It was yet another busy day in chilly Barcelona with some interesting announcements. Nothing revealed details of its upcoming smartphone, realme announced the GT3 240W with the fastest charging tech, TECNO showed off its folding smartphone, Oasis Smart-SIM showcased its CloudSIM™ solution, and much more. Below is our quick summary of the announcements from Day 2 of the MWC 2023:

TECNO joins the foldable revolution

TECNO made its MWC debut launching several products, including the Phantom V Fold, Spark 10 Pro selfie phone and Megabook S1 2023 laptop. Of course, the standout product announced at the event was the TECNO Phantom V Fold book-type foldable smartphone. Under the hood is a MediaTek Dimensity 9000+ SoC, making it the second folding smartphone powered by MediaTek SoC after the OPPO Find N2.

The smartphone features a 6.42-inch 120Hz LTPO AMOLED cover screen and a 7.85-inch 2K 120Hz LTPO folding display inside, which is bigger than the Galaxy Z Fold4. It comes with a 5,000mAh battery and 45W fast charging. The TECNO Phantom V fold will first launch in India at a price of $1,099 for the 12GB RAM and 256GB storage version, making it the most affordable book-type folding smartphone. There will also be a 512GB storage version priced at $1,222.

The Africa market, where TECNO is the #1 brand, is relatively dominated by the low-end segment. Expansion to overseas markets, where consumers are ready to pay a more premium amount, has also presented an opportunity for TECNO to launch devices in higher price bands. For that, foldables currently seem to be the perfect option to make a statement in the premium segment. Since it is a new segment, OEMs also have opportunities to launch products at new price points. The debut of its foldable at the MWC 2023 cements TECNO’s global aspirations.

realme GT3 240W brings the fastest charging tech to smartphones

realme is holding true to its ‘Dare to leap’ motto. In 2022, it was the first OEM to offer a 150W charging-capable smartphone. The company is pushing the boundaries further and has now become the first brand to introduce a 240W-capable smartphone. At the MWC 2023, realme announced its latest phone, the GT3, featuring 240W charging capability. According to the realme presentation, the 240W technology is capable of fully charging the GT3’s 4,600mAh battery in roughly 10 minutes, and it can charge to 50% capacity in just four minutes.

GT3 is the fastest phone in the industry to charge from 0 to 20% in only 80 seconds, which realme showcased in the real-time demo during the MWC announcement. realme also claims this is the industry’s fastest charging speed while gaming. A vapor chamber liquid cooling system takes care of the overall health of the battery by reducing extra heat produced during fast charge. realme added multiple sensors and a fireproof design to the new device while also addressing the major issue of battery longevity, which reduces due to fast charge. The GT3’s battery can be at 80% battery health after 1,600 charging cycles which is double the industry standard of 800 cycles. The realme GT3 price starts at $649 for the 8GB RAM with 128GB storage variant.

Oasis Smart-SIM demonstrates new CloudSIM™ solution

At the MWC 2023, Oasis Smart-SIM and TATA Communications jointly revealed their latest innovation, the CloudSIM™. It is a remote hardware SIM which is stored in a dedicated, secure, GSMA-certified environment. CloudSIM™ is primarily aimed at use cases that do not require permanent connectivity. The overall cost of connectivity is reduced by limiting the number of profiles required for fleet operations and providing on-demand connectivity. The below video demonstrates some of the key use cases of the CloudSIM™ solution.

Nothing Phone (2) to be powered by Qualcomm flagship SoC

Nothing made a small announcement at the MWC 2023 about its upcoming smartphone. While it did not reveal much, the company did mention that the next smartphone will be powered by a Qualcomm Snapdragon 8-series chipset. This will be a big upgrade from the existing 7-series SoC on the Nothing Phone (1). However, Nothing did not mention which chipset it will be using, so it could be the Snapdragon 8 Gen 2 or could also be last year’s Snapdragon 8+ Gen 1 SoC. Looks like we will have to await further details.

