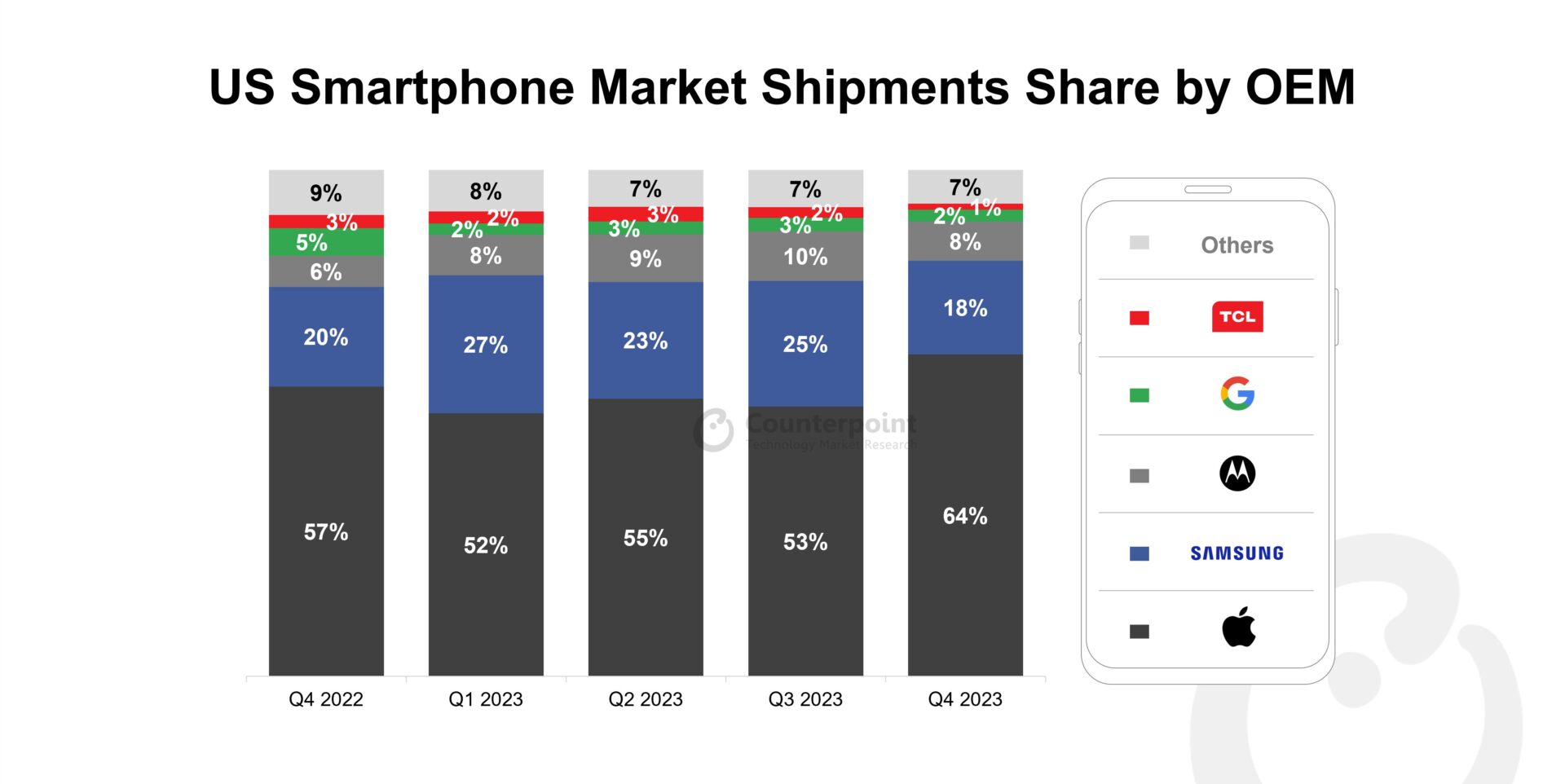

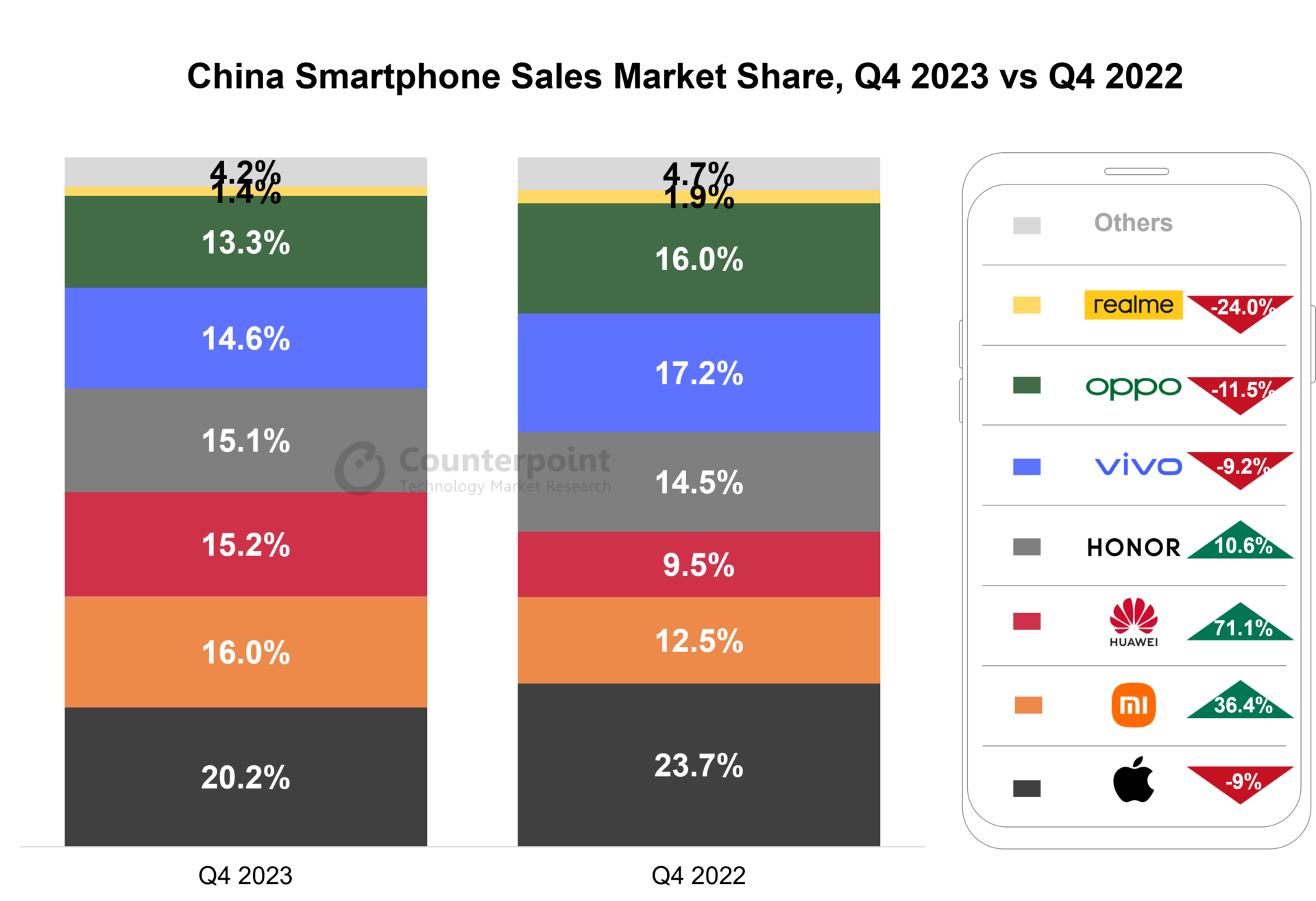

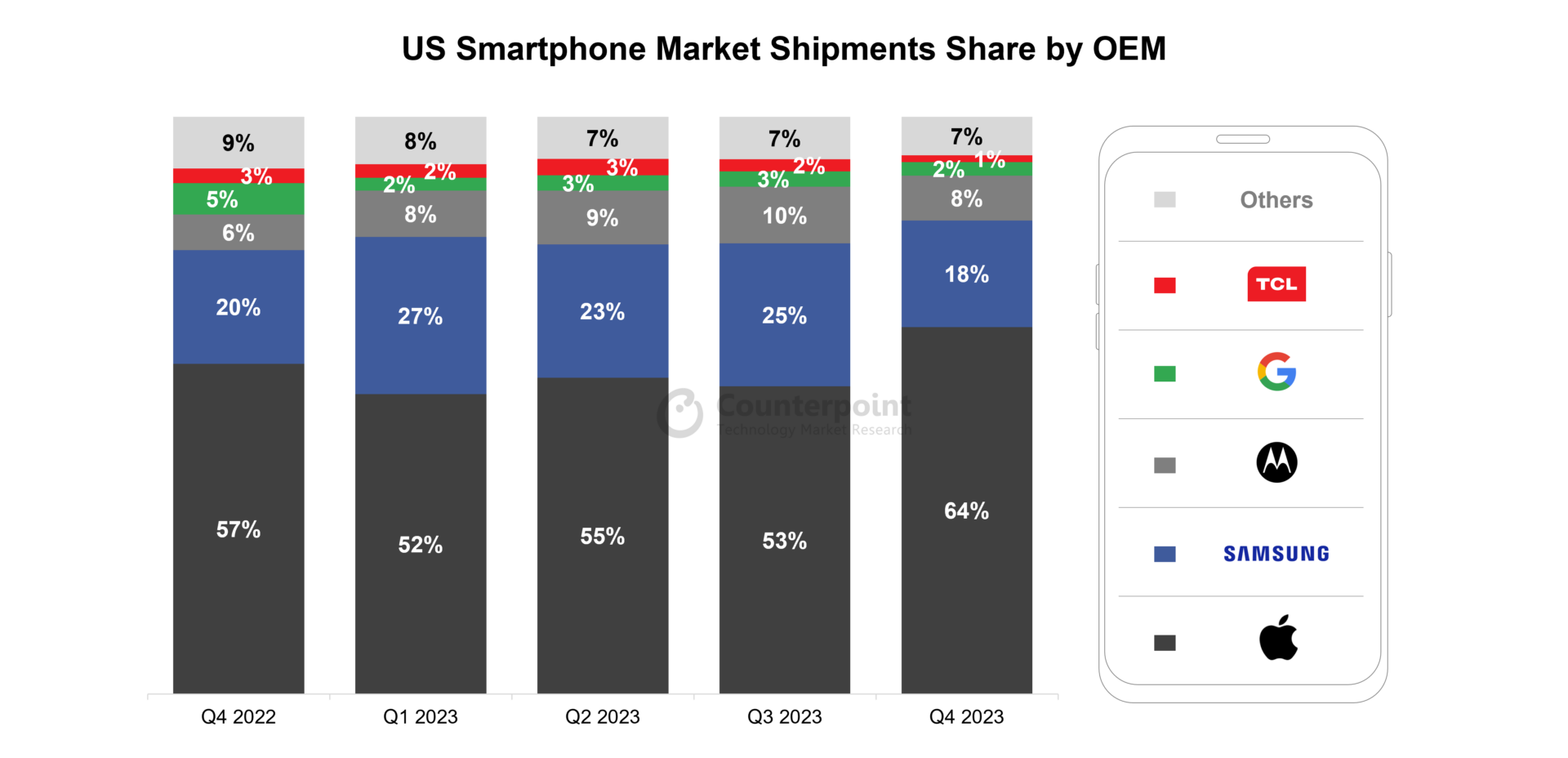

- Apple’s sell-in share grew to 64% in Q4 2023, the highest since Q4 2020.

- Android sell-in declined in Q4 as lower-end OEMs experienced demand weakness.

- AT&T, T-Mobile and Verizon all reported weaker upgrade rates and equipment sales.

- The US smartphone market will likely see low single-digit growth in 2024 as the economy rebounds.

San Diego, Boston, Fort Collins, Beijing, Buenos Aires, Hong Kong, London, New Delhi, Seoul – Feb 1, 2024

US smartphone shipments grew 8% YoY in Q4 2023, according to Counterpoint Research’s preliminary Market Monitor data. This was primarily due to Apple’s sell-in rebounding strongly from the previous year’s COVID-19-induced factory shutdowns that caused production disruptions. Android sell-in declined over the same period, as the sub-$300 segment saw declining demand.

“Q4 is usually very robust for Apple given the strong demand for iPhones during the holiday sales,” said Jeff Fieldhack, Counterpoint’s Research Director for North America. “Throughout 2023, Apple made inroads in prepaid with its N-2 or N-3 devices, selling the iPhone 12 or iPhone 11 at very reduced prices, which also helped it grow its market share in this segment.”

