- PHEV sales* saw a significant rise with a 46% YoY growth, while BEV sales increased by just 7% YoY as OEMs gradually pulled off their BEV supply targets.

- China remained the global leader in EV* sales with a 28% YoY growth, while the US experienced a modest 2% YoY growth.

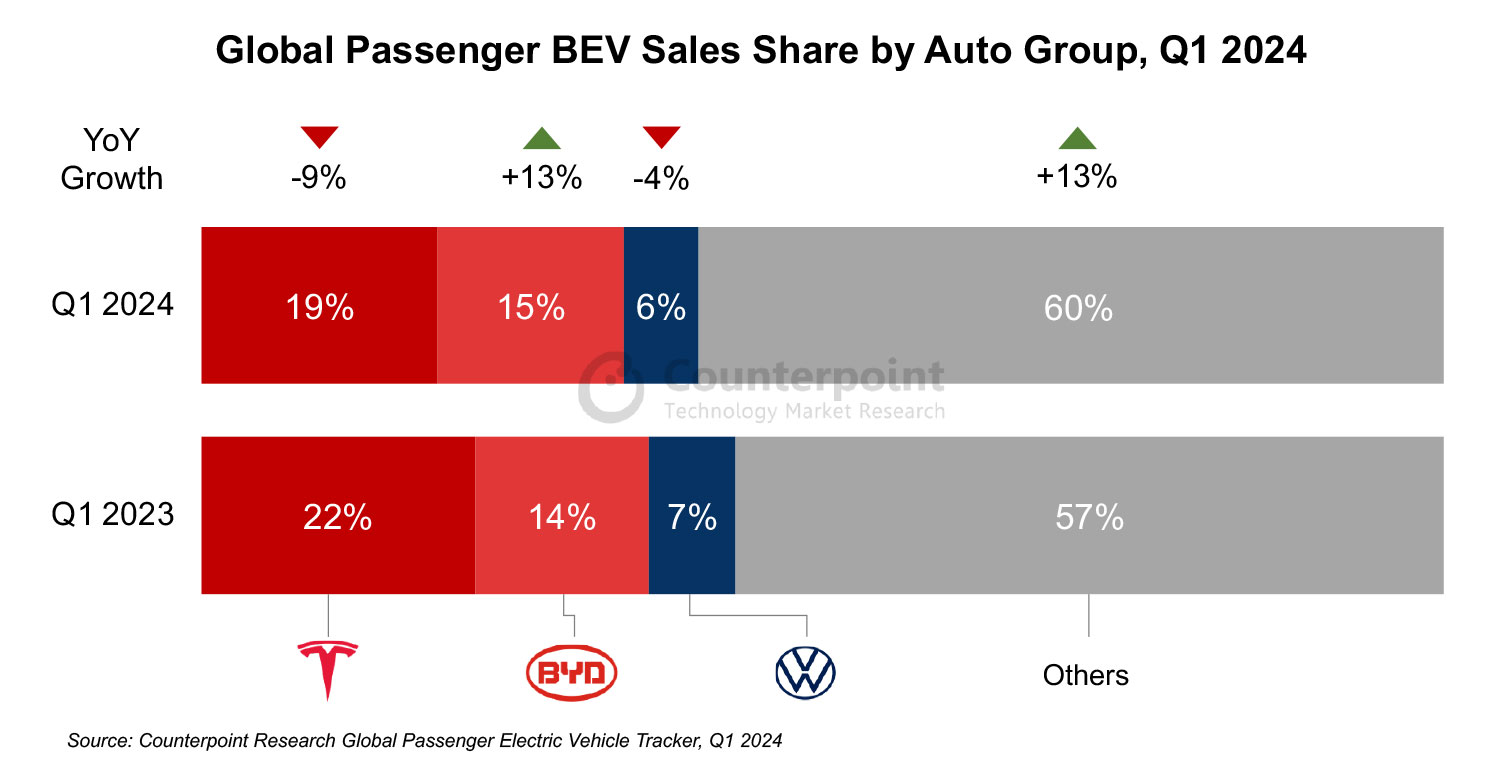

- Despite a 9% YoY decline, Tesla regained the top position in BEV sales with a 19% market share, while BYD achieved a 13% YoY growth.

- BYD exported almost 100,000 EVs, including PHEVs, with a substantial 152% YoY growth, primarily in the SEA region.

Seoul, Beijing, Boston, Buenos Aires, Fort Collins, Hong Kong, Jakarta, London, New Delhi, San Diego, Tokyo – May 13, 2024

Global passenger EV (BEV+PHEV)* sales grew 18% YoY in Q1 2024, according to Counterpoint’s EV Market Tracker. While BEV sales increased by a modest 7% YoY during the quarter, PHEV sales grew 46% YoY.

China remained the global leader in Q1, followed by the US and Europe. China’s EV sales grew 28% YoY, while the US recorded a modest 2% YoY growth. Overall EV sales in the US grew, but BEV sales declined by 3% YoY.

Leading EV players like Tesla and BYD have managed to reduce their BEV manufacturing costs, allowing them to offer competitive prices. This has put pressure on other automakers like Ford and GM which are struggling to reduce their manufacturing costs. These companies have introduced BEVs at competitive prices but are facing significant losses.

To mitigate these losses, traditional automakers are adjusting their BEV targets and prioritizing PHEVs. The increased adoption of PHEVs is expected to continue until these automakers develop strategies to reduce BEV manufacturing costs and meet emission targets to avoid fines.

