- Amazon held its highest ever 47% share among online channels

- Flipkart led the sub-INR 10,000 segment with more than 50% share in online channels

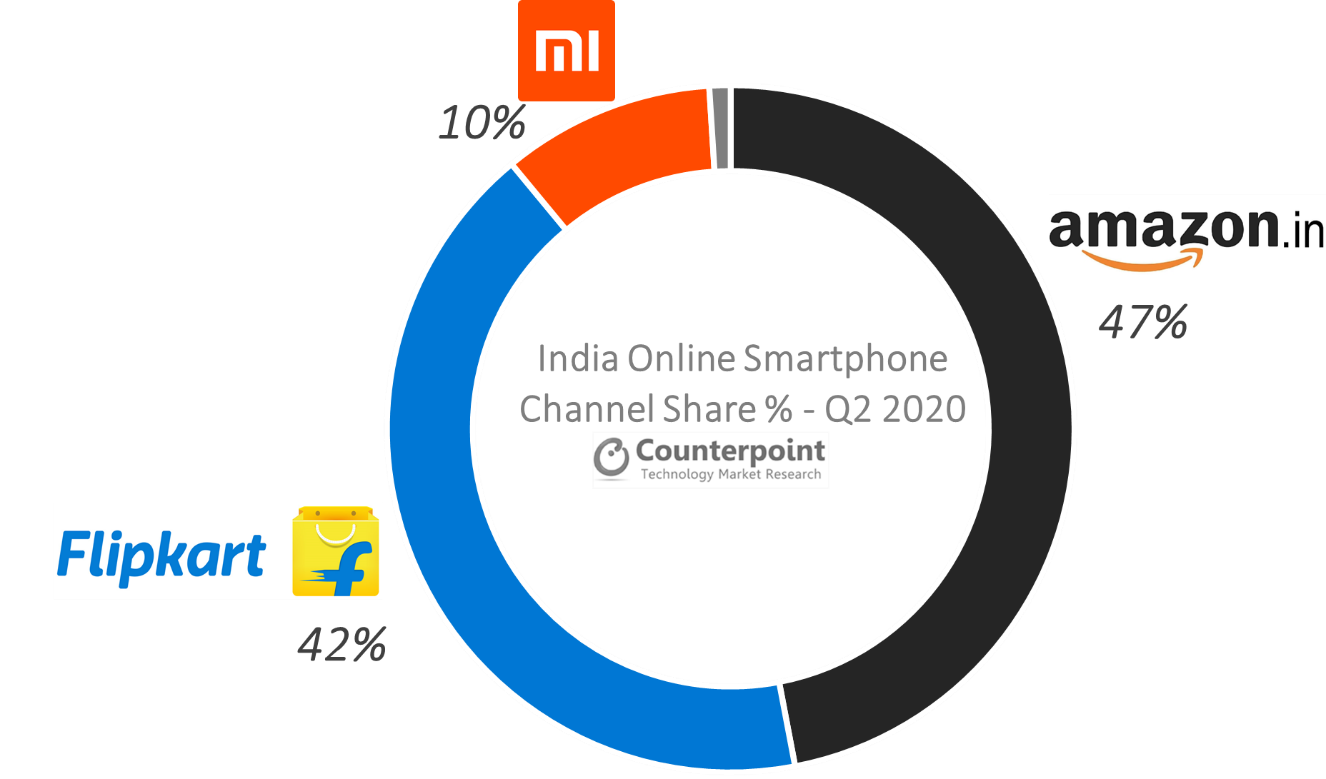

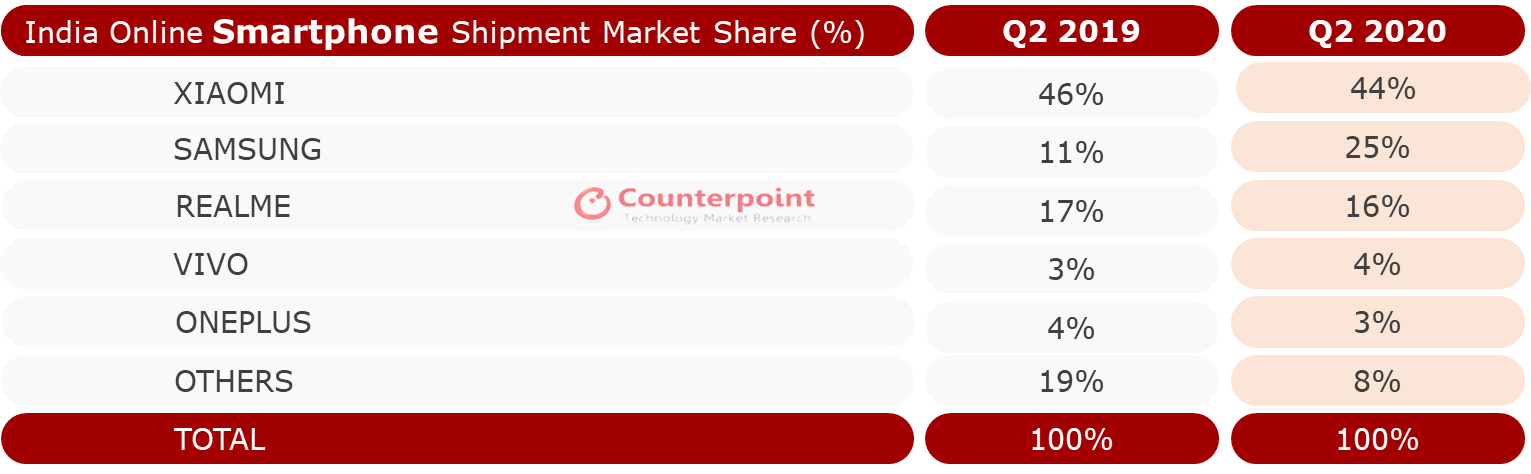

- Xiaomi remained the top online smartphone brand with a 44% share

- Samsung grabbed 25% share in online channels, its highest ever share in a quarter

- OnePlus was the top premium smartphone brand on Amazon

- realme remained the top brand on Flipkart

New Delhi, Hong Kong, Seoul, London, Beijing, San Diego, Buenos Aires –

August 13, 2020

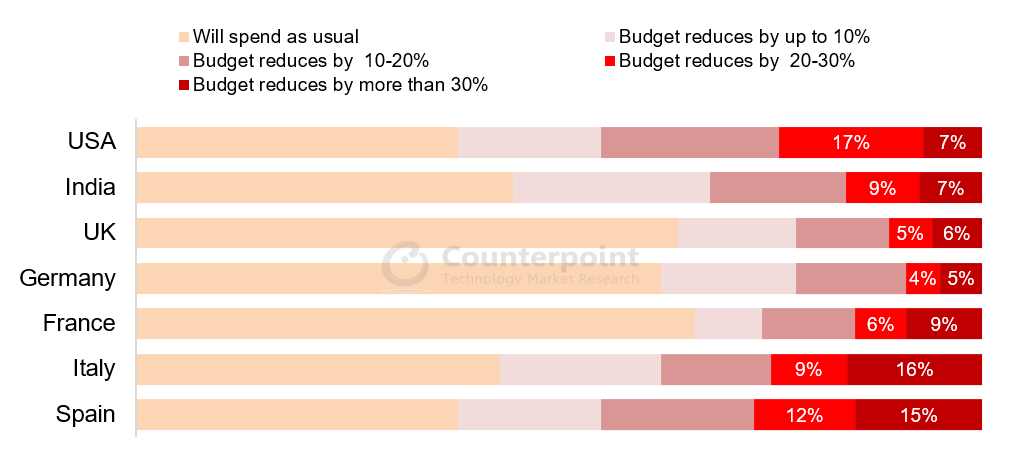

Online Channels held a 43% share in Q2 2020 in the India online smartphone market, according to the latest research from Counterpoint Research. The increase in online channels share is due to a shift in consumer behavior, who are now preferring contact-less shopping experience and practicing social distancing. The quarter also saw Amazon reaching its highest ever share of 47% among online channels, compared to Flipkart’s 42%. The share of online channels in overall smartphone shipments reached 43% during the quarter as consumers preferred contact-less shopping experiences. Looking forward, we see online channels remaining strong this year and taking a 45% share in the Indian smartphone market in 2020. The COVID-19 pandemic had a huge impact on the current market scenario and innovative business models have emerged.