Note: Figures may not add up to 100% due to rounding.

On Android shipments, Senior Analyst Maurice Klaehne said, “While Q4 saw a slowdown in premium sales, it was the sub-$300 segment that saw the largest declines. Prepaid-to-postpaid migration continues to be robust and cable players like Comcast’s Xfinity Mobile and Charter Communications’ Spectrum Mobile are getting strong net-adds. Prepaid upgrade eligibilities have gone from 90 days to as high as 365 days. All these factors contribute to lower demand for prepaid smartphones.”

Commenting on carrier earnings and outlook, Associate Director Hanish Bhatia said, “Carriers continued to report weak upgrade rates, citing longer holding periods. However, postpaid gross adds for the Big Three were up 5% YoY, which helped premium device sales somewhat. Carrier revenues were largely driven by increasing service revenues due to consumers moving to higher-tier plans and increasing prices of legacy plans. The trend of bundling multiple products and services to help sales is rising and we will see more of it in 2024.”

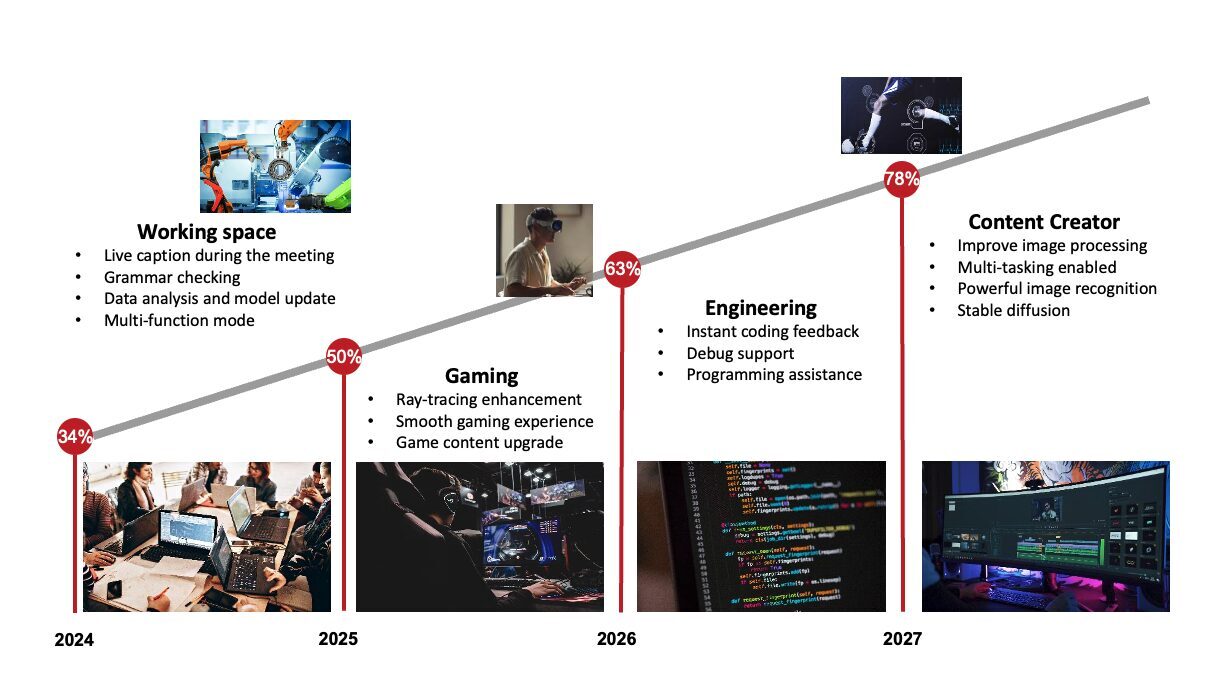

Bhatia continued, “The outlook for 2024 will largely depend on the US economy. It is an election year, which generally means improvements in various economic parameters. Therefore, demand is expected to pick up across all price segments, leading to modest growth throughout the year. MVNOs like Google Fi, which have increased their presence in national retail channels, will continue to bring competition to prepaid. With the Affordable Connectivity Program (ACP) funding likely ending or being reduced soon, this will be another driver for the low-end market. Another growth driver for premium smartphones will likely be generative AI features. The Samsung Galaxy S24 features many examples, such as near-real-time translation and leveraging GenAI to edit photos.”

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research