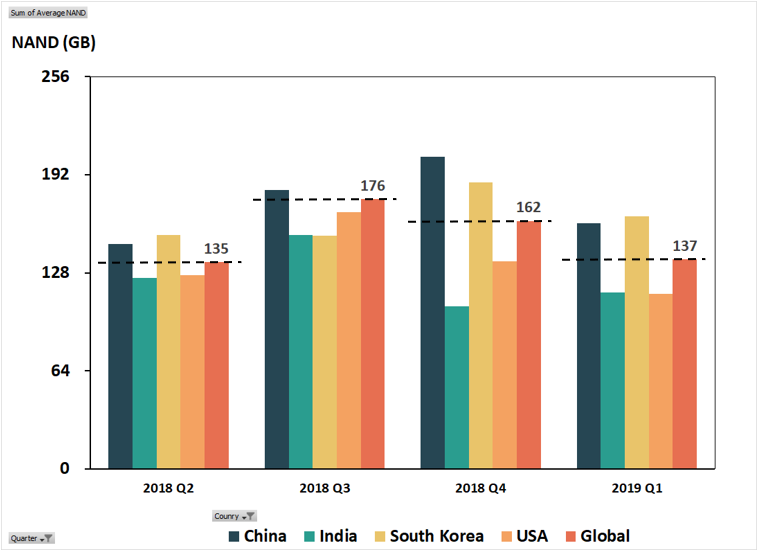

NAND flash capacity has emerged as one of the most important considerations for consumers while purchasing a new smartphone. The advancements in cameras, Application Processors (APs) and displays have stimulated increased storage demand for videos, images and other multimedia applications. Consequently, NAND capacity has shown significant growth in smartphones.

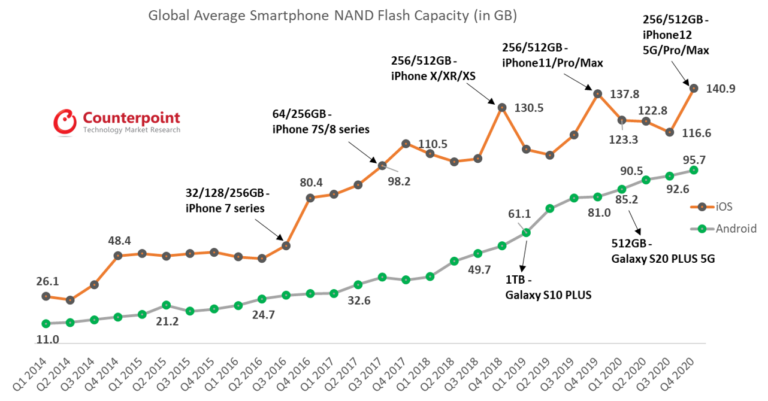

According to Counterpoint’s latest report on smartphone memory, the average smartphone NAND flash capacity crossed the 100GB mark in 2020 for the first time. However, it differs in iOS and Android phones. In iOS phones, the average NAND capacity reached 140.9GB in Q4 2020, compared to 95.7GB in Android phones during the same period. But this gap is narrowing. It is evident from the graph below that the average capacity of Android has been increasing rapidly in the past few years. The average capacity in 2020 grew 5.6% and 20.5% for iOS and Android phones, respectively.

Exhibit 1: Global Average Smartphone NAND Flash Capacity by iOS and Android

The data indicates that Apple did not push the boundaries of its storage size and chose to stick to 512GB NAND, its highest storage capacity which has been there since 2018. On the other hand, the biggest Android OEM, Samsung, looked to maximize its storage capacity and launched the Samsung Galaxy S10 Plus in 2019 with 1TB NAND. All this resulted in a lower storage growth rate for iOS compared to Android in 2020.

According to our Q1 2019-Q4 2020 mobile handset sell-through tracker, NAND flash in smartphones grew by 20.3% on average, from 80.7GB in 2019 to 97.11GB in 2020. However, iOS saw a 5.6% increase in 2020, much lower than the 20.5% growth in non-iOS devices. The difference in average capacity between iOS and non-iOS devices continues to decrease. The gap between the two groups was approximately 45.2GB in Q4 2020, down from 56.8GB in Q4 2019.

Although NAND price continued to fall during 2019-2020, the share of sales of high-capacity models (256GB and 512GB) for iOS did not grow during the same period. The share of high capacity in Q4 2020 was about 21.5%, even lower than the 27.2% in Q4 2019. The average capacity of iOS has reached nearly 130GB. 128-256GB is high enough for the average consumer to use during the iPhone usage cycle. The demand for 512GB iPhone was around 3.7% in Q4 2020.

We also observe a similar situation for high capacity (256GB+512GB+1,024GB) in non-iOS smartphones. The proportion of high capacity was around 7.5% in Q4 2020, only slightly higher than the 6.3% in Q4 2019. However, the proportion of 128GB for non-iOS smartphones increased from 26.2% in Q4 2019 to 39.0% in Q4 2020, showing that 128GB was the minimum standard for mid-range and high-end phones.

For the details, please check the report on our website.

Smartphones Memory Historical data and Forecast, Worldwide Demand, 2018-2024

Overview:

This forecast provides detailed statistical data for DRAM and NAND flash for smartphones by density, segment and network in the short and long terms.

Table of Contents:

- Historical NAND Flash Units Sell-through by Smartphone Segment (Q1 2019 – Q4 2020)

- Historical NAND Flash Units Sell-through by Smartphone Network (5G, 4G, Others)

- Historical NAND Flash Units Sell-through by Smartphone Density

- Historical NAND Flash Units Sell-through by Smartphone Density

- Forecast Memory Units Shipment in Annual Base (2018-2024)

- Charts

- Global average smartphone NAND flash capacity trends (GBs), 2014-2020

Author: Brady Wang

Number of Pages: 33

Published Date: March 2021

Related Posts

- How 5G, AI and IoT are Shaping Future of Storage

- Storage Capacity Requirement for Autonomous Vehicles in the Next Decade

- Three Improvements Apple Made for Cameras of its iPhone 12 Pros

- Apple Silicon Set to Energize PC Market as Possibilities Beckon

- Apple ‘Arms’ Macs with Apple Silicon

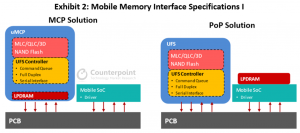

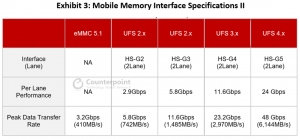

- Rising UFS Shipments Opens Up Opportunity for Western Digital and Toshiba Memory Corporation