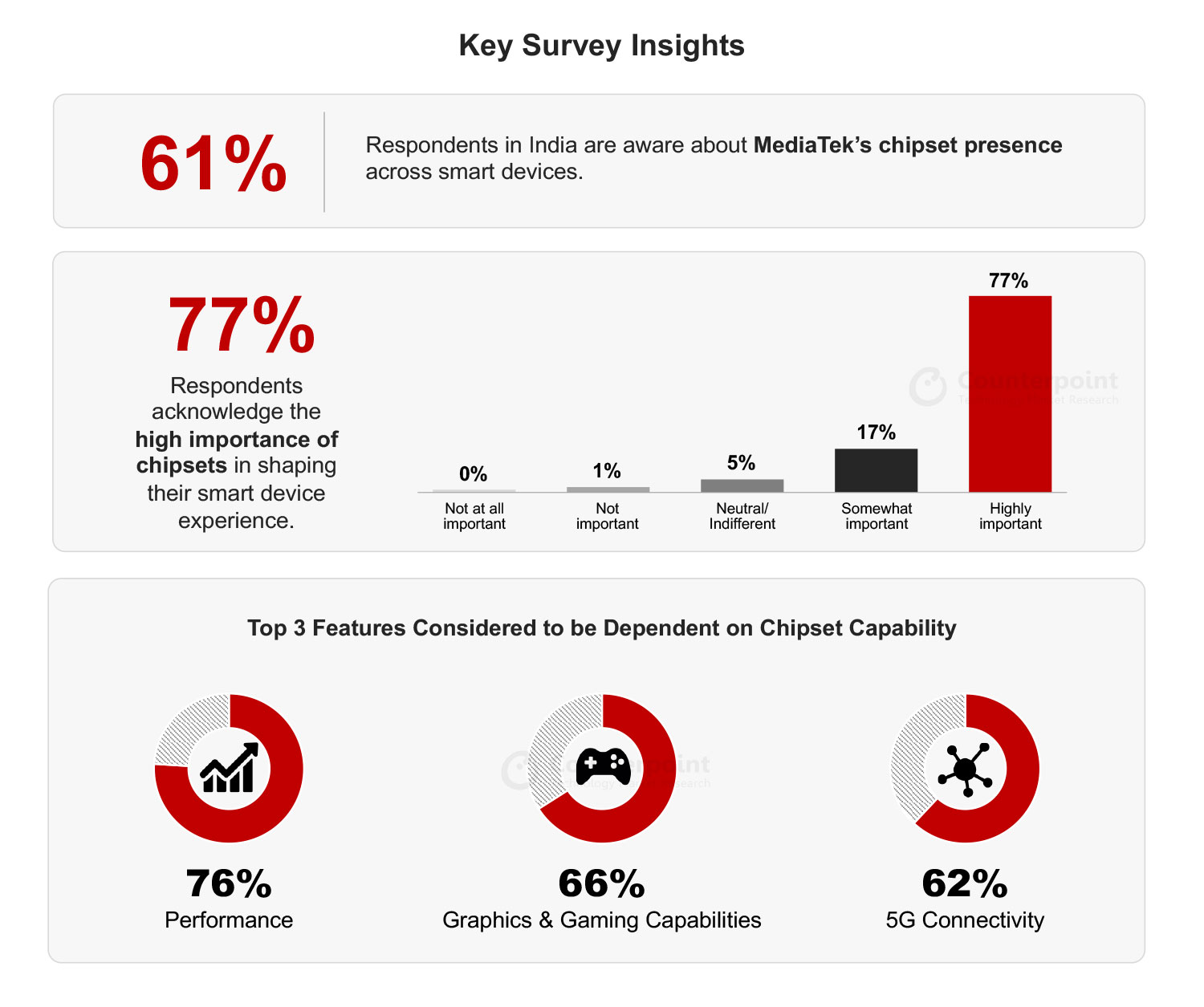

- Smart device users rate performance (76%), graphics and gaming capabilities (66%), and 5G connectivity (62%) as the top three features dependent on chipset capabilities.

- The awareness level for MediaTek’s chipsets is 61% across smart device users in India, driven by the brand’s leadership position in smartphones as well as in other categories like smart TVs and smart speakers.

New Delhi, Beijing, Buenos Aires, Fort Collins, Hong Kong, London, Seoul, Taipei, Tokyo – January 3, 2024

As the smartphone market in India matures, consumers are becoming increasingly knowledgeable about the smart devices they own. They make well-informed decisions when purchasing smartphones, crucial devices for their daily activities. Recognizing the significance of chipsets as key differentiating factors in smart devices, Counterpoint Research conducted a consumer survey in India. The focus was to comprehend the awareness and importance of chipsets among people in India, a market that ranks as the second largest for smartphones globally and is one of the fastest-growing markets for various smart devices.

