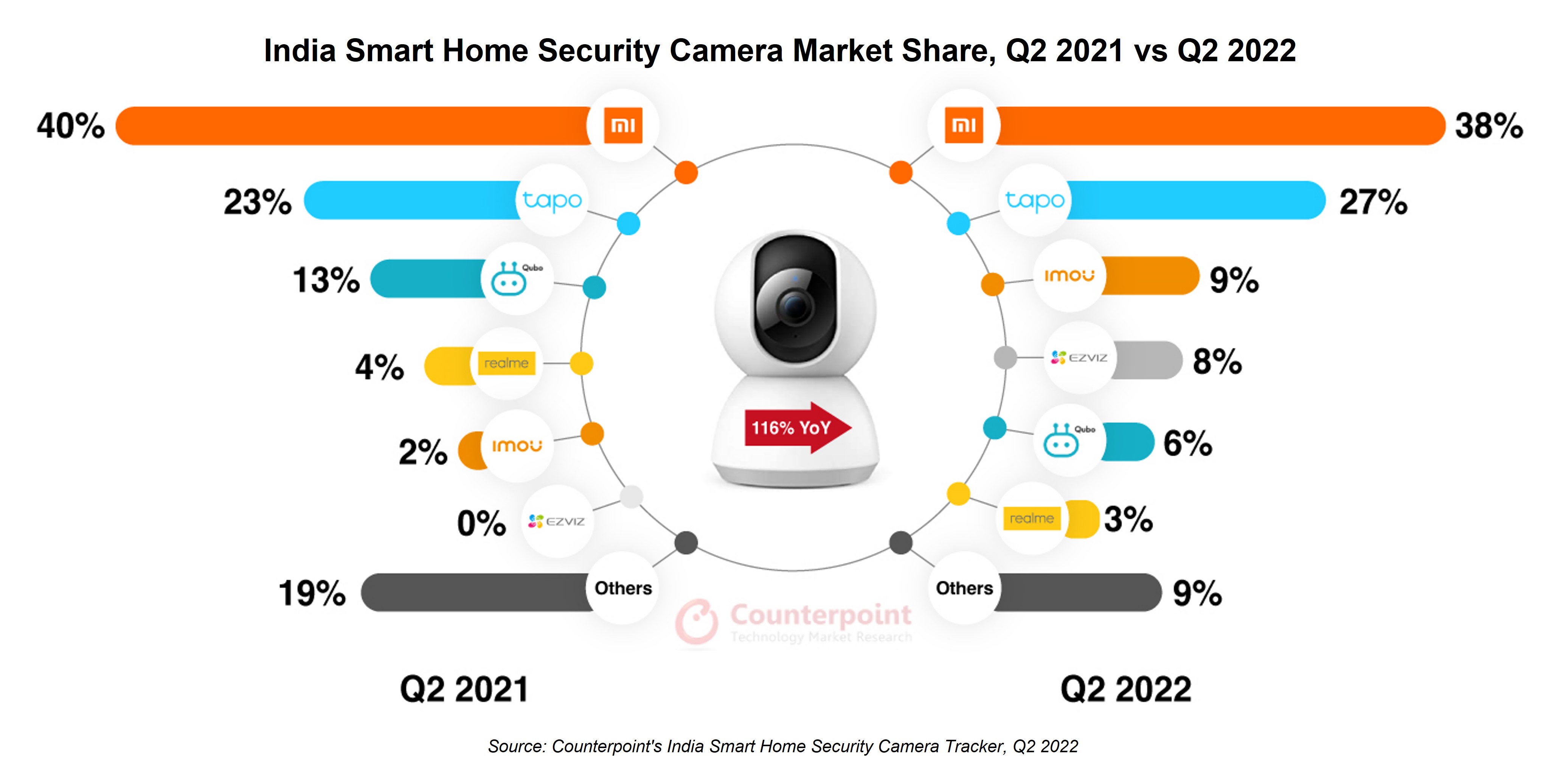

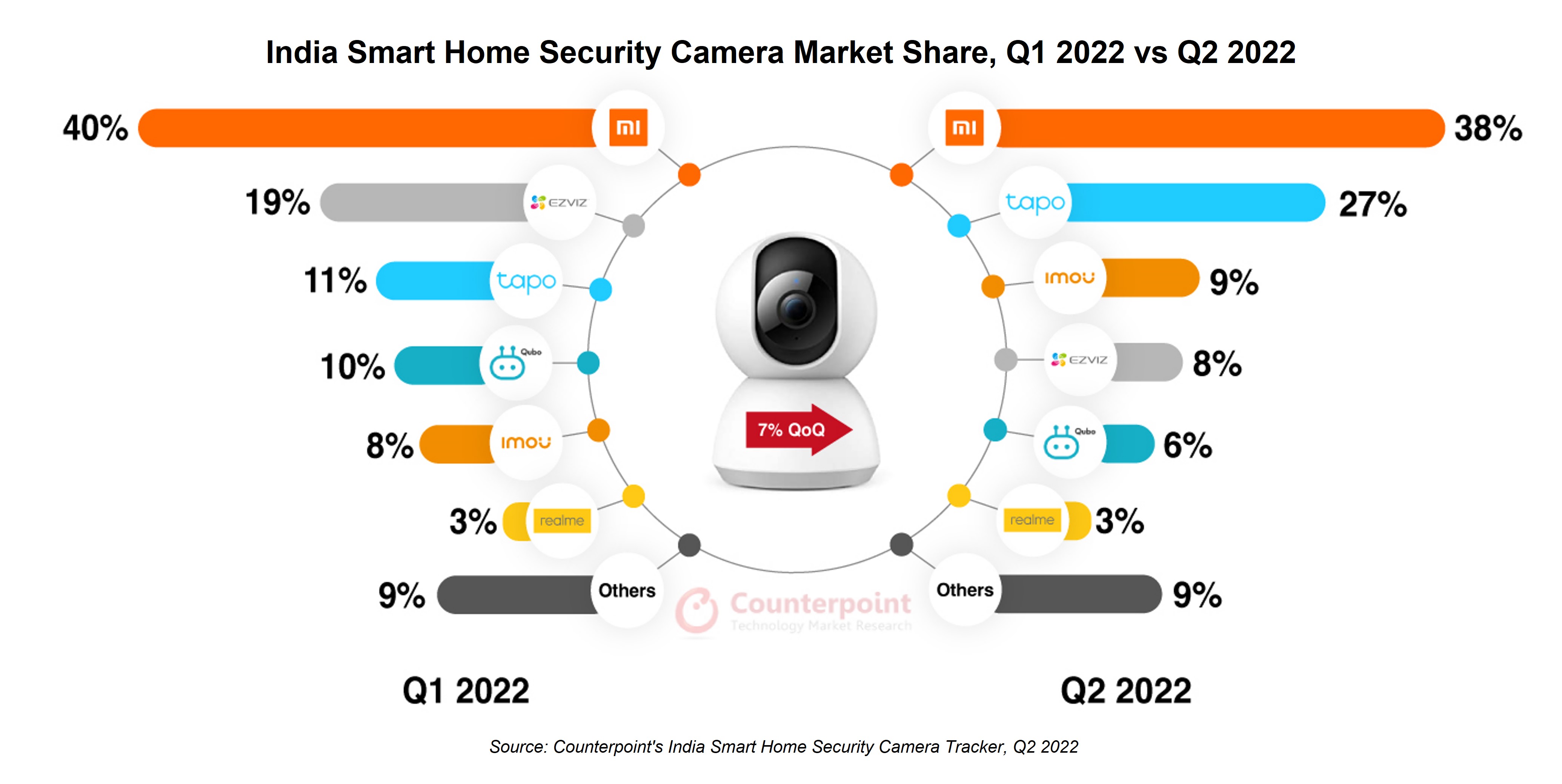

- Xiaomi led the market in Q2 2022 (April-June) with a 38% share.

- Tapo registered the highest YoY growth at 153% and took the second position in Q2 2022 with a 27% share.

- Imou captured the third spot with a 9% share, driven by its ranger series.

- EZVIZ maintained its position in the top five list for the third consecutive quarter.

New Delhi, Boston, Toronto, London, Hong Kong, Beijing, Seoul, Buenos Aires – August 5, 2022

India’s smart home security camera market grew 116% YoY and 7% QoQ in Q2 2022 (April-June), according to the latest research from Counterpoint’s Smart Home IoT Service. This growth was driven by increasing consumer interest, greater concerns over security, shift from traditional security cameras, and brands’ marketing push through discounts and promotions.

Commenting on the market trends, Research Analyst Varun Gupta said, “The growing consumer interest in smart home security cameras is a result of various factors, including ease of use, availability of smart features, and affordability. Consumers are more concerned about safety inside their premises, and these devices offer features that help them to keep a check on their surroundings. The pricing of these devices has been a key to the success of the smart camera market as most brands are offering devices below <INR 2,500 ($31), which is less than the conventional camera systems.”

From the brand perspective, Gupta said, “The market seems consolidated as the top three brands captured 74% share in Q2 2022. There was a push towards offline retail channels by leading brands such as Xiaomi, EZVIZ, Imou, Qubo and CpPlus. The Security Camera 360o by Xiaomi is the best-selling model for the brand and in the overall market in Q2 2022. Tapo registered the highest YoY growth in Q2 2022 owing to its wider portfolio and value-for-money offerings. Imou jumped to the third spot in Q2 2022 from the fifth spot in Q2 2021, driven by affordable products in the INR 2,000-INR 2,500 ($25-$32) price band. More brands focused on creating consumer awareness through offline channels. However, the majority of the sales were still online driven.”

Commenting on the market outlook, Senior Research Analyst Anshika Jain said, “The smart home security camera market is expected to grow over 50% in 2022 due to the continuous efforts by brands to make these devices available offline, special discount schemes and launch of value-for-money devices. In addition to this, we also expect the entry of new brands to build their position in this untapped market. In terms of applications, the indoor security camera market will witness a jump due to demand coming from working professionals resuming work at offices after the work-from-home routine during the pandemic. Security of senior citizens will also drive demand.”

