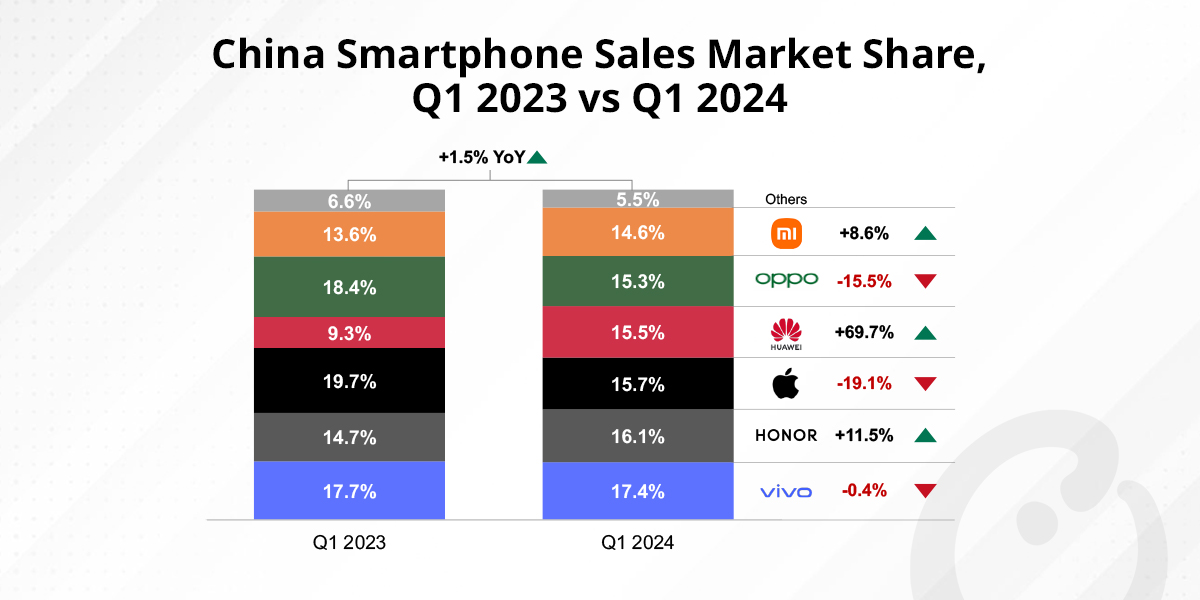

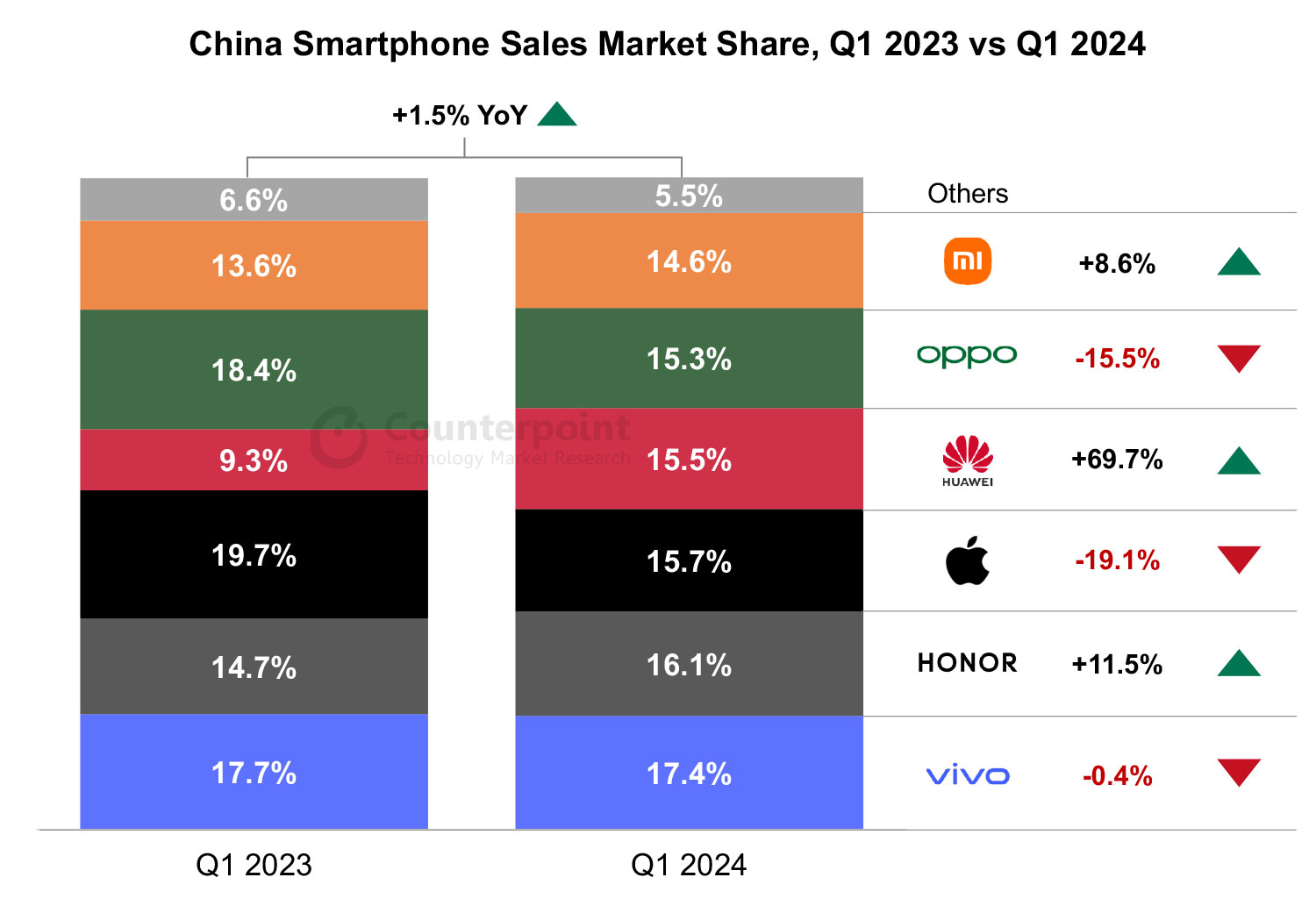

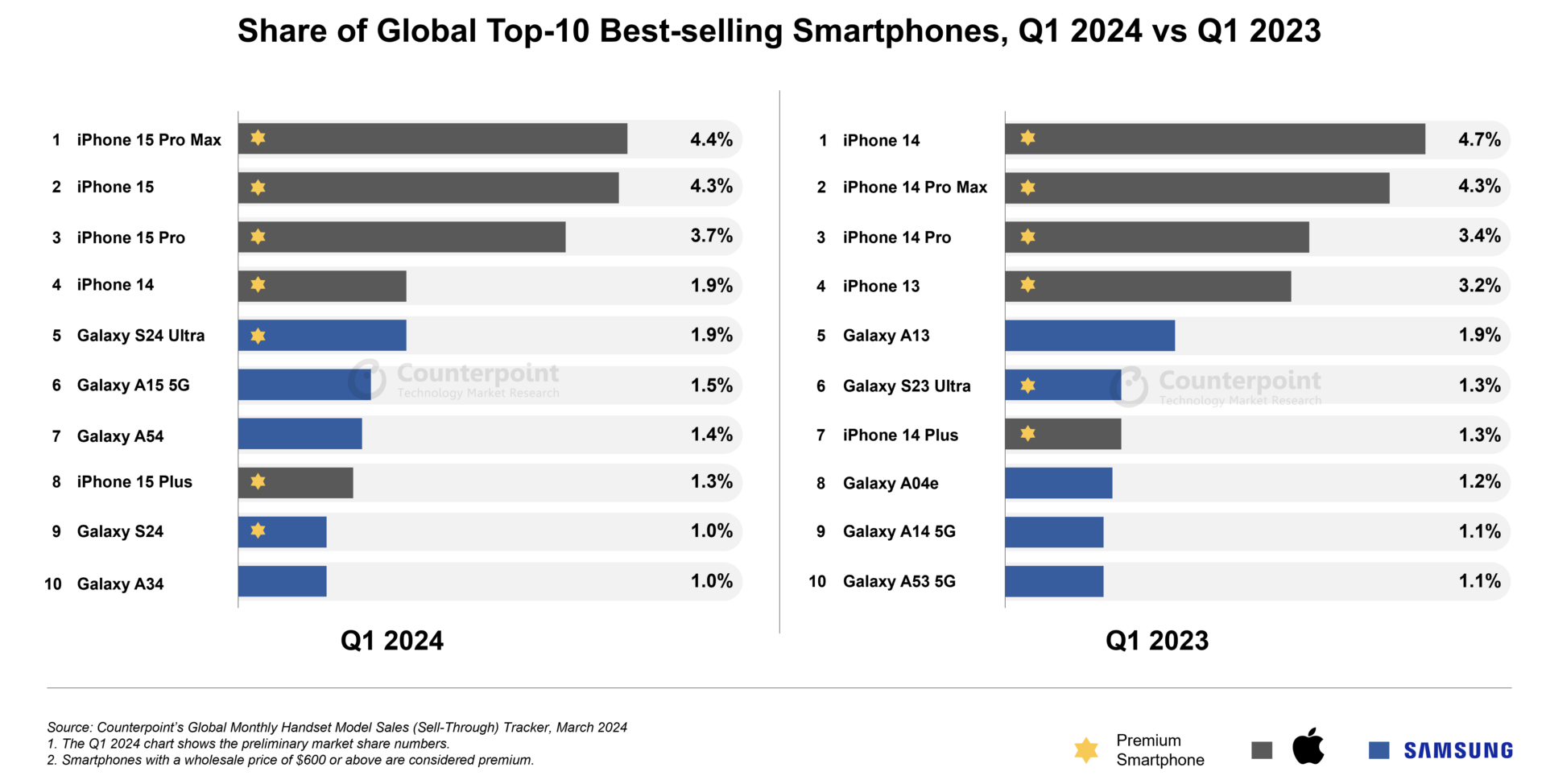

- Apple and Samsung dominated the list of top 10 best-selling smartphones in Q1 2024, a period which grew 6% YoY and one in which Samsung dethroned Apple to become the best selling smartphone OEM worldwide.

- This was the first quarter in which the top 10 smartphones were all 5G capable.

- This was also Apple’s first non-seasonal quarter when the iPhone Pro Max took the top spot.

- The Pro line-up captured half of Apple’s total sales in Q1 2024, a significant increase from 24% in Q1 2020.

Seoul, Beijing, Boston, Buenos Aires, Fort Collins, Hong Kong, London, New Delhi – May 6, 2024

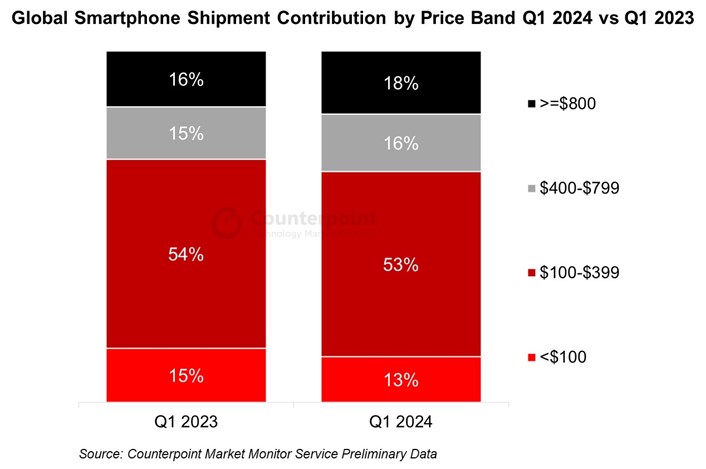

Apple and Samsung dominated the top-10 best-selling smartphones list for Q1 2024, each capturing five positions and leaving no spot for other brands, according to Counterpoint Research’s Global Monthly Handset Model Sales Tracker. This was the first quarter in which the top 10 smartphones were all 5G capable. Besides, the trend towards premiumization was evident, with 7 of the top 10 smartphones being premium (wholesale price at $600 and above).

Apple’s iPhone 15 Pro Max was the best-selling smartphone of Q1 2024. Notably, the Pro Max variant achieved the top position for the first time in Apple’s non-seasonal quarter, reflecting an increasing trend of consumer preference for high-end smartphones. All four iPhone 15 variants and the iPhone 14 were among the top 10 bestsellers. Further, the iPhone 15 line-up secured the top three spots.

The growing popularity of the Apple Pro line-up was evident, as it captured half of Apple’s total sales in Q1 2024, a significant increase from 24% in Q1 2020. The Pro iPhones have become the major revenue drivers for Apple, contributing over 60% of its sales value in Q1 2024. The Pro line-up offers substantial upgrades and significant enhancements over the base models. This strategic move has proven successful, as consumers are willing to pay for premium features. The Pro line-up’s features include an innovative dynamic island interface, more advanced chipsets, ultra-smooth displays, titanium chassis and a telephoto camera. The iPhone 15 Pro Max performed well despite its first price increase since the launch of the Pro series in 2019, indicating a strong consumer desire for the extra features the Pro line offers.

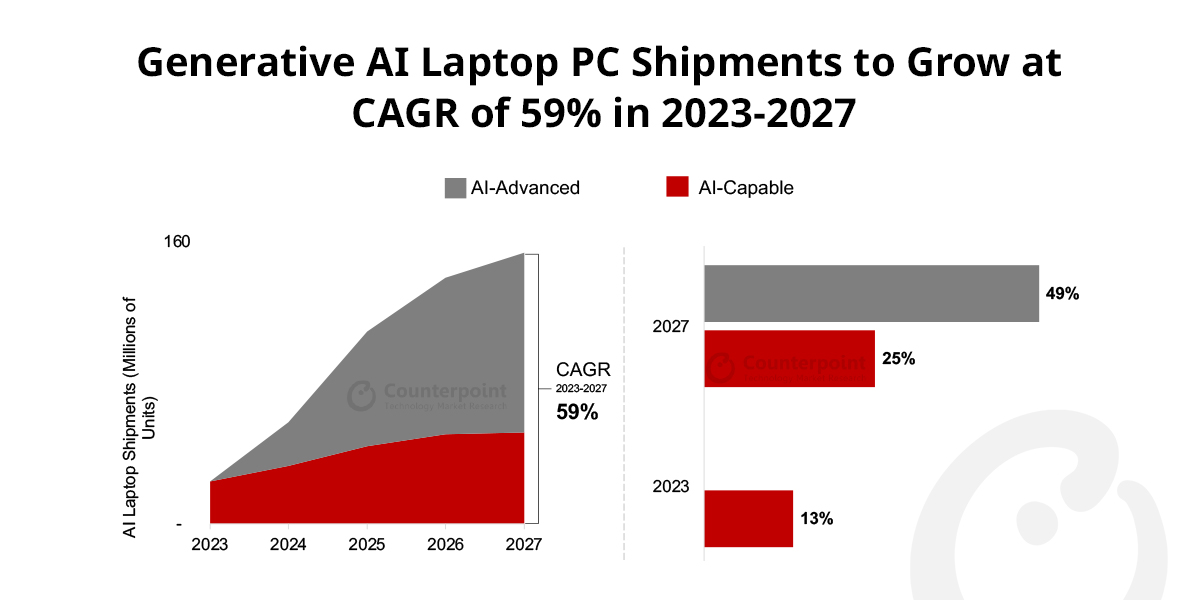

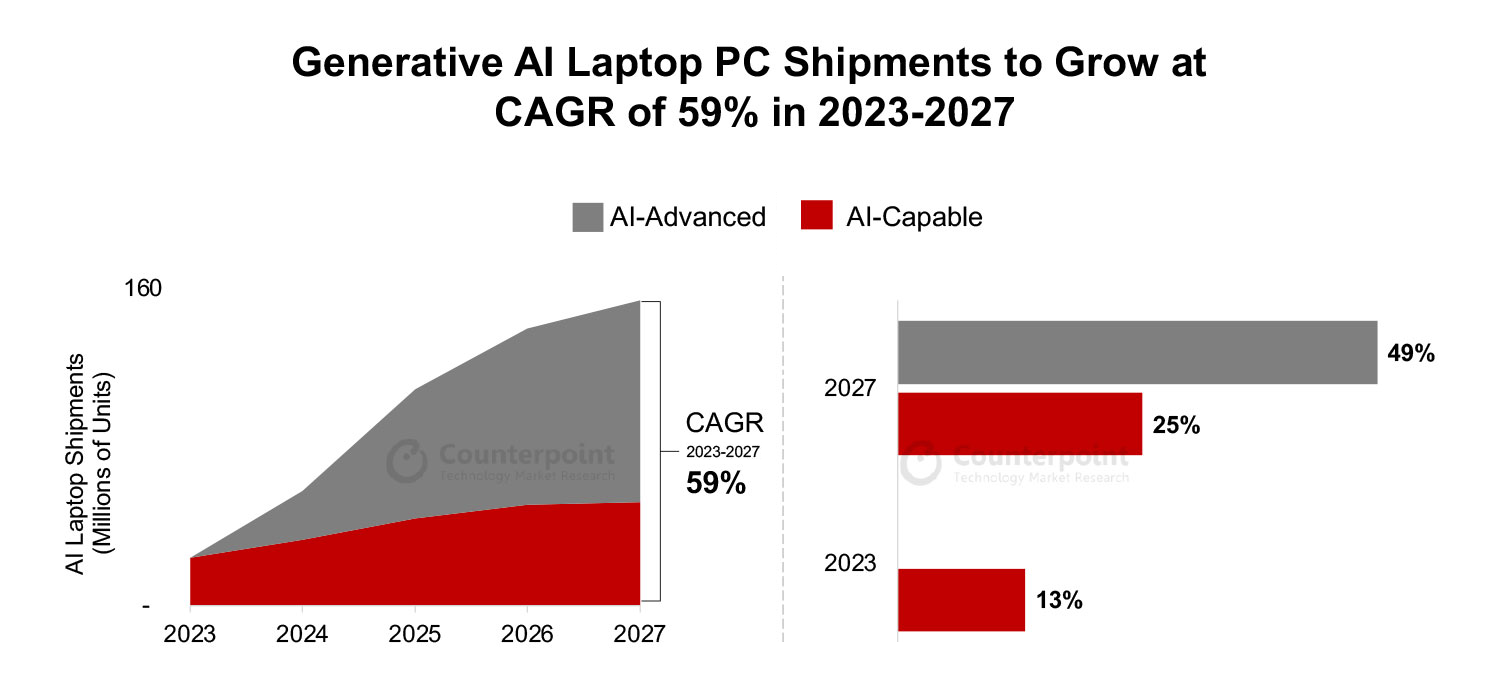

Samsung’s Galaxy S24 series secured two spots in the top 10 for Q1 2024, with its Ultra variant ranking fifth and the base variant coming in ninth. The strong performance of the S24 series can be attributed to Samsung’s early refresh of the series, and its efforts in generative AI (GenAI) technology. The S24 series was the first to reach the market with GenAI features and capabilities, allowing users to create unique content and experience a new level of interaction with their smartphones.

Consumers are holding onto their smartphones for longer periods because upgrades are offering limited differentiation in features. This leads consumers to opt for high-end smartphones to ensure their devices remain technologically relevant for a longer duration. Going forward, we expect the top 10 best-selling smartphones to capture a larger share of total smartphone sales as OEMs are focusing on leaner portfolios with premium features, including GenAI.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research

press(at)counterpointresearch.com