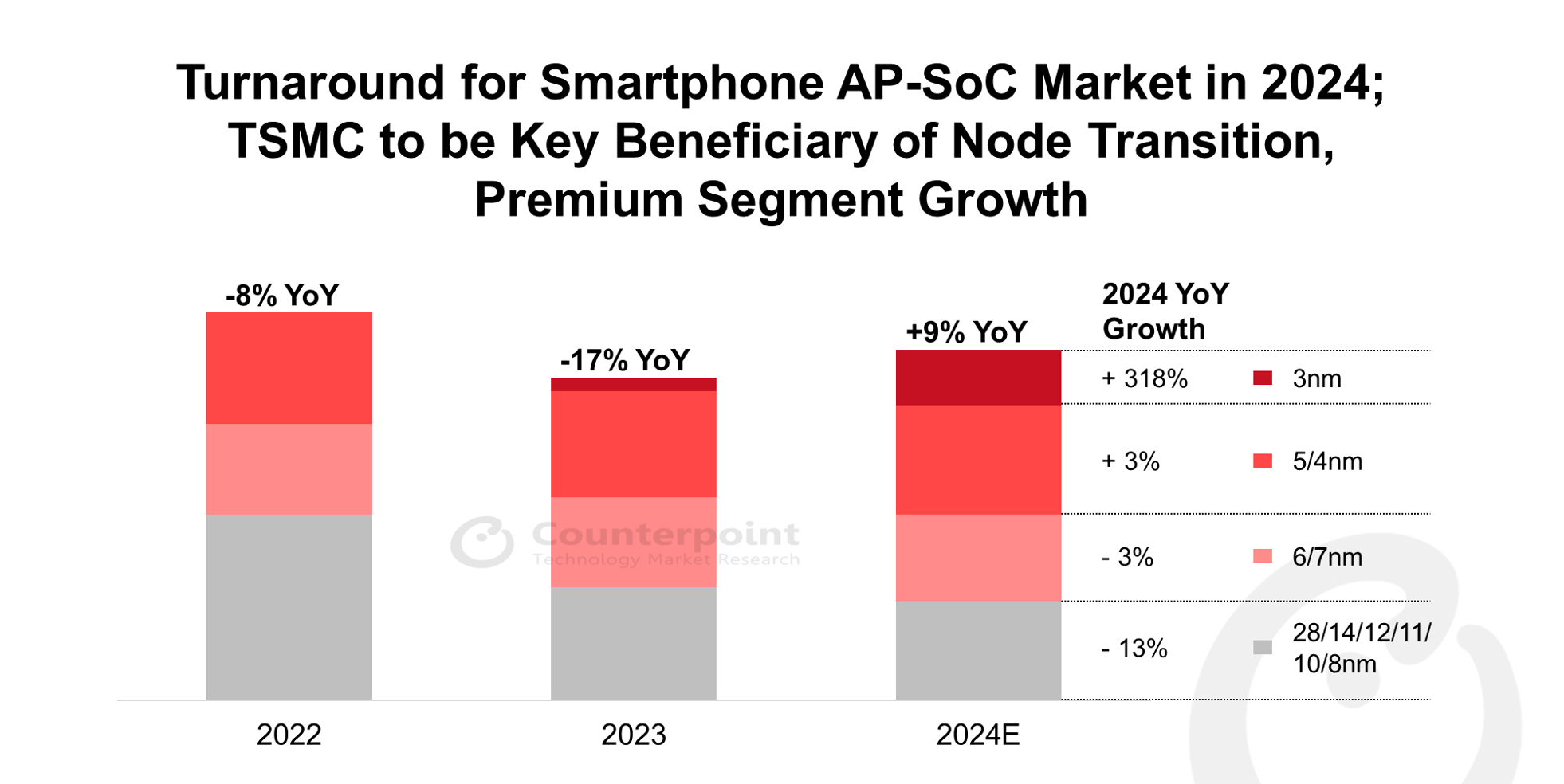

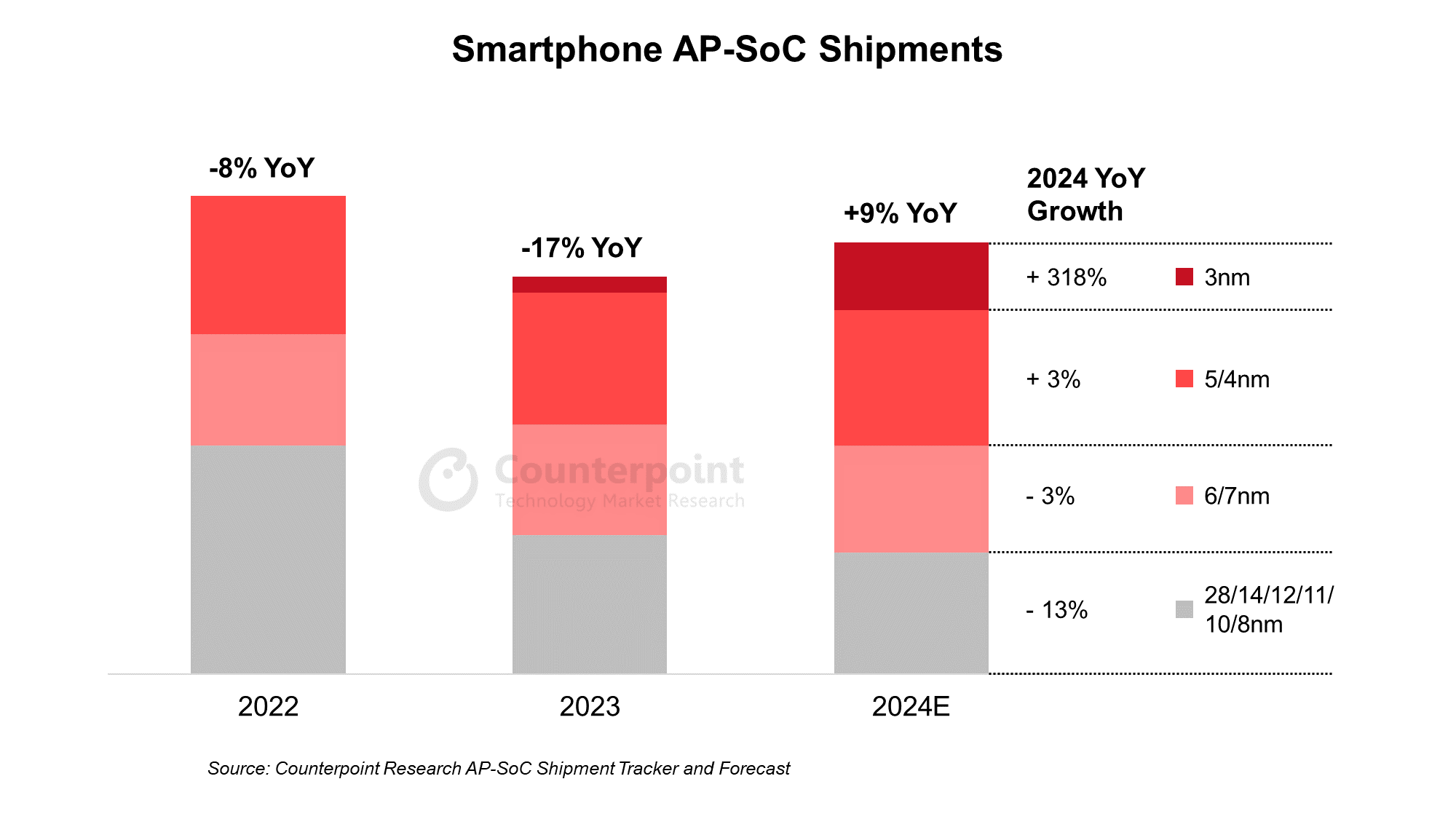

- Growth: AP-SoC shipments will rebound 9% YoY in 2024 after two years of declines.