Nothing made a small announcement at the MWC 2023 about its upcoming smartphone. While it did not reveal much, the company did mention that the next smartphone will be powered by a Qualcomm Snapdragon 8-series chipset. This will be a big upgrade from the existing 7-series SoC on the Nothing Phone (1). However, Nothing did not mention which chipset it will be using, so it could be the Snapdragon 8 Gen 2 or could also be last year’s Snapdragon 8+ Gen 1 SoC. Looks like we will have to await further details.

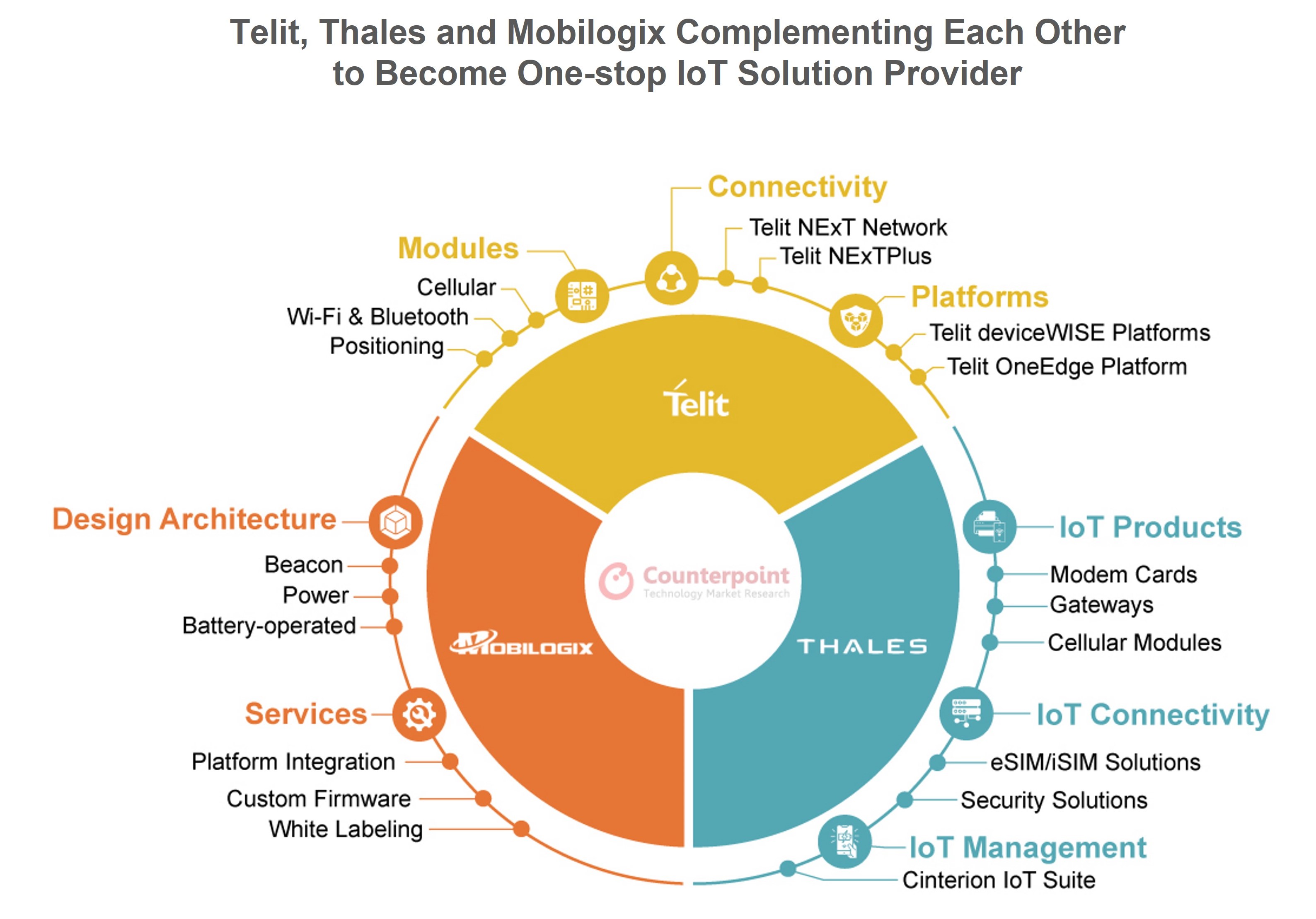

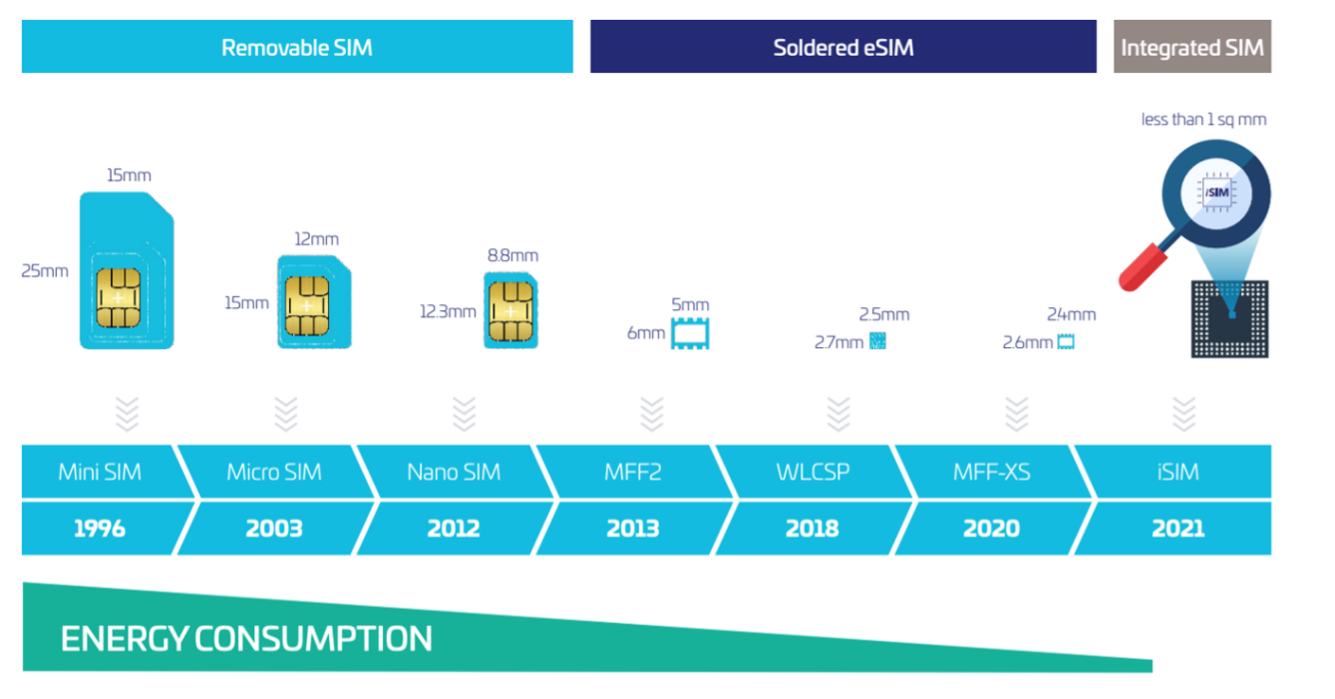

Thales launches the world’s first GSMA-certified iSIM with Qualcomm’s latest Snapdragon mobile platform

Thales has announced that its integrated SIM (iSIM) solution has now been certified by the GSMA and is ready to be deployed commercially with Qualcomm’s Snapdragon 8 Gen 2 platform. In 2021, Thales, Vodafone and Qualcomm had shown a working demonstration of the iSIM.