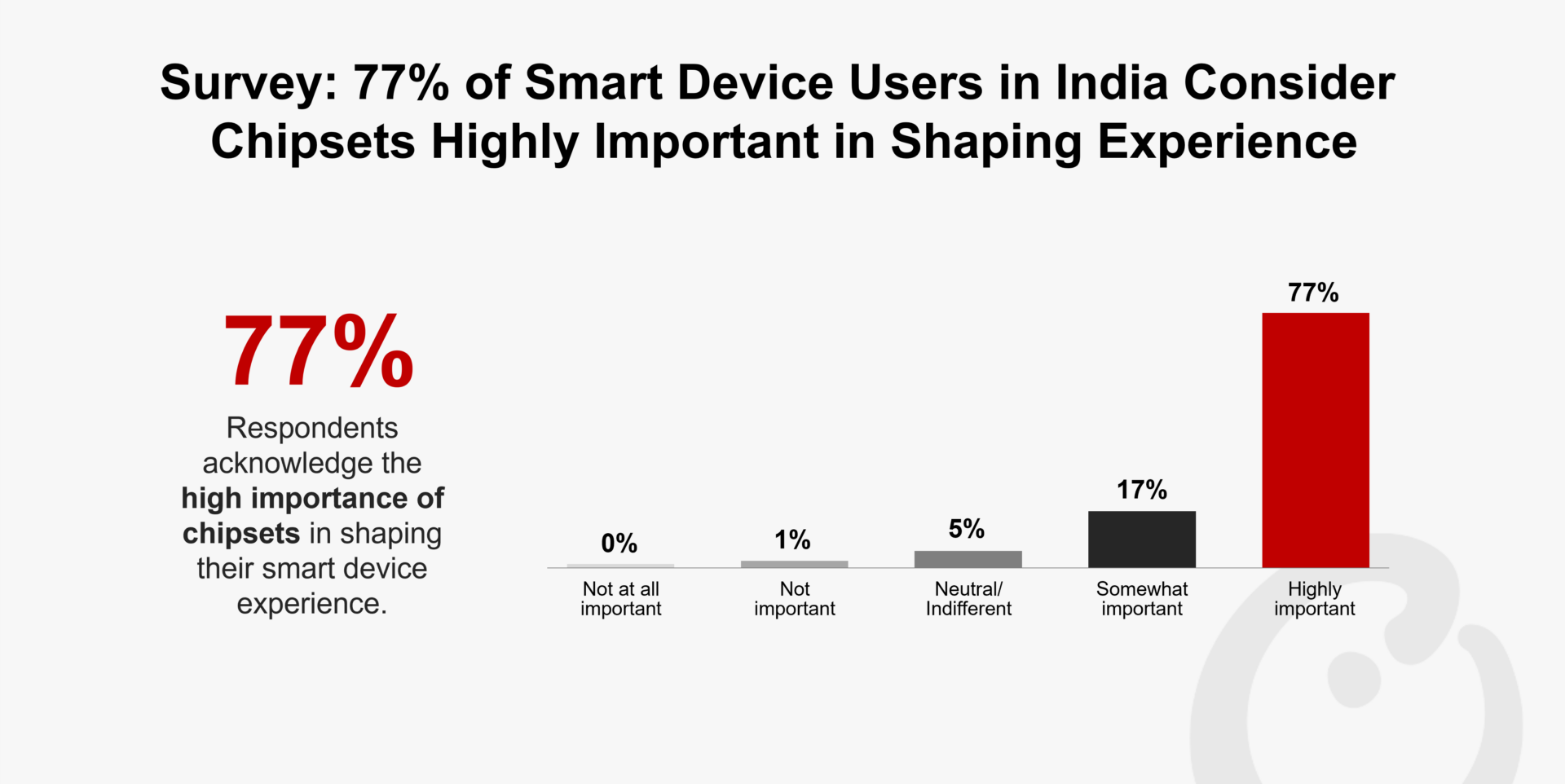

The survey revealed that 77% of the country’s smart device users consider chipset capabilities highly important in influencing their device experience. The survey also shed light on the significance of chipsets across different smart devices such as smartphones, earphones/TWS, smart TVs and laptops.

Many of the advanced features we find in our current smart devices are enabled and enhanced through the evolution of the underlying chipsets. These chipsets shape consumer experiences and help OEMs differentiate their offerings at a time when we are transitioning to next-generation 5G networks. According to the survey respondents, performance (76%), graphics and gaming capabilities (66%), and 5G connectivity (62%) are the top three features dependent on chipset capabilities.

