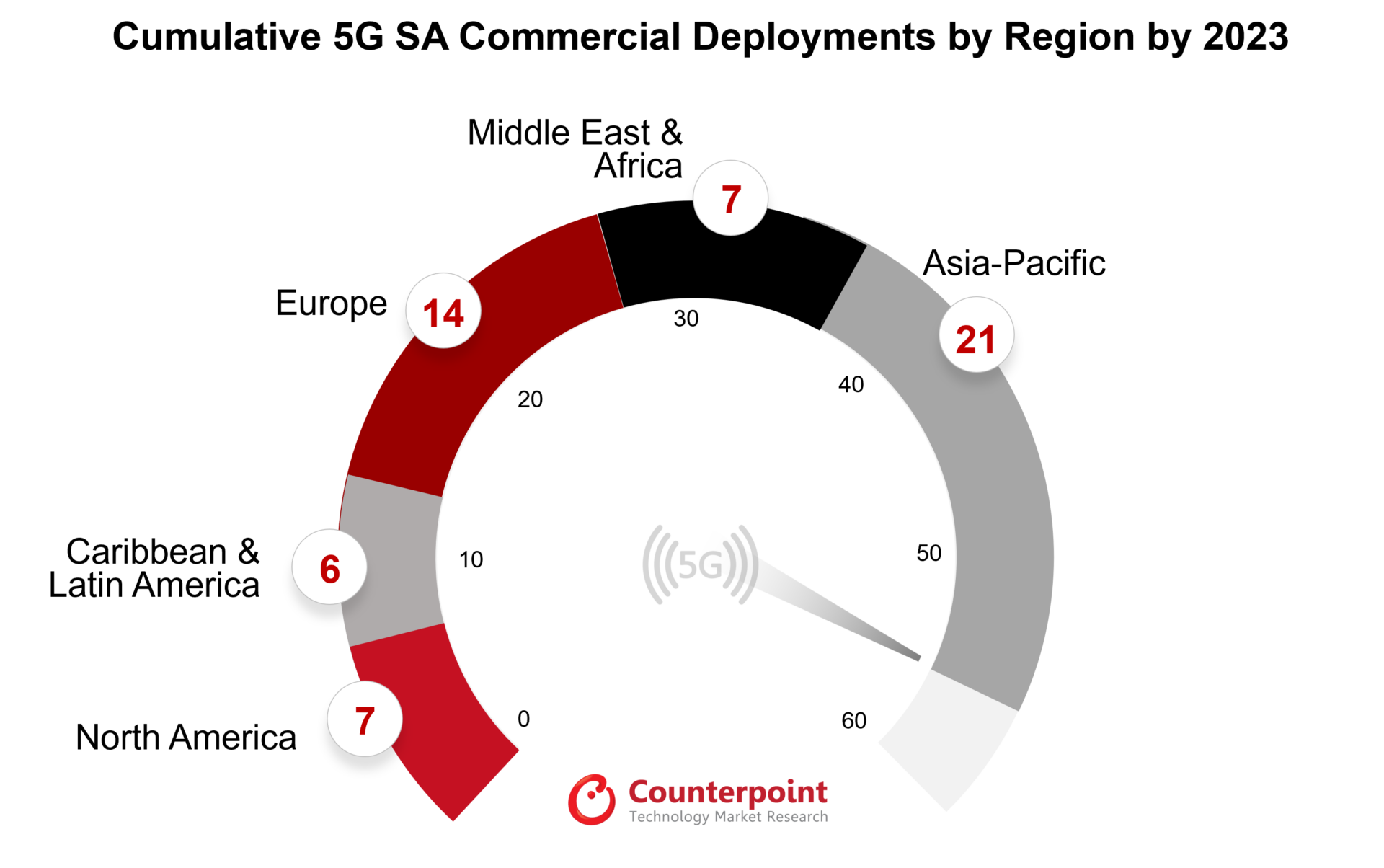

- Operator migrations to 5G SA remained low in 2023, despite more than 60 operators investing.

- Asia-Pacific continued to lead the deployment charts, while Europe gained momentum.

- Total number of deployments between 2020 and 2023 reached 55.