What is iSIM? And why is it important?

iSIM is a type of SIM that is directly integrated into the processor of the device. As the next step of SIM evolution, iSIM offers significantly more space reduction than eSIMs do and lowers power consumption. This is also part of a bigger trend where we have seen multiple components, such as the modem, getting integrated into the processor of the device. Along with smartphones, iSIMs also bring multiple benefits to the IoT ecosystem.

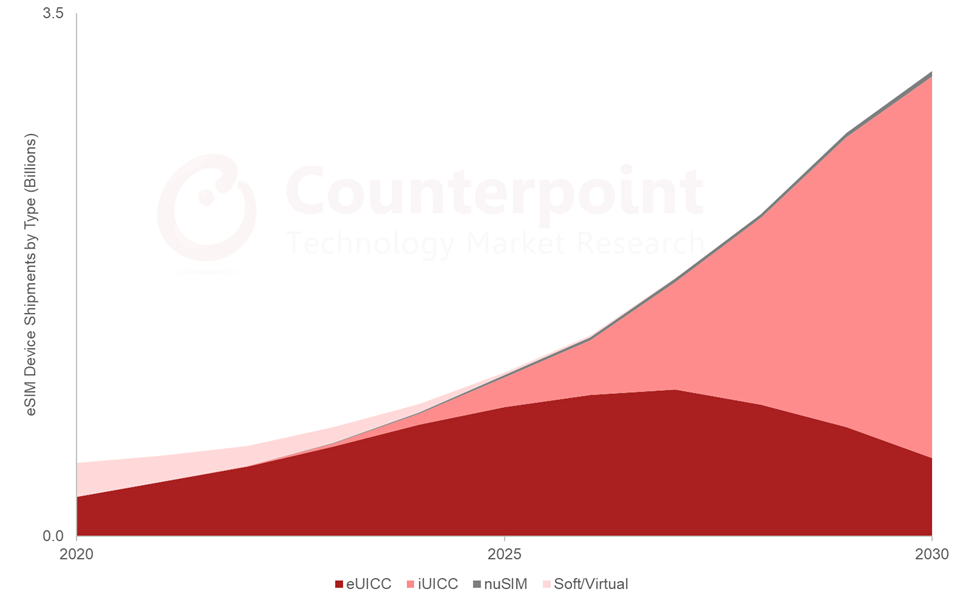

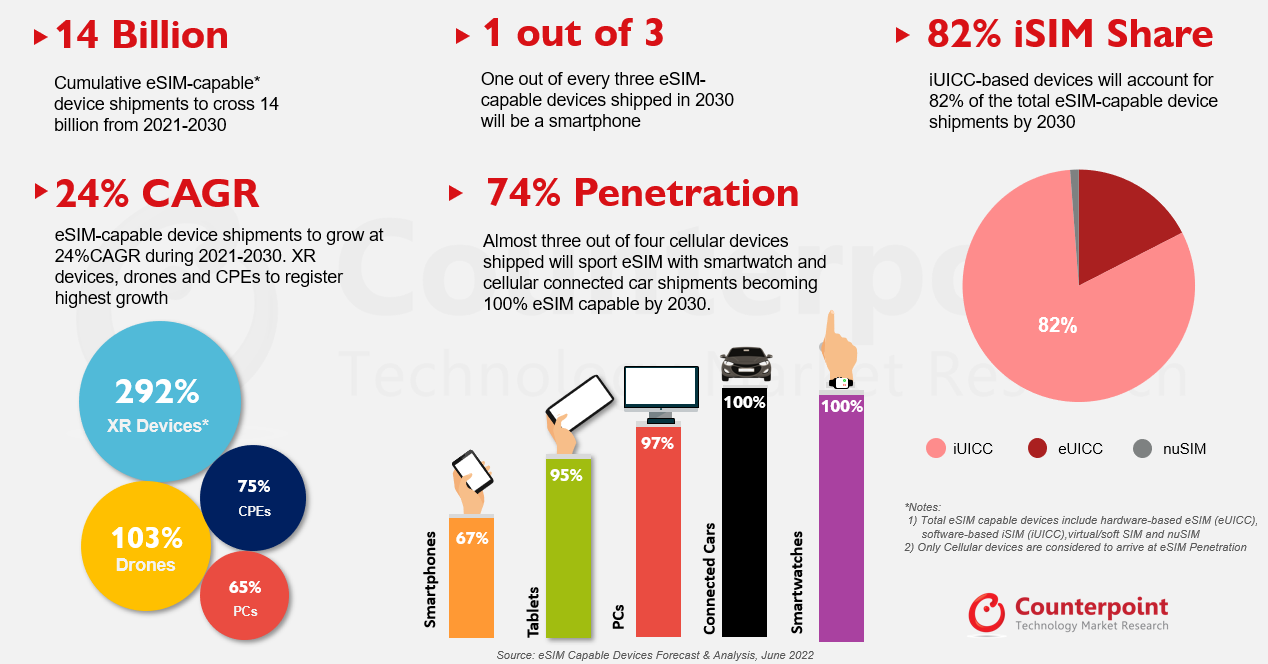

Currently, around 20% of smartphones shipped in 2022 were eSIM capable. The adoption of eSIM in smartphones has been slower than what was expected three years ago due to a variety of reasons. However, the biggest hurdle has been the need for additional components required to add eSIM capability.

For iSIMs, it would be a different case because the SIM is integrated into the processor and its adoption, unlike the eSIM, will be dependent on the support of chipsets. The iSIM will see faster adoption than the eSIM because the number of players providing chipsets is limited. While we have already seen multiple IoT devices with iSIM, the first iSIM smartphone is expected in 2024.

Huawei Watch GT Cyber gets an extreme makeover