Research Analyst Abhik Mukherjee said, “The cheaper upfront cost of PHEVs when compared to BEVs and the availability of a fuel tank that eliminates range anxiety were among the main reasons for high PHEV demand.” PHEVs are available in different body types, like sedan, SUV and crossover. Buying mid-priced PHEVs is a more logical choice for consumers since their prices are comparable to or lower than most of BEVs. In this category, PHEVs with the SUV body type is more in demand.

Despite a 9% YoY decline, Tesla regained the top position in BEV sales in Q1 2024, commanding a 19% market share. Following closely behind were the BYD Group and Volkswagen Group. Notably, among the top three OEMs, only BYD achieved growth (13% YoY), while both Tesla and Volkswagen experienced declines of 9% and 4% YoY, respectively.

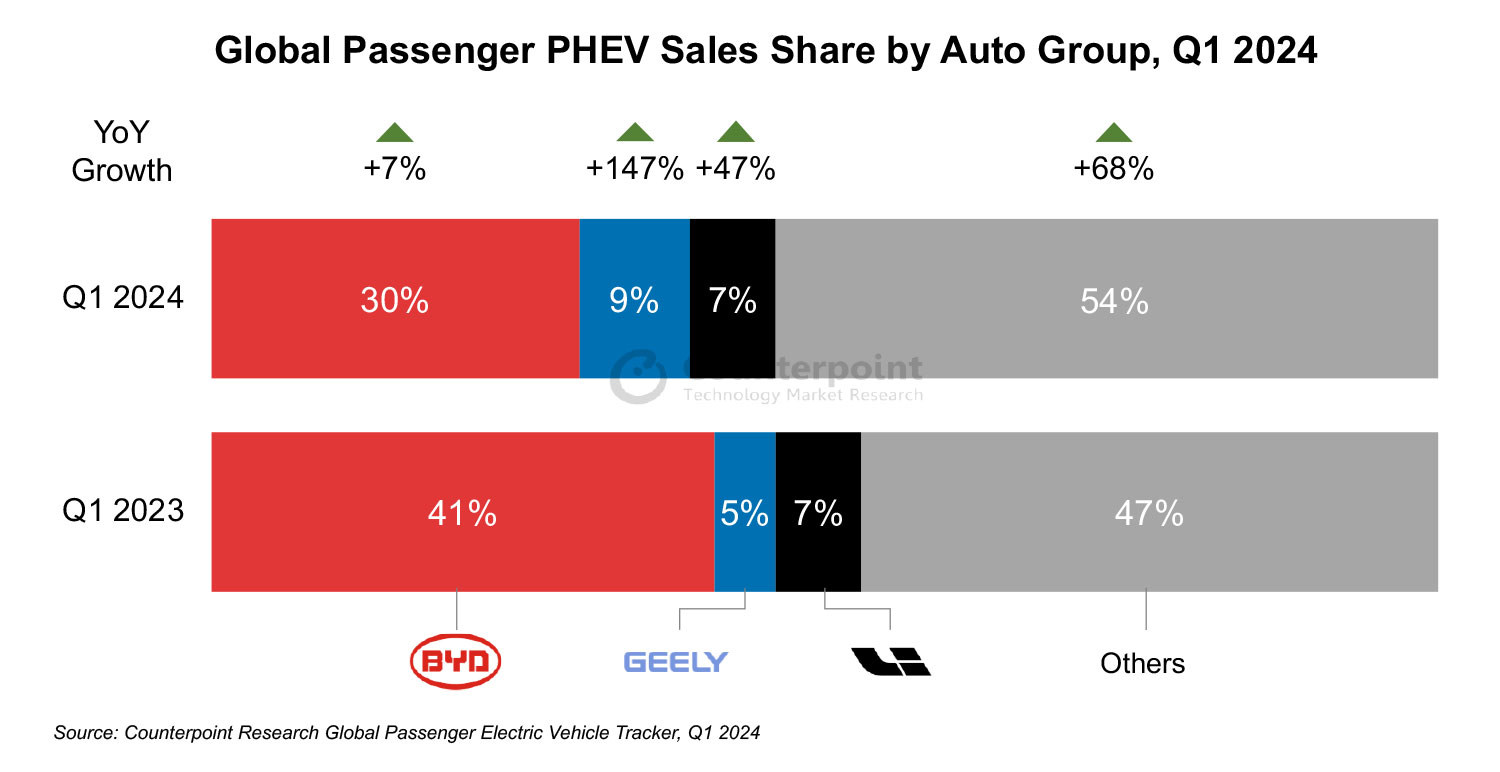

BYD also excelled in the PHEV segment, accounting for nearly one-third of global PHEV sales, followed by Geely Holdings and Li Auto. BYD exported almost 100,000 EVs, including PHEVs, with a substantial 152% YoY growth, primarily in the SEA region.

Commenting on the market outlook, Associate Director Liz Lee said, “In 2024, the EV market is poised for significant growth, yet signs of a slowdown also loom and the annual growth may dip below 20%. The leveling off of early-adopter interest suggests a shift in consumer dynamics to the mass market in the long term and a new phase of evolution for the EV industry.

BYD’s remarkable export performance, especially in the SEA region, highlights the growing global demand for EVs, including PHEVs. However, Tesla, which has only BEV fleets, currently faces challenges such as production delays and weakened early-adopter demand, which initially boosted its sales in advanced markets.”

*Notes:

*EVs here include battery EVs (BEVs) and plug-in hybrid EVs (PHEVs).

Sales here refer to wholesale figures, i.e. deliveries out of factories by respective brands.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research

press(at)counterpointresearch.com