Commenting on the COVID-19 situation and market dynamics, Senior Research Analyst Prachir Singh said: “The COVID-19 pandemic had a huge impact on the overall smartphone market, April being a washout month. Online channels’ shipments also declined compared to the last year. However, due to the current circumstances, consumers are preferring online platforms. We have already witnessed pre-COVID level shipments at the end of Q2 2020 due to the pent-up demand created in the market by the nationwide lockdown. Brands are aligning their product as well as channel strategies to drive up volumes. Multiple financing options and attractive offers have made the devices more affordable for consumers. During the quarter, multiple brands adopted an online-to-offline (O2O) business model and hyperlocal delivery to help their offline channel partners.”

Commenting on the Q2 2020 findings, Research Analyst Shilpi Jain said: “Online channels remained strong in Q2 2020, grabbing a 43% share in the overall Indian smartphone market. Pent-up demand and changed consumer behavior due to the current circumstances, accompanied by attractive offers and promotions by online platforms, were the main reasons for the increased share. During the quarter, Flipkart organized Big Savings Day Sale to drive up volumes. Due to the preference for online channels, no offline-exclusive model was launched during the quarter. However, during the same period, 11 online-exclusive SKUs were launched.”

Commenting on the brand performance, Jain said: “Xiaomi remained the market leader in online channels with 44% market share. Xiaomi Redmi 8A Dual was the top model for the brand in online channels. Samsung was quite aggressive on online channels and increased its share to 25%, its highest ever share in online channels. Strong shipments of M-series smartphones led to this increase. realme remained the top brand on Flipkart. In Q2 2020, offline channels captured 57% market share. We believe that offline channels will fare better during the latter half of the year. Vivo remained the top brand in offline channels, followed closely by Samsung. Vivo Y91i was the top model for offline channels.”

Exhibit 1: India Online Smartphone Market Share by Channel – Q2 2020

Source: Counterpoint Research Market Monitor Q2 2020

Exhibit 2: India Online Smartphone Top Brands Share – Q2 2020

Source: Counterpoint Research Market Monitor Q2 2020

Market Summary for Q2 2020:

- While smartphone shipments in the online segment declined by 46% YoY, the offline segment declined by 54% YoY.

- Amazon became the top online smartphone channel for the first time, with a 47% share. Xiaomi, Samsung, and OnePlus drove the shipments for Amazon.

- Amazon saw strong shipments of Xiaomi Redmi 8A Dual, Samsung Galaxy M30s, and Galaxy M31. Among the top ten smartphone models on Amazon, nine were from Xiaomi and Samsung.

- The INR 15,000 – INR 20,000 price band contributed the most and reached its highest ever share on Amazon. Samsung Galaxy M31 and M30s were the top models in this price band on Amazon.

- OnePlus remained the top premium smartphone brand on Amazon.

- Flipkart’s share declined; however, the platform led the sub-INR 10,000 price band with more than 50% share in the overall online smartphone market.

- realme remained the top brand on Flipkart. Among the top ten models on Flipkart, five were from realme. Newly launched Narzo 10 series drove the shipments for the brand.

- realme, Xiaomi, Samsung, and Poco contributed most for Flipkart and accounted for more than three-fourths of its total smartphone shipments.

- Poco maintained its strong performance in online channels in Q2 2020 as well. Poco X2 was the second-highest shipped model on Flipkart.

- The top 5 brands captured more than 88% of the total online market.

- Xiaomi alone captured more than 44% of the total online market in Q2 2020. Its Redmi 8A Dual, Note 8 series and Redmi 8 drove volumes, contributing to more than three-fourths of Xiaomi’s total online shipments.

- Samsung increased its share in online channels to 25%, driven by its Galaxy M-series models. Top five online models for the brand were all Galaxy M-series and they contributed to almost 90% shipments for the brand.

- Vivo hosted sales on both the leading online platforms, offering discounts on its models. The brand maintained its top position on offline channels, driven by Y91i and Y11.

- Six out of the top ten online models were from Xiaomi, followed by Samsung with three models. Xiaomi Redmi 8A Dual was the best-selling device in Q2 2020.

- OnePlus drove the shipments in the online premium smartphone segment, capturing more than 50% share, followed by Apple with a 25% share.

The comprehensive and in-depth Q2 2020 Market Monitor is available for subscribing clients. Please contact us at press(at)counterpointresearch.com for further questions regarding our latest research and insights, or press enquiries.

Analyst Contacts:

Prachir Singh

Shilpi Jain

Tarun Pathak

Follow Counterpoint Research

press(at)counterpointresearch.com