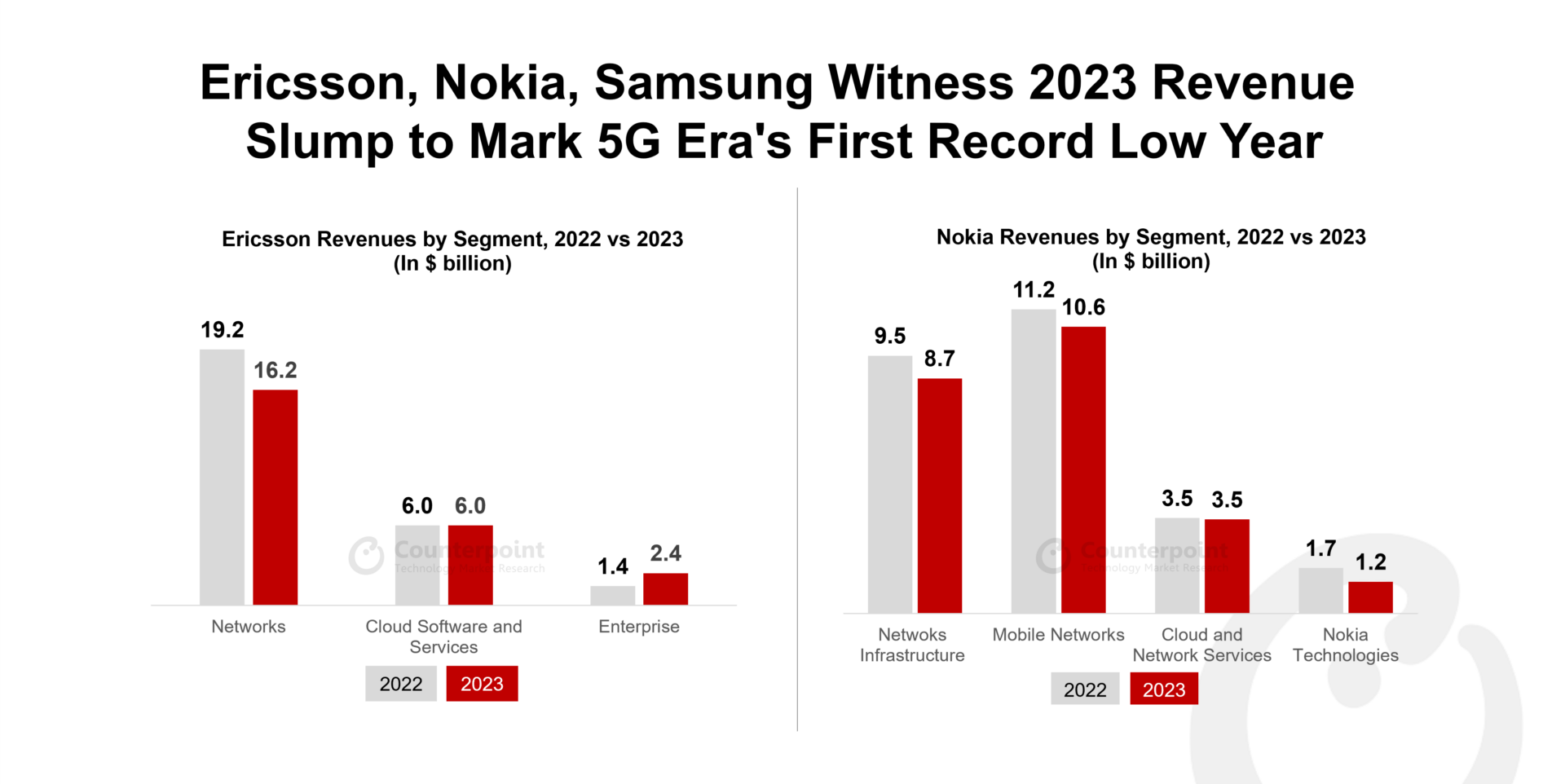

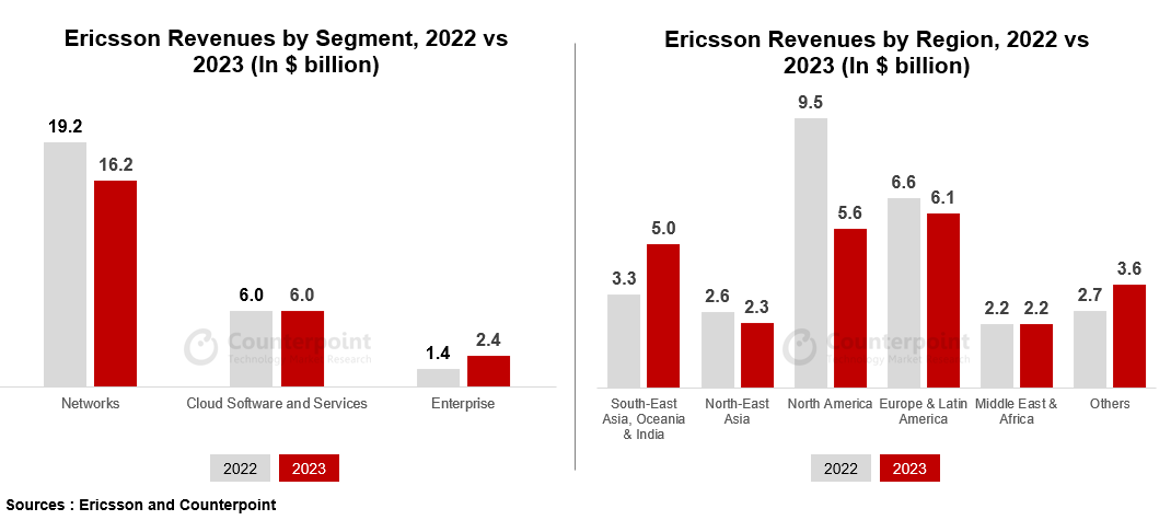

- Key deals in leading markets helped Ericsson maintain top spot, followed by Nokia, Huawei and ZTE.

Seoul, Beijing, Boston, Buenos Aires, Fort Collins, Hong Kong, London, New Delhi – February 29, 2024

The number of mobile operators transitioning to a dedicated 5G core decreased to 12 in 2023. Although numerous operators have been running 5G SA core pilots, they have yet to move forward with the transition because they believe the existing architecture is sufficient to meet the current network demand. Another reason for the staggered deployment is the prevailing macroeconomic headwinds and lack of monetization opportunities with 5G.

The transition should increase following the introduction of 5G Advanced starting in 2025, which promises a plethora of new features that will help improve device and network capabilities, lower OPEX costs and introduce new use cases. However, operators need to urgently prioritize the deployment of 5G SA cores to maximize the potential offered by 5G Advanced.

The delay in turning on 5G SA implies that we might see a bunch of rollouts in a shorter time starting H2 2024 and running into 2025, rather than steady rollouts spread out across the next three to four years.

The gradual penetration of 5G SA into Tier-2 operators and nations with smaller geographic areas appears to have begun as MNOs seek to improve user experience. According to Counterpoint Research, about 30 nations have at least one operator running a 5G SA network commercially. Counterpoint Research forecasts that transitions in H1 2024 will remain sluggish before gaining momentum in H2 2024, which will continue into 2025.

As indicated in Exhibit 1, the Asia-Pacific region had the highest number of deployments, followed by Europe. North America, Middle East and Africa, and Latin America trailing behind.

Key Points

Key points discussed in the report include:

- Operators – 55 operators have commercially implemented 5G SA, with many more in the testing and trial stages. We are seeing a mix of countries adopting 5G Standalone, with some Tier-2 carriers in LATAM launching 5G SA services. The rate of deployment was slightly faster in H2 2023, with some important Tier-1 operators in developed nations shifting to 5G SA, although the list of MNOs currently in the trial phase is still quite extensive.