Huawei showcased its Watch GT Cyber, which is already available in China since November 2022. The smartwatch comes with interchangeable cases, and the display updates when inserted into a new case. It uses magnets along with mechanical parts to remain connected with the cases. The concept is similar to smart bands with changeable straps but with innovation that makes the whole watch body different. We will have to see if Huawei allows third-party case makers to function with the smartwatch.

The Huawei Watch GT Cyber flaunts a 1.32-inch circular display with a resolution of 466x466pixels and a pixel density of 352ppi. It is water resistant up to 5ATM and comes with all the regular sensors like a barometer and magnetometer. The battery can last up to seven days on a single charge. It also has a Bluetooth calling feature.

Huawei showcases the 5.5G era and its use cases

With 5.5G, Huawei aims to offer 10X better performance over 5G, and thus create 100-fold business opportunities by opening up five frontiers:

1) Expansion in services with immersive and interactive experiences

Online 3D malls and 24K VR gaming to become mainstream. While 5G allows these use cases, 5.5G will enhance them. Huawei expects over one billion users.

2) Enable industry digitalization

Huawei expects private networks to increase 10x as the tech becomes more capable. It forecasts one million private 5G networks by 2030.

3) Cloud applications entering a new era, creating new opportunities for network connectivity

The company aims to reduce latency which will further make cloud applications more reliable and accessible.