“The major hurdle to mass adoption of these cameras is the lack of consumer awareness. Brands need to focus on setting up experience zones and providing some sort of bundled offers with other smart home products to market these products in a better way,” Jain added.

- Xiaomi shipments doubled YoY in Q2 2022 due to an increase in demand for home security cameras and better brand outreach through promotional events. Xiaomi is planning to have new SKUs in the current price segment and has also come up with Xiaomi Camera Viewer, a useful and simple standalone laptop camera app for MS Windows. It allows users to record videos, take snapshots and facilitate multi-camera view on one screen.

- Tapo by Tp-Link rose to the second position again after Q2 2021 with a 27% share. The brand has continuously focused on the online market and its C200 device has been the best-seller for the brand in recent quarters.

- Imou by Dahua Technologies rose to the third position with a 9% share for the first time. The ranger series of indoor cameras has been its most popular series. The devices offer AI human detection and smart tracking for more control of the indoor environment.

- EZVIZ by Hikvision fell to the fourth position in Q2 2022 from the second position in Q1 2022. It has introduced the C1C-B indoor camera with smart features like motion detection, user-friendly sound alerts and two-way talk.

- Qubo by Hero Electonix took the fifth spot in Q2 2022 with a 6% share. It has been focusing on local manufacturing. The Home Cam 360 Indoor Camera and Smart Outdoor Cameras are its most popular devices.

- realme registered a 74% YoY growth in Q2 2022 due to good performance by its Home Cam 360o. The brand is expanding its offline presence and is expected to refresh its portfolio soon amid strong demand.

Other Emerging Brands

- Zebronics maintained its position in the top 10 but with a decline of 3% YoY in Q2 2022. It is offering value-for-money devices in the sub-INR 2,000 category. The Smart Cam 100 is its most popular device.

- CpPlus had a 1.5% share in Q2 2022. Its E21A Ezykam, a made-in-India product, performed well in the online marketplace. However, the brand is increasing its presence in the offline market by leveraging its established surveillance business.

- D-Link grew 22% YoY in Q2 2022 due to good performance by its DCSP6000LH home camera, which offers portability, motion and sound detection.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts:

Varun Gupta

Anshika Jain

Counterpoint Research

press(at)counterpointresearch.com

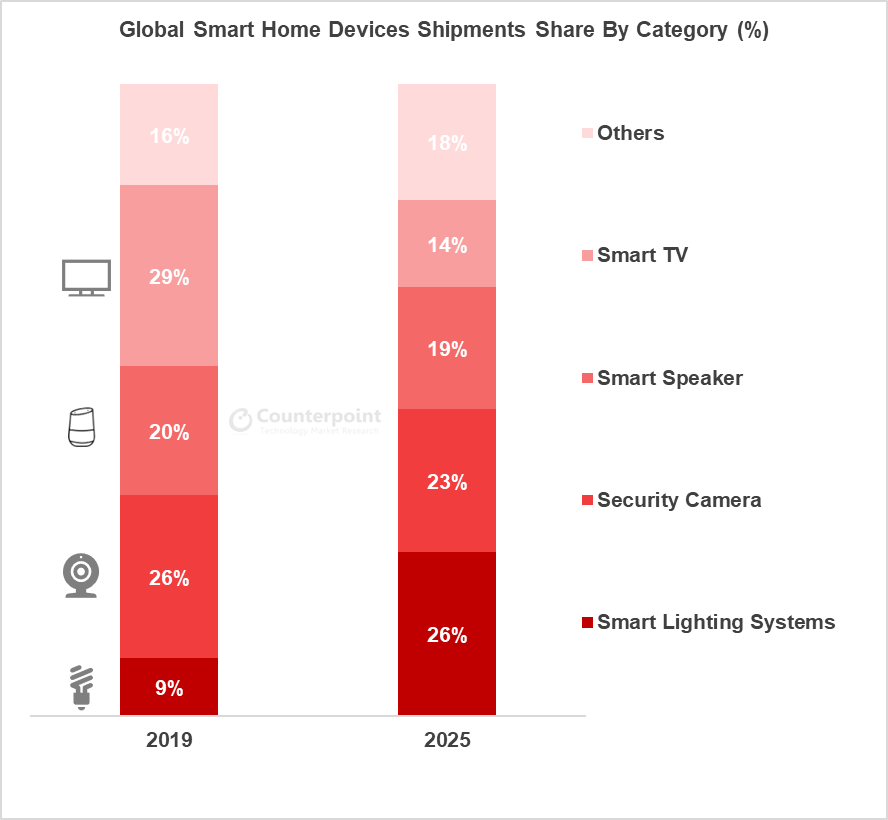

Source: Counterpoint Research Global Smart Home Market Report, 2021

Source: Counterpoint Research Global Smart Home Market Report, 2021