- Vendors – Ericsson’s role as a leader in 5G SA is expanding, and the Swedish company has the largest market share among all cloud-native core providers. Nokia follows Ericsson in terms of the number of deployments of its 5G core. Both have a considerable number of vendor deals with operators that have not yet been commercialized. South Korea’s Samsung and Japan’s NEC are primarily focused on their respective domestic markets, but they are expanding their reach to Tier-2 operators as the focus shifts to vRAN and Open RAN solutions while emerging vendors Parallel Wireless and Mavenir are collaborating with operators in Europe, the Middle East, and Africa.

- Spectrum – Most operators are installing 5G at mid-band frequencies (n78), which give higher speeds and better coverage. Some operators have also started offering commercial services in the mmWave wave n258 bands. FWA and other eMBB are currently the most common use cases, although edge services and network slicing are also gaining traction.

- Use Cases – Operators are looking for ways to monetize 5G services, as they are struggling to make the ROI from their investments in 5G. Globally, operators are trying to extract better returns from consumer networks before taking their 5G services deeper into enterprises. Although FWA is a promising application for 5G SA monetization, there are many other use cases that operators can look into to increase their ROI, including network slicing, live broadcasting, XR applications, and private networks.

Report Overview:

Counterpoint Research’s 5G SA Core Tracker, January 2024 is a culmination of an extensive study of the 5G SA core market. It provides details of all operators with 5G SA cores in commercial operation at the end of 2023, covering market share by region, vendor, and the most popular deployed frequency bands. Further, the tracker provides details about the 5G SA vendor ecosystem split into two categories – public operator and private network markets and touches on the potential monetization opportunities for telecom operators across different domains and use cases.

Table of Contents:

- Overview

- Market Update

- 5G SA Market Deployments

- Commercial Deployment by Operators

- Network Engagements by Region

- Network Engagements by Deployments Status

- Leading 5G Core Vendors

- Mobile Core Vendor Ecosystem

- 5G Core Vendors Market Landscape

- Outlook

- 5G Standalone Use Cases – Consumer and Enterprise

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research

press(at)counterpointresearch.com