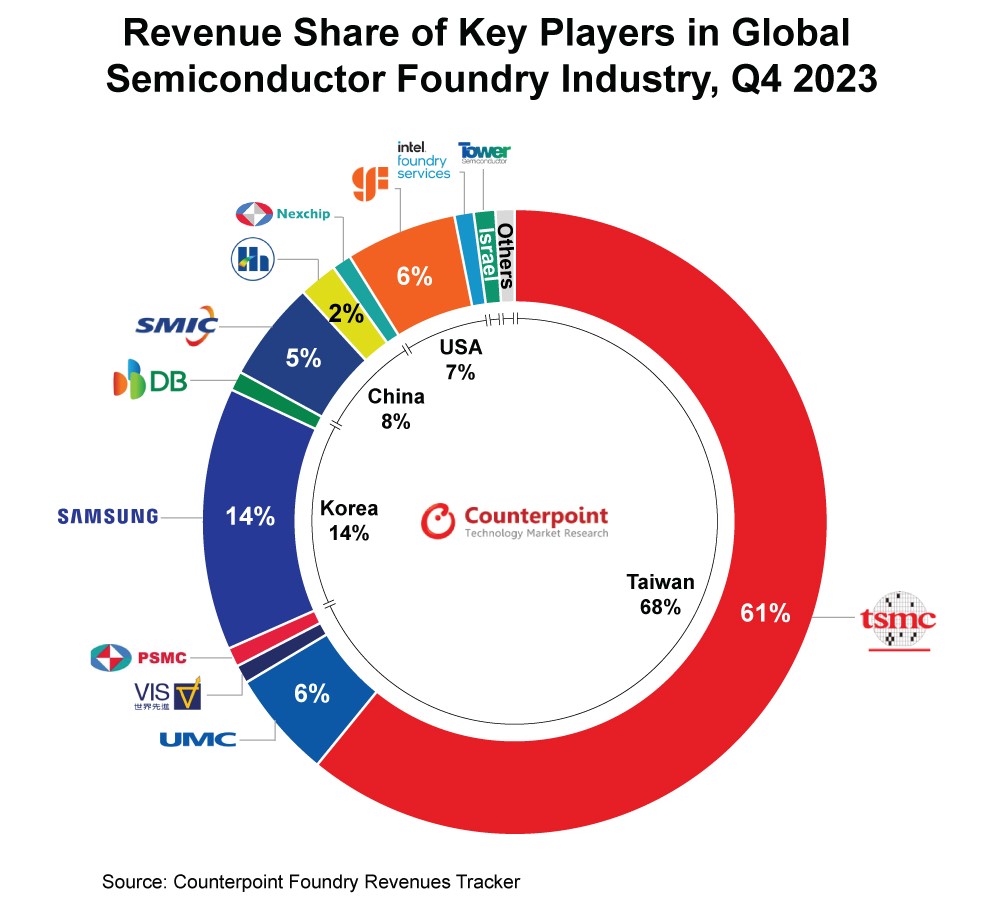

- Driver: Advanced nodes will be the key driver in this growth due to the migration of Apple- and Qualcomm-powered flagships from 5/4nm to 3nm. TSMC will be the key foundry beneficiary in the long term.

- Driver: 5/4nm offers support as OEMs switch to entry-level 5G from older nodes.

- Outlook: MediaTek and Qualcomm will reap benefits from the 6/7-to-5/4 transition; Qualcomm will dominate through 2025.

- Outlook: SMIC will gain some share in 6/7nm but advanced node challenges will persist.

- Outlook: Key 3nm flagship transition likely to push H2 up. 2nm will be likely delayed till late 2026.