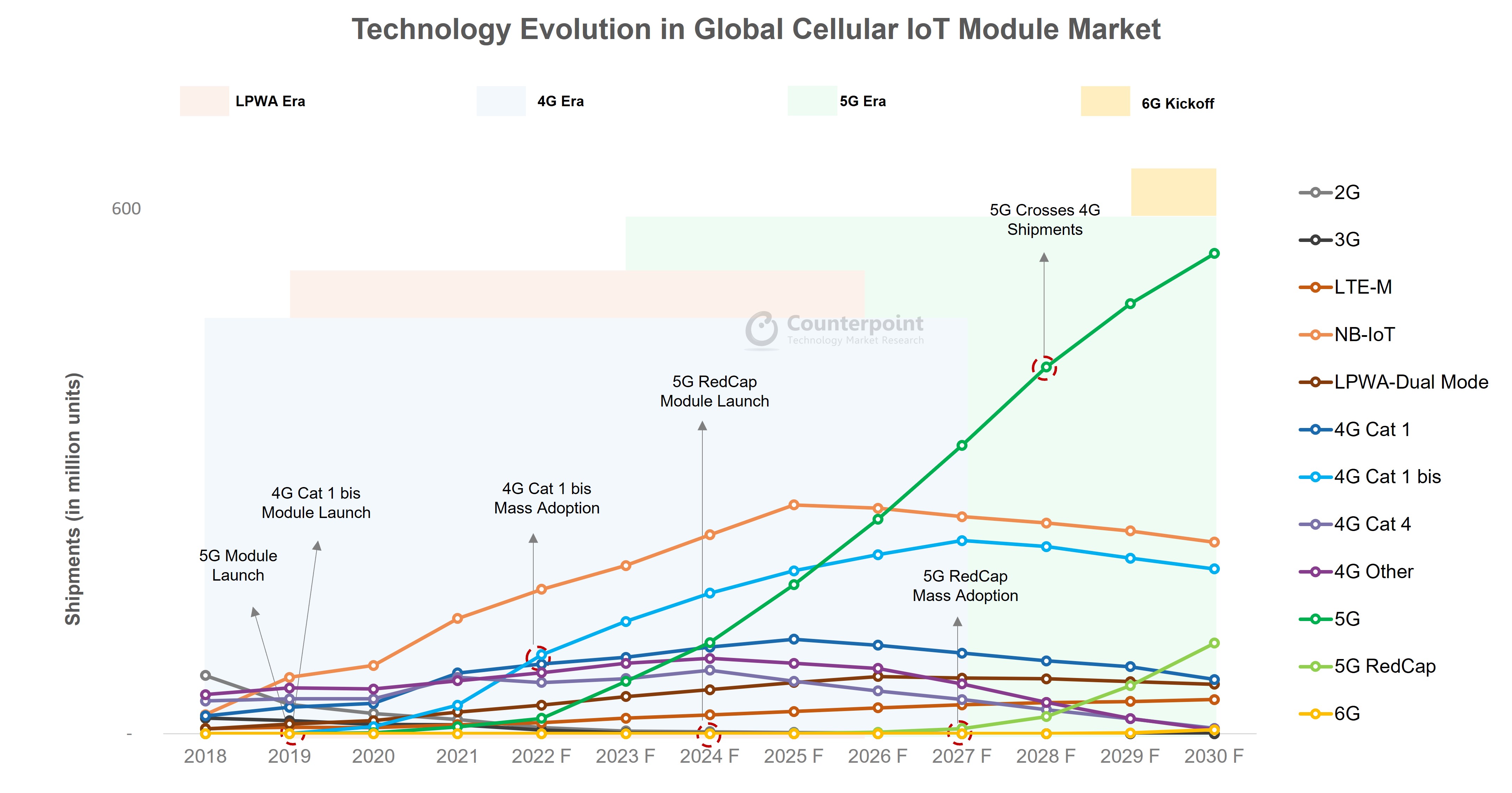

4) Cellular networks cover all IoT applications and passive IoT enables 100 billion connections

Passive IoT tags (e.g. RFID) will allow further solutions to better warehouse management, asset tracking, and other scenarios. Huawei expects 100 billion passive IoT tags per year from 30 billion in coming years as industries get more digital.

5) From communication to integrated sensing and communication, facilitating new services

Huawei aims to develop a more connected world using the sensing capabilities of 5.5G. It would help bring up information about areas where cameras are unable to work like during fog or rain. This would make transportation much safer.

With inputs from Varun Mishra, Karn Chauhan, Ankit Malhotra and Harshit Rastogi.

This is a developing post…….