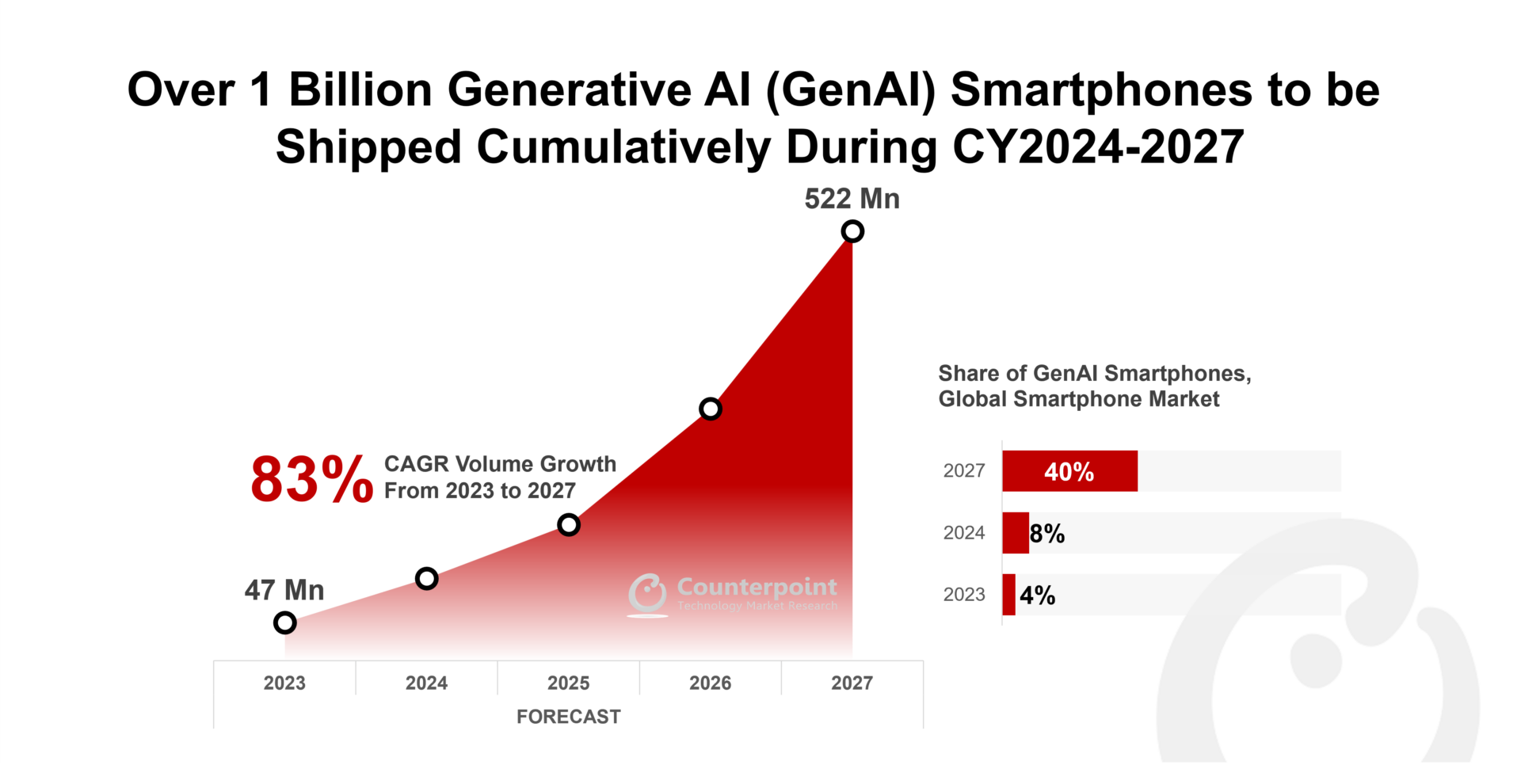

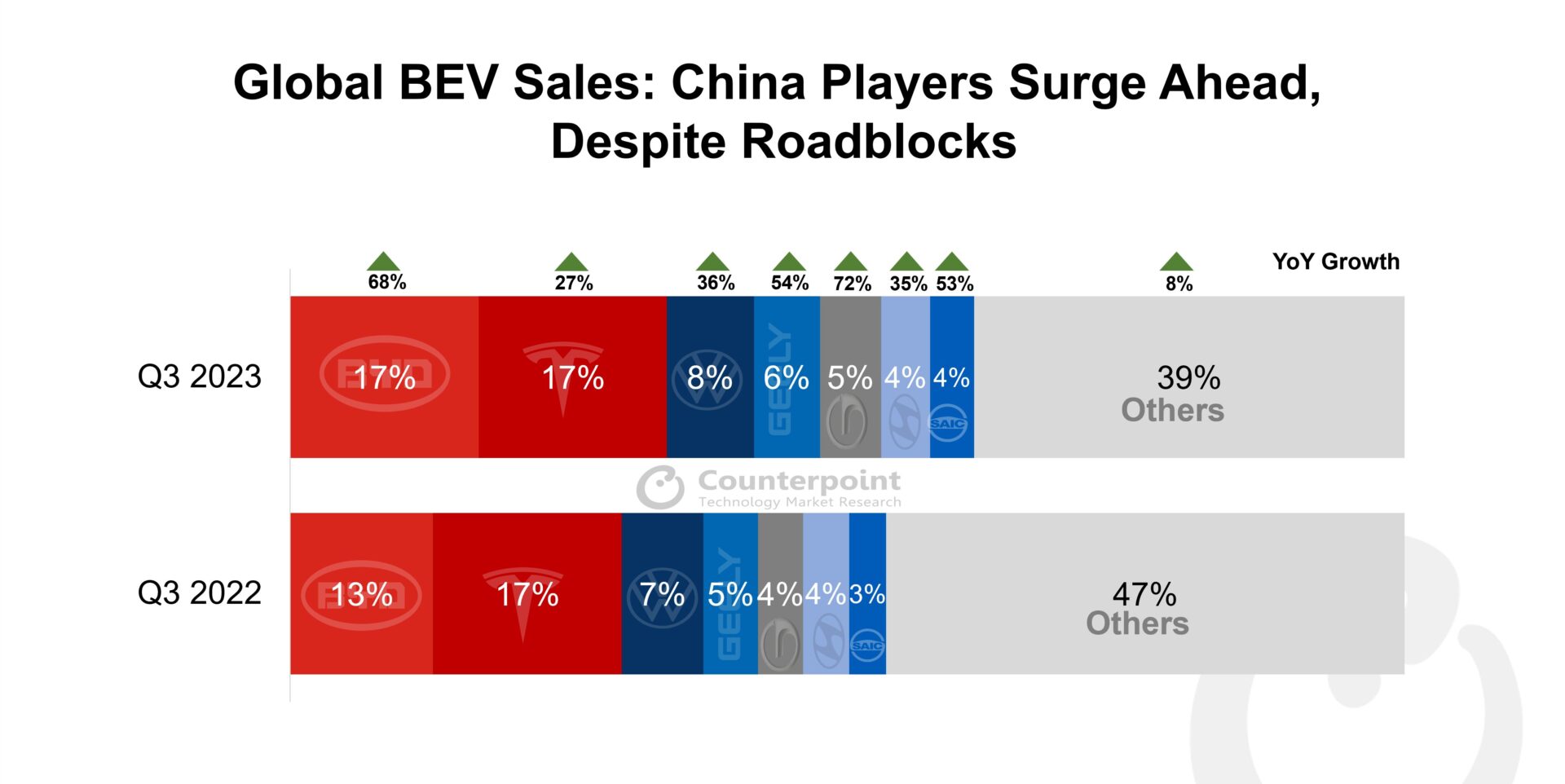

In terms of brands, the survey showed that 61% of the respondents were aware of MediaTek’s chipsets across smart devices in India, driven by the company’s leadership position in smartphones as well as in categories like smart TVs and smart speakers. MediaTek was the world’s top smartphone chipset brand in Q3 2023 with a 31% market share, according to Counterpoint’s latest Global smartphone AP Shipments. The Taiwan-based company develops systems-on-chips (SoCs) for mobile, home entertainment, connectivity and IoT devices, and is also involved in other key technology areas.

Commenting on the importance of chipsets and MediaTek’s role in the chipset ecosystem, Research Director Tarun Pathak said, “For any electronics device, we believe that personalized experiences will be the real differentiator for consumers going forward. This means deeper integration of advanced technologies leveraging artificial intelligence for a seamless, reliable and personalized experience with a relentless focus on ultra-fast connectivity. Therefore, companies like MediaTek are well positioned in this space as the tech industry shifts its focus from smart connected devices to smartly connected devices.”

Methodology: This Counterpoint Research survey was commissioned by MediaTek to understand chipset awareness among smart device users in India. With a sample size of more than 1,200 respondents, the survey was conducted online across India. We expect the survey results to have a statistical precision of +/- 4%.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research