Taipei, Seoul, Hong Kong, Boston, New Delhi, London, Hong Kong – April 4, 2024

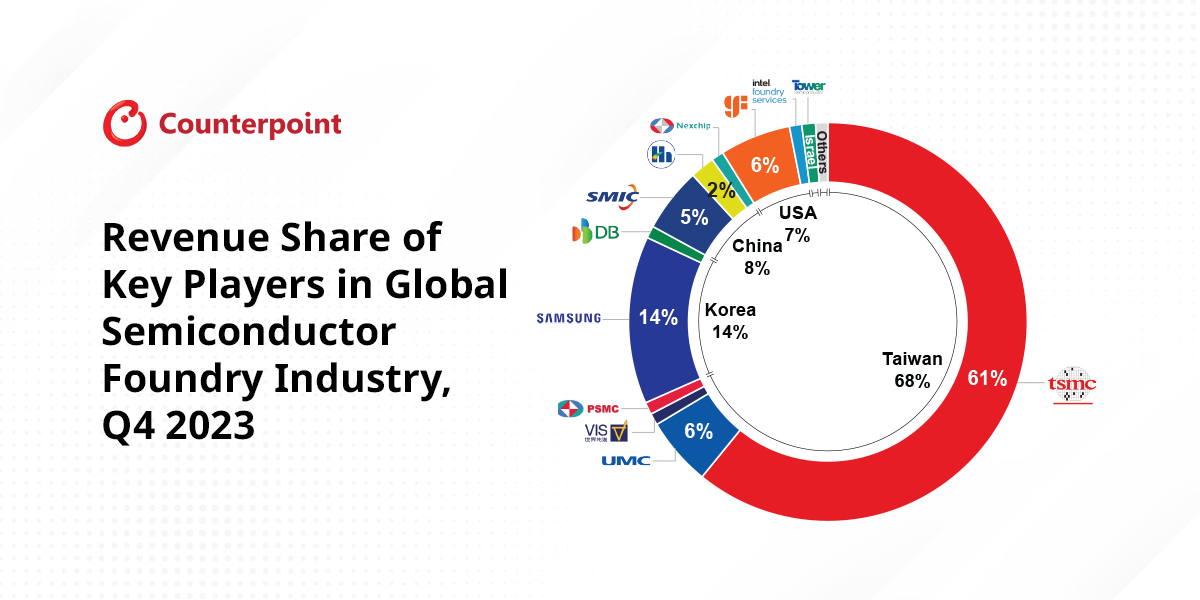

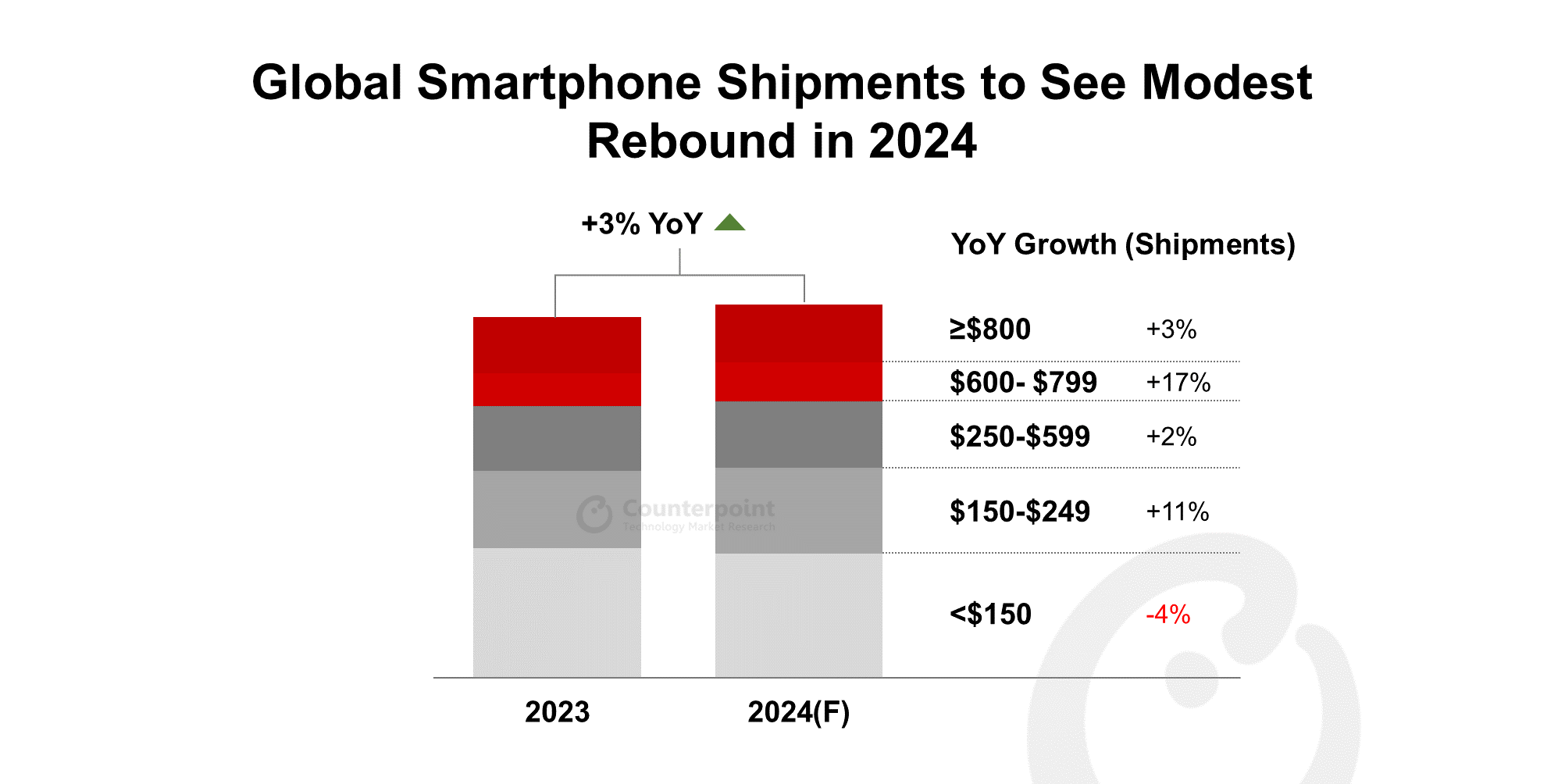

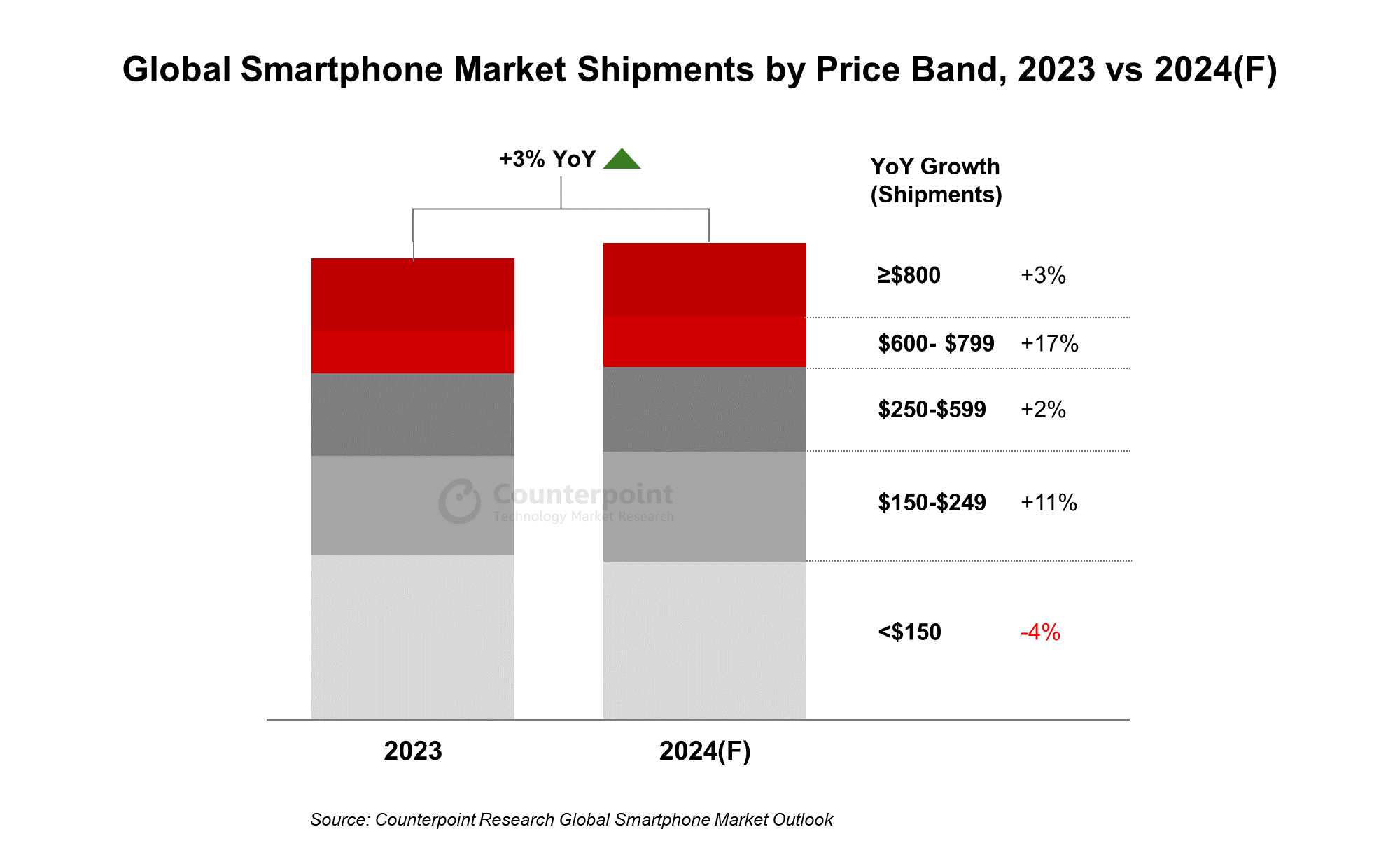

After two years of significant declines, the smartphone semiconductor market is likely to turn the corner, with 2024 smartphone AP-SoC shipments rebounding 9% YoY, according to Counterpoint Research’s latest Smartphone AP-SoC Long-term Shipment Forecast by Node and Foundry. The key driver of this growth will be the transition from 5/4nm chips to 3nm chips across flagships, as well as expected growth in premium and ultra-premium smartphones. TSMC will be the key foundry beneficiary here in the long term.

“With all the growth coming from the advanced nodes this is positive for TSMC through the long term” says Brady Wang, Associate Director for Counterpoint Research’s Foundry and Semiconductor 360 research services. “And with the surge in AI semiconductors the short term view looks even brighter.”

Supporting the growth of advanced nodes will be 5/4nm, which is set to become another long-term node as smartphone OEMs switch more of their portfolios to entry-level 5G, thanks to growth in emerging markets, growing consumer awareness, and rise in demand for 5G as a feature in line with expanding network coverage.

“For fabless, it is a given that both MediaTek and Qualcomm are going to be the big winners in the 4G-to-5G transition,” said Parv Sharma, Senior Analyst at Counterpoint’s Semiconductor 360 research service. “It is a good opportunity for MediaTek to capitalize on its leading-edge sweet spot, but we still see Qualcomm dominating through 2025 when it will have almost 50% share of the 5/4nm segment.”

SMIC will see increasing relevance in 7/6nm but will likely face challenges in any shift towards more advanced nodes as DUV equipment bans slow progress.

2nm continues to be elusive but will likely emerge in 2026 with the arrival of Apple’s iPhone 18 series.

*Note: We have updated the last sentence of this PR to reflect 2nm will likely emerge in 2026 with the arrival of Apple’s iPhone 18 series; it was originally stated as the ‘iPhone 19 series’.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research

press(at)counterpointresearch.com