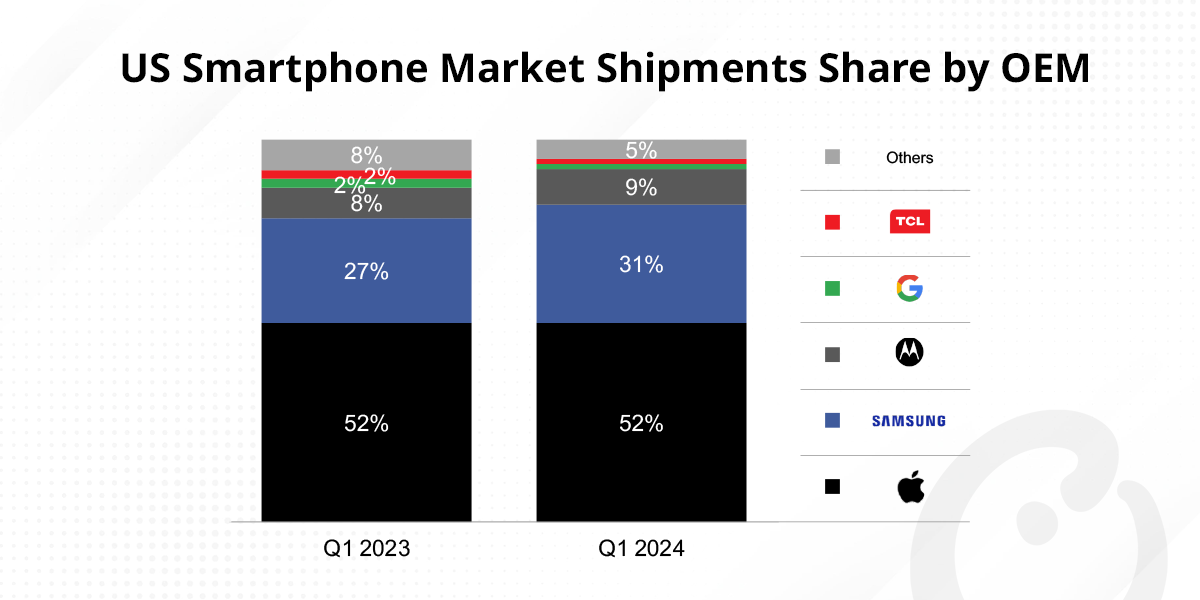

- LATAM’s smartphone shipments were up 21.9% YoY and 12% QoQ in Q1 to reach the highest level since Q4 2021.

- Samsung remained the market leader with a 31% share, but its shipments declined 8.5% YoY.

- Motorola saw its highest shipments since Q4 2021 to hold strong in the second spot with a 21% share.

- Xiaomi took the third spot, with its shipments growing 41.2% YoY.

Buenos Aires, Beijing, Fort Collins, Hong Kong, London, New Delhi, San Diego, Seoul, Tokyo – May 27, 2024

LATAM’s smartphone shipments increased 21.9% YoY and 12% QoQ in Q1 2024 to reach the highest level since Q4 2021 and the highest YoY growth among all regions, according to Counterpoint’s latest Market Monitor report. This was also the third consecutive quarter to record a YoY rise. This is a strong sign of market recovery.

Commenting on the market dynamics, Senior Research Analyst Tina Lu said, “Part of the growth was due to the sell-in declining in most markets in Q1 2023 to clear inventory, while in Q1 2024, operators and retailers were building inventory for Mother’s Day. Demand for smartphones was also fueled by the Chinese OEMs increasingly getting aggressive with their promotions for 4G models and price discounts. All this defied the traditional seasonality and showed that the region’s sales channels were confident enough about the demand to build some inventory.

Mexico and Venezuela led the shipment growth. But most of the other markets also grew YoY in double digits. Only Argentina’s market dropped by 62%, affected by a severe economic crisis. With assembly plants in the country laying off employees, this market would continue to be soft for the first three quarters of 2024. This will principally affect Samsung and Motorola. The grey market in the region continued to grow, fueled by high import duties in many countries.”

Key insights on top-selling brands during Q1 2024

- Samsung’s shipments declined 8.5% YoY but increased 12.9% QoQ. The brand remained the market leader with a 31% share. Xiaomi and HONOR squeezed Samsung, especially in the $100-$249 price band. Samsung has been advertising extensively its GenAI capabilities in a few key countries. This has helped it to build its branding.

- Motorola’s volume increased by 31% YoY, as its shipments during the same quarter last year were heavily impacted by retailers reducing inventory. In Q1 2024, the brand saw its highest shipments since Q4 2021.

- Xiaomi’s shipments increased by 41.2% YoY but grew by only 11.5% QoQ. The brand is growing by offering better 4G specs. It is also increasingly gaining support in the grey market in Brazil and smaller South American countries. Argentina’s grey market also expanded following the stoppage of local manufacturing between December 2023 and February 2024.

- HONOR’s shipments surged by 211.5% YoY. This brand entered the region two years ago and is already among the top five for the third consecutive quarter. Mexico is its most important market in terms of volume, but Peru is its most important market in terms of share. HONOR along with Xiaomi was the Peruvian market leader in Q1 2024.

- Samsung, Apple and Motorola are portraying themselves as leaders in 5G technology in LATAM.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the technology, media and telecom (TMT) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research

press(at)counterpointresearch.com

Market Summary:

